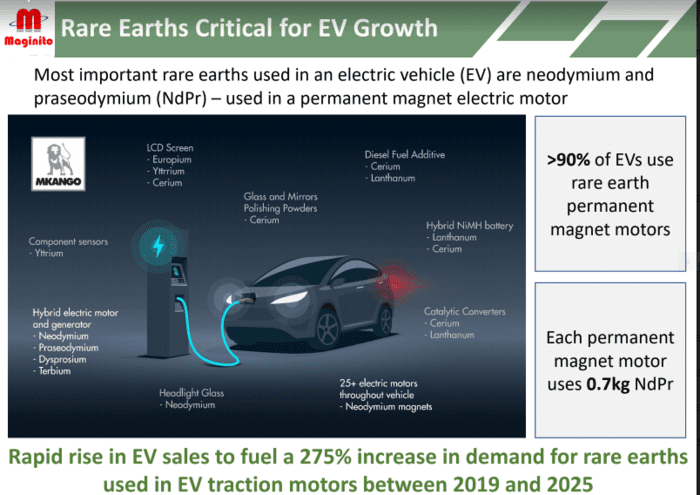

Rare Earth Elements (REEs) are a major driver in the green-ride (EV) revolution.

Electric motors, generators, catalytic converters, component sensors, LCD screens… REEs can even be found in the powder used to polish the windshields and mirrors.

Hailed as the “vitamins of chemistry”, REEs exhibit a broad range of electronic, optical, and magnetic properties.

They’re an essential ingredient in everything from night vision goggles to the control rods in nuclear reactors.

They make our TV screens glow brighter, our batteries last longer, our electronic gadgets more beguiling, and according to Equity Guru’s Chris Parry, “they’re in your pocket right now keeping your Candy Crush scores updated.”

Their properties are so unique, so unequaled, there’s no replacing them, and we’d likely be right-screwed without them.

Concerning the EV market specifically, recent headlines underscore the need…

U.K. Moves to End Sales of All Non-Electric Cars by 2035

China’s electric vehicle push spells doom and gloom for oil demand growth

EVs to Overtake Gas Guzzlers in India by 2030, Mahindra Says

Biden wants to replace government fleet with electric vehicles

Biden’s push for electric vehicles puts US in international race to electrify

General Motors Pledges a Zero-Emissions Light-Duty Vehicle Fleet by 2035

Upping the ante, in a recent Super Bowl ad, General Motors trotted out one irate Will Ferrell bewailing America’s failure to keep pace in the global race to electrify.

“Did you know that Norway sells way more electric cars per capita than the U.S.? Well I won’t stand for it,” says Ferrell giving some defenseless globe What-For.

“We’re going to crush those lugers,” exclaims Ferrell (sounds more like “losers”)

“Crush them. Let’s go, America.”

Hilarious stuff, but this green revolution is for real.

An interesting stat relating to Ferrell’s lament…

54% of new vehicles registered in Norway in 2020 were electric, according to The Norwegian Road Federation, compared to 2% market share in the U.S.

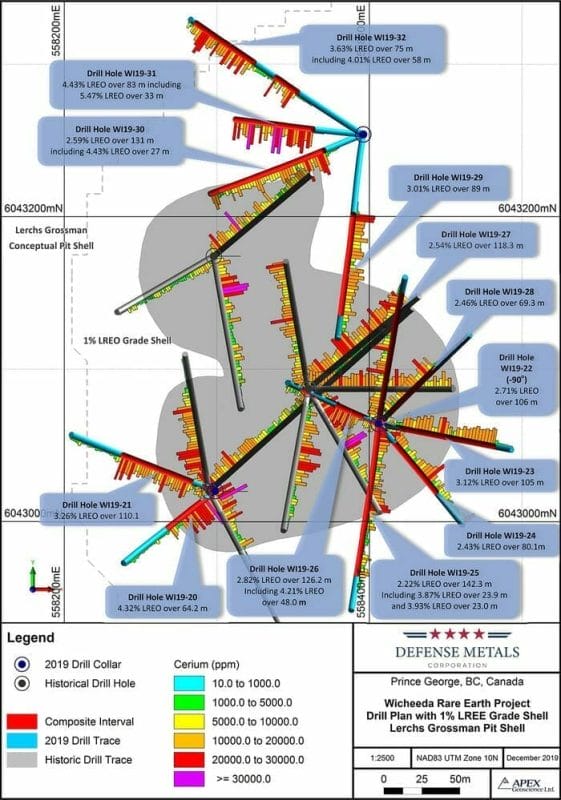

Defense Metals (DEFN.V) is pushing its wholly-owned Wicheeda REE project aggressively along the development curve.

This 1,708-hectare project, located along a well-maintained forestry road in the mining-friendly region of Prince George, B.C., is the Company’s flagship.

Wicheeda is surrounded by all the infrastructure necessary to breathe life into a modern-age mining operation.

Wicheeda’s resource is high-grade…

4,890,000 tonnes averaging 3.02% LREO (Light Rare Earth Oxide) in the Indicated category, and 12,100,000 tonnes averaging 2.90% LREO counted as Inferred.

In late 2019, the Company produced some extraordinary assay-related headlines as results emerged from a 2000-meter drilling campaign.

In more recent months, newsflow has been dominated by the engagement of strategic partners, noteworthy hires, and numerous pushes along the metallurgy-processing front.

Two recent developments that stand out to this humble observer…

Craig Taylor, Defense Metals’ CEO:

“The engagement of Welsbach will enable Defense Metals to leverage their extensive experience and relationships in the Asia-Pacific region (Australia, Singapore, China, Japan, and South Korea), Continental Europe, and the United States towards engaging in one-on-one discussions with REE refiners and separators. The goal is the successful negotiation of one or more binding commercial REE offtake and/or other supply chain agreements with respect to the Wicheeda REE Deposit. Welsbach will immediately commence its work aiding with respect to strategic partner identification, business introductions, and ultimately commercial negotiations.”

CEO Taylor:

“Defense Metals is extremely pleased with rapid advances being made in our pre-pilot hydrometallurgical optimization. We continue fine-tune our gangue leach, via milder conditions versus base case, with an eye to striking the optimal balance of high front-end impurity rejection with minimal REE losses. The results announced today speak to the success of these efforts.”

A brief Q & A

On Mar. 3rd, I had the pleasure of chatting with Defense Metals’ CEO, Craig Taylor. The following represents the guts of that enlightening Q & A…

Greg Nolan (Greg from here on): Hi Craig, it’s been a few months since we last talked. Thanks for taking time out of your busy schedule to answer a few questions.

CEO Craig Taylor (Craig from hereon): Not a problem Greg.

Greg: Cutting right to the chase, what are your ultimate goals for Wicheeda—do you see yourself pushing the deposit towards production, or would you prefer to monetize it, selling it to the highest bidder?

Craig: I see selling the deposit rather than putting it into production ourselves. With the interest in REEs worldwide, I see potential suitors coming to the table as we move the project forward. We’re currently working on a PEA, we’re working on a hydromet pilot plant, we’ll be working on expanding the current resource with an upcoming drill program, and we’ll be looking to move towards the prefeasibility stage. At that point, we should see some fairly big players take an interest. There aren’t a lot of REE companies out there at this stage of development—there’s not a lot to choose from.

Greg: What do you see as some of the more compelling fundamentals supporting REE prices going forward?

Craig: There’s a serious supply/demand issue arising from the push towards green energy. There’s a real shortage of REEs. We’re seeing new forecasts, almost daily, from governments and from manufacturers talking about ramping up EV production. There are also large wind turbine development projects in countries like Korea and England, some of the biggest of their kind, that have yet to come online. China has similar initiatives—they’re turning into a major EV player as well. Internal demand in China could consume all available supply—there may not be anything left over for the West.

Greg: That’s interesting.

Craig: This has been decades in the making. The West is ill-prepared for this. We’re just waking up now to the realization that we don’t have the processing facilities, we don’t have the production… all of the things necessary for our endeavors on the green energy side, and the military side.

Greg: Your company has been delivering numerous developments on the technical front—can you summarize what you’re currently working on with SGS Canada?

Craig: In a nutshell, what we’re trying to do through the SGS bench-scale test work is optimization towards our hydromet pilot plant. The more bench-scale testing we do, the more kinks we can iron out ahead of building the pilot plant. All of these technical studies are aimed at achieving greater efficiencies—optimal output at the lowest cost. The team at SGS are very good, they’re very thorough scientists and they’re coming up with some new ideas that could yield bigger, better results. It’s been money well spent, and the SGS team isn’t finished yet.

Greg: Back in February, you engaged Welsbach Holdings to assist you in a number of areas. What are your expectations—what do you hope to achieve with this partnership?

Craig: Welsbach has ties in Singapore, Japan, Korea, Europe, Australia, and China. They’re connected to every smelter, every end-user in the space. They’ll serve as a key broker, moving us forward in securing MOUs for offtake agreements. They see the upside in what’s happening globally.

Greg: You probably can’t answer this, but are there any names, any end-users in the space that have expressed interest in your REE concentrate?

Craig: No. I can’t give you any names, not just yet. We’re in the short strokes now—we’re working on putting together a list and sending out samples of our concentrate. I’m hoping to have that list within the next six to eight weeks.

Greg: Changing gears here a bit, what are your exploration plans for Wicheeda this coming field season?

Craig: I’m anticipating another drill program, something in the order of 13 to 15 holes, roughly 2,000 meters, to upgrade and expand the resource further.

Greg: So it will be a combination of infill and stepout drilling—Wicheeda is open in multiple directions, including at depth?

Craig: Yes, we’ll be working mainly on upgrading our categories. We need to do this in preparation for a prefeasibility study. Regarding stepout drilling, the program is still in the planning phase but we’ll definitely do some stepouts from the main deposit.

Greg: What do you see as potential catalysts for your stock in 2021?

Craig: We have a PEA on deck. We’re working towards securing offtake agreements, expanding our resource, and we’re working on constructing a pilot plant that will produce an oxide with the potential for scale. These are all potential catalysts for our stock.

Greg: Thanks for your time Craig.

Craig: Anytime Greg.

This just in…

The following headline dropped earlier this a.m…

DEFENSE METALS X-RAY TRANSMISSION AMENABILITY STUDY

This, along with a myriad of headlines released over the past several months, continues the momentum in de-risking this high-grade REE resource.

Here, the Company announced results from an X-Ray Transmission amenability study completed on Wicheeda drill core samples. The work was performed by the Saskatchewan Research Council.

Highlights from this study:

- X-ray transmission measurements and QEMSCAN® confirmed that XRT technology can identify Wicheeda REE minerals in drill core samples (Figure 1 below).

- Crushing to -15 mm size particles and using a 5% REE mineral lower cut-off in the sorting algorithm, demonstrated the potential of low-cost front-end XRT sorting to upgrade 2.3x from approximately 11% REE mineral content to 25% REE mineral content.

- Upgrading of Wicheeda REE mineralization via XRT sorting has the potential to significantly reduce feed volume forwarded to downstream the hydrometallurgical process.

Quoting the balance of this press release…

XRT sorting is a technology that exploits the atomic density (atoms/cm3) differences of minerals. The atomic density of a mineral is closely related to the minerals’ density (gram/cm3) and is therefore a viable technology for upgrading the mineralized feed prior to processing. Previous test work indicated that gravity separation prior to flotation was beneficial in concentrating Wicheeda REE minerals due to the large density differences between the REE and gangue minerals.

To evaluate amenability to XRT sorting, a combination of high-resolution XRT and QEMSCAN® (Quantitative Evaluation of Materials by Scanning Electron Microscopy) measurements were carried out at the SRC. These measurements identify if the atomic density differences between the REE and gangue minerals can be exploited for XRT sorting. The greyscale levels associated with the various minerals are identified using QEMSCAN® measurements.

Using the X-ray greyscale images and the QEMSCAN® images, additional theoretical information on the grade of the REE minerals for various particle sizes is generated. The particle grade information determined how much gangue and how much REE mineralization is present in each size fraction. Information is necessary to determine the benefits of upgrading the mineralized feed at different particle sizes.

Size fractions greater than 6 mm can be viably sorted using XRT sorters while size fractions greater than 0.6 mm are more amendable to sorting using dense medium separation (DMS) and spirals. Size fractions less than 0.6 mm are concentrated via hydrometallurgy processes. The average distribution of the REE minerals and the theoretical grade of the XRT sorted mineralized feed for the six core samples, for each size fraction within 20 mm, 10 mm, and 6 mm particles are shown in Table 1.

CEO Taylor:

“Defense Metals is excited to establish the amenability of Wicheeda REE mineralization to the application of low-cost front end upgrading via sensor-based sorting technologies. We know from our very successful flotation pilot plant and bench-scale hydrometallurgical test-work that early volume reduction and upgrading has significant downstream benefits. The quality of concentrate we can deliver to flotation process has direct benefits in terms of process recovery, and reduced costs related to reagent reduction. Based on the success of this amenability test work SRC have recommended proceeding to a series of confirmatory XRT sorting optimization tests.”

This is yet another step in de-risking the project and pushing it further along the development curve.

Final thoughts

In this environment of heightened REE demand, new companies are popping up out of nowhere. But few can boast a legit REE resource. Fewer still can boast a solid foundation—a three-year track record of producing outstanding results on multiple fronts, like Defense Metals.

The stock has created a lot of happy shareholders since the beginning of 2021. Now, as the stock is correcting and consolidating recent gains, current prices may represent an attractive entry point for those looking to add REEs to their (resource) portfolios.

END

—Greg Nolan

Full disclosure: Defense Metals is an Equity Guru marketing client. We own shares.

Leave a Reply