When conducting due diligence on a Company touting a new discovery in the junior exploration arena, there are numerous factors to consider, the most obvious being geology. You might ask: How significant is the discovery? What is the potential for grade, scale, continuity? What are the potential economics should the discovery continue to evolve in a meaningful way? And will I be able to swap my shares for that condo in Whistler once the limits have been defined?

If you’ve been around this arena for any length of time, chances are you’re still here because you’ve experienced the rush of watching your sub-dime stock go parabolic on the back of a fat drill hole. If, like me, you’ve witnessed one of these discoveries evolve into a full-blown takeover scenario—suddenly putting that Whistler real estate within reach—you’re likely here to stay.

But if you’ve been around this sector for more than one upcycle in the metal, you know that geology alone is not enough to generate sustainable momentum after the initial stages of blast-off.

The one detail that requires rigorous detective work—the one factor that can trump all other considerations combined – is the project’s zip code.

“Are we in a mining-friendly jurisdiction?”

This is the question. It’s difficult to overstate the importance of the ultimate reply.

A twitchy government, one without a clear and fair set of values where mining interests are concerned, can wreak all kinds of havoc on your new discovery’s trek along the exploration, development, and permitting curve.

A country without an established and trusted track record of permitting mines to production may all-of-a-sudden pull a fast. Out-of-the-blue it might decide to revise its mining codes. It might lead your company down the garden path—allowing millions to be poured into the project—and then suddenly raise taxes during the final phase of development. Some might try bullying their way in for a (larger) piece of the action or even expropriate the project outright… It’s been known to happen.

I’ve been around this sector for a good long while, since my late teens. I have stories. I’ve been burned.

Examples from way back, still fresh in my mind

Back in 2009, I fell in love with a gold stock (never fall in love with anything in this sector btw). I began accumulating a company called Lydian International. Lydian’s Amulsar gold project in Armenia was an oxidized, (near-surface) high-sulphidation gold discovery that began demonstrating grade, scale, and continuity right from the get.

The deposit grew with each phase of stepout drilling. The mineralization was so pervasive, gold was discovered in the subsurface layers of the areas assigned to mining infrastructure.

Within a short space of time, Amulsar’s resource grew to greater than four million ounces (in all categories).

Amulsar’s economics were robust. The CapEx was modest. It was going to be a cheap mine to build and operate.

Though Armenia couldn’t boast a long history of supporting mining operations within its borders (there was no real history to speak of), the government appeared to be onside—permitting moved along at a comfortable pace.

I can’t remember anyone raising a red flag. All of the names I respected and followed in the sector—geologists, newsletter writers, analysts—appeared to appreciate the latent potential at Amulsar.

One highly respected geologist I followed closely stated that out of the hundred gold deposits he tracked, Amulsar was one of the few that checked all of his boxes.

And of course, there was talk of an imminent takeover after the final permitting hurdle was cleared. THE final permit appeared to be a mere formality, a done deal.

Lydian had it all… or so it seemed.

Then, in the summer of 2013, Lydian dropped the following headline…

Lydian International Provides Amulsar Project Update

An excerpt…

However, during a Government session on July 18, 2013, the Armenian Government passed a resolution (the “Resolution”) that modifies the area defined as the “catchment basin” to Lake Sevan, Armenia’s largest freshwater resource. The Resolution is yet to be promulgated and is then scheduled to come into force 10 days after its promulgation. According to the text of the Resolution, the borders of the catchment basin have been expanded to include the horizontal zone 3000 meters on each side of the “axis” to the Vorotan-Sevan tunnel. Based on the Company’s understanding of the Resolution, if projected to surface, the modified catchment basin includes the Company’s currently proposed location for its heap leach processing facility. Furthermore, the Resolution states that this part of the “catchment basin” is to be classified as the “Immediate Impact Zone” to Lake Sevan. This impacts the Company’s current mine layout plans as mineral processing activities are not permitted in this “Immediate Impact Zone.

Things went south from there. Fast.

The message to shareholders on that fateful day of July 24th, 2013 was clear: “Welcome to Shitsville”.

You might be thinking, “Ya, but the good people of Armenia had a right to protect their life-giving groundwater from any potential threat, no matter how rich the project.” Damn straight. Quite right.

But in reality, the only threat posed to the region’s groundwater was if the laws of gravity were to suddenly reverse causing water to flow uphill.

In the end, Amulsar’s feasibility study, which was 95% complete at the time, was scrapped. EVERYTHING was put on hold. Many early shareholders, those who were loyal to the company from the get, bailed. Key management stepped down.

The market held out hope that the gov’t would spot the flaws in its logic, but in the end, the stock was given a real lesson in gravity.

Whatever became of Lydian and the Amulsar deposit?

Two headlines, both in the first two weeks of March 2020:

Lydian Provides Update on Restructuring Proceedings Under the Companies’ Creditors Arrangement Act

The Amulsar gold deposit may as well be located on some frozen asteroid hurtling through space millions of miles from Earth.

Venezuela is another example of overzealous politicians (generals) doing their worst.

Back in the mid-1990s, an area called Kilometer 88 in the eastern part of the country was besieged by Canadian mining companies both large and small. It was a staking rush that rivaled some of the largest in recent history.

I chased over a half dozen of these companies shortly after the rush began.

Kilometer 88 was a traders’ dream. The action was fast, furious, and lucrative.

But in the end, after political idealists entered the fray, foreign companies were shown the door, putting the kibosh on what should have been a glorious economic windfall for the entire country.

Venezuela to Nationalize Country’s Largest Gold Mine Las Cristinas

We all know how that experiment ended…

Romania was yet another disaster for unwitting investors.

The risk in Romania wasn’t immediately apparent. It was different. But it was simmering just below the surface.

The fate of Rosia Montana, Europe’s largest undeveloped gold deposit (17.1 million ounces of gold and 81.1 million ounces of silver) has been in limbo for years after tens of thousands of people took to the street in protest. This prompted the Romanian government to slam the door shut on future development.

Rosia Montana: Seeds of utopia in town almost lost to gold mining

Romania is a good example of why it’s important to examine every aspect—every corner—of a jurisdiction before laying your hard-earned money down.

Visiting the tiny village at the edge of Rosia Montana—sitting down with the locals at a favored pub or cafe—would have been a shrewd bit of due diligence. I’m sure the project dominated conversations far and wide.

‘Jurisdictional risk’ is a weighty consideration. Downplay it at your peril.

The Institute

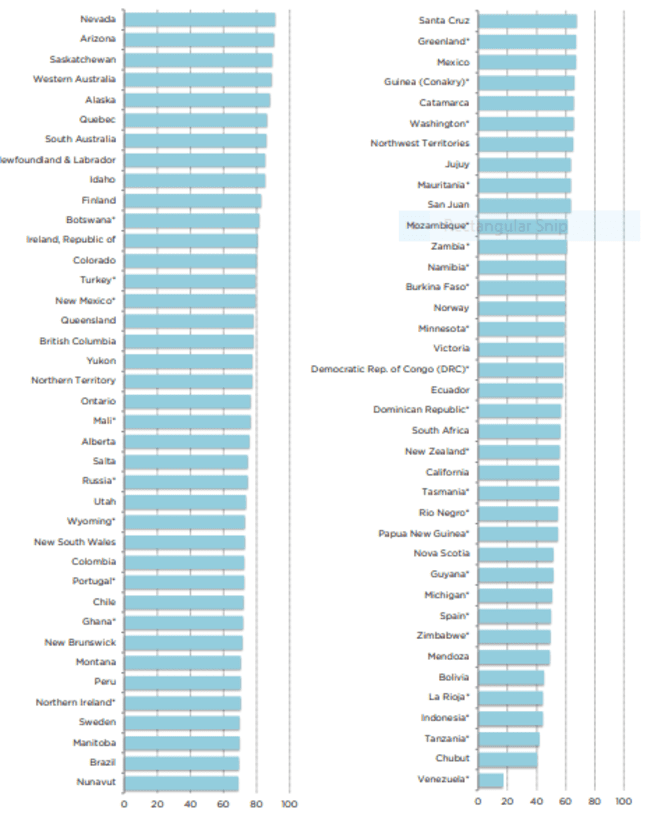

The Fraser Institute, a think-tank that analyses jurisdictional risk, just published its most recent survey of mining jurisdictions.

Annual Survey of Mining Companies, 2020

This annual survey is one of the better shortcuts to getting a handle on the “Investment Attractiveness” of a jurisdiction, be it a country, state, or province.

It also serves as a “report card” to governments on the attractiveness of their mining policies.

This report presents the results of the Fraser Institute’s 2020 annual survey of mining and exploration companies. The survey is an attempt to assess how mineral endowments and public policy factors such as taxation and regulatory uncertainty affect exploration investment. The survey was circulated electronically to approximately 2,200 individuals between August 6th to November 6th, 2020. Survey responses have been tallied to rank provinces, states, and countries according to the extent that public policy factors encourage or discourage mining investment.

We received a total of 276 responses for the survey, providing sufficient data to evaluate 77 jurisdictions. By way of comparison, 76 jurisdictions were evaluated in 2019, 83 in 2018, 91 in 2017, and 104 in 2016. The number of jurisdictions that can be included in the study tends to wax and wane as the mining sector grows or shrinks due to commodity prices and sectoral factors.

Like last year’s survey, this year’s survey also includes an analysis of permit times.

According to Elmira Aliakbari, director of the Institute’s Centre for Natural Resource Studies:

“The Fraser Institute’s mining survey is the most comprehensive report on government policies that either attract or discourage mining investors.”

Fraser’s Top Ten list

The top jurisdiction in the world for investment based on the Investment Attractiveness Index is Nevada, which moved up from 3rd place in 2019. Arizona, which ranked 9th in 2019, moved into 2nd place this year. Saskatchewan climbed eight spots from 11th in 2019 to 3rd in 2020. Western Australia ranked 4th this year after topping the ranking last year, and Alaska dropped a spot from 4th in 2019 to 5th in 2020. Rounding out the top 10 are Quebec, South Australia, Newfoundland & Labrador, Idaho, and Finland.

The Top Mining Jurisdictions 2020…

Fraser’s Bottom Ten list

The 10 least attractive jurisdictions for investment based on the PPI rankings (starting with the worst) are Venezuela, Chubut (Argentina), Zimbabwe, Bolivia, Argentina: Mendoza, Tanzania, Papua New Guinea, the Democratic Republic of Congo (DRC), Indonesia, and La Rioja (Argentina).

Our clients with assets in the Top Ten…

Nevada, ranked #1 by Frasier.

Fremont Gold (FRE.V)

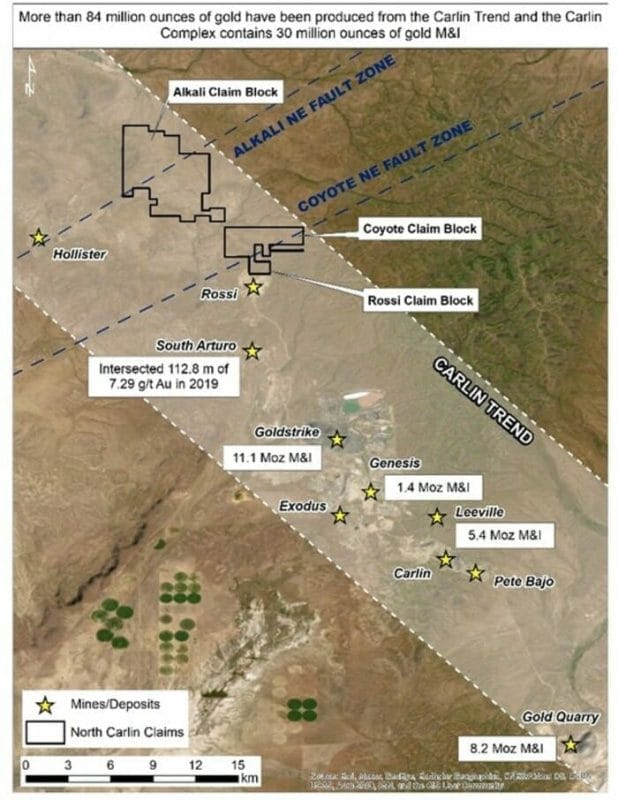

Freemont is focused on the discovery potential in one of the most prolific geological settings on the planet.

The Company’s current project pipeline consists of four gold projects along the Carlin, Cortez, and Independence Trends.

- The North Carlin project is located in the Carlin Trend. The company is targeting a Carlin-style gold deposit and/or low-sulfidation epithermal mineralization.

- The Cobb Creek project is located on the Independence Trend—the target is a Carlin-style gold deposit.

- The Griffon project is located on the Cortez Trend—the target is Carlin-style gold.

- The Hurricane project is located on the Cortez Trend—the target is a Silica replacement-type gold deposit.

The 42-square kilometer North Carlin Project and its three claim blocks—Alkali, Coyote, and Rossi—currently bears flagship status.

The project is located at the very northern end of the Carlin Trend in proximity to a number of world-class deposits.

The project’s southern boundary is located only six kilometers north (and on-strike) of the South Arturo mine operated by Nevada Gold Mines (NGM)) and Premier Gold (soon to be i-80 Gold). The deposits comprising the South Arturo package have produced roughly 2.3 million ounces of gold to date

(NGM is a JV between mining behemoths Barrick and Newmont).

Recent drilling at South Arturo tagged an exceptionally fat intercept of 39.6 meters grading 17.11 g/t Au.

Six clicks to the south is NGM’s Goldstrike mine which hosts a resource of 11.1 million ounces of Au (Measured and Indicated).

Hecla’s (HL.NYSE) high-grade Hollister mine is located six kilometers from North Carlin’s western boundary.

In mid-January, the Company mobilized a drill rig for a first pass campaign where multiple targets were prioritized via the application of good science—soil geochemistry, gravity-geomagnetic surveys, and the projection of key faults that control gold mineralization in the region.

That drill program is now complete.

Assays are pending.

Nomad Royalty Company (NSR.T)

Nomad is a gold & silver royalty company with a portfolio of high-quality projects consisting of 14 royalty, stream, and gold loan assets—six of which are currently producing.

The Company has exposure to Nevada, Arizona, and Quebec—all on Fraser’s Top Ten list.

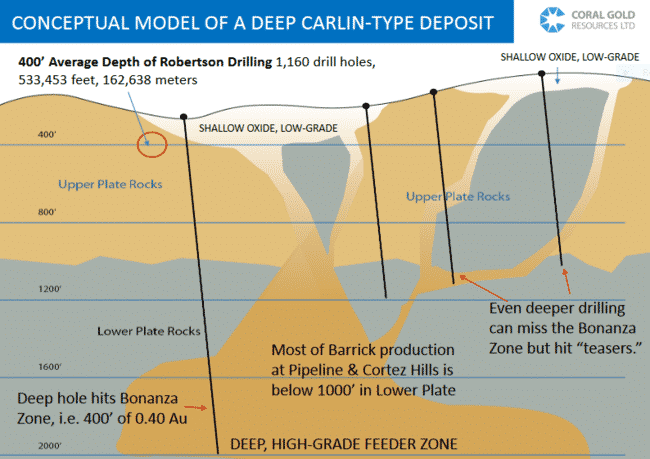

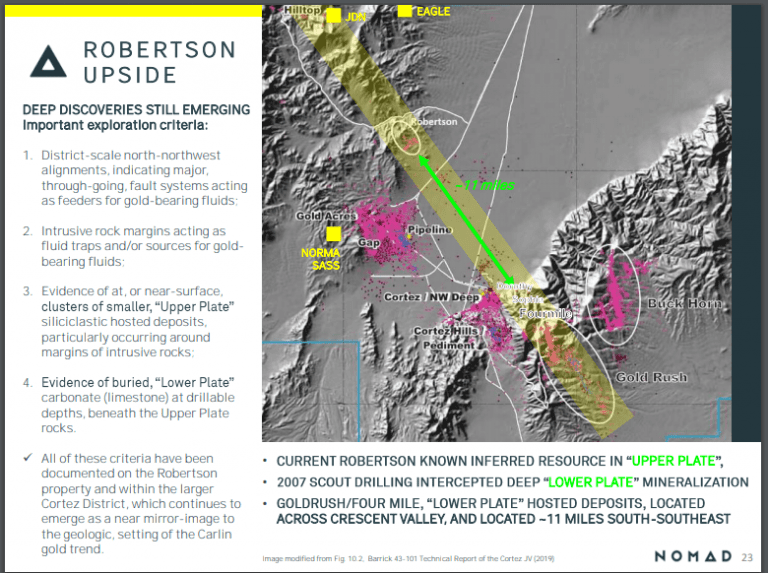

The Robertson NSR is one example of the Company’s exposure to Nevada.

This uncapped sliding scale NSR (1% to 2.25%) covers over 2.7 million ounces at Nevada Gold Mines’ (NGM) Robertson Property located along the prolific Cortez Gold Trend in the northern part of the state.

Robertson is a joint venture between mining behemoths Barrick (61.5%) and Newmont-Goldcorp (38.5%).

Note Robertson’s proximity to Pipeline, Cortez Hills, and Goldrush—three of the largest Carlin-type gold deposits on the planet. They make up NGM’s lowest-cost assets with over 26.8 million ounces of gold reserves & resources.

It’s important to note that Robertson’s ounces are considered part of the mineral resource base at the Cortes Mine Complex and as of November 2020, these 2.7 million ounces are now included in the 5-year mine plan at Cortez.

This inclusion is a huge development.

First production at Robertson is slated for 2025 (Cortez is forecasted to produce 750,000 to 850,000 ounces annually from 2021 to 2025).

This is excellent news, but what’s really compelling about this NSR, and what a lot of people miss, is that this 2.7 million ounce-count may represent only the tip of the iceberg.

Robertson holds considerable exploration potential at depth.

Finding a deep, rich “feeder” deposit—the source of Robertson’s surface gold—is high on NGM’s priority list.

NGM’s geologists have stated they’ll be looking for a “Meikle-style” discovery at depth (the Meikle deposit was discovered in September 1989 when a deep drill hole tagged 164.5 meters of 11.62 g/t Au from 397.5 meters to 562 meters).

According to a Jan. 21st press release…

“Barrick will be conducting drilling programs at Robertson and initiate earlier stage generative exploration work on the Pipeline-Robertson corridor.”

Drilling success at Robertson could be a game-changer for the project, and a potent catalyst for Nomad’s common shares.

Arizona – ranked #2 by Fraser

Arizona Metals (AMC.V)

A couple weeks back, Arizona Metals accelerated a fully-funded Phase 2 drilling campaign at its flagship Kay Mine Project.

The Kay project is located in a prolific volcanic massive sulphide (VMS) setting—a region where roughly 4 billion pounds of copper was produced over its century-long run… a region host to 60 past-producing underground Cu-Au-Zn VMS mines, all within a 150-kilometer radius of this highly prospective asset.

The copper grades in this district typically ran 3.5%.

There is a historic resource at Kay. In the early 1980s, Exxon Minerals delineated 5.8 million tonnes grading 2.2% Cu, 3.03% Zn, 55 g/t Ag, and 2.8 g/t Au for a CuEq grade of 5.8% ***

Without taking into account recovery rates, the precious metals component of this historic resource runs higher than most VMS deposits.

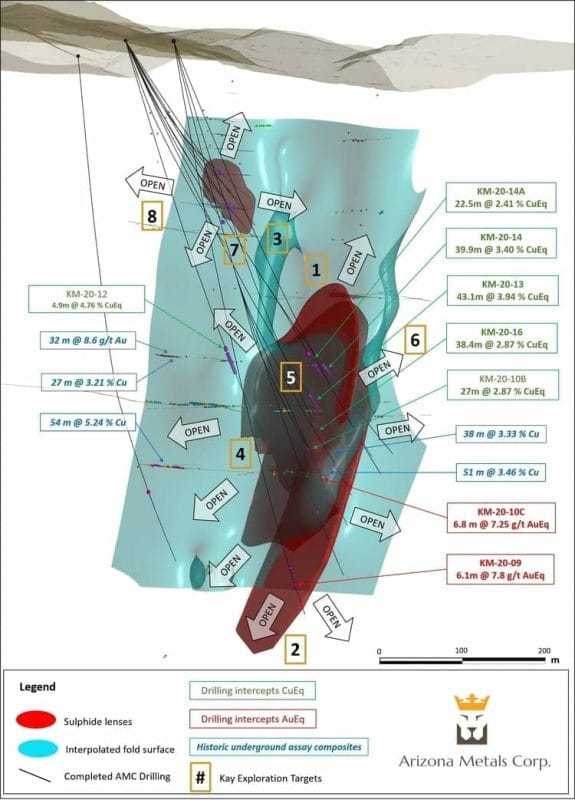

This next map shows the location of the historic Kay deposit relative to the pad locations established for this current Phase-2 (29 hole) campaign…

As noted further up the page, the drill program was accelerated—a 2nd rig was mobilized to the project on February 3rd.

“This addition will accelerate drilling under the fully-funded Phase 2 program, which will consist of a minimum of 11,000 m in 29 core drill holes. This expansion drill program will test for new VMS lenses in anticlinal hinge zones identified to the north and south of recent drilling, as well as the up-plunge and down-plunge extensions of known hinges (image below). Drilling will begin at the Kay Mine targets and progress to targets on strike (north and south) of the Kay Mine, and then to Central and Western targets as permitting is completed (above map). Permitting is currently underway for these targets and is progressing well.”

A thorough review of Phase-1 drill results set the stage for Phase-2.

This data review, with the aid of SRK Consulting (Canada), included 1,202 spectral alteration measurements combined with digitized historical data and structural mapping to “undertake sulphide lens modeling and fold modeling to identify new drill targets.”

Translation: the Company is using good science to prioritize its drill targets.

“Arizona Metals completed spectral analyses to map alteration within and away from the mineralized zones. These data were used by SRK to define five alteration types, which can be used as vectors towards mineralization.”

SRK determined that the thickest and most continuous sulphide lenses are located in the anticlinal hinges.

These anticlinal hinges represent the highest priority drill targets (numbered 1 through 8, map below)…

It won’t be long before we get our first look at drill hole assays from this Phase-2 campaign.

Quebec – ranked #6 by Fraser

Delta Resources (DLTA.V)

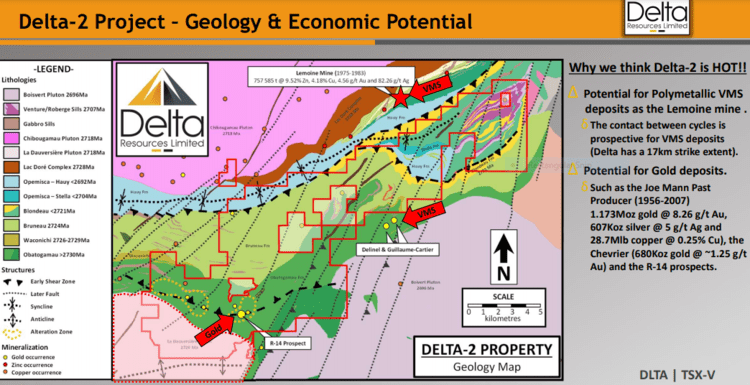

Delta’s 16,400-hectare Delta-2 project is located along the northeast end of the Abitibi Volcanic Belt, just to the southeast of Chibougamau.

The Company is targeting two types of deposits in the region—Volcanogenic Massive Sulphide (VMS) deposits like the past-producing Lemoine mine (757 585 tonnes @ 9.52% Zn, 4.18% Cu, 4.56 g/t Au and 82.26 g/t Ag), and Magmatic-hydrothermal Au deposits like the Chevrier Zone (43-101 Resource of 10.8Mt @ 1.22 g/t Indicated and 6.3Mt @ 1.27 g/t Au Inferred).

Interesting to note, the past-producing Lemoine Mine, just two kilometers to the north of Delta-2’s upper boundary, was one of the richest mines in Canadian history, not in terms of size, but in terms of metal content.

Lemoine is located at the top right of the map below, Chevrier on the bottom left (the Delta-2 property is outlined in red).

Delta launched a Phase-2 drilling campaign at Delta-02 earlier this year, stating…

“Delta is planning between 2000 and 3175 metres of drilling in this second phase of drilling, testing up to 18 isolated, never-tested conductors of short strike length, located in the south-eastern portion of the property. The conductors are all located in proximity to the newly interpreted stratigraphic horizon that hosts the past producing Lemoine Mine north of the property (1975 to 1983: 757 585 tonnes @ 9.52% Zn, 4.18% Cu, 4.56 g/t Au and 82.26 g/t Ag) (Source: www.sigeom.mines.gouv.qc.ca) and are believed to hold excellent potential for similar VMS mineralization.”

Assays from this Phase-2 campaign should begin to flow shortly.

X-Terra Resources (XTT.V)

The Company’s wholly-owned Troilus East property, located along the (underexplored) Frotet-Evans greenstone belt in northern Québec, is about to see an acceleration in activity.

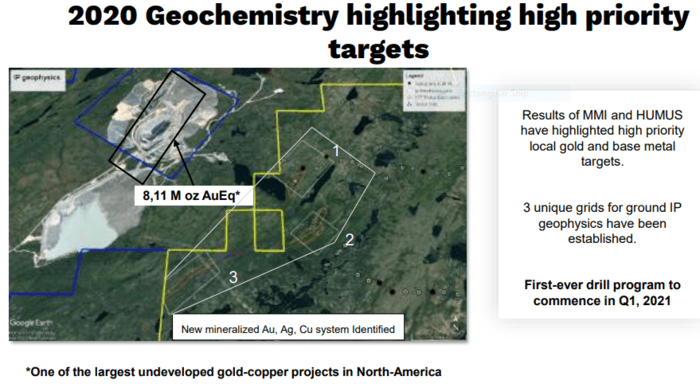

Troilus East shares a common border with Troilus Gold’s (TLG.T) 8.11 million ounces AuEq deposit. Here, X-Terra has established three unique geological grids.

Note the proximity of X-Terra’s highly prospective ground to this 8.11M AuEq resource.

We’re roughly a week away from the start of a geophysical campaign—ground IP surveys—along these three grids at Troilus East. This will mark a final round of exploration that will help refine and prioritize targets for an upcoming drill program.

Drilling, as you well know, is an expensive proposition. The more layers of good science you lay down ahead of mobilizing a drill rig—the greater the correlation between geophysics and geochemistry—the better the chances of tagging a discovery.

Troilus East encompasses 92 square kilometers of parallel geology— the same geological characteristics—to Troilus Gold’s 8.11M AuEq deposit. That’s 92 square kilometers of highly prospective terrain that has never received a proper probe with the drill bit.

The Company’s CEO, Mike Ferreira, is currently reaching out to local contractors and expects to be drilling by early April.

This is a highly anticipated campaign.

Idaho – ranked #9 by Fraser

Freeman Gold (FMAN.C)

Freeman operates the Lemhi Gold Project in a state with an extensive and rich mining history.

This is a classic story of where a real gem, one hidden from the mining world for over a decade, suddenly comes back into the light after being liberated from private interests.

The Company’s goal is to define a 1.5M – 2M ounce open-pit (oxide) resource.

The historical resource estimates at Lemhi range between 500k and one million-plus ounces of oxide material. The spread between these estimates was due to property boundary constraints that seesawed over time. A recent consolidation of many of the key claims in the region resolved those issues. This was a real heads-up move on management’s part.

Quoting a recent Guru offering…

Lemhi is a near-surface deposit

Much of Lemhi’s oxidized rock extends 30 to 50 meters below surface (oxidized ore often produces robust economics).

This oxidized material, where there is a healthy component of free gold, opens up the possibility of a low-cost open-pit heap leach mining scenario.

Freeman’s first step will be validating the historical data via an aggressive drilling campaign, one designed to move the historic ounces into 43-101 compliant categories.

The second step will be growing the ounce count via resource expansion and exploration drilling.

The Company began drilling Lemhi last summer—a two rig campaign wrapped-up late last year with 34 holes drilled for a total of 7,149 meters.

Set with the first four holes from this recent campaign, the Company dropped the following headline on Jan. 12th:

All four holes tagged (shallow) high-grade oxide gold.

Highlights:

- 3.3 g/t Au over 25 meters (including 5.4 g/t Au over 7 meters);

- 3.4 g/t Au over 51.6 meters (including 14 g/t Au over 10 meters);

- 3.2 g/t Au over 14.6 meters;

- 1.8 g/t Au over 92 meters (including 8.7 g/t Au over 7.7 meters (and also including 15.1 g/t Au over 4.3 meters));

“Gold mineralization extends to at least 200 meters and is open at depth. Of note, the high-grade zones lie within broader lower grade mineralized envelopes, such as 1.1 g/t over 189.1 meters. Drill holes reported in this press release cover an area of 150 by 50 meters of the Lemhi deposit.”

The full table of results…

In the body of this release, the Company went on to describe the geological setting.

“Geologically, the Lemhi Gold Project lies within the Idaho-Montana porphyry belt, a northeast-trending alignment of metallic ore deposits and mines related to granitic porphyry intrusions. These extend north-easterly across Idaho and are related to the Trans-Challis fault system, a broad (20-30 km-wide) system of en-echelon northeast-trending structures extending from Boise Basin more than 270 km into Montana. At Lemhi, gold mineralization is hosted in Mesoproterozoic quartzites and phyllites within a series of relatively flat-lying lodes consisting of quartz veins, quartz stockwork and breccias. Mineralized lodes are associated with low angle faults, folding and shear zone(s). The mineralized zones have varying amounts of sulphides (pyrite, chalcopyrite, bornite, molybdenum, and occasionally arsenopyrite) where free gold is common. Gold mineralization at Lemhi is open at depth and on strike.”

The following video interview offers some interesting insights into what’s coming down the pike (note the details re drill hole FG20-014C—the deepest hole drilled to date at Lemhi).

Near-term catalysts for the stock include continued newsflow out of this recently concluded drilling campaign—an additional 30 holes are pending—and a maiden NI 43-101 compliant resource estimate scheduled to drop later this quarter or early next. A Phase-2 campaign should follow-up fast.

Final thoughts

The Fraser Institute’s survey is my go-to for assessing jurisdiction risk. But it’s not decisive. You still need to dig, to determine just how “mining-friendly” a jurisdiction really is.

A vivid example…

US Forest Service rescinds environmental report for Rio’s Arizona copper mine

This is a stirring development, especially when you consider that Arizona is ranked # 2 on Fraser’s Top Ten list.

END

—Greg Nolan

Full disclosure: All of the companies featured above are Equity Guru marketing clients.

*** The Kay Mine historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to be a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

Leave a Reply