When a ‘devastating’ expose on a company opens with the line ‘We are short this company’, I have to say, I find it hard to read much further. To open the discussion admitting you’ll make more money if the company you’re writing about gets obliterated, and then proceed to map out your obliteration strategy, well it’s a bit lacking in the integrity department.

Mountain Valley MD Holdings (MVMD.C) was bitten by one of these reports this week and, after looking into the allegations published within, we’d suggest MVMD investors don’t have much to worry about.

Short sellers are an integral part of a properly functioning market, in that they counterbalance the pumping of shitty companies and, at least by design, should stop share prices from spiraling upwards out of control.

As a group, we don’t short companies. Never have. Just not in our game plan. And the major reason why we stay out of that game is, it puts us in conflict.

If we tell you a company is dogshit while we have a running bet against that company, are you getting our true thoughts or just muddied waters intended to help our bet? If you can’t tell, we shouldn’t be involved.

We’re in the honest information game, so we focus on placing our money where it can be aligned with investors, not acting against them.

In our opinion, and we’ll explain why shortly, Night Market Research has taken part in a ‘short and distort’ campaign against MVMD that combines honest quibbles about the company with dishonest filler, designed to cast the company in a ‘straight to zero’ light that doesn’t make sense.

Why am I answering to this instead of the company itself?

There are several reasons a company would let a short report against them sit unanswered:

- The Streisand effect, where fighting against an allegation helps to spread the allegation further

- You can’t fight a negative: The old ‘When did you stop beating your wife?’ has no realistic helpful response

- Defamation lawsuits cost an insane amount to file and fight, and rarely bring a result that covers costs, let alone remedies the original offense

- MVMD has work to do that is, frankly, more important than this kind of thing

But I’m a vindictive son of a bitch, and Night Sweats Research decided to cast aspersions on Equity.Guru in their ‘research’ piece, so Imma be their huckleberry.

Night Terrors Research seems to have a few major problems with MVMD.

- They promote themselves.

- The company used to be in a different business

- The company’s tech has been applied to multiple potential uses, rather than one

- People involved in the company were once involved in other companies that ultimately didn’t make money.

- Unnamed people they’ve spoken to think the company isn’t great

That’s pretty much it.

Now, you could apply these beefs to just about every biotech company out there, most weed companies, certainly all psychedelics companies, every mining explorer with the phrase ‘resources’ in its name, the Ginger Beef Company, Tesla, and the laundromat on my corner that used to be a sushi place.

But okay, let’s try to treat Night Farts Research’s ‘research’ as serious, so we don’t fall into the same dismissive hollow pageantry they’re guilty of.

Several months after going public in March 2020 via reverse takeover, Mountain Valley abruptly divested its remaining cannabis related assets and acquired a “desiccated liposome” drug delivery technology from an entity owned by Michael Farber, MVMD’s Director of Life Sciences. [..] MVMD initially applied Farber’s delivery methods to supplements and nutraceuticals in categories such as anxiety, nicotine, testosterone and libido. Then, in another pivot, MVMD shifted attention to vaccines and treatments for polio, tuberculosis, and COVID.

OK. No argument here, but to say if a technology applies to those use cases, why wouldn’t the owner of that tech pursue the multiple uses?

I mean, aspirin is good for relieving a headache, but also good at helping avoid heart attacks. Blood thinners thin your blood, but also get your dick hard. Sometimes a thing that helps a thing can help another thing, or even 70 other things.

And any biotech company that didn’t pursue all the potential uses for its tech would be betraying its shareholders, not to mention potential end users.

Unlike many biotech plays, MVMD has booked revenues. It’d be valid for Night Shirt Research to mention that as a positive. Instead, they paint it as a problem because they don’t like the licensee’s management.

MVMD recorded its first ever revenues in February 2021 when it finalized a licensing agreement with a private mushroom company called Circadian Wellness for C$200k in cash and $50k in equity (we found troubling evidence with regard to Circadian’s management which we highlight later).

Jesus, maybe you could accuse them of not recycling their plastic bottles and having a disregard for the musical works of Rick Astley while you’re at it?

Circadian gave MVMD cash and a small chunk of stock. If that stock ends up being ultimately worthless, who gives a red rat’s ass?

When Nightmare Research looks for dirt, they don’t let the sands of time get in the way. One of their complaints take us back to the year 2001, home of the dotcom collapse, the end of the World Trade Center, and a certain Space Odyssey.

They really don’t like Michael Farber, who generated the MVMD tech, or the company he was running with a few decades back, Vitalstate.

Twenty years ago, Vitalstate was advertising its delivery system and making near identical claims to those being made by MVMD today: enhanced absorption, increased stability, oral delivery of injectable vaccines. In 2004, Vitalstate generated less than $290k in revenue and a net loss of $4.8m. Vitalstate stock was delisted in 2005.

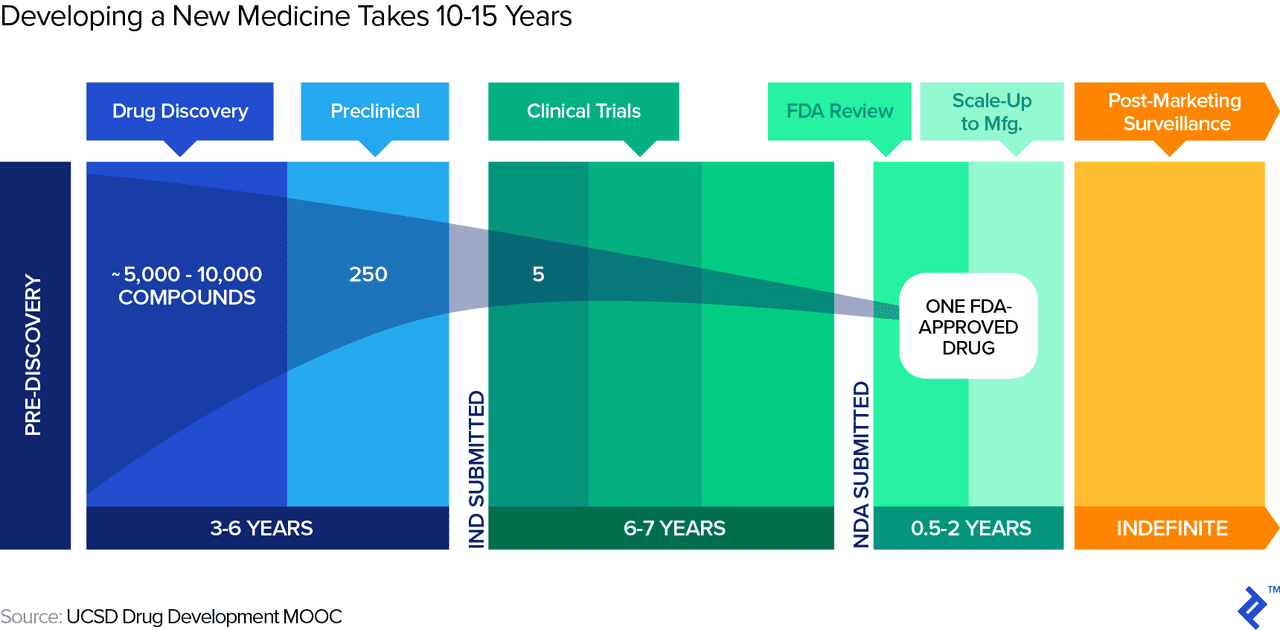

The thing is, bringing a new drug tech to market can take as much as 15 years, if you can keep a company together for that long. Many can’t, or find alternate means of productivity before a given tech proves out.

This timeline shows the usual route to production,

So Vitalstate took a run at it and flamed out in four years. mIt happens.

But Nightgown Research isn’t gonna let him off that easy!

Farber next appears in 2005 as founder of an entity known as Oral Delivery Technology Ltd, which changed its name to Sklar Pharma in 2011. The only information we found on Oral Delivery/Sklar was that Farber assigned Oral Delivery a handful of patents related to the composition of supplements for improving testosterone levels, muscle strength, libido and sexual performance. Seven of nine applications were abandoned. Only one patent was granted, “Nitric oxide releasing amino acid ester compound, composition and method of use”.

How you formulate a sentence shows what your intent with the sentence is.

For instance, if you want to make Sklar Pharma look like a failure, you might say “Seven of nine applications were abandoned.“

If you wanted to make it look like a success, you might say, “Sklar had a patent granted, for Nitric oxide releasing amino acid ester compound, composition and method of use.”

Ultimately, Farber did sell out and used some of his tech on some questionable ‘gains, bro’ bullshit supplement products called Warmeds that I’m not going to defend considering the company used phrases like, “insane muscle size gains, herculean strength gains, and crazy increased libido” in its marketing. Farber has to look at himself in the mirror every day, and that ought to be punishment enough for being involved in that sort of jackfruit bullshit.

We’ve all been through those periods, where the work we’ve been putting in seems like it’s never gonna pay off, so we start baking edibles or making homemade energy drinks or wearing a slightly shorter skirt at our bartending job. It happens. You’ve got to hit rock bottom before you bounce back.

Whether or not the tech Farber was leaning on during his blue period actually has some medical use isn’t changed by his year of selling out. Again, if you tried to tell me aspirin would give me monster libido, it wouldn’t mean it also wouldn’t cure this headache that comes along with reading the bullshit Night Cap Research is putting out there.

Frankly, this paragraph gives a lot away for me as it shows how Nightwear Research is trying to tilt its story [bolding mine].

Farber has only been one granted patent (granted in different jurisdictions) for his desiccated delivery system – or any delivery system. Filed in 2013, “Preparation of desiccated liposomes for use in compressible delivery systems” is the same patent underpinning Mountain Valley’s current work. In fact, we believe it is the only active patent that MVMD currently owns. MVMD says its technologies are based on a “global patent portfolio”, but in this case portfolio means one patent, granted in the US, EU and Canada.

Where else would you like it to be patented? You concerned it’s not going to hit that burgeoning Belarus biotech market?

‘Only’ one patent? How many do you need to get a product up and running?

Frankly, I’d love to have ‘only’ one patent, because it’d be one more than I (or Nightstand Research, for that matter) currently have.

It appears WARMEDS is no longer in business [..], but consider that less than two years ago, Farber was selling a testosterone booster using the same technology and patent that forms the basis of MVMD’s efforts in vaccines and COVID today.

Consider!

You know what else was happening two years ago?

COVID hadn’t happened yet.

Two years can be a lifetime – or 500,000 ended lives, for that matter.

So here we are with the world facing a pandemic and suddenly this guy who had all but given up putting his tech to good use, suddenly realizes he pulled the ripchord too soon and can apply his years of work to a thing that has just emerged that is CRIPPLING THE FUCKING PLANET.

You’ve seen this movie before – the asteroid is heading towards the Earth and the scientists are out of answers but one guy wrote a theory years ago that said this might happen and he was ostracized by the community, but suddenly he looks like he was onto something, so George Clooney has to go find him in a trailer in the Arizona desert, get him off the weed long enough to dry him out, and bring him back to NASA to save the world while all these young hotshots look on. It ends with a Taylor Swift song that you can’t name but bop along to on your way out of the theater.

Too much?

Okay, nobody is saving the world here, but it’s a technology that should be explored, and just because it hasn’t been properly fleshed out previously doesn’t mean it a dud.

Nightsticks Research also makes a big deal out of the fact that the address Farber registered his businesses to was also attached to ‘VivaLife Travel agency, Integrated Martial Arts and Fitness, and Grooves Unlimited Dance Studio.’

A more charitable person would shrug and suggest Farber liked to keep fit, knows how to dubstep, and would help his mom’s friends get discounts on cruise travel. But also, WHO FUCKING CARES.

This is a public company that purchased a company that owned a tech that had clearly struggled to get through the expensive and arduous and often arbitrarily slow FDA approval process, and Nightshade Research is having a conniption because the guy who started it gave rear naked choke lessons on Thursdays.

“IT’S GOING TO ZERO, YOU GUYZ!”

Perhaps not surprisingly, CEO Dennis Hancock has spent most of his career in sales and marketing. Prior to becoming CEO of MVMD, he co-founded PerformanceSPARK, a marketing consultancy with two LinkedIn profiles (Hancock and his co-founder).

YOU GUYS, HE HAD A LINKEDIN PROFILE AND HIS COMPANY ALSO HAD A LINKEDIN PROFILE WHAT DOES THIS MEAN CAN WE NOT HAVE CONFIDENCE IN ANYTHING ANYMORE WHY DO I HEAR VOICES TELLING ME TO KILL GRANDMA?

Prior to that Hancock was on the advisory board of a grocery chain called Organic Garage which has five stores in the Toronto area.

OMG, HE WAS! WHATEVER CAN THIS MEAN?

Narrator: It means a large investor and capital markets consultant working with MVMD is also working with Organic Garage and referring strong executives he’s worked with before to fill vacancies with the right people?

Hancock was also VP of Sales and Marketing at ZENN Motor Company. ZENN manufactured low-speed battery powered cars beginning in 2006. Due to poor sales, ZENN stopped producing cars in 2010.

I was once a clerk at a Radio Shack, a company that filed for bankruptcy in 2017. Clearly I should never work again, just like Dennis Hancock, who was obviously to blame for that company ending its manufacture of vehicles cars in 2010.

DAMN YOU, DENNIS!

If this is all starting to look ultra-small change to you, you’re not alone. I’m gonna skip a load of repetitive bullshit in this short report if that’s okay, because it’s some weak ass shit and I feel like I’m making fun of short kids right now. Mostly it’s talk about how the company, in a previous iteration, was a cannabis company that didn’t take off.

I mean, duh. Even the cannabis companies that have taken off, very few have ‘actually’ taken off in a real business sense. Nightdress Research points out its assets were written down to zero, which puts it in line with MOST CANNABIS COMPANIES EVER.

So let’s get to the other bone of contention here: That MVMD (gasp!) promotes itself to investors.

We count dozens of paid promotions with well-known stock touts Proactive Investors, Agoracom and Equity.Guru. During advertisements portrayed as interviews, Hancock and Farber make fantastical declarations regarding MVMD’s science..

DOZENS OF PAID PROMOTIONS [at three marketing companies]… so.. you mean ‘three’ paid promotions?

Hate to burst your bubble, Nightclub Research, but these three market awareness companies, Proactive Investors, Agoracom, and us, are perhaps the three most basic elements of public company market awareness in Canada.

I mean, if you DON’T have the money to do business with Proactive, I’m not sure where you’re going to be buying lunch outside of a Tim Hortons. Agoracom, never a group Equity.Guru has paid much attention to, is nonetheless an ever-present group that has been doing it for years, and as for us.. we have it line one in our sales deck that we reserve the right to kick around a client company if they do anything untoward that leaves investors betrayed, and have a long history of doing just that, to the point where some execs steer clear.

If you think this holy triumvirate is some sort of evil megacorp stock promotion black hole, you’re demonstrating exactly how little research you at Nightmare on Elm Street Research actually do before you claim a company is ‘going to zero.‘

By our reckoning, MVMD may have spent $100k on promotion in total. They haven’t dumped a few million shares to some schissehouse outfit in Germany, they haven’t dumped $400k into any 4-day Ad-sense tsunamis, or signed up to a Boca Raton fax factory, and they haven’t paid a few hundred bucks to SeekingAlpha to dump anonymous bullshit claims into a third party sinkhole so they can claim it wasn’t them if they ever get sued into oblivion – like some.

MVMD have done precisely what any reasonable shareholder would hope they’d do to get the word out, in spending a reasonable amount with respectable entities employing interviewers with strong reputations.

Like Jody Vance, who was a TV anchor in Toronto and Vancouver for decades, can be heard weekly on CKNW radio, and has moderated local election debates because she’s FUCKING WELL RESPECTED BY EVERYONE IN THE BUSINESS.

Here she is talking to both Farber and Hancock in an update recently that Nighttime Emissions Research considers crazy.

Their particular paragraph of concern:

“You know we’re over half a billion dollar market cap. Now we’re getting a lot of attention. I’ve done a couple interviews today and I was asked this sort of interesting question that you’re, you’re kind of alluding to, and then I candidly said you know someone’s gonna yell at me, never answer about share price, but I’m very convinced we’re building a world class company, shares will follow, and our objective, of course, is shareholder value as the guiding touchstone for my role. However, I was very comfortable saying, you know, my personal belief is, I feel like we’re the most undervalued stock on the planet because, people are like wow, why, and it’s like, if you really understand how even something as simple as Ivermectin – we have the best pharmacokinetic data on Earth, with Ivermectin, we have something that can use 1/5 of an existing oral dose and we have, you know 1/8 to 1/10 for an injectable – that doesn’t exist, in the only human, safe injectable format. And so as you start to understand that application, you get excited about the market potential in that.”

The only words Nightie Research pulled from that whole interview?

“I feel like we’re the most undervalued stock on the planet.”

Good fucking grief.

I will say one personality that has given MVMD a thumbs up doesn’t pass the smell test. This Cameo clip with Kevin O’Leary is terrible and unnecessary and, for mine, the only promo piece I’ve seen that I think someone should have thought twice about.

Hey, sometimes companies make mistakes. Especially companies associated with that particular fake billionaire, but I digress, we now get to the beefiest part of No Market Research, and that’s where they bring aboard their ‘experts’.

As part of our early work on Mountain Valley, to familiarize ourselves with the science we wanted the unbiased opinions of qualified experts. We searched for specialists in drug delivery, with particular experience in liposomes. Approaching them as investors doing diligence on a company and its technology, we found two willing to share their thoughts. We are protecting their identities in order to maintain their privacy, especially since many of their opinions are critical and we don’t want to risk exposing them to potential abuse.

They found experts, you guys! And those experts are convinced MVMD is bogus! So convinced they… won’t put their name to their work?

Look, I’m not going to repeat the words of anonymous experts who won’t stand behind their words here, but I will say we at Equity.Guru have out own ‘expert’, in Ehsan Agahai, who has a masters in biochemistry and is on our staff.

Here’s what he had to say about MVMD’s tech: “It makes sense to me, and it will be interesting to see how it plays out.”

No pumping, no shitting on it, just ‘It makes sense’ and ‘we’ll see.’ Which is, presumably, why the company got a patent. And, presumably, why enough investors have tagged in that it has a $300 market cap.

Meanwhile, using M. Night Shyamalan Research’s own standards of fact-checking, I spoke to two experts in puppy fornicating who say the short sellers are definitely well known in the bestiality community and hold many records for fucking the dog every bit as hard on their previous short reports as they have on this one.

MVMD has $20m in the bank. Plenty enough dough to see their tech through. And no amount of blog posts on SeekingAlpha with fake ‘experts’ while decrying our interviews as ‘fake interviews’ is going to change that.

Excelsior, Mountain Valley.

— Chris Parry, a real life person who has put his real actual name to his words like a real grown up boy, you shit-sipping frittatas.

FULL DISCLOSURE: Mountain Valley MD Holdings has paid money for us to look at them sometimes and tell you what we found, and get time sitting in front of Jody Vance, who you denigrate at your own damn reputational risk, you puppy seducing fraud outfit.

Leave a Reply