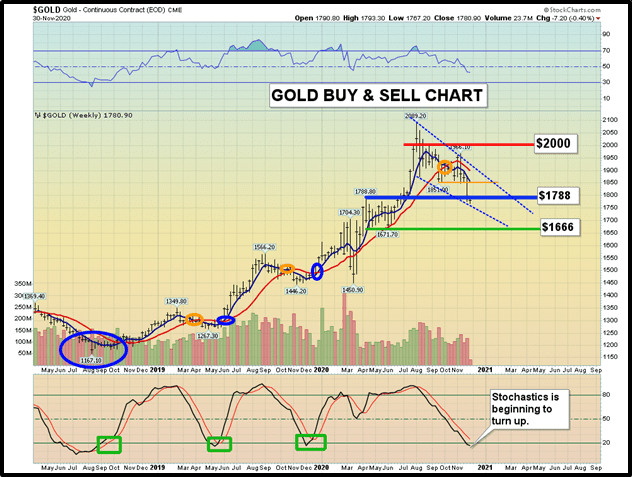

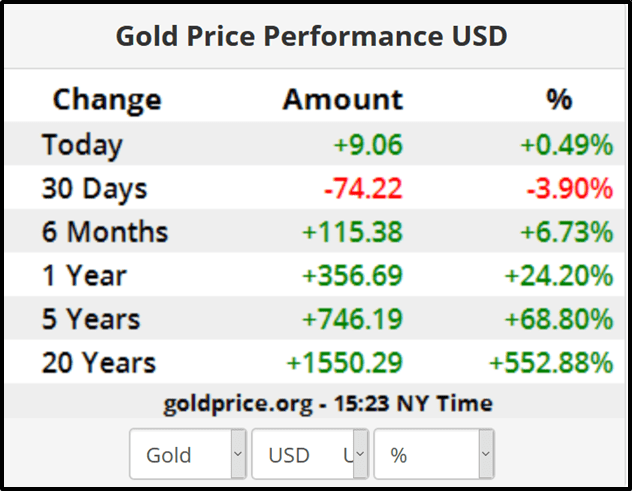

On August 5, 2020 gold was selling at USD $2,051.

During the next 4 months, gold plunged to a November 30, 2020 low of $1,775.

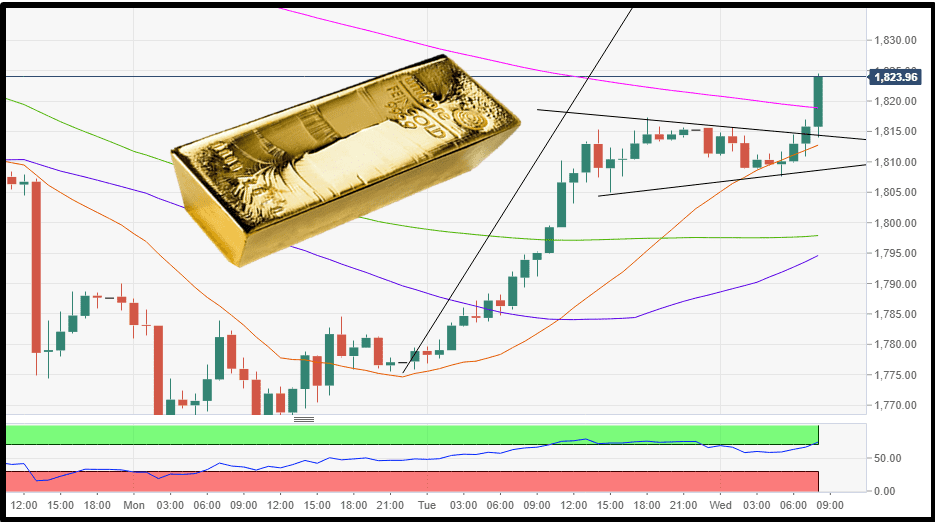

This week, the gold price has perked up $67 to $1,842.

What’s going on?

Is gold just an “expensive pet rock”?

Will surging global debt send gold to $20,000/ounce by 2025?

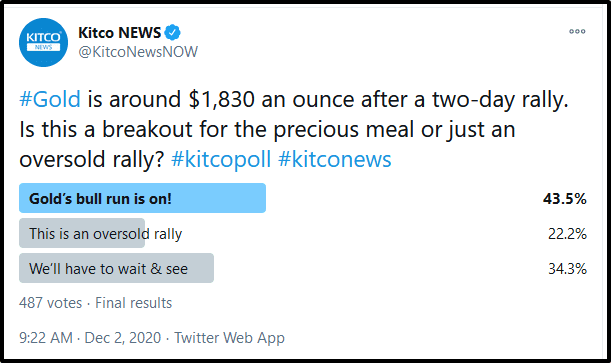

Kitco Gold readers believe “the bull run is on”!

In other news, registered ornithologists concur that it’s wrong to poison owls, while NASCAR fans report being excited by loud car engines.

“The US election is still being disputed by republican fiat bugs, but it looks more and more likely that democrat fiat bugs have won,” writes Stewart Thomson, an ex-Merrill Lynch broker on Kitco.com.”

“Seasonally, the December time frame is often a launch pad for significant rallies. Chinese citizens buy to celebrate the New Year and Western hedge funds often get caught in a short covering rally,” added Thompson.

“It’s unknown whether gold now rises to significant resistance at $2000-$2089, or it eases down to significant support at $1666”.

Stewart’s chart is below.

For the last 60 years, the U.S. dollar has been “The World’s Reserve Currency”.

“The end of US dollar dominance and the beginning of some new form of global monetary system will soon be upon us,” states investment legend Frank Guistra in a Kitco Op-ed.

Call me a fuddy-duddy, but I believe in the value of gold, and particularly in the explosive share price appreciation potential of gold juniors.

Here’s an update on 4 Equity Guru clients with heavy gold exposure:

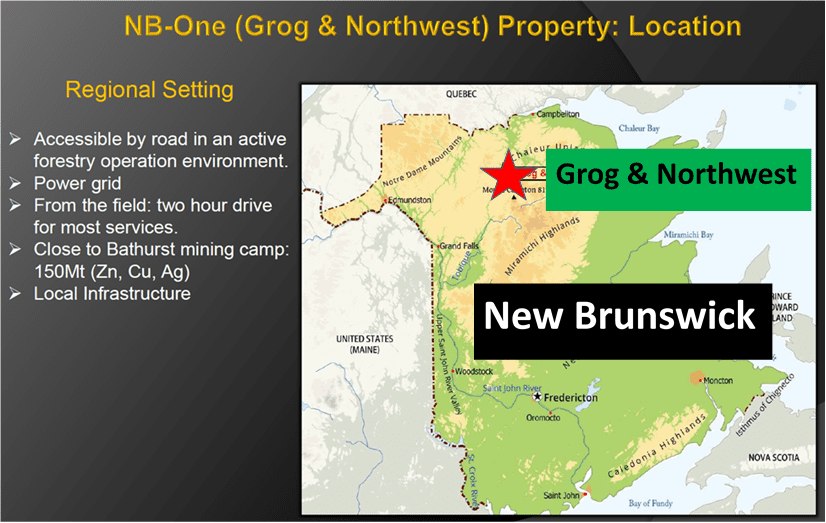

“X-Terra Resources (XTT.V)’s 280 square kilometer Grog and Northwest projects, located along the McKenzie Gulch Fault in Northeastern New Brunswick, delivered a new gold discovery in recent weeks from an 11-hole drilling campaign staged earlier this year,” wrote Equity Guru’s Greg Nolan on June 22, 2020.

“The discovery at Grog is in hole GRG-20-012 which tagged 0.41 g/t Au over 36 meters (including 0.46 g/t Au over 31 meters and 7.59 g/t Au over 0.6 meters) at a vertical depth of 81 meters,” continued Nolan.

“No, the grade isn’t especially fat or sexy, but it’s a broad intercept of mineralization suggesting a (potentially) large mineralized system lurking in the project’s subsurface layers.

Thus far, GRG-20-012 is the only hole drilled into this newly identified structure.

It’s important to understand that epithermal systems are often defined by sub-one-gram material. It’s the scale and near-surface nature of the mineralization that moves the needle for these types of deposits.” – End of Nolan

On October 13, 2020, XTT announced that it has started drilling the Rim Vein target on the Northwest property and the Grog target on the Grog property using two drills.

Additional data obtained from the ground IP geophysics as well as the geochemical sampling has strongly contributed to the final planning of this drill program.

The drill section planned over the Rim vein target covers approximately 500 metres following a west north-west orientation cross cutting the main structural orientation. Gold bearing veins are believed to be concordant or parallel to the sedimentary bedding.

“X-Terra’s exploration team and drilling crews are excited to be drilling the Rim vein target which has never been drill tested,” stated Michael Ferreira, President and CEO of X-Terra, “given the additional gold-in-soil anomalies, it highlights the compelling possibility of a stacking of gold bearing veins below.”

Ferreira points out that The Rim vein target has yielded gold grades from 4.5 g/t Au to 1,205 g/t Au with visible gold – (See X-Terra’s press release dated December 5, 2018).

“We were able to secure a second drill to begin drilling the Grog target at the same time,” stated Ferreira, “this should reduce the wait time for the first batch of results. Furthermore, this will be X-Terra’s largest drill program completed on any of its properties to date”.

In additional news, X-Terra has mandated ExploLab of Val d’Or, Quebec to carry out a bench scale metallurgical test using 129 kilograms of material originating from the Rim vein to evaluate the recovery model by gravimetric analysis.

The goal of this metallurgical test at this early stage is to determine how the material will respond to this conventional process and how much metal (gold) can be recovered.

Nomad Royalty (NSR.T) owns a portfolio of 11 royalty, stream, and gold loan assets, of which 5 are on currently producing mines.

When Nomad recently launched, it stated that it “plans to grow and diversify its low-cost production profile through the acquisition of additional producing and near-term producing gold & silver streams and royalties.”

Two months ago, Nomad entered into a definitive Arrangement Agreement to acquire all of the outstanding common shares of Coral Gold.

Acquisition Highlights

- Premier, uncapped sliding-scale 1.00% to 2.25% net smelter return (NSR) royalty on Robertson property which forms part of the greater Cortez & Pipeline mining complex.

- Premier gold mining operator in the world on the tier 1 Cortez & Pipeline mine complex

- The Robertson development project contains an historical Inferred mineral resource estimate (MRE) in excess of 2.7 million ounces Au in total oxide and sulphide materials.

“When we created Nomad, we set the objective to become a catalyst for sector consolidation,” stated Nomad CEO Vincent Metcalf, “Today’s announcement marks the first step of our consolidation strategy and follows our desire to become the best global acquisition-driven precious metals royalty company in the sector.”

“Since its debut on the TSX on May 29th, Nomad (NSR.T) management has done everything it said it would do, and in only a few months time,” confirmed Equity Guru’s Greg Nolan on November 23, 2020.

From the get-go, the Company set out to acquire high-quality assets, adding to an already robust project portfolio of producing and advanced-stage assets.

A recent example of this deal making prowess is the July 27th acquisition of a 1% net smelter return royalty (NSR) on the 8.11 million gold equivalent ounce Troilus Gold Project located along the Frotet-Evans Greenstone Belt in northern Québec.

On November 19th, Nomad completed the acquisition of Coral…

Nomad Royalty Company Completes Acquisition of Coral Gold

“Pursuant to the Transaction, Nomad acquired all of the outstanding shares of Coral (“Coral Shares”). Coral shareholders received, for each Coral Share held, consideration consisting of C$0.05 in cash and 0.80 of a unit (a “Unit”) of Nomad (collectively, the “Consideration”). Each whole Unit is comprised of one Nomad common share (a “Nomad Share) and one-half of a common share purchase warrant (a “Warrant”). Each full Warrant entitles the holder thereof to purchase one additional Nomad Share at a price of C$1.71 for a period of two years following the date hereof. If the daily volume-weighted average trading price of Nomad Shares on the Toronto Stock Exchange exceeds the Warrant exercise price by at least 25% for any period of 20 consecutive trading days after one year from the date hereof, Nomad will have the right to give notice in writing to the holders of the Warrants that the Warrants will expire 30 days following such notice, unless exercised prior thereto.” – End of Nolan [edited]

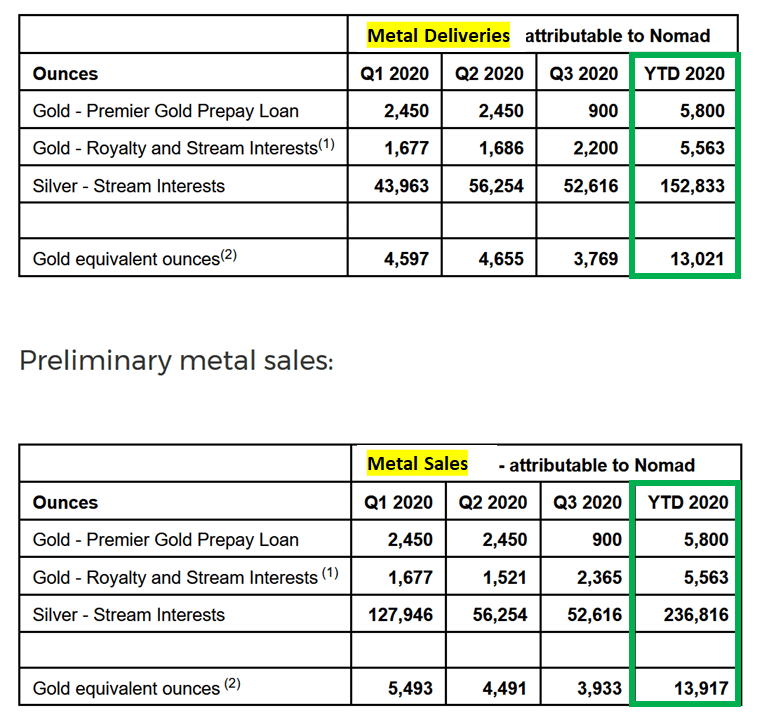

On October 13, Nomad Royalty announced its Q3, 2020 preliminary gold and silver deliveries from its royalty, stream and gold loan interests:

Nomad realized preliminary revenues of $7.6 million during the three-month period ended September 30, 2020 resulting from 3,933 gold equivalent ounces sold.

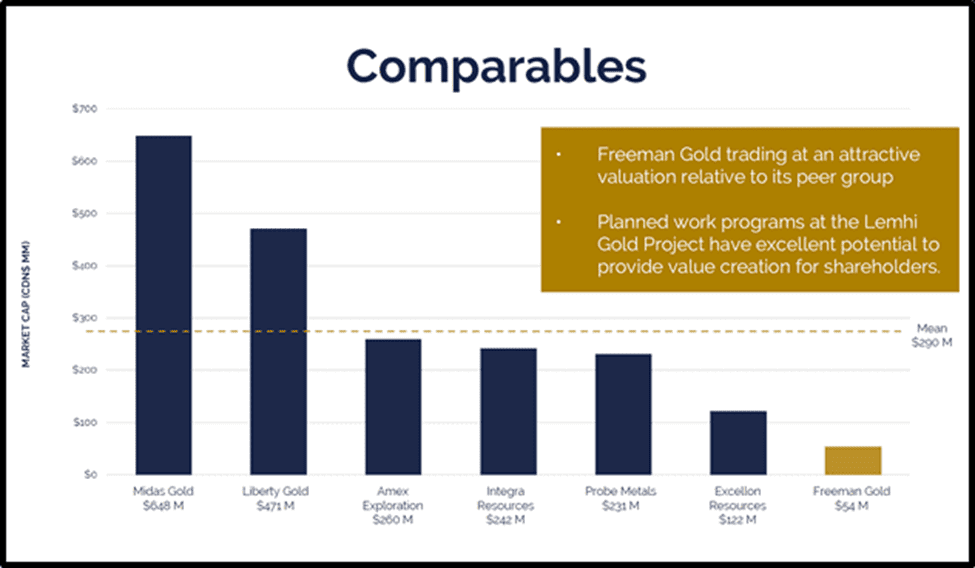

Freeman Gold (FMAN.C) is developing its 100% owned Lemhi Gold Project, located in Idaho, USA. The project covers 30 square kilometers of highly prospective land.

“The mineralization at the Lemhi Project consists of shallow, near surface primarily oxide gold mineralization that has seen over 355 drill holes but remains open at depth and along strike,” reports FMAN.

The company is working towards de-risking the asset and producing a maiden NI 43-101 compliant resource estimate as a result of both brownfield and greenfield exploration.

On October 29, 2020 FMAN provided an exploration update for the Idaho Lemhi Gold Project.

Objectives of Phase 1 – 5,000 metre, 33 priority hole diamond drill program:

- Twin certain holes,

- Complete infill drilling along sections,

- Allow interpretation of the mineralization and structural controls,

- Complete initial bench scale metallurgy,

- Complete a maiden NI 43-101 compliant resource estimate.

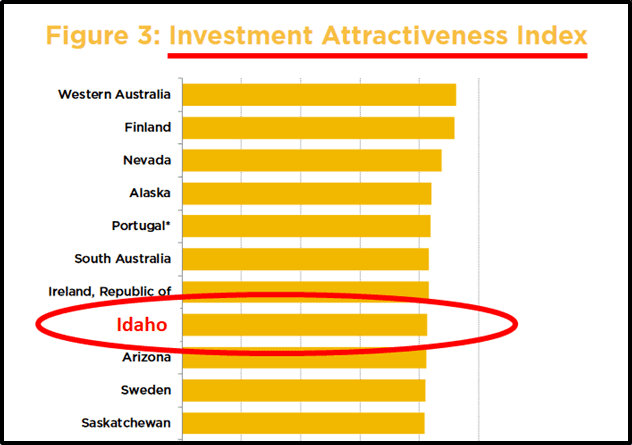

“According to the esteemed Fraser Institute, in its most recent “investment attractiveness” survey, Idaho is ranked in the top ten global jurisdictions when it comes to kicking rocks and digging desirable minerals outta the ground,” reported Equity Guru’s Greg Nolan on September 24, 2020.

“NOW, more than ever, it makes sense shortlisting only those companies operating in the friendliest of mining jurisdictions,” confirmed Nolan.

“There’s always a risk in mining, no matter how friendly the jurisdiction. But taking a close look at the Lemhi project and the surrounding terrain, there are no environmental or social issues that stand out—there are no fish-bearing streams, rivers, or lakes in the region.

The project is fairly isolated—there are no communities in the immediate vicinity. And the nearby towns—Salmon, Gibbonsville, North Fork—are supportive of the mining industry.

Bottom line: permitting the project should be a walk in the park” – End of Nolan.

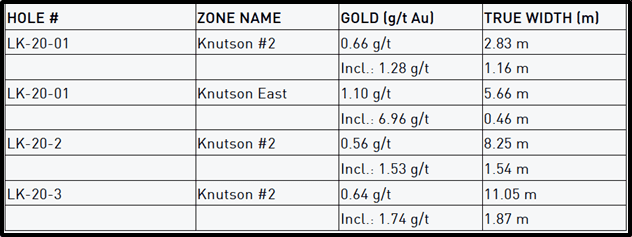

“Two diamond drill rigs are currently operating around the clock at Lemhi, with 16 cored drill holes totaling 3,328 meters completed to date (see Table 1 below),” reports FMAN.

“The on-going drilling campaign has confirmed the presence of extensive gold mineralized horizons first established by historical exploration conducted between 1984 and 2013.

Detailed geological logging of recovered core has noted multiple occurrences of visible gold from 5 holes drilled within the 30 square kilometer property.

“The potential to grow this resource into a world-class ore-body is very real,” states Equity Guru’s Greg Nolan, “Deposits of this type are often part of a much larger mineralized system”.

“The deposit is open in multiple directions, including at depth where high-grade feeder zones may come into play.

Highlights from historical drilling include:

- 193.55 meters grading 1.8 g/t Au

- 179.83 meters grading 1.81 g/t Au

- 13.72 meters grading 15.19 g/t Au

- 59.44 meters grading 3.55 g/t Au

- 54.96 meters grading 4.28 g/t Au

- 152.86 meters grading 1.06 g/t Au

- 149.35 meters grading 1.06 g/t Au

- 143.26 meters grading 1.09 g/t Au

These historical values are extraordinary.

If the company is successful in tagging similar broad intervals of one-gram-plus material outside the main resource base, the ounces will begin piling up in a big way.

Importantly, much of Lemhi’s 30 square kilometers has seen little in the way of (modern) exploration.” – End of Nolan.

“Our Phase 1 drill campaign is successfully underway and is confirming our understanding of the mineralization and geology of the Lemhi Gold Project,” stated Will Randall, President & CEO of FMAN.

“Results have so far matched historical logs closely,” continued Randall, “Multiple flat lying, high grade zones, often containing visible gold, are stacked and may constitute a bulk tonnage target.”

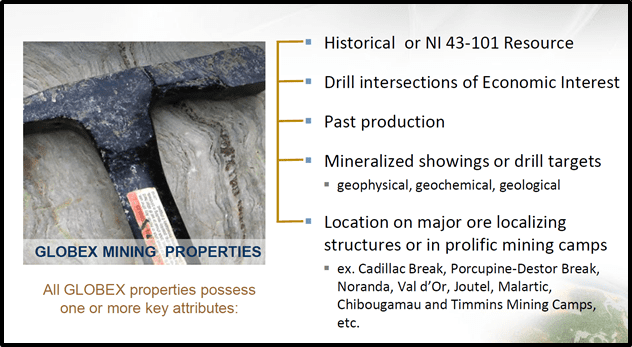

Globex Mining (GMX.T) has invested in a matrix of mineral properties many of which have appreciated sharply in 2020.

Globex CEO Jack Stoch is a legend in the mining business.

“A registered Professional Geologist in the province of Quebec and major Globex shareholder—he was once reported to be the largest private mineral rights holder in the Province of Quebec,” wrote Equity Guru’s Greg Nolan on September 11, 2020.

“Management’s specialty is acquiring high-quality assets in well established mining-friendly jurisdictions, upgrading the asset by way of exploration and intellectual input, and monetizing said asset via options, outright sales, and royalties,” continued Nolan.

“With a total of 188 properties in the company’s project portfolio, 95 are prospective for precious metals, 60 for base metals, and 33 for specialty metal metals (lithium, manganese, scandium, and the like).” – End of Nolan.

On December 01, 2020 Globex announced that it has received all the assays from the drilling program on our Laguerre/Knutson gold project near Larder Lake, Ontario.

Seven hundred and fifty-nine metres (759 m) were drilled in three holes on the Knutson portion of the property where historical trenching returned 0.42 oz/t Au over an average width of 5.3 feet for a length of 160 feet on Vein # 1 and 0.25 oz/t Au over an average width of 5.9 feet for a length of 90 feet.

Despite the obvious visual indicators in the core, the assays did not match those from surface sampling and are listed below:

While the three drill holes did not return assays comparable to those reported on surface and encountered in grab sampling by Globex, the fact that the zones do project to depth as displayed by the intense alteration, shearing and sulphide mineralization is a positive outcome which suggests more work is warranted.

As a Globex shareholder, it is impossible to keep track of each of the 188 properties. We are buying into the demonstrated expertise of the management.

On April 15, 2019, NSGold (NSX.V) announced that it acquired 100% ownership of the Mooseland Gold Property and certain secondary properties from Globex.

At the time, Globex was awarded a Gross Metal Royalty of 2%, while NSGold handed over about 10% of its stock to Globex (1.75 million shares).

On September 16, 2020 – NSGold received a “43-101 Resource Update on the Mooseland Gold Property” located in Halifax County, Nova Scotia.

Total inferred mineral resources for the Mooseland Gold Property are estimated at 3,454,000 tonnes with an average diluted grade of 4.71 grams per tonne containing 523,000 ounces of gold.

“A lot of CEOs in this arena claim to have aligned their values alongside those of their shareholders,” states Nolan, “Talk is cheap in this Wild West of a sector. The proof is in the share structure.

Get this: there are currently 54.63 million Globex shares outstanding (57.5 fully diluted). Since Stoch took over the company in 1983, he has kept the dilutive financings to an absolute minimum and he has never engineered a share rollback.

If you’ve been following the junior exploration sector for as long as I have, you know how remarkable a feat this is. I know of companies who are rolling back their shares within their first year of operation.” – End of Nolan.

Four months of downward gold price pressure has got some gold bugs eye-balling Bitcoin (which has risen 75% in the same time frame).

“Bitcoin has no intrinsic value, and governments may fight hard to keep their monopoly over issuing currency,” states Bloomberg, “But for the time being bitcoin is showing some signs of growing maturity as an asset class.”

Historically (100% of the time) when an army of neophyte investors pile speculatively into an asset class, the bubble will pop and the price will plummet dramatically. Bitcoin could be the first counter-example to that rule.

Personally, I prefer something tangible, with a track record of storing and growing value.

Shaved flakes of bullion have been found in Paleolithic caves dating back to 40,000 B.C. “Foul cankering rust, the hidden treasure frets,” wrote Shakespeare in 1602, “But gold that’s put to use – more gold begets.”

Gold demand rises and falls, but it never dies.

- Lukas Kane

Full Disclosure: X-Terra (XTT.V), Nomad (NSR.T), Freeman (FMAN.C), Globex (GMX.T) are Equity Guru marketing clients.

Leave a Reply