On February 9, 2021, Tocvan Ventures (TOC.C) published results from its maiden drill program at the Pilar gold-silver project in Sonora, Mexico.

“Tocvan’s flagship Pilar Gold Project is located along the historic Sonora gold district within the Sierra Madre Occidental geological province,” wrote Equity Guru’s Greg Nolan on May 14, 2020,”

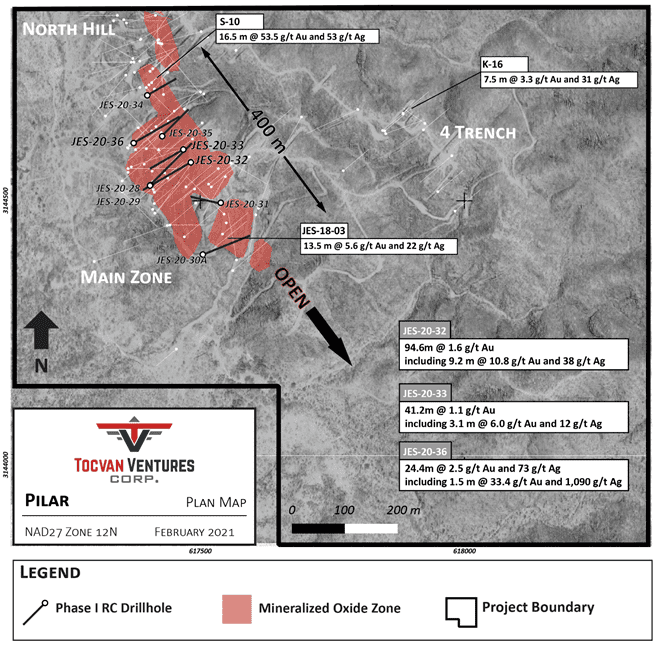

The phase 1 drill program was completed in December of 2020 totalling 1,505 metres of reverse circulation (RC) drilling in nine drill holes.

Results for all nine drill holes are included in the Feb 9, 2021 release; all drill targets were step-outs of historic drill holes within the Main zone.

“Step out drilling programs have a fixed starting point from which they intend to expand the mineralization zone,” explains Under Valued Equity, “Infill drilling programs are used to confirm the presence of mineralization between the step-out drill holes.”

Crudely, when a company chooses to “step-out” – rather than infill – it is demonstrating an ambition to grow the resource, rather than a desire to raise the level of confidence in established mineralisation.

Drilling highlights announced Feb 9, 2021

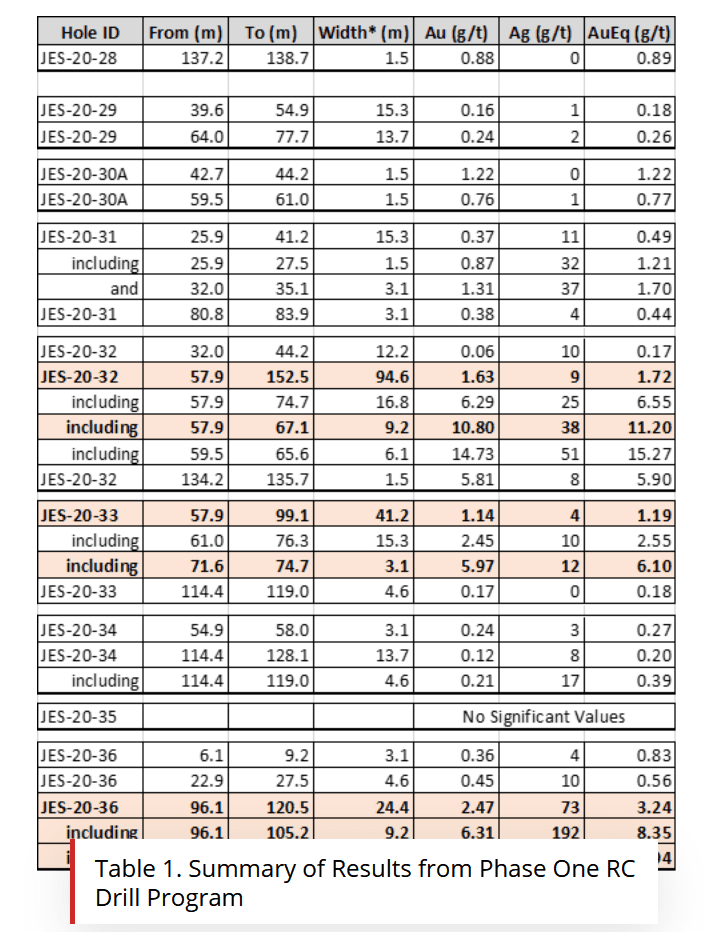

- JES-20-32 — 94.6 metres at 1.6 grams per tonne gold from 57.9 to 152.5 metres, including a high-grade core of 9.2 metres at 10.8 g/t Au and 38 g/t silver from 57.9 to 67.1 metres;

- JES-20-33 — 41.2 metres at 1.1 g/t Au from 57.9 to 99.1 metres, including a high-grade core of 3.1 metres at 6.0 g/t Au and 12 g/t Ag from 71.6 to 74.8 metres;

- JES-20-36 — 24.4 metres at 2.5 g/t Au and 73 g/t Ag from 96.1 to 120.5 metres, including a high-grade core of 9.2 metres at 6.3 g/t Au and 192 g/t Ag from 96.1 to 105.2 metres, including 1.5 metres at 33.4 g/t Au and 1,090 g/t Ag from 96.1 to 97.6 metres.

In 2021, Tocvan’s Pilar gold-silver challenge is to demonstrate further consistency of grade.

“Sonora is a friendly jurisdiction steeped in the mining culture,” wrote Nolan, “It’s currently credited for nearly 37% of Mexico’s annual gold production (the country’s largest Au contributor)”.

TOC Investor Highlights:

- Controls an under-explored Mexican gold-silver asset

- Only 25 million shares out

- Bullish macro-indicators for gold.

- Management has a magic mix of rock-kickers and deal makers

- A micro market-cap of $14 million Canadian pesos.

The Pilar Gold-Silver property is an epithermal project. Hydrothermal fluids carrying gold and silver are transported through the pre-existing structures to become mineralized veins.

Is gold still a thing?

Trading at USD $1840/ounce today, bullion is up $260 from its Feb 2020 price, but down $170/ounce from the August 2020 price.

To some real extent, Bitcoin is a competing commodity.

We are using the word “commodity” loosely here – since no-one has successfully explained the intrinsic value of Bitcoin – or why federal governments won’t regulate it into irrelevance.

Big news last week: Elon Musk converted $1.5 billion cash into Bitcoin.

Drowned out in this news, was a short declaration in Tesla’s recent 10k filing:

“In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash,” stated Tesla, “We may invest a portion of such cash in certain alternative reserve assets including digital assets, gold bullion, gold exchange-traded funds and other assets as specified in the future.”

Gold is a counter-bet against the U.S. dollar.

For a century, it’s been the global reserve currency.

That is ending.

“If you have $41 billion to spare for 10-years, our government will be happy to pay you almost (but not quite) 1% interest for holding your money,” reports The Street.

“Needless to say, these auctions have been attracting less and less interest,” adds The Street, “If it is perceived that the US has trouble borrowing money, that could put upward pressure on rates and we certainly can’t afford that since we are $27 trillion in debt – soon to be $30 trillion in debt when Biden passes his $1.9 trillion Stimulus Bill“.

You can’t print gold.

It’s getting harder to find.

Gold mine production dropped 3% in 2020, down from 3,300 tonnes to 3,200 tonnes, partly due to pandemic protocols at mine sites.

“We are excited to announce the results for our first drill program at Pilar,” stated President and CEO Derek Wood on February 9, 2021. “Today’s results confirm the impressive gold and silver mineralization at Pilar is open for expansion”.

“When we first talked about Tocvan Ventures (TOC.C) back in June, it was selling for around $0.15 and nobody was really talking about it,” observed Equity Guru’s Chris Parry on September 29, 2021.

Tocvan is trading at .60 today.

“In certain markets, hype is rewarded hard, but there’s something to be said for a deal in which what’s being said is the very essence of non-hype,” added Parry.

“Planning is well under way for our next phase of drilling that will continue to expand the areas of known mineralization and test other property-wide targets, drilling deeper and farther out from our established Main zone,” added Wood.

Full Disclosure: Tocvan Ventures is an Equity Guru marketing client, and we have purchased stock in the company.

Leave a Reply