On April 26, 2021 Harborside (HBOR.C) reported financial results for Q4, 2020 and full year ending December 31, 2020.

HBOR is a $48 million company that operates three big dispensaries in the San Francisco Bay Area, a dispensary in the Palm Springs, a dispensary in Oregon, and a cultivation/production facility in Salinas, California.

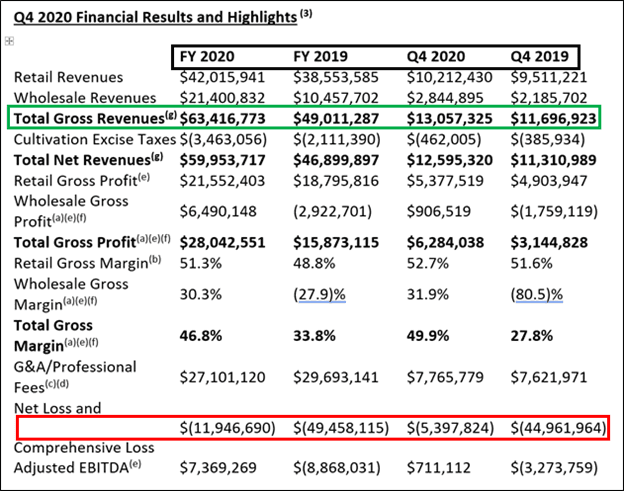

Harborside’s full year 2020 gross revenues expanded 29% year-over-year to $63.4 million.

The 2020 gross revenues are 130% of HBOR’s market cap.

To put this in context, Aphria’s (APHA.Q) 2020 revenues were 9% of its market cap, Tilray’s (TLRY.Q) 2020 revenues were 7% of its market cap, and Canopy’s (WEED.T) 2020 revenues were 3% of its market cap.

HBOR also reported Q4, 2020 gross revenues of $13.1 million and positive adjusted EBITDA of $700.000.

Fourth Quarter Total Gross Margins improved from 22.1% to 49.9%.

The improved gross margins were driven by “Improved Harvest Yields, Higher Wholesale Volumes, and Improved Operating Leverage Supported by Tight Expense Management.”

Full year 2020 adjusted EBITDA grew to $7.4 million from an adjusted EBITDA loss of $8.9 million in 2019.

Tempering these robust numbers, HBOR reported a FY 2020 net loss of $11.9 million.

“2020 marked a turning point year for Harborside,” stated Matt Hawkins, Chairman of Harborside, “Despite experiencing a pandemic, we worked hard to better serve our customers, improve and scale our cultivation operations, increase the availability of our branded products and create a strong foundation for future growth.”

“The impact of our efforts is evident in our impressive full year financial results, where we drove solid top line revenue growth of 29% while actively managing our expenses and driving operating leverage throughout our business to expand our total gross margins to 47% and generate $7.4 million in Adjusted EBITDA in 2020,” added Hawkins.

It’s worth noting that HBOR made a number of deals in 2020 which are expected to boost future revenue.

For instance, in December 2020 HBOR closed a deal to acquire 50.1% of FGW Haight (FGW) – which has the conditional use approval necessary “to operate a cannabis dispensary and related businesses in the Haight Ashbury area of San Francisco, California”.

Harborside paid USD $2,179,350 based on a post-build-out and proforma working capital enterprise value of USD $4,350,000.

Harborside has agreed to purchase an additional 29.9% of FGW to get to an 80% ownership of the Haight Ashbury enterprise, subject to regulatory approvals.

“The cost of these additional shares will be USD $1,300,650. Harborside retains the right of first refusal to purchase the remaining 20% of FGW.

With the completion of the FGW Haight Acquisition, Harborside expands its retail dispensary footprint in the state of California to five and solidifies a strong presence in the historic and culturally-significant Haight-Ashbury district of San Francisco.

HBOR expects to complete the build-out, receive all necessary regulatory approvals, and open the social equity retail dispensary in Q3, 2021.

“We have also ensured that Harborside has a strong balance sheet, successfully raising C$35.1 million and securing a US$12 million revolving credit facility subsequent to year end,” reported Hawkins.

Q4 2020 Operational Highlights

- Completed the acquisition of a 21% interest in a San Francisco Dispensary in the historic Haight-Ashbury District

- Announced cultivation facility upgrades at the Company’s production campus in Salinas, CA and launched clones sales at all Harborside retail stores

- Received DTC eligibility

- Announced refreshed slate of Directors and appointed Matt Hawkins as Chairman

- Announced launch of new product lineup and initiative

Subsequent Events

- Secured a $12 million revolving credit facility

- Completed a $5 million strategic investment in Loudpack, a premier California cannabis company

- Recognized for exceptional curbside pickup and delivery services

- Announced Final Resolution in San Jose Wellness 280E Case

- Closed upsized private placement for gross proceeds of approximately C$35.1 million

California is the world’s biggest cannabis market.

But that doesn’t mean its an easy place to operate.

The roll-out of legal rec week in California was extremely messy.

“The United Cannabis Business Association, a statewide group of legal marijuana businesses, found that about 2,835 illicit sellers, including storefronts and delivery services, are operating statewide,” reported NBC in September 2019, “That’s more than three times as many illegal sellers as legal ones — 873. The group unveiled the numbers earlier this month in an open letter to Gov. Gavin Newsom and state marijuana czar Lori Ajax”.

Slowly, steadily, the business environment in California is improving for legal cannabis operators.

Sales of cannabis in California hit $4.4 billion in 2020, up 57% from the year prior, reports MJBizDaily.

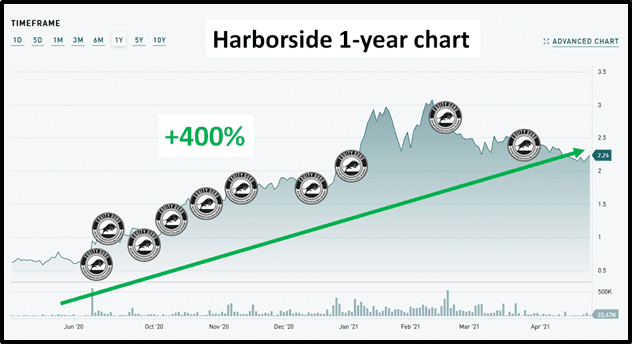

Over the last year, Equity Guru has covered Harborside’s aggressive expansion in California.

“With the initial cultivation upgrades at our Salinas production campus now complete, a recently strengthened balance sheet and a refreshed team of operators with deep industry experience at the helm, Harborside is well-positioned to accelerate our growth and continue to extend our leading position in the California cannabis market,” stated Hawkins.

Lukas Kane

Full Disclosure: Harborside is an Equity Guru marketing client

Leave a Reply