After forming a Double Bottom at key support on March 8th and March 31st, Gold mounted a successful assault on the $1750 line, a bulwark that has kept prices in check for the past month and a half.

Gold’s next major hurdle might be the 100 period MA at $1802 and change. The precious metal is currently trading at $1794 as I edit this piece mid-way through the session on April 21st.

Underpinning this recent strength in the metal is a surfeit of compelling fundamental factors: negative real interest rates, trillions’ worth of cheap (stimulus) paper orbiting the global economy, central bank buying pressure, rising geopolitical tensions, and of course, the threat of rising inflation.

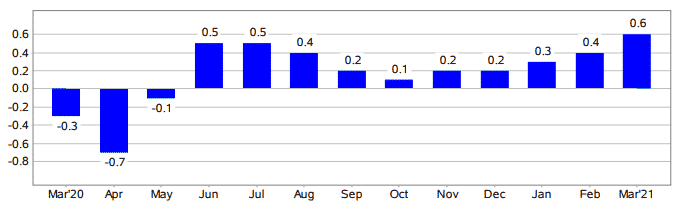

After some surprisingly strong Producer Price Index (PPI) numbers released on April 13th—the U.S. PPI popped 1% month-on-month pushing its annual headline rate to 4.2% (the highest in nearly a decade)—the U.S. Labor Department reported a 0.6% rise in its U.S. Consumer Price Index (CPI) for March. This follows a 0.4% rise in February. Consensus forecasts anticipated a 0.5% pop.

The report stated: “The March 1-month increase was the largest rise since a 0.6-percent increase in August 2012”.

Gold’s reaction following these higher-than-expected inflation numbers exposes a leery market—one that suspects that this price pressure may not be as ” transitory” as the Fed hopes (hope is a weak prayer).

The Fed is in the mother of all binds here. It can’t pull the trigger on higher rates to combat inflationary pressure. To do so would kill whatever momentum the U.S. economy manages to generate as it claws its way out of the abyss.

It would appear that no matter what the Fed does, it’ll be behind the (inflation) curve.

Out-of-control inflation is a Gold Bug’s best friend. But be careful what you wish for. What will be a pays de Cocagne for those prepared—those well-positioned in the metal—could turn into a flat-out f*cking nightmare for the unsuspecting.

The junior gold arena

In a recent Guru offering we stated the following…

“Though a select group of companies in the Junior space are trading firm to up, reflecting this recent strength in the metal, a large contingent is still trading sideways to down. This sets up an opportunity for those companies that are currently flying under the radar—those with compelling fundamentals backstopping their lowly valuations.”

This especially applies to companies with significant new discoveries in their crosshairs.

Delta Resources (DLTA.V) dropped the following headline earlier today:

Nice headline numbers.

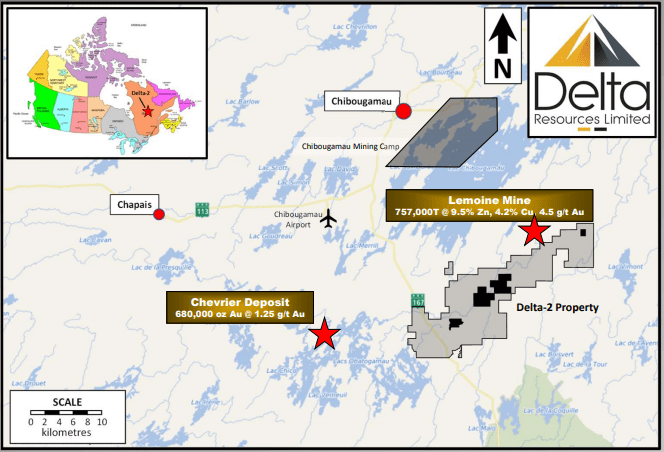

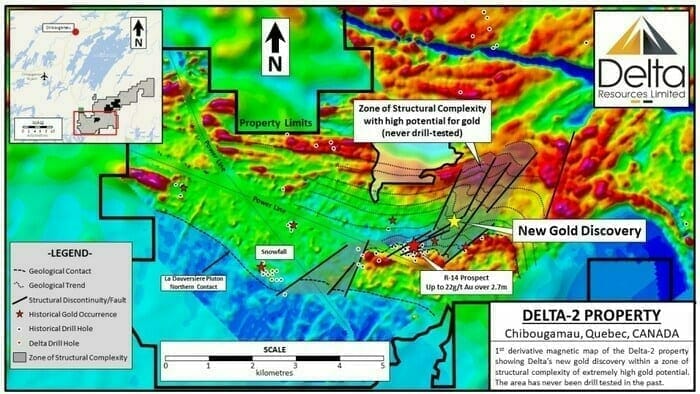

Here, the Company announced results from a follow-up drill campaign at its Oli-Gold discovery—a discovery announced early last month at its wholly-owned 126 square kilometre Delta-2 Gold Property in Chibougamau, Quebec.

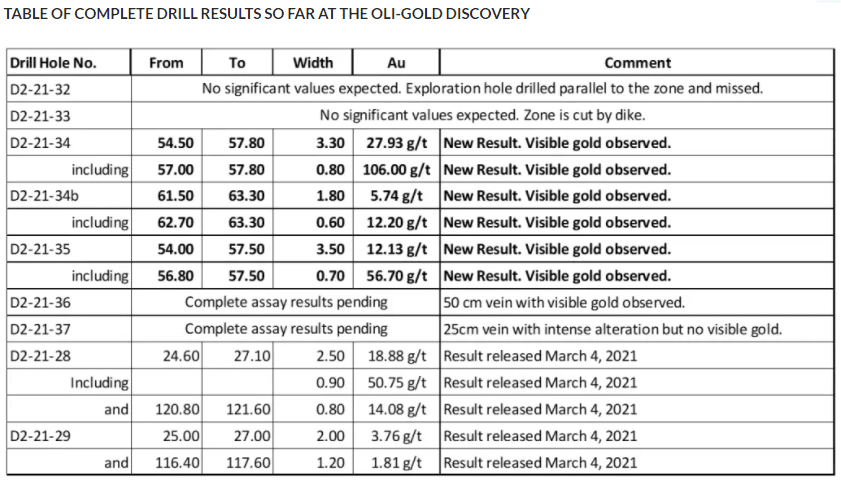

Significant drill results include:

- 27.93 g/t over 3.3 meters including 106 g/t over 0.8 meters;

- 5.74 g/t over 1.8 meters including 12.2 g/t over 0.6 meters;

- 12.13 g/t over 3.5 meters including 56.70 g/t over 0.7 meters.

Seven drill holes were completed for a total of 1,059 meters over the course of this second phase of drilling. Of those, five intersected the mineralized zone—four tagged high-grade, visible gold.

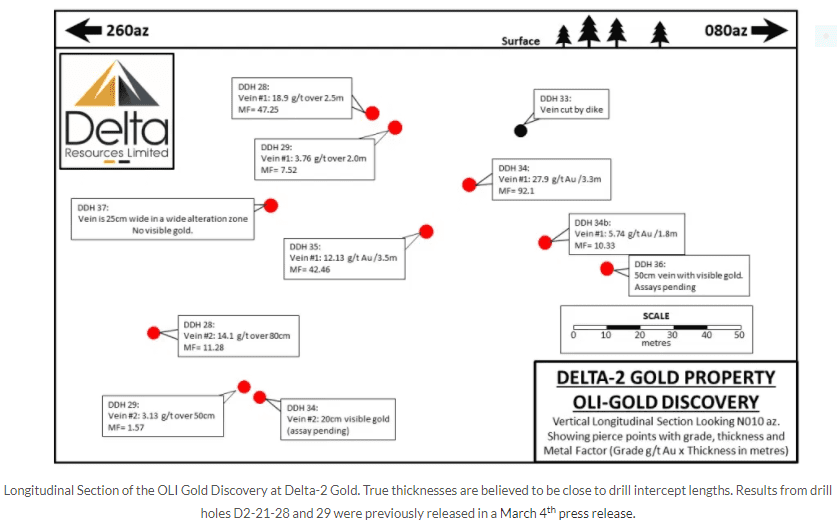

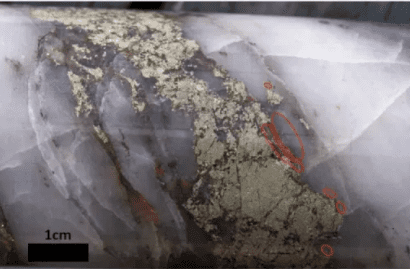

Right: Photo of visible gold intercept in drill hole D2-21-35 at 57.2m metres. The vein here consists of quartz-carbonate with abundant pyrite, sphalerite, pyrrhotite and specks of visible gold (circled in red).

The Company is targeting two distinct deposit types at Delta-2.

To better convey this potential, management recently subdivided the project into two manifest zones:

THE DELTA-2 GOLD PROPERTY will refer to the southwestern portion of the property which shows a high potential for hydrothermal gold mineralization.

THE DELTA-2 VMS PROPERTY will refer to the northeastern portion of the property where Delta is exploring for gold-rich VMS deposits.

This April 21st press release went on to state that, to date, complete assay results have been received for drill holes D2-21-34, D2-21-34b, and D2-21-35, while results are still pending for drill holes D2-21-36 and 37.

Complete assay results are displayed in the table below, including those previously announced on March 4, 2021:

True widths are believed to be close to the intercepted lengths.

The mineralized zones consist of quartz-carbonate-tourmaline-fuschite veins with up to 10% pyrite clusters, and disseminated pyrrhotite, chalcopyrite, sphalerite, and visible gold. Drilling now suggests that these veins are trending between 075 to 080 azimuth with a dip of approximately 70 degrees towards the south. The quartz veins are associated with felsic dikes and locally (such as in drill hole D2-21-33) the dikes crosscut the veins. The mineralization is located approximately one kilometre north-east of the R-14 Gold prospect where gold grades of up to 142.29 g/t Au over core length of 2.44 metres have been reported in the past (Brunelle, 1983 quoted by Faure, 2012). The area between R-14 and the new discovery has never been drill tested despite the presence of two surface gold occurrences (see press release dated March 4th, 2021). Additional mineralized zones are suspected between R-14 and the Oli-Zone.

Drill holes D2-21-32 and 33 did not intersect the mineralized zone as D2-21-32 was drilled parallel and south of the zone and missed while the mineralized zone was cut by a dike in drill hole D2-21-33.

The assays reported in this press release were submitted to the SGS lab in Lakefield Quebec for metallic sieve analysis on a “rushed” basis. The remaining samples are being analyzed by fire assay (with an atomic absorption finish)—results will be released as soon as they become available.

André Tessier, President and CEO of Delta Resources:

“This is an amazing start at Delta-2. These are extremely exciting drill intercepts in wide open, underexplored terrain. We still have some work to do to better understand this mineralization and we will endeavour to pursue our drilling at some point during the summer to acquire this knowledge and test additional gold targets that are emerging.”

The Delta-2 story has a good number of moving parts, especially when you factor in the project’s wide-open VMS potential where multiple targets are stacked high… waiting for a proper probe with the drill bit.

For a deeper delve into Delta-2, and Delta-1, where the Company is currently in the midst of a 1,500 to 2,000-meter drill program, the following links should bring you up to speed:

Delta Resources (DLTA.V) encounters pristine gold grains at Delta-1—drilling to commence shortly

Also,

Delta Resources (DLTA.V) launches winter VMS (gold/copper/zinc) drill campaign

Final thoughts

Based on today’s results, and the prospect of continued (significant) newsflow from multiple target areas, I believe the stock is due for a re-rating. I’m hopelessly biased though (we own shares and the Company is a client). Nonetheless, this one is worth your due diligence.

Also worth checking out…

The Great Gold vs Bitcoin Debate premiers today at 3 p.m. EST.

In a prompt delivered via email yesterday, this…

Want to get involved in the conversation on Twitter? Tell me what you’re most looking forward to by tagging me @DanielaCambone, with the hashtag #AssetOfTheAges. You can share DanielaCambone.com with anyone who wants to sign-up early.

I’m pulling up a favorite chair with a big bowl of popcorn for this one.

END

—Greg Nolan

Full disclosure: Delta Resources is an Equity Guru marketing client.

Leave a Reply