Globex Mining (GMX.T) has invested in a matrix of mineral properties. Over the last 12 months, many of them have appreciated sharply in value.

Globex’s CEO is a man named Jack Stoch.

As Tom Cruise is to action movies – Stoch is to mineral resources.

A consummate pro, Stoch reliably avoids duds – while generating gold at the box-office.

“Management’s specialty is acquiring high-quality assets in well established mining-friendly jurisdictions, upgrading the asset by way of exploration and intellectual input, and monetizing said asset via options, outright sales, and royalties,” wrote Equity Guru’s Greg Nolan on September 12, 2020.

“With a total of 192 properties in the Globex project pipeline, 96 of which are prospective for precious metals, 60 for base and polymetallic metals, 36 for specialty metal metals (lithium, manganese, scandium, etc), there’s a lot of potential to incubate here,” added Nolan on April 1, 2021.

With such a large project portfolio, GMX generates a lot of newsflow.

On May 12, 2021 Chibougamau Independent Mines (CBG.V) and Globex informed shareholders that Vanadium One Iron (VONE.V) has enlisted the support of Glencore plc one of the worlds largest commodity traders to aid in the development of the Mont Sorcier iron and vanadium project located just east of Chibougamau, Quebec.

According to the release: “The companies have entered into a finance raising assistance agreement and a separate concentrate offtake agreement to support the ongoing development and the eventual construction and production of the Mont Sorcier iron and vanadium project.”

CBG holds a 2% Gross Metal Royalty on all mineral production from the property and Globex Mining Enterprises retains a 1% Gross Metal Royalty on Mont Sorcier iron production.

Globex also owns 3 million shares of Electric Royalties (ELEC-V) that retains a 1% Gross Metal Royalty on Mont Sorcier vanadium production.

Under an agreement with Electric Royalties related to Globex’s potential sale of its Mid-Tennessee zinc royalty, to Electric Royalties, if completed, Globex will receive an additional 14,500,000 Electric Royalty shares.

On May 26, 2021 Globex annouced that Electric Royalties (ELEC.V) has entered into a revised letter of intent (LOI) with Sprott Resource Streaming and Royalty (Sprott) regarding Electric Royalties’ and Sprott’s intent to purchase Globex’s Mid-Tennessee zinc royalty.

To help the close the proposed deal, Globex agreed to revise the purchase agreement as outlined below:

- Globex will receive an additional $500,000 for a total of $13,750,000 of which $250,000 has already been paid.

- Globex will receive 9,000,000 Electric Royalty shares and 5,500,000 four-year warrants with an exercise price of $0.60 per share.

Under an acceleration clause, after 2 years, should the Electric Royalties share price exceed $1.00 for 10 consecutive days, Globex must exercise 2,750,000 warrants at $0.60 per share.

Likewise, after 3 years should the Electric Royalties share price exceed $1.50 for 10 consecutive days, Globex must exercise 2,750,000 warrants at $0.60 per share.

Under the revised agreement, Globex will, excluding warrants to be exercised at a later date, have slightly less than a 20% shareholder stake in Electric Royalties and thus, shareholder approval will not be required for the transaction.

The closing date of the transaction has been extended 21 days in order to get required approvals and final legal documents but it is expected that the sale of Globex’s Mid-Tennessee zinc royalty will be completed before that date as Sprott has now committed to the entire cash portion of the purchase price.

At closing of this deal, Globex expects to have over $27,500,000 in cash and shares of other listed companies as well as the 5,500,000 Electric Royalties warrants.

In addition, Globex is working to complete several other transactions which, if finalized, will generate additional revenue for the company.

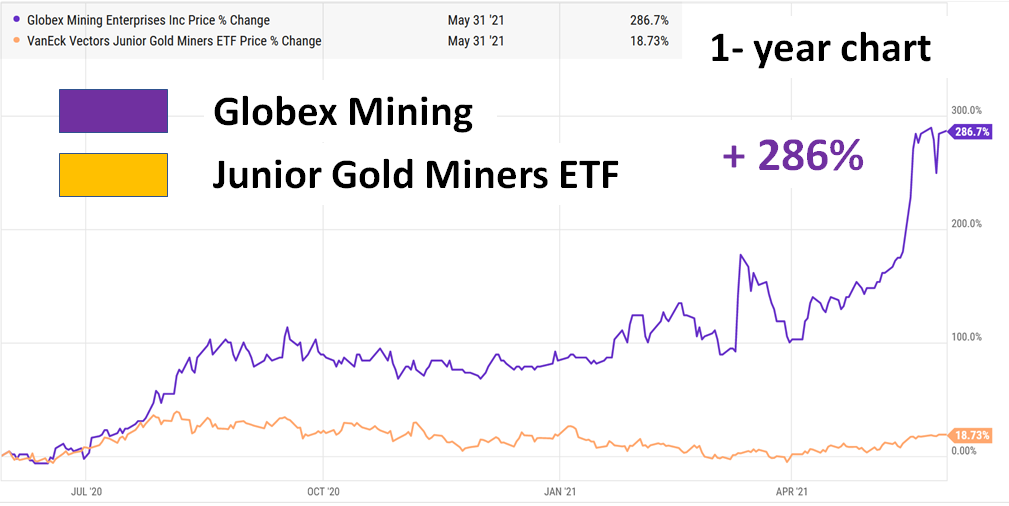

As commodity prices surge, Globex is outperforming the market including the Junior Gold Miners ETF (GDXJ.NYSE).

“When I first chatted with Jack Stoch, Globex Mining’s president and CEO, I must confess to being somewhat overwhelmed by the sheer number of properties in his project pipeline,” stated Equity Guru’s Greg Nolan on April 1, 2021.

“Talk is cheap in this Wild West of a sector. A company can boast any number of attributes—fundamentals that may ultimately forge shareholder value—but in my way of thinking, the proof is in the share structure.

Since CEO Stoch took over the company in 1983, he has kept the dilutive financings to an absolute minimum and has never rolled back the stock. If you’re unfamiliar with Globex, you might ask, “So what… how many billions are outstanding?” Get this: there are currently 54,999,817 outstanding and 57,829,817 fully diluted (management owns 11.03%).

If you’ve been following the junior exploration sector for as long as I have, you’ll be scratching your head wondering, “How is that possible in this capital-intensive arena… some companies blow out their structure within the first few months of trade?”

The answer is in the Company’s business model, management’s core values, and their ability to execute.

Globex is a project bank and incubator.

CEO Stoch is well connected and is always on the hunt for high-quality assets in well-established mining-friendly jurisdictions.

Sure, everyone claims to be well connected in this sector, but Stoch—a registered Professional Geologist in the province of Quebec—was once reported to be THE largest private mineral rights holder in the province.

Stoch’s approach involves acquiring properties dirt cheap, advancing them using good science and intellectual input, and monetizing them via options, outright sales, and royalties. If you look at his deals, they very often include an upfront cash component and/or marketable securities.

This is how Stoch keeps his treasury topped up and the share count low” – End of Nolan.

“There aren’t many fifty-something actors happy to be filmed hanging off the side of aeroplanes as they take off,” stated The National News, “It’s to Tom Cruise’s enduring credit that he not only does these stunts himself, but he still pulls off playing the dashingly cool action hero with considerable élan.”

Like Cruise, Globex CEO Stoch is still acing it, after all these years.

– Lukas Kane

Full Disclosure: Globex Mining is an Equity Guru marketing client.

Leave a Reply