The real price of gold: While the spot price of gold is struggling to take out resistance at $1800—it’s currently trading at $1,770 as I edit this piece—the REAL price, if you were to go out and purchase a one-ounce American Gold Eagle, is closer to $2k.

This steep premium—the disconnect between the spot price and the amount investors are forced to fork out at the coin counter—is due to a shortage of physical metal. This, according to Ed Moy, former director of the U.S. Mint.

“Not only the U.S. Mint, but other Mints around the world, Australia’s Perth Mint, the Mexican Mint, have all run out of gold, they can’t keep it in spot and there’s so many shortages retailers are having problems accessing that gold.”

If you go to any of the top retailers for gold bullion and take a look at what they’re charging for an ounce American Eagle gold bullion coin, even though the spot price right now is $1,775 give or take, you’re hard pressed to find a ounce gold coin for anything less than $2,000, and I’ve seen it as high as $2,100.”

The number of high-quality juniors with turnkey projects on a fast track to production, particularly those with REAL exploration upside, is also in short supply.

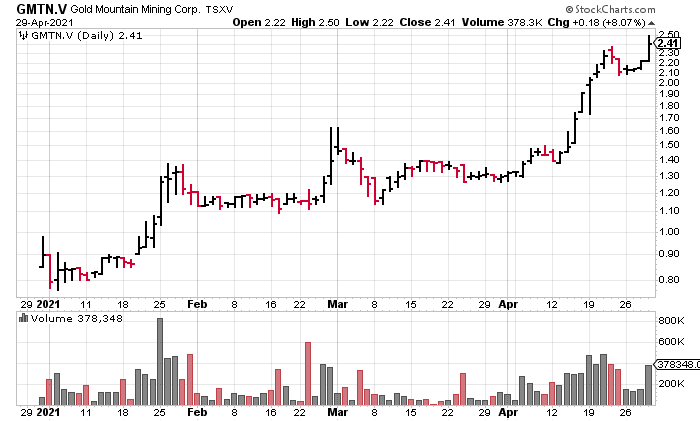

Gold Mountain (GMTN.V) has been exceedingly active on the news front since its debut on the Venture Exchange only four months back.

This hasn’t been your run-of-the-mill, garden variety newsflow. The headlines tabled in recent weeks generated significant shareholder value (enviable price trajectory as per the following chart). Nearly everyone is in-the-money over here.

Color yourself “Smart Money” if you spotted this latent potential early in the going.

The momentum continues

Staying true to form, buoying its momentum as it transitions into BC’s Next Gold Producer, today’s headline…

Gold Mountain to Begin Mine Construction

Highlights

- On April 29, the Company received authorization from the Ministry of Mines to begin construction and upgrades required to put the mine back into production.

- This milestone is inline with the Company’s Q2 forecast and is a major catalyst to preparing the site for ore mining and delivery.

- The Company has resolved the remaining Information Requests from the Ministry of Energy, Mines and Low Carbon Innovation (“EMLI”) and the Ministry of Forests, Lands, Natural Resource Operations and Rural Development (“FLNROD”).

- Once all Information Requests have been accepted, it is anticipated the Permit Amendment will be sent up for final approval.

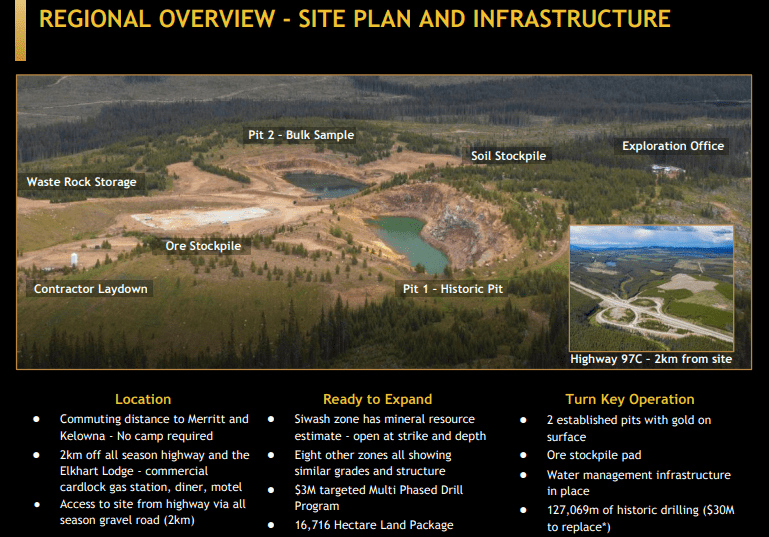

Here, the Company announced the receipt of a Notice of Departure (NoD), a nod from the B.C. Ministry of Mines, to begin construction at its wholly-owned 16,716 hectare Elk Gold Project in the Merritt region of mining-friendly BC.

This is yet another milestone, one that allows Gold Mountain to begin stripping and carving out Elk’s immediate subsurface layers in anticipation of hauling ore to New Gold’s New Afton mill as early as October of this year.

Clearly, this NoD is a vote of confidence from the Ministry of Mines. I very much doubt that this authorization would’ve been handed down if final permit approval wasn’t a foregone conclusion.

This isn’t just an inside track the Company needs to continue its aggressive push along the development curve—it’s a major cost-cutting initiative.

Rather than purchasing and hauling road building material (aggregate) at great cost, this NoD allows the Company to begin stripping and mining waste rock from its planned initial pit—waste rock that will be used to build and resurface a network of roads throughout the property.

Aside from getting a jump on construction and reducing the project CapEx, this phase of development will see reduced carbon emissions and will mitigate wasteful mining procedures.

With the NoD in hand, recently engaged mining partner, Nhwelmen-Lake Mine Contracting, will begin mobilizing heavy equipment to the project—a CAT 390 Excavator, multiple rock trucks, rock drills… everything required to layout a network of roads and staging areas… everything required to commence production.

Administrative offices, support facilities, and an upgrade to the project’s water management system will also come into play during this first phase of construction.

The Mine permit and the community

Gold Mountain has continued to advance it’s Mine Permit amendment (the “Mine Permit ”) with the necessary regulators to adhere to it’s aggressive timelines. Currently, the Company has addressed all round 2 questions from the EMLI and FLNROD. The permitting team is now cohesively working with the Ministry of Environment and Climate Change Strategy to address its final information requests for the receipt of the Effluent Discharge Permit.

Additionally, the Company continues to emphasize and foster it’s relationships with Indigenous Communities in the region and has made significant progress in developing strong relationships. Gold Mountain looks forward to sustaining it’s rapport with the communities and building a working relationship built on transparency and respect.

Kevin Smith, CEO:

“Feedback from institutions has always been that our projected timelines are aggressive and might be difficult to achieve. Receiving this Notice of Departure allows us to take the critical steps of upgrading our existing water management system, installing a weigh scale, as well as leveraging a gravel borrow to start stripping waste from our initial pit and repurpose it into aggregate needed to resurface roads throughout the property. By getting into construction early, we will be ready to hit the ground running once our various mine permit amendments are approved. Since acquiring this project, we were very clear about our intent to quickly put this mine back into production, with efficient deployment of capital. Management intends to continue maintaining our strong treasury, while pushing the pace of project advancement and delivering key milestones, week after week. With the snow on site nearly gone, our mine construction partner, Nhwelmen-Lake LP, has been notified to begin mobilizing their equipment, in anticipation of developing BC’s next high grade Gold and Silver producer.”

A quick summary of recent events…

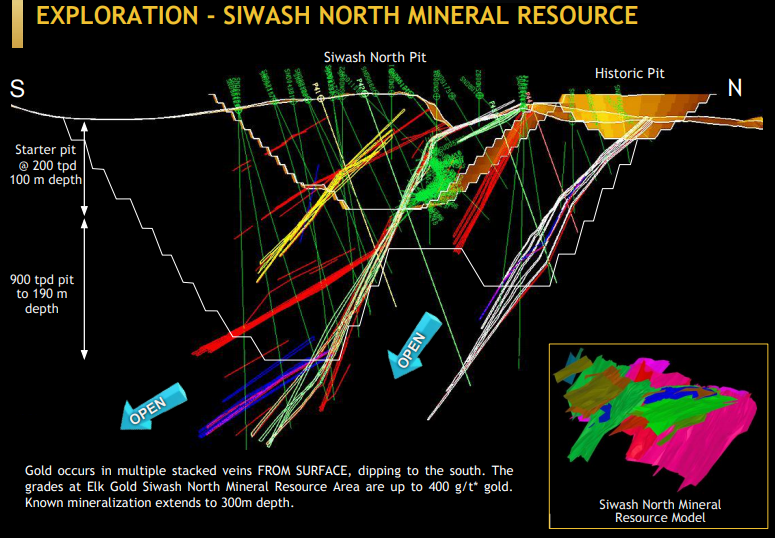

As it pushes its pit constrained ounce count towards production (454,000 ozs Measured and Indicated plus 95,000 ozs Inferred), the Company continues to generate significant shareholder value via the drill bit.

Assays flowing from a recent Phase 1 drill campaign, one designed to in-fill gaps and probe for high-grade extensions in two deep vein systems called “2600” and “2700”, included the following values:

- SND20-029 intercepted 1.42 meters averaging 37.00 g/t Au (including 0.42 meters averaging 124.00 g/t Au);

- SND20-032 intercepted 1.22 meters averaging 16.23 g/t Au (including 0.30 meters averaging 62.20 g/t Au);

- SND20-032 intercepted 1.30 meters averaging 7.95 g/t Au (including 0.30 meters averaging 31.30 g/t Au);

- SND20-033 intercepted 1.3 meters averaging 13.3 g/t Au (including 0.30 meters averaging 56.5 g/t Au);

- SND20-033 intercepted 1.3 meters averaging 4.5 g/t Au (including 0.30 meters averaging 19.2 g/t Au).

This Phase 1 program boasts a hit rate of 100%. There’s strong continuity of mineralization here.

The Company has also embarked on a campaign of re-logging historical drill core. And it’s paying off handsomely.

To date, two new veins have been discovered—mineralization missed by previous operators:

- 1.2 meters averaging 52.3 g/t Au (including 0.30m averaging 216 g/t Au);

- 0.2 meters averaging 47.8 g/t Au.

The Company’s geological model continues to evolve with these recent (and historical) high-grade hits. Elk’s ounce count is destined to grow.

Before we close this one out, a quick look at the economics as per a September 2020 Preliminary Economic Study (PEA):

- A Post-Tax NPV of $191M;

- A low OPEX – AISC of US$735 per oz;

- A low start-up CapEx at CA$6.9M;

- An expansion CAPEX of CA$26M once the Company decides to scale the project;

- A 50,000 ounce per year mine plan by Year 4;

- A payback period of 6 months, from the start of production.

Note that back in mid-February, the Company engaged JDS Energy & Mining to complete a pre-feasibility study (PFS), one that will reflect ALL advancements brought about in recent weeks/months, most notably, the signing of a Contract Mining Agreement and an Ore Purchase Agreement.

This PFS will also delineate a maiden reserve for the project, update the (Siwash North) resource estimate, and explore the underground mining potential—the high-grade values generated via this Phase 1 drill campaign being a motivating factor.

This… all of this sets the stage for robust newsflow going forward.

If you’re new to Gold Mountain, the following article offers a deeper delve into the fundamentals underpinning this compelling near-term production play.

CEO Smith again:

“Gold Mountain finds itself in a unique position where we’re able to deliver shareholder value not only through our exploration efforts but also through the coming transition into development and production. This gives us a unique upside in the junior space which we feel sets us apart from our peers.”

END

—Greg Nolan

Postscript: I chatted with Grant Carlson, Gold Mountain’s COO recently. We talked about the toll milling agreement with New Gold, how the ore grade will be determined prior to hauling it off to the New Afton mill, and the process they have set up for assaying the ore. Interesting stuff which I’ll detail next time round.

Full disclosure: Gold Mountain is an Equity Guru marketing client.

Leave a Reply