In your wildest dreams, can you conjure up a revenue-generating business that links cow manure with crypto-currency?

No?

Don’t worry – Earthrenew (ERTH.C) has connected the dots for us.

On April 23, 2021 ERTH announced it has signed a power sales agreement with a cryptocurrency mining company “to provide off-peak power over a 5-year term for the purposes of cryptocurrency mining”.

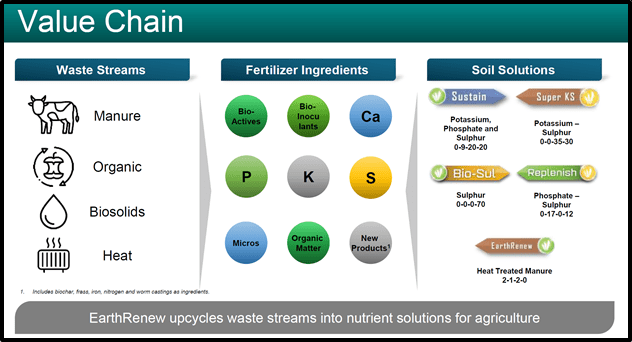

ERTH transforms livestock waste into a high-performance organic fertilizer, creating revenues from multiple streams, including electricity generation.

Earthrenew takes a biologically compromised product (cow shit) that is trapped in local markets, and frees it into a pure organic product that can be transported across provincial and state lines.

The value proposition for the owner of the cows?

- Annual lease payments for ERTH’s processing plant

- Disposal of manure.

- Electricity generation.

Electricity produced by the gas turbine is sold to offset the majority of fuel costs, creating an economically sustainable and environmentally friendly method of organic fertilizer production.

Located on a 25,000 head cattle feedlot, ERTH’s flagship Strathmore plant in Alberta is capable of producing up to four megawatts (MW) per hour.

The April 23, 2021 agreement allows for the potential for further revenue generation from EarthRenew’s power generating asset, the 4 MW Rolls Royce turbine.

The cryptocurrency mining company gains access to a portion of the ERTH’s power production, while this still allows EarthRenew to take advantage of power peaking opportunities.

Power-peaking has been a good source of revenue for EarthRenew.

EarthRenew’s operation as a peaking plant (whereby electricity is only supplied by the plant to the electrical grid if certain minimum power price thresholds are met), allowed the Strathmore facility to generate a 77% gross margin on electricity production.

“For January and February 2021, EarthRenew generated 845.17 MWh of electricity which it sold into the provincial grid for an estimated $342,727 in electricity sales revenue,” reported EarthRenew on March 31, 2021.

Also, on March 31, 2021 Earthrenew announced a deal with the North American division of the electricity company, Enel-X, to be involved in an operating reserves program in Alberta,”.

ERTH will be compensated for providing short-term power supply to the Alberta power grid.

“Looking ahead, we plan to supplement our electricity peaking revenue by participating in the operating reserves program with Enel-X. This will allow us to further optimize revenue, without sacrificing our ability to take advantage of peaking events,” stated Driver.

“Earthrenew is going to continue providing power to Alberta’s grid when electricity prices are up,” wrote Equity Guru’s Joseph Morton, “But this program will give them the opportunity to make more money when times aren’t optimal for generating power.

“As a result of the power sales agreement revenue for power generation at the Strathmore facility is now forecast to exceed $1.3 million dollars for the 2021 calendar year, up from $506,000 for 2020,” stated ERTH, “The corresponding gross margin for 2021 is estimated at 40%.”

With electricity and cryptocurrency dominating today’s ERTH headlines, it’s easy to forget about the company’s core business.

Producing and distributing organic fertiliser.

From an investor’s perspective, the “organic” subplot changes this from a niche green business into a something with a clear blue-sky story.

About 12 million square miles of the earth’s surface are currently arable (farmable). Due to the encroachment of suburbs, arable land is being lost at the rate of over 38,000 square miles per year.

Land devoted to organic farming is tilting hard in the opposite direction.

“The U.S. organic sector posted a banner year in 2019, with organic sales in the food and non-food markets totaling a record $55.1 billion, up a solid 5% from the previous year”. That’s double the sales of a decade ago.

In this April 21, 2021 interview with Equity Guru’s Jody Vance, EarthRenew CEO Keith Driver talks about the company’s business objectives.

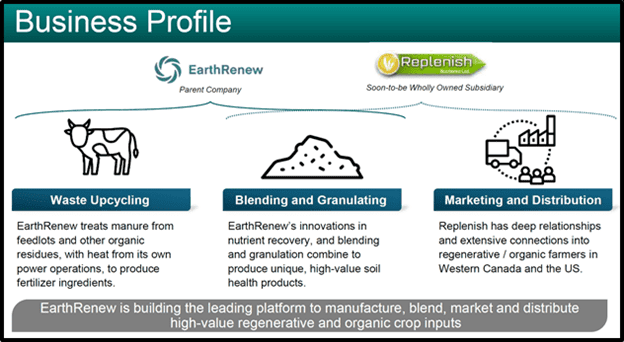

Last month, ERTH announced that it has negotiated an increase to its proposed equity ownership stake of Replenish nutrients from 38% to approximately 100%.

“The Replenish Nutrients team will support all aspects of the marketing, distribution and sales of the Earthrenew products into the regenerative agriculture space,” stated ERTH, “Replenish Nutrients currently has an established product line that it sells across Western Canada and the United States (North Dakota and Montana), generating strong revenues”.

The combined EarthRenew/Replenish entity expects to generate significant revenue growth within the expanding regenerative and organic fertilizer markets.

Financial Highlights and Projections:

- Replenish Nutrients booked revenue of $5.1 million for the last six months of 2020 and through the end of January 2021.

- ERTH is forecasting $4.8 million in revenue for the balance of the first half of 2021.

- New Entity projections are for a total $9.9 million for the period of July 2020 through June 2021, up from $3.6 million for the same period in 2019/2020.

ERTH anticipates that Replenish Nutrients will continue to operate as a marketing and distribution company as a wholly owned subsidiary of EarthRenew.

“Cryptocurrency mining is a way for the Company to utilize the unique asset at our Strathmore facility while we pursue our primary objective of building a regenerative fertilizer business,” CEO Keith Driver commented on the April 23, 2021 news release, “We are excited to have found an off-take partner that was such a good fit with our power production plans.”

“We anticipate that this arrangement will allow us to run the Strathmore unit more consistently, ramping production up when power pricing is at a premium.”

“This, along with our agreement with ENEL-X, announced in a press release dated March 31, 2021, is projected to allow us to maximize the utility of our power generation asset as we scale our business,” added Driver.

Full Disclosure: EarthRenew is an Equity Guru marketing client.

Leave a Reply