On May 11, 2021 Defense Metals (DEFN.V) published an update regarding its ongoing pre-pilot hydrometallurgical test work on the Wicheeda Rare Earth Element (REE) asset in British Columbia.

“REEs are crucial for high-tech manufacturing,” confirms The Verge, “These elements are produced mostly in China, and used in the US for everything from electric cars to missiles”.

The U.S. currently gets 77% of its REEs from China.

“The Critical Materials Caucus, is the latest effort by officials in Washington to blunt China’s prowess as the world’s largest producer or processor of rare earths, lithium, titanium and other niche but important minerals,” reported Mining.com.

Resource investors tend to focus on drill results, but metallurgy is an equally critical component of a development resource project.

“Process metallurgy is concerned with the extraction of metals from their ores and the refining of metals,” states Science Direct.

Reading a press release about “tribology” “hysteresis” and “marquenching” is not going to quicken the pulse of most retail investors.

But this nerdy stuff is important because unfavorable metallurgy can make it impossible to extract the target mineral at a profit.

Favorable metallurgy can radically improve the numbers on the bankable feasibility study.

DEFN metallurgy test work utilizes high-grade rare earth element (REE) mineral concentrate produced at DEFN’s 26-tonne flotation pilot-plant that yielded a mineral concentrate averaging 7.4% NdPr oxide (neodymium-praseodymium)1.

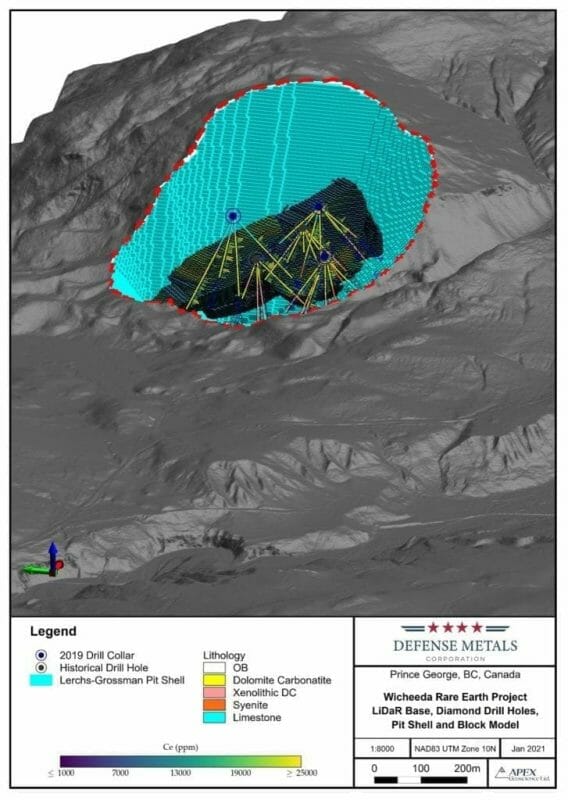

The road accessible Wicheeda REE Property is located close to infrastructure approximately 80 kilometres northeast of Prince George, BC.

The Wicheeda project has indicated mineral resources of 4,890,000 tonnes averaging 3.02% LREO (Light Rare Earth Elements) and inferred mineral resources of 12,100,000 tonnes averaging 2.90% LREO2.

The infill hydrometallurgical test results centred around optimizing caustic crack-acid leach conditions, and leach liquor impurity removal.

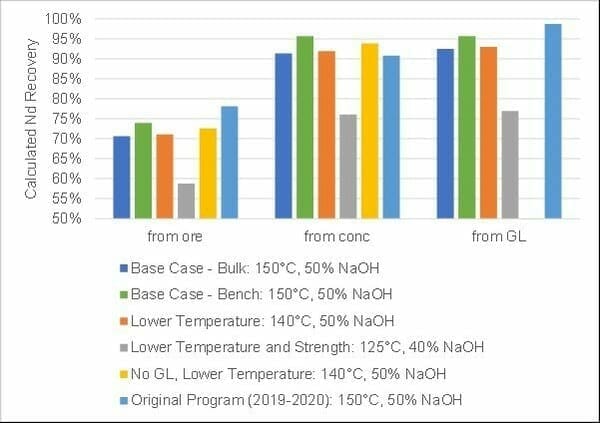

High REE extraction (using neodymium as a proxy, Figure 1) for base case bench and bulk (3 kg) caustic crack across the range of test conditions in comparison to initial 2019/2020 bench test work (see Defense Metals News Release dated February 16, 2021).

Comparable REE extraction via direct crack of mineral concentrate shows promise with calculated neodymium extraction within a 5% range of the base case.

The success of direct crack test results opens up the potential of future optimization work to reduce circuit complexity though potential elimination of gangue leaching and associated solid-liquid separation steps.

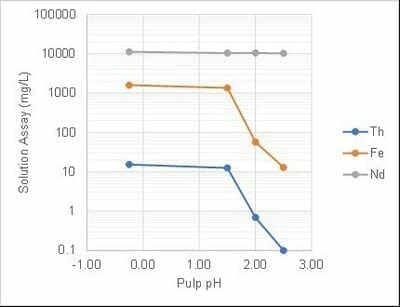

Primary impurity removal tests on leach liquor at terminal pH yield very efficient Th and Fe removal (>99% Th and >95% Fe) at negligible Nd losses (Figure 2).

“These latest results establish that stable REE extractions are achievable across a range of test conditions bracketing our emerging base case flowsheet,” states Craig Taylor, CEO of Defense Metals.

“Significantly, direct crack REE extractions were similarly high opening up the door for potential circuit complexity and future capital cost reductions,” added Taylor, “Primary impurity removal test show that at the bench scale we can produce a high quality REE leach liquor suitable for conversion to mixed REE oxide end product.”

“Hailed as the ‘vitamins of chemistry’, REEs exhibit a broad range of electronic, optical, and magnetic properties,” reports Equity Guru’s Greg Nolan in this March 9, 2021 article.

In the same article, Nolan conducted an informative Q&A with Defense Metals CEO, Craig Taylor.

Greg: Cutting right to the chase, what are your ultimate goals for Wicheeda—do you see yourself pushing the deposit towards production, or would you prefer to monetize it, selling it to the highest bidder?

Craig: I see selling the deposit rather than putting it into production ourselves. With the interest in REEs worldwide, I see potential suitors coming to the table as we move the project forward. We’re currently working on a PEA, we’re working on a hydromet pilot plant, we’ll be working on expanding the current resource with an upcoming drill program, and we’ll be looking to move towards the prefeasibility stage. At that point, we should see some fairly big players take an interest. There aren’t a lot of REE companies out there at this stage of development—there’s not a lot to choose from.

Greg: What do you see as some of the more compelling fundamentals supporting REE prices going forward?

Craig: There’s a serious supply/demand issue arising from the push towards green energy. There’s a real shortage of REEs. We’re seeing new forecasts, almost daily, from governments and from manufacturers talking about ramping up EV production. There are also large wind turbine development projects in countries like Korea and England, some of the biggest of their kind, that have yet to come online. China has similar initiatives—they’re turning into a major EV player as well. Internal demand in China could consume all available supply—there may not be anything left over for the West.

Greg: That’s interesting.

Craig: This has been decades in the making. The West is ill-prepared for this. We’re just waking up now to the realization that we don’t have the processing facilities, we don’t have the production… all of the things necessary for our endeavors on the green energy side, and the military side.

Greg: Your company has been delivering numerous developments on the technical front—can you summarize what you’re currently working on with SGS Canada?

Craig: In a nutshell, what we’re trying to do through the SGS bench-scale test work is optimization towards our hydromet pilot plant. The more bench-scale testing we do, the more kinks we can iron out ahead of building the pilot plant. All of these technical studies are aimed at achieving greater efficiencies—optimal output at the lowest cost. The team at SGS are very good, they’re very thorough scientists and they’re coming up with some new ideas that could yield bigger, better results. It’s been money well spent, and the SGS team isn’t finished yet.

Greg: Back in February, you engaged Welsbach Holdings to assist you in a number of areas. What are your expectations—what do you hope to achieve with this partnership?

Craig: Welsbach has ties in Singapore, Japan, Korea, Europe, Australia, and China. They’re connected to every smelter, every end-user in the space. They’ll serve as a key broker, moving us forward in securing MOUs for offtake agreements. They see the upside in what’s happening globally.

Greg: You probably can’t answer this, but are there any names, any end-users in the space that have expressed interest in your REE concentrate?

Craig: No. I can’t give you any names, not just yet. We’re in the short strokes now—we’re working on putting together a list and sending out samples of our concentrate. I’m hoping to have that list within the next six to eight weeks.

Greg: Changing gears here a bit, what are your exploration plans for Wicheeda this coming field season?

Craig: I’m anticipating another drill program, something in the order of 13 to 15 holes, roughly 2,000 meters, to upgrade and expand the resource further.

Greg: So it will be a combination of infill and stepout drilling—Wicheeda is open in multiple directions, including at depth?

Craig: Yes, we’ll be working mainly on upgrading our categories. We need to do this in preparation for a prefeasibility study. Regarding stepout drilling, the program is still in the planning phase but we’ll definitely do some stepouts from the main deposit.

Greg: What do you see as potential catalysts for your stock in 2021?

Craig: We have a PEA on deck. We’re working towards securing offtake agreements, expanding our resource, and we’re working on constructing a pilot plant that will produce an oxide with the potential for scale. These are all potential catalysts for our stock.

End of Nolan/Tayor Q&A.

Three months ago, DEFN engaged of Welsbach Holdings to assist in market research, finding supply chain partners and commercial negotiations, for its REE Property,

“The engagement of Welsbach will enable Defense Metals to leverage their extensive experience and relationships in the Asia-Pacific region (Australia, Singapore, China, Japan, and South Korea), Continental Europe, and the United States towards engaging in one-on-one discussions with REE refiners and separators,” stated Taylor.

Recent Wicheeda 43-101 Technical Report Highlights:

- 49% increase in overall tonnage of Updated Wicheeda REE Project Mineral Resource Estimate (MRE) based on the results of 2019 diamond drilling of 13 holes totaling 2,007.5 metres;

- 30% increase in overall average grade, in part though the incorporation of potentially economically significant praseodymium not previously estimated;

- Conversion of 4,890,000 tonnes to Indicated Resources previously defined as Inferred;

- Increased Inferred Resources by 730,000 tonnes in comparison to Defense Metals Initial Wicheeda MRE; and

- Potential for expansion of the Wicheeda Deposit to the north and west in the down plunge direction.

“The goal is the successful negotiation of one or more binding commercial REE offtake and/or other supply chain agreements with respect to the Wicheeda REE Deposit,” stated Taylor on February 11, 2021, “Welsbach will immediately commence its work aiding with respect to strategic partner identification, business introductions, and ultimately commercial negotiations.”

Ongoing hydrometallurgical optimisation test work being conducted at SGS Lakefield is expected to be completed over the next 4-6 weeks resulting in finalization of a base-case flowsheet to inform operation of a future hydrometallurgical pilot plant.

Final test work is expected to focus on secondary impurity removal and the production of a purified mixed REE precipitate and on the regeneration of hydrochloric acid.

Full disclosure: Defense Metals is an Equity Guru marketing client.

Leave a Reply