Major US stock indexes plummeted on Wednesday as it became clear the Covid-19 pandemic will not go quietly into the night.

With four days to go, January, 2021 is already the deadliest Covid-19 month in the U.S.

In January, there have been more than 79,000 coronavirus fatalities. On a mortality meter, that’s about one 9/11 – every day.

U.S. President Joe Biden is aiming to https://equity.guru/wp-content/uploads/2021/10/tnw8sVO3j-2.pngister 100 million vaccination shots in the first 100 days of his presidency.

But “It’s going to take months before we can get the majority of Americans vaccinated,” admitted Biden.

Biden’s vaccination target is ambitious because many Americans believe vaccines are a diabolical plot by scientists, socialists and other fancy people to take their guns.

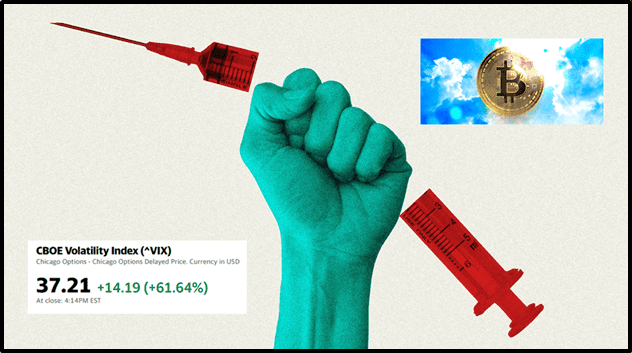

On Wednesday, the Dow Jones Industrial Average fell 2.05%. The S&P 500 fell 2.57%. The Nasdaq fell 2.61%.

Even trusty old Netflix got a 7% haircut.

Meanwhile, The VIX volatility index spiked an astonishing 61.6%.

The VIX measures the 5- day average put/call ratio on the options market.

A put option is a bet that a stock will go down.

A call option is a bet that a stock will go up.

When options-traders suddenly buy a tonne of put options, the VIX surges.

Switzerland’s largest bank, UBS, just published a report on Bitcoin.

“While we wouldn’t rule out further price increases, we’re somewhat skeptical of any essential real-world use cases,” stated UBS, “which makes it hard to estimate a fair value for bitcoin and other cryptocurrencies”.

“We are also cognizant of the real risk of one losing one’s entire investment. Investors in cryptocurrencies must therefore limit the size of their investments to an amount they can afford to lose. We also suggest thinking about an exit strategy.”

“There is little in our view to stop a cryptocurrency’s price from going to zero when a better designed version is launched or if regulatory changes stifle sentiment.”

The bank noted that institutional and retail investors are buying bitcoin because it is “an attractive investment opportunity, a hedge against depreciating fiat currency, and FOMO”.

“Bitcoin can’t be real money,” opined one amateur pundit on an investor bullboard, “To be money on a global stage, you need to have a bond market. Since bitcoin is finite, by definition it would be deflationary.”

“Who is going to borrow a currency if when they go to pay it back, it will be even more valuable? Why wouldn’t you borrow in dollars instead, and repay the debt with cheaper dollars later”?

“It can be an asset, a speculation, even a form of currency. But it can never be money.”

“Putting 1% of your portfolio into Bitcoin there’s roughly a 1% chance this doesn’t work out,” explained one investor who is probably not an accountant, “but a 99% chance you’ll end up being up 10x, 100x or higher in the coming years.”

“Every day there is some article about an institution buying another 1,000 or 10,000 bitcoins,” observed another investor, “I guess all these institutions are just buying to ride down the crash and lose their money? Is that it?”

“The activity in GameStop is more proof of concept that Bitcoin is going to work,” stated Trump antagonist and media-slut Anthony Scaramucci, “How are you going to beat that decentralized crowd? That to me is more affirmation about decentralized finance.”

In a recent poll, “42% of Republicans said they “definitely or probably would not” get a vaccine.

35% of U.S. rural residents think vaccines are fake science.

Lack of education could be a factor. 50% of Americans don’t know which country dropped the atomic bomb (hint: it’s close to home).

According to the “collective wisdom of the markets,” the DJIA is worth 50% more today than it was in March 2020.

GameStop (GME.NYSE) – which sells new and pre-owned video games in mini-malls – is valued at $22 billion.

Bitcoin – a virtual currency that has no utility – is worth $30,000/coin.

“Magical Thinking” is the “the belief that one’s own thoughts, wishes, or desires can influence the external world.”

Common in very young children, psychologists claim that “Magical Thinking tends to fade as children master concepts of logic and cause and effect.”

Trump supporters believe Joe Biden “stole the election”.

Anti-vaxxers believe that vaccines cause autism.

Reddit users believe GameStop is worth $22 billion.

Bitcoin investors believe the value of their investment will keep going up forever.

Magical thinking.

Grow up.

Or face the consequences.

- Lukas Kane

Leave a Reply