After the close of trading on Jan. 21st, our go-to contingent in the royalty and streaming space, Nomad Royalty Company (NSR.T), released its quarterly deliveries and updated several of the projects in its rapidly expanding project pipeline of producing and advanced-stage assets.

If you’re new to the royalty and streaming space, the following link will help demystify some of the more esoteric terms…

Franco Nevada—Royalties and Streams Explained

If you’re new to Nomad, a recent Guru offering—A Guru ClientCo Resource Roundup – Delta (DLTA.V), Nomad (NSR.T), Freeman (FMAN.C), Defense (DEFN.V), Fremont (FRE.V), and BARU.V—will help bring you up to speed.

2020 was a busy one on the corporate development and acquisition front. I count four—the number of acquisitions the Company announced since making its market debut only eight months back.

The Jan. 21st headline:

Nomad Announces Q4 2020 Deliveries & Provides Asset Updates

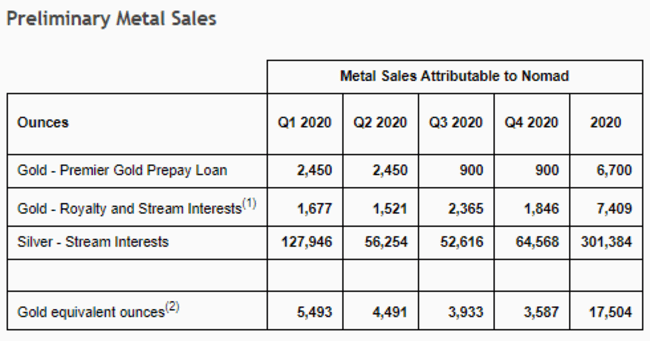

Preliminary gold and silver deliveries plus sales from its royalty, stream, and gold loan interests are as follows:

The Company saw preliminary revenues of $6.8 million during the three-month period ended December 31, 2020, following the sale of 3,587 gold equivalent ounces(2).

Preliminary revenues for the year ended December 31, 2020, and cash acquired from the Bonikro gold stream (as per the vend-in transactions closed on May 27, 2020) totaled $29.9 million.

“As per the vend-in transactions closed on May 27, 2020, Nomad was entitled to payments made in respect of the acquired assets since January 1, 2020. As such, the preliminary gold and silver deliveries and sales above for the three-month periods ended March 31, 2020, June 30, 2020, and the year ended December 31, 2020, include payment received on the closing of the vend-in transactions.”

Asset Updates and Recent Developments:

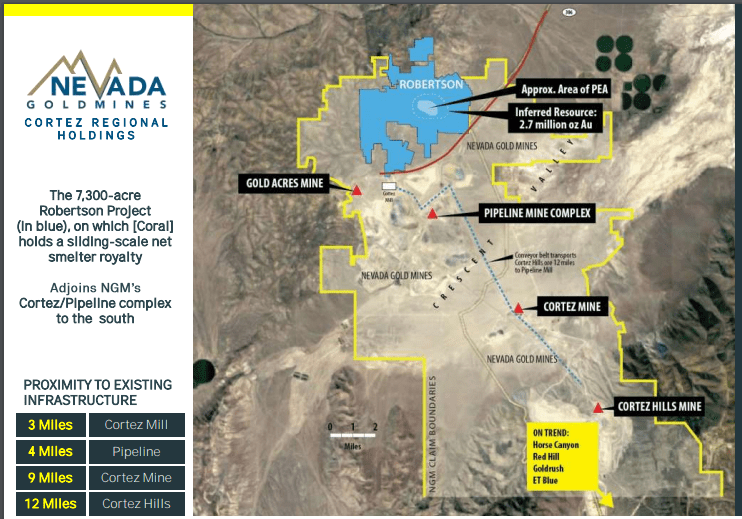

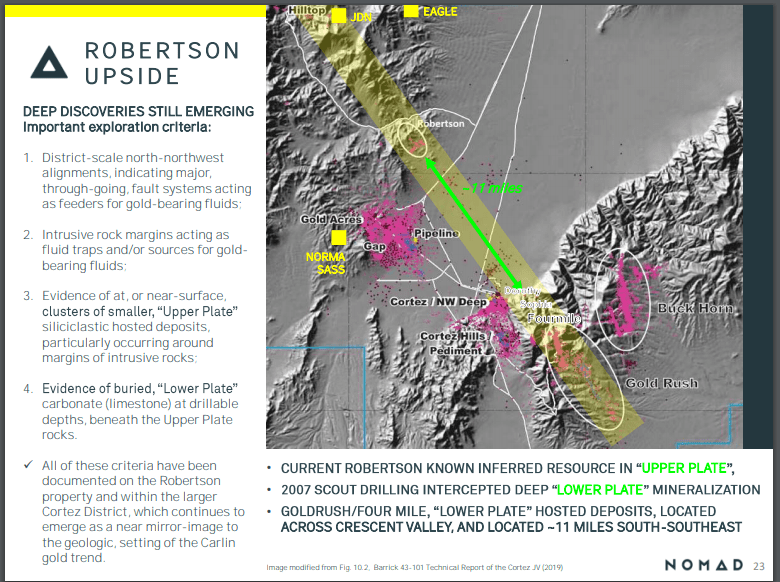

The Robertson NSR

This uncapped sliding scale NSR (1% to 2.25%) covers over 2.7 million ounces at Nevada Gold Mines’ (NGM) Robertson Property located along the prolific Cortez Gold Trend of northern Nevada.

Robertson is a joint venture between mining behemoths Barrick (61.5%) and Newmont-Goldcorp (38.5%).

Note Robertson’s proximity to Pipeline, Cortez Hills, and Goldrush—three of the largest Carlin-type gold deposits on the planet. They make up NGM’s lowest-cost assets with over 26.8 million ounces of gold reserves & resources.

It’s important to note that Robertson’s ounces are considered part of the mineral resource base at the Cortes Mine Complex and as of November 2020, these 2.7 million ounces are now included in the 5-year mine plan at Cortez.

This inclusion is a huge development.

First production for Robertson’s ounces is targeted for 2025 (Cortez is forecasted to produce 750,000 to 850,000 ounces annually from 2021 to 2025).

This is excellent news, but what’s really compelling about this NSR, and what a lot of people miss, is that this 2.7 million ounce-count may represent only the tip of the iceberg.

Robertson holds considerable exploration potential at depth.

Finding a deep, rich “feeder” deposit—the source of Robertson’s surface gold—is high on NGM’s priority list.

NGM’s geologists have stated they’ll be looking for a “Meikle-style” discovery at depth (the Meikle deposit was discovered in September 1989 when a deep drill hole tagged 164.5 meters of 11.62 g/t Au from 397.5 meters to 562 meters).

According to this Jan. 21st press release…

“Barrick will be conducting drilling programs at Robertson and initiate earlier stage generative exploration work on the Pipeline-Robertson corridor.”

Drilling success at Robertson could be a game-changer for the project, and a potent catalyst for Nomad’s common shares.

Blyvoor Operations Ramping Up:

Blyvoor is expected to begin producing this year and represents another (potentially) potent catalyst for the Company in 2021.

Blyvoor could become one of the Company’s top producing assets as the project is scaled higher in multiple future development phases.

Blyvoor Gold continues to ramp up mining operations at the project. Blasting activities are now fully operational and taking place daily. The process plant construction is complete and ore processing has commenced. A technical report in connection with the Blyvoor mineral resource is expected to be completed in the first half of 2021.

As the above slide shows, Nomad owns a 10% gold stream on Blyvoor’s first 160k ounces of production within a calendar year, and 5% on any additional gold production within the calendar year.

Following the delivery of 300k ounces of gold to Nomad, the stream percentage drops to 0.5% on the first 100k ounces of production within a calendar year until 10.32 million ounces of gold are produced.

Nomad will make ongoing payments of $572/oz for each ounce of gold delivered under the contract. With gold currently hovering around $1,850 per oz, this promises to be a fat stream.

The Company updated several other projects in its portfolio as follows:

Mercedes Acquired by Equinox Gold:

On December 16 2020, Equinox Gold announced the friendly acquisition of Premier Gold. Equinox will become the operator of the Mercedes mine and has indicated there is expansion potential to increase production to 80,000 to 90,000 ounces of gold annually. Equinox operates seven mines globally, is very well capitalized, and is led by a reputable management team which we anticipate will have the ability to drive further productivity increases at the mine site.

Nomad owns a 100% silver stream on the silver production from the Mercedes Mine and 100% on the silver production from the South Arturo Mine attributable to Premier (40% attribution), until a total of 3.75 million ounces of refined silver have been delivered, after which the stream percentage reduces to 30%.

This silver stream is subject to a minimum annual delivery of 300,000 ounces of refined silver until the cumulative delivery of 2.1 million ounces. Nomad will make ongoing payments equal to 20% of the prevailing silver market price for each ounce of silver delivered under the contract.

South Arturo Silver Resource Growth:

Nevada Gold Mines had another exceptional year with production exceeding budget by over 30%. The strong performance was driven by higher production rates that averaged 694 tonnes per day processed. On January 19, 2021, Premier published a preliminary feasibility study on South Arturo which outlined an 18-year mine life and was based on a mineral resource estimate as of December 1, 2020. This included Nomad attributable reserves of 1.9 million ounces of silver (3.8Mt at 15.23g/t), measured and indicated resources of 4.0 million ounces of silver (20.0Mt at 6.19g/t) and an inferred mineral resource of 1.8 million ounces of silver (10.1Mt at 5.47g/t). In 2020, drill programs were completed at El Nino, with initial results suggesting the potential to expand underground resources and extend the mine life. A new mineral resource estimate will be completed in 2021 following receipt of all 2020 drilling results.

Moss Expands Drill Program:

Northern Vertex is conducting an aggressive exploration program with 3 drill rigs onsite to expand the resource with the aim of extending the mine life and testing district-scale targets.

Recent results intersected high grade at the Ruth Vein target, widespread mineralization within the Gold Bridge and West Extension targets located 1.5km west of the pit, and similar Moss pit mineralization at the West target. Phase II drilling program was initiated in November 2020 and will extend to February 2021, Phase II will focus on the high-grade Ruth Vein target, resource infill at Gold Bridge and target new discoveries within extensive stockwork gold and silver mineralization both on strike and at depth at the Moss Mine. The combined Phase I and II drilling programs will total 32,000 meters. In addition to the multi-phased exploration program, Northern Vertex continued to successfully implement a number of new initiatives to further optimize operations and reduce costs at the Moss Mine.

Nomad owns a 1 – 3% NSR royalty on the Moss property.

Troilus Expands Southwest Zone:

In early 2021, Troilus Gold reported great results on the Southwest zone, including a 200-metre step-out hole which intersected high-grade gold-bearing mineralization between 50m and 450m from surface, and located outside of the NI 43-101 mineral resource envelope and the open pit proposed in the August 2020 PEA. For winter 2021, Troilus is implementing a 7,000 metres per month drilling program with the objective of expanding the mineral resource estimate at the Southwest Zone, definition drilling in the Z87 and J Zone and geotechnical drilling in support of the Pre-Feasibility Study. A Pre-Feasibility Study is expected to be published later in 2021 and an Environmental Impact Study targeted for early 2022.

Final thoughts

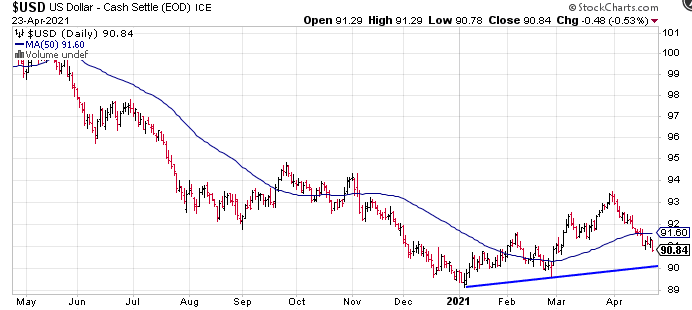

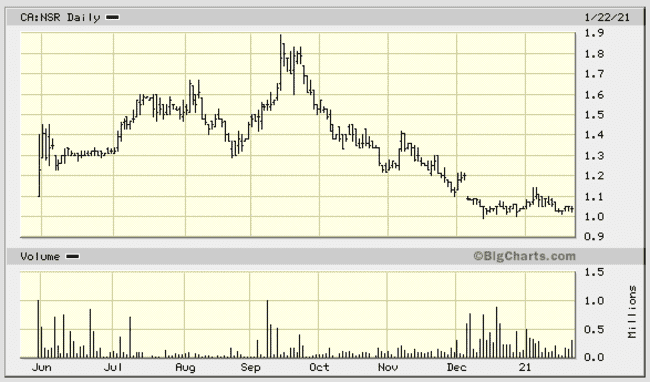

Nomad’s share price has taken a beating over the past few months. A combination of Yamana (YRI.T) monetizing a large block of shares via a $25M secondary offering in early December and a measure of tax-loss selling pressure as 2020 drew to a close, pushed the stock to levels few who follow the Company expected.

Regarding Yamana’s recent $25M (NSR) secondary offering, it’s important to know that roughly half went to institutions (funds), half into retail hands.

A number of funds initiated ‘starter positions’ in Nomad—positions that will likely be bulked-up over time as these fund managers increase their exposure to this burgeoning royalty-streaming play.

Nomad’s public float is currently > 20% versus the ~6% prior to the Yamana transaction (a syndicate of over a dozen brokers was involved in the distribution). This increased liquidity is a positive development as the Company continues to gain market awareness via an expanding project portfolio.

Yamana still maintains a fully diluted position of >10% in Nomad btw.

Question: Does Nomad represent a bargain at current prices? That’s not for me to say, but if you have been following the royalty and streaming space for any number of years, you’ll know that some of the better run entities boast multi-billion dollar valuations and enviable price chart trajectories.

Bottom line: Nomad’s underlying assets are performing well. The Company is generating revenue on a daily basis. It recently unveiled a dividend policy. It has an undrawn US$75M credit facility in place giving it the capacity to grow its asset base even further.

On the subject of growth, this management team likely has larger deals in its crosshairs ($50M-plus). Getting larger deals done will manifest this crew’s deal-making prowess which will draw increased market support and attract operators looking to develop projects or expand current operations.

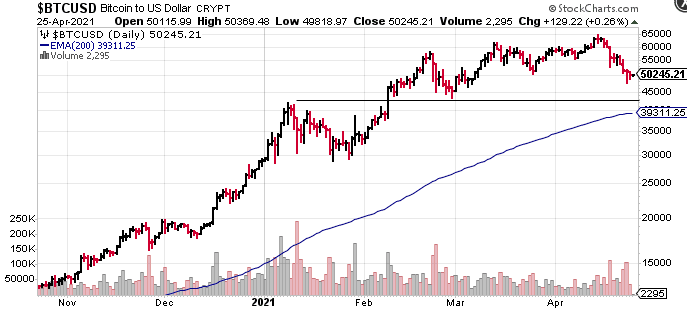

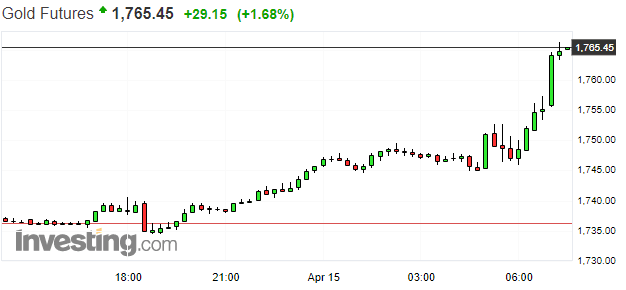

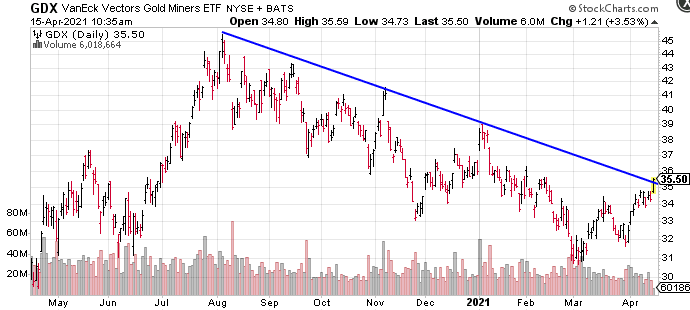

If we are, as I suspect, in the very early stages of an epic bull run in all things metals and mining, this very recent retreat in price may represent an opportunity.

We stand to watch.

END

—Greg Nolan

Full disclosure: Nomad is an Equity Guru marketing client.

Notes:

(1) Preliminary gold deliveries and sales from royalty and stream interests include the gold equivalent ounces of cash settled amounts for the RDM and Moss net smelter return royalties.

(2) The Company’s royalty and stream revenues are converted to gold equivalent ounces by dividing the gold royalty and stream revenues for a specific period by the average realized gold price per ounce for the same respective period. Silver earned from royalty and stream agreements are converted to gold equivalent ounces by multiplying the silver ounces by the average silver price for the period and dividing by the average gold price for the period. The gold equivalent ounces attributable to Nomad include the revenues, net of cost of sales from the Bonikro gold stream from January 1 to May 27, 2020, reflected in the consolidated statement of cash flows, investing activities as Cash acquired for the three-month periods ended June 30, 2020.

Leave a Reply