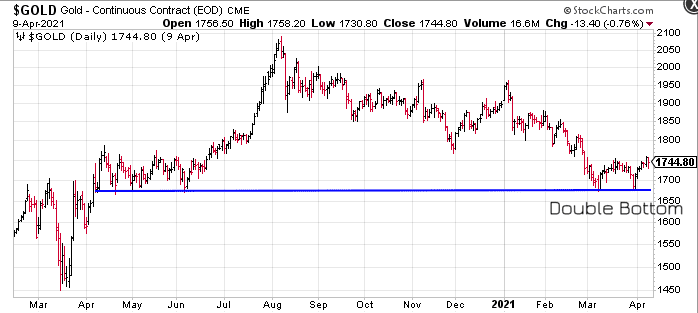

It would appear that Gold, after a hasty retreat in Q1 of 21, is back to riding the $1750 line, a level that has held prices in check for the past month and a half.

After breaching and taking out this key resistance level last week—pushing to $1760, nearly $80 higher from the lows tagged on March 31st—the precious metal has backed off and is currently trading well shy of that key resistance level, waiting for the right catalyst claim and hold higher ground.

Rising inflation—an event that can trigger a powerful and sustainable move in the metal—could be in the offing. The Fed is expecting it, but believes the swell will be transitory.

With the markets shifting their focus to an inflationary environment, some analysts believe that gold does not currently reflect that shift.

Standard Chartered precious metals analyst Suki Cooper:

“Gold prices are not fully reflecting risks of high inflation in the near term as economies reopen but are garnering support from recovering physical demand. While the Fed’s dovish stance and the scale of U.S. fiscal stimulus provide a favorable backdrop, gold prices tend to rally strongly amid periods of high and unexpected inflation.”

In the very near term, we’ll see U.S. inflation data later this morning.

After some surprisingly strong Producer Price Index (PPI) numbers released last Friday—the U.S. PPI popped 1% month-on-month pushing its annual headline rate to 4.2% (the highest in nearly a decade)—we could see some lofty CPI numbers this a.m.

All short-term speculations aside, it looks like the bottom is in for this alluring, malleable (and most shiny) metal, after forming a Double Bottom at key support on March 8th and March 31st.

Physical demand for the metal, with all of the trillions’ worth of cheap (stimulus) paper floating around the globe, appears to be picking up.

Central bank buying, after a pause in 2020 as gold rallied to record highs, also appears to be gaining momentum.

In February, global central banks were net buyers led by India which acquired 11.2 tons of the shiny stuff.

In March, the Polish central bank stated its intentions to buy at least 100 tons in the near future.

A more recent headline shows Hungary’s central bank increasing its gold reserves to 94.5 metric tons from 31.5 tons. This marks one of the most significant central bank gold purchases in decades.

The Budapest Business Journal – Hungary triples gold reserves

A choice quote from the National Bank of Hungary (MNB):

“As it carries no credit or counterparty risks, gold facilitates reinforcing trust in a country in all economic environments, which still renders it one of the most crucial reserve assets worldwide, in addition to government bonds.“

Geopolitical tensions around the globe—Russia vs Ukraine, the U.S. vs Russia, China vs the U.S. et al (sometimes I despair our species)—is another potential catalyst.

Regarding the Gold versus Bitcoin debate—It’s On…

We probed the two prestigious personalities pondering this potential parley in a piece titled Globex Mining (GMX.T) monetizes assets adding to its cash horde + Giustra challenges Saylor to a Gold vs Bitcoin debate + Gold’s repeated attempts to put resistance in its rear view

If you have a vested interest in either of these two assets, this is one debate you’re not going to want to miss.

Rounding up some of the companies we follow closely

Delta Resources (DLTA.V)

On March 22nd, Delta dropped the following headline:

Delta Returns Drills to Its New Gold Discovery at Its Delta-2 Gold Property in Chibougamau, Quebec

Having secured a rig, the Company commenced drilling at its Delta-2 Gold Project in Chibougamau, Quebec to probe a new discovery announced on March 4th, 2021.

We covered that event via the following offering…

Delta tags high-grade gold – up to 50.75 g/t Au in a new discovery in mining-friendly Quebec

The Company states that its primary objective for this phase of drilling is to better understand the geometry of the two mineralized zones intersected in drill holes D2-21-28 and D2-21-29.

A quick review of these two discovery holes at Delta-2:

Drill Hole D2-21-28

- 18.88 g/t gold over 2.5 meters (24.6 to 27.1 meters)

Including: 50.75 g/t gold over 0.9 meters; - 14.08 g/t gold over 0.8 meters (120.8 to 121.6 meters).

Drill Hole D2-21-29

- 3.76 g/t gold over 2.0 meters (25.0 to 27.0 meters);

- 1.81 g/t gold over 1.2 meters (116.4 to 117.5 meters)

Including 3.13 g/t Gold over 0.5 meters.

(core angles suggest true thicknesses to be close to drill-core lengths)

The new discovery was made while testing the extensions of the Due Diligence gold occurrence discovered through prospecting by Delta in 2019. At Due Diligence, surface grab samples had returned up to 55.8 g/t gold in grab samples (see press release October 28, 2019) while channel samples returned 22.97 g/t gold and 10.25 g/t gold over 25 centimetres (see press release October 26, 2020).

Up to seven drill holes are planned (approximately 1000 metres) for this current phase of drilling.

To better illustrate the two deposit types—Volcanogenic Massive Sulphide (VMS) and hydrothermal—the Company is targeting at Delta-2, management decided to subdivide the project into two distinct zones:

THE DELTA-2 GOLD PROPERTY will refer to the southwestern portion of the property which shows a high potential for hydrothermal gold mineralization.

THE DELTA-2 VMS PROPERTY will refer to the northeastern portion of the property where Delta is exploring for gold-rich VMS deposits.

For a deeper delve into this Company and its two key projects—Delta-1 and Delta-2—the following Equity Guru article will bring you up to speed:

Arizona Metals (AMC.V)

On April 8th, AMC announced results from a petrographic study of mineralization at its flagship Kay Mine Project located in mining-friendly Arizona.

The study confirms the strong similarity of the Kay Mine mineralization to other bimodal mafic-felsic-hosted VMS deposits in the Jerome-Prescott area (located one hour north of the Kay Mine) and in other Proterozoic VMS belts (e.g., Flin Flon-Snow Lake, Skellefte). The sulfide assemblage is mineralogically simple and typical of polymetallic ores in this type of deposit. The observations in thin section show uniform granoblastic textures that should be amenable to conventional mineral processing.

The study noted that chalcopyrite is the primary copper mineral and sphalerite is the primary zinc mineral, which occur together with arsenopyrite, galena and copper sulphosalts. Importantly, the mineralization contains very low concentrations of galena (lead sulphide), comprising less than 1% of total sulphide content. Both copper-arsenic sulphosalts (tennantite) and copper-antimony sulphosalts (tetrahedrite) were observed in only trace amounts, the latter being a possible host for silver.

Kay’s mineralization is comparable to the massive sulphides encountered in the prolific Flin Flon and Snow Lake VMS camps. Its rock is also similar to the polymetallic ores at Lalor, LaRonde, and Kidd Creek, and is expected to demonstrate similar metallurgy.

This press release goes on to state that the abundance of carbonate in the samples (up to 65% modal abundance), might positively impact metallurgical performance, including the hardness of the material and the acid-neutralizing potential of the waste rock and tails—these aspects require further testing.

Marc Pais, Arizona Metals’ CEO:

“This petrographic study further confirms the results of a metallurgical review of the Kay Mine Project, completed by SRK and ProcessIQ in November, 2020. The Kay Mine mineralization is simple and typical of neighbouring past-producing VMS deposits, as well as to deposits currently in operation around the world. Demonstrating that the deposit is amenable to conventional metallurgical processing is an important de-risking step in advancing towards production. We recently announced an increase of the Kay Mine Phase 2 drill program from 25,000m to 75,000m, and will be conducting batch flotation testing of core as we drill, at the labs of SGS Canada Inc.”

The petrographic study was a detailed examination of 15 mineralized samples in polished thin section (5 from the North Zone and the remainder from the South Zone) plus 14 host rock samples, all from the South Zone. The studied samples are representative of the massive sulfides, stringer mineralization, and altered felsic and mafic volcanic rocks in the Kay Mine. An analysis of the modal mineralogy of each sample was provided, together with extensive photographic documentation.

For a closer look at this advanced stage VMS exploration and development play, tap the following link:

Nomad Royalty Company (NSR.T)

An April 7th headline – Nomad Announces Amended Terms for the Mercedes Gold and Silver Stream With Equinox and for the South Arturo Silver Stream With i-80 Gold

Here, Nomad announced certain amendments to its Mercedes and South Arturo precious metals streams, including new gold delivery obligations and the repayment of the gold prepay loan with Premier Gold Mines (Premier was recently acquired by Equinox Gold resulting in a spinoff of various assets into a new entity called i-80 Gold Corp.

Both Equinox and i-80 Gold are helmed by highly competent (and aggressive) management teams. Both of these assets could be on the verge of finding a whole new gear (accelerated mine plans).

Nomad, through its wholly owned subsidiary OMF Fund II SO Ltd (“OMF”), has entered into a second amended and restated purchase and sale agreement (gold and silver) with certain subsidiaries of Equinox in respect of the Mercedes Mine in Mexico (the “Mercedes Stream Agreement”) and a new purchase and sale agreement (silver) with i-80 Gold in respect of the South Arturo Mine (the “South Arturo Stream Agreement” and collectively with the Mercedes Stream Agreement, the “Stream Agreements”). The key changes to the terms of the Stream Agreements are as follows:

New Mercedes Gold and Silver Stream Agreement and Repayment of Gold Prepay Agreement

The Mercedes Stream Agreement has been amended and restated and now provides for, in addition to silver deliveries, fixed quarterly gold deliveries of 1,000 ounces of refined gold to OMF from the Mercedes Mine (subject to upward and downward adjustments in certain circumstances), plus an additional 6.5% of such adjusted amount payable in refined gold. Fixed quarterly gold deliveries shall terminate once an aggregate of 9,000 ounces of gold have been delivered (not including any refined gold received pursuant to the additional 6.5% of the adjusted amount). If the quarterly average gold price is greater than US$1,650 per ounce in any quarter, then the aggregate gold quantity deliverable in the next quarter is reduced by 100 ounces of refined gold, and if the quarterly average gold price is less than US$1,350 per ounce, then the aggregate gold quantity deliverable is increased by 100 ounces of refined gold). Concurrently with the completion of the Arrangement and entering into the Mercedes Stream Agreement, the Gold Prepay Agreement has been terminated.

The Mercedes Stream Agreement will continue to provide for a 100% silver stream on the Mercedes Mine until 3.75 million ounces (2.73 million ounces as of March 31, 2021) of silver have been delivered to OMF, as well as minimum annual deliveries of 300 thousand ounces of silver until 2.1 million ounces (1.5 million ounces as of March 31, 2021) of silver have been delivered to OMF.

South Arturo Silver Stream Agreement

OMF and i-80 Gold have entered into a new South Arturo Stream Agreement that provides for deliveries from i-80 Gold to OMF of 100% of the ounces of refined silver in attributable production from the existing mineralized areas at South Arturo and 50% of ounces of refined silver in attributable production from the exploration stream area.

Commenting on how these amended terms will impact future cashflow, CEO Metcalfe broke things down, piece by piece, over on the Nomad channel at ceo.ca…

“The Delivery obligations under the gold prepay loan will now be encompassed within the Mercedes stream.

New Mercedes Stream Terms: Silver /// 100% silver stream until 3.75 Moz delivered to Nomad, and 30% thereafter (Unchanged).

Minimum annual deliveries of 300,000 oz Ag until 2.1 M oz delivered to Nomad (Unchanged, with the exception that deliveries from South Arturo will no longer contribute to this total, so a positive for Nomad) – 20% Transfer Price (Unchanged).

Gold /// 1,000 oz Au delivered quarterly subject to +/- 100 oz based on the quarterly average gold price with total delivery obligations remaining the same (unchanged vs. current prepay obligations). Quarterly 6.5% delivery gross-up (equivalent to the existing interest rate on the gold prepay).

New South Arturo Stream Terms: 100% silver stream on existing mineralized areas with no reduction (previously reduced to 30% after threshold, so positive for Nomad). 50% silver stream on new discoveries (previously likely 30% stream on these areas, so positive for Nomad) – 20% transfer price (unchanged).”

The following link offers a closer look at this dynamic (new) high-yield, cash-flowing play in the royalty-streaming arena:

Nomad (NSR.T) tables Q4 metal deliveries – updates progress on multiple fronts

Prime Mining (PRYM.V)

Prime dropped two headlines on April 6th…

Here, Prime reported additional positive results from an ongoing 15,000-metre Phase-1 drilling campaign at its wholly-owned Los Reyes Gold-Silver Project in Sinaloa State, Mexico.

The Company states that five diamond drills will remain spinning on the property until the rainy season sets in (August).

The results announced here include initial core assay results from the Zapote-South, Noche Buena, and San Miguel East deposits, three of eight known deposits that comprise the current mineral resource at Los Reyes.

Current Measured and Indicated pit-constrained oxide mineral resources include 19.8 million tonnes (‘mt’) containing 633,000 ounces of gold at 1.0 gpt and 16,604,000 ounces of silver at 26.2 gpt plus an additional 7.1 mt Inferred containing 179,000 ounces gold at 0.78 gpt and 6,831,000 ounces silver at 30 gpt.

Highlights from this April 7th press release:

- Drilling encountered several higher-grade intervals within the Zapote-South mineralized envelope, with drill hole 21ZAP-04 intersecting 4.5 metres (or 3.6 m estimated true width) at 8.95 grams per tonne (gpt) gold (Au) and 74.5 gpt silver (Ag);

- Drill hole 21ZAP-03 intersected 13.0 m at 0.76 gpt Au and 33.0 gpt Ag, including 1.66 gpt Au and 41.5 gpt Ag over 4.6 m. This expands the Zapote deposit 35 m down-dip on the most southerly drilled section. The mineralized zone in this area of Zapote-South now has a 150.0 m dip length and is completely open to the southeast and down-dip;

- Drill holes 21ZAP-04, 05, and 06 all intersected discrete zones of higher-grade adularia-bearing quartz mineralization within a broader lower grade envelope. 21ZAP-07 intersected 11.3 m at 0.97 gpt Au and 29.2 gpt Ag and 21ZAP-08 yielded 18.7 m at 1.96 gpt Au and 63.1 gpt Ag, including 2.44 g/t Au and 85.3 g/t Ag over 7.2 m;

- The eight Zapote-South holes provide: (1) information on the key geological and structural controls for the mineralized intervals that can be used to effectively target higher-grade mineralization along structures within the optimal boiling point elevation, (2) missing silver assay data for the block model, and (3) higher confidence in resource categories that will upgrade the currently defined in-pit resources;

- The four step-out holes completed at Noche Buena expanded in-pit mineralization both down-dip and to the southeast. Noche Buena also remains open along strike. Drill hole 21NB-02 intersected 3.17 gpt Au and 141.2 gpt Ag over 2.9 m within a broader zone of 39.0 m at 0.7 gpt Au and 29.5 gpt Ag. This expands Noche Buena down dip by 20.0 m. Drill hole 21NB-03 expands this mineralized zone 25.0 m along strike with an intersection of 1.12 gpt Au and 29.7 gpt Ag over 6.0 m.

Daniel Kunz, Prime’s CEO:

“These are Prime’s first results from three of the larger deposits at the western end of Los Reyes. They are in-fill drill holes largely designed to improve our geological understanding, upgrade known resources and test local extensions to the currently interpreted in-pit resources. At this early stage, we have extended the margins of known deposits, and the gold and silver grades encountered appear consistent with current resource grades. Drilling also gathered silver assay data in an area of the Project where limited silver assaying had occurred historically and was potentially underrepresented in our current resource. Silver is already a valuable contributor to the economics of any potential operation at Los Reyes; while incorporating the additional silver assays is expected to have a positive impact on silver grades in the resource and improve project economics. As these are the first holes in our Phase 1 program, they were drilled from more easily accessible locations. Later in our current program, with an improved geological understanding gained from these holes, we plan to aggressively drill step-out holes and test the numerous targets for resource expansion within the district-scale epithermal system at Los Reyes.”

A few hours later…

Prime Mining Corp. Announces C$25 Million Bought Deal Private Placement Financing

Following fast on the heels of the Los Reyes drilling update, the Company announced having entered into an agreement with a syndicate of underwriters co-led by Desjardins Capital Markets and TD Securities to purchase, on a bought deal private placement basis, 8,475,000 units priced at $2.95 for gross proceeds of approximately $25,001,250.

Each Unit will consist of one common share in the Company and one-half of a 3-year warrant—each whole warrant is exercisable at $5.00.

The net proceeds from the Offering will be used by the Company for exploration and development of the Company’s Los Reyes mineral property and for general corporate purposes. Prime has also been informed that Pierre Lassonde intends to participate in the Offering.

The following link digs deeper into this expertly helmed, advanced stage exploration-development play:

A pair of Green Energy Cos

The Green Energy Revolution isn’t just a fanciful notion—the underlying supply-demand dynamics underpinning the green metals space are most compelling.

The Green Energy Revolution is real.

And about to get real-er.

Two companies in the Green Energy arena we track closely…

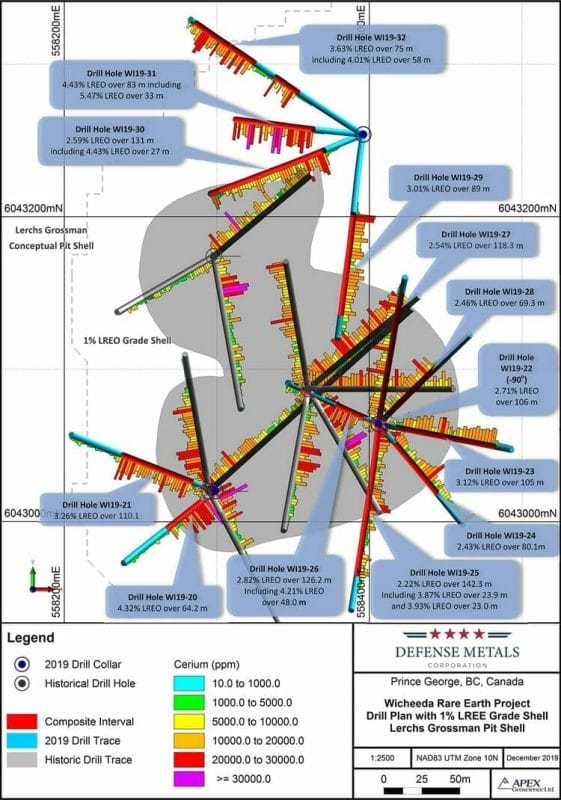

Defense Metals (DEFN.V)

An April 12th headline – Defense Metals Prepares Additional High-Grade Rare Earth Element Concentrate Samples For Evaluation By Leading Global Rare Earths Producers

Here, the Company announced having received requests from two leading global Rare Earth Element (REE) smelting and separator firms for samples of its (Wicheeda Project) REE mineral concentrate for evaluation. This could ultimately lead to mineral concentrate offtake agreements with an initial memorandum of understanding (MOU) setting the stage.

The count is now four—the requests-for-REE samples received to date, and discussions are ongoing with several other interested parties.

Concentrate sample requests are significant given that these rare earth smelting and separator enterprises have previously executed capital investment, in addition to REE mineral concentrate product offtake MOU agreements, with multiple international third party REE miners and explorers.

Craig Taylor, Defense Metals’ CEO:

“We have now received four requests for evaluation samples of our high-grade Wicheeda REE mineral concentrate from Asian-based REE refiners. Defense Metals believes this underscores growing international market demand for readily accessible, high-quality, North American REE products. Discussions with potential offtake partners have the potential to yield benefits through opportunities for direct project funding, technical services agreements, and access to the full downstream rare earths value chain.“

The following article link offers additional insight into this strategic advanced stage REE development play:

Forum Energy Metals (FMC.V)

Forum, an expertly run Saskatchewan-focused ExploreCo, has been featured in these pages for the discovery potential at its Janice Lake Copper-Silver Project where mining behemoth Rio Tinto is earning up to 80% by spending a weighty $30M.

Forum has an extensive project portfolio which includes the Fir Isand Uranium Project located along the northeast edge of the prolific Athabasca Basin.

An April 12th headline…

Forum Completes Drill Program on Fir Island Uranium Project

Here, the Company announced that the winter drilling campaign at Fir Island is now complete.

Ten holes for 3,051 meters were drilled, short of the 5,000 meters planned, due to a slow start-up caused by poor ice conditions.

The drills probed the subsurface stratum along the Cathy Fault/resistivity anomaly with eight holes. The Company also tested a smaller resistivity low to the southwest (above map).

This winter program was operated by Forum and funded by Orano Canada—Orano has an option to earn up to 70% by spending up to $6 million on exploration.

Infill drilling on land tested the Cathy Fault on approximately 500 metre sections. The offset of the unconformity continued along its length and the holes returned strong tectonization, quartz dissolution and remobilization, strong alteration, and confirmed the presence of dravite clays in both sandstone and basement lithologies (dravite is a common indicator around most uranium deposits on the east side of the Athabasca Basin).

A total of 361 core samples were collected and sent to the Saskatchewan Research Council (SRC) for geochemical analysis; results should be available by the end of April. Approximately 500 samples were collected for clay analysis and are currently being processed.

On deck is an update from the flagship Janice Lake Copper-Silver project and news regarding plans for the Company’s wholly-owned Love Lake Project.

The following link offers a good overview of the Company and its key assets:

A new addition to the Highballer shortlist – Forum Energy Metals (FMC.V)

This just in…

The U.S. Labor Department just reported that its U.S. Consumer Price Index (CPI) rose 0.6% in March. This follows a 0.4% rise in February. Consensus forecasts anticipated a 0.5% rise.

The report stated: “The March 1-month increase was the largest rise since a 0.6-percent increase in August 2012”.

Gold’s reaction in the minutes following these higher-than-expected inflation numbers…

END

—Greg Nolan

Full disclosure: Of the companies featured in this roundup, Delta Resources, Arizona Metals, Nomad Royalty Co, and Defense Metals are Equity Guru marketing clients.

Leave a Reply