On June 3, 2021 Gold Mountain Mining (GMTN.V) announced that it has executed three Memorandum of Understandings (MOU) with surrounding Indigenous communities, establishing a process for ongoing engagement towards social and economic collaboration.

“An MOU is an expression of agreement to proceed,” confirms Investopedia, “It indicates that the parties have reached an understanding and are moving forward. Although it is not legally binding, it is a serious declaration that a contract is imminent”.

Publicly-traded companies do not generally sign MOUs willy-nilly, because there is a negative consequence to saying later “The negotiations have been terminated without success.”

Whatever happens, history suggests that Gold Mountain CEO and Director Kevin Smith will give a clear honest explanation.

In an era when many small-cap CEOs hide behind the screen of an outward-facing “Communications Director” – Smith always stands and delivers – even including his personal email in each press press-release.

It’s unusual, and it’s refreshing.

“From the time we took this project over, it was very important to us to take an inclusive approach with all the surrounding communities,” explains Smith in the June 3, 2021 video, “In the spirit of the UNDRIP legislation, we believe that first nation partnerships are critical for doing business in British Columbia”.

“UNDRIP [United Nations Declaration on the Rights of Indigenous Peoples] provides a road map to advance lasting reconciliation with Indigenous peoples,” states Justice.ca.

In December 2020, the Government of Canada introduced legislation to implement the Declaration.

“Having secured three MOUs with local indigenous communities, as well as a mining contract within Nhwelmen-Lake shows the success of our engagement,” stated Smith.

The goodwill of the local government and community is as critical to your investment as mineral grades.

Anti-mining sentiment can – and does – kill mining projects.

Newmont Mining (NEM.NYSE), for instance, spent 10 years developing the Conga copper and gold project in Peru. Local opposition was so intense, Newmont eventually walked away from its $5 billion investment.

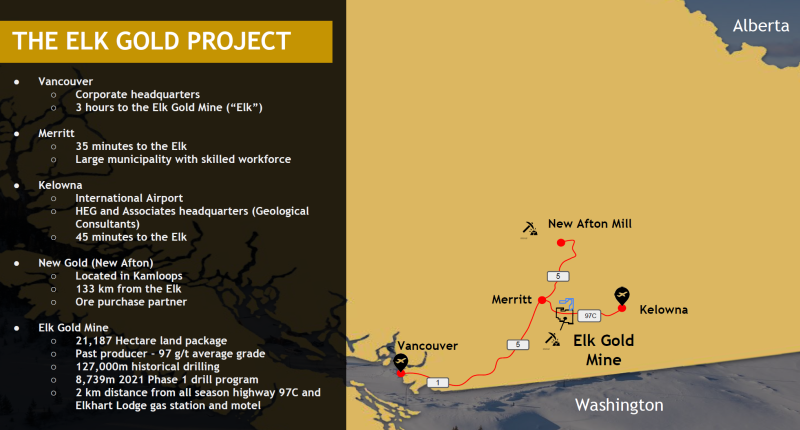

On January 19, 2021 Gold Mountain signed a definitive agreement with Nhwelmen-Lake LP, for contract mining services at the Elk Gold Project.

Nhwelmen-Lake is a majority Indigenous-owned excavating company.

HIGHLIGHTS:

- Gold Mountain will leverage the experience and expertise of Nhwelmen-Lake for mining and ore hauling services at the Elk Gold Property.

- Nhwelmen-Lake will be paid a fixed price per tonne mined at a price that’s in line with the Company’s Preliminary Economic Assessment (PEA) metrics over the first three years, which is determined based on the planned production rate, mined volumes, haulage distances and equipment productivity.

- The Mining Contract is for the life of mine while the price schedule carries a three-year term and gives Gold Mountain confidence in its forecast and cash flow to scale the business efficiently.

“The Nhwelmen-Lake partnership is a major milestone for Gold Mountain and its shareholders,” stated Smith at the time, “Having an established mining contractor and solidifying a well-defined cost structure, is one of the key pieces necessary in order to confidently go into production.”

The team at Nhwelmen-Lake is not new to the mining industry.

The group operates at other open pit mines in British Columbia like Highland Valley Copper, Gibraltar and Mount Paul.

“The MOU’s and mining contract with Nhwelmen-Lake are a result of our positive engagement and provide the company with momentum as we continue to scale this project through collaborative partnerships,” added Smith.

On May 27, 2021 Gold Mountain announced an updated Preliminary Economic Analysis (PEA) of the Elk Gold Project.

“If you are looking for exposure to the precious metal and can appreciate the risk/reward dynamics of the junior exploration arena, Gold Mountain is a compelling speculation—a near-term production scenario boasting a (growing) high-grade resource and significant exploration upside,” wrote Equity Guru’s Greg Nolan on May 14, 2021.

The updated PEA assumes a conservative long term gold price of USD $1,600 – about $300/ounce lower than it is today.

GMTN’s update comes on the heels of three recent developments:

January 19, 2021 – Mining Contract with Nhwelmen-Lake LP

January 26, 2021 – Ore Purchase Agreement with New Gold

May 14, 2021 – Increased Mineral Resource Estimate.

Highlights:

- Updated PEA with an After-tax NPV5% of C$231M

- 19,000oz annual production (Years 1-3) expanding to 65,000oz annual production (Years 4-11)

- Increased cost certainty over September 2020 PEA through executed:

- Construction and Mining Contract with Nhwelmen-Lake LP

- Ore Purchase Agreement with New Gold Inc.

- Revised mine plan eliminates construction of an onsite mill and incorporates underground mining

Elk Gold Project PEA Summary

The PEA contemplates an initial 19,000 ounce per year mine that ramps up to 65,000 ounces of annual production by Year 4.

The pre and post-tax NPV (5% discount) are $395M and $231M, respectively.

Year 1

- Two months of site preparation

- New water settling pond below the Rock Storage

- Stripping organic material, topsoil, and till from the initial footprint of the RSF and open pit Phase 1

- Mobilizing the initial fleet of mobile equipment, modular office facilities, and explosives storage.

- Mining production, including 70,000 tonnes of mineralized material shipped to the New Afton Mine

Years 2 and 3

- Mine and transport 70,000 tpa of mineralized material to the New Afton Mine.

- Initiate an Environmental Assessment process required for mine expansion

- Apply for a mine permit amendment for the expanded mining rate.

- Existing underground decline will be rehabilitated and extended in preparation for underground mining activities.

Years 4 to 10

Note: The increase in production in Year 4 assumes all permits are in hand

- Upon receipt of an Environmental Assessment Certificate, the mining rate will increase deliveries to the New Afton Mine to 324,000 tpa.

- The open pit mining rate will increase to an average rate of 150,000 tonnes of mineralized material per year.

- Underground mining activities will begin on the 1300 vein system to supplement the open pit plant feed, followed by the 2500, 2600 and 2800 veins later in the mine life.

- The combined open pit and underground plant feed will total 324,000 tonnes per year sold to the New Afton Mine.

Year 11

Initiation of major reclamation activities. The mine will prepare ahead of time for the ultimate reclamation and closure of the facility.

Year 12

Major mine site reclamation activities will be completed.

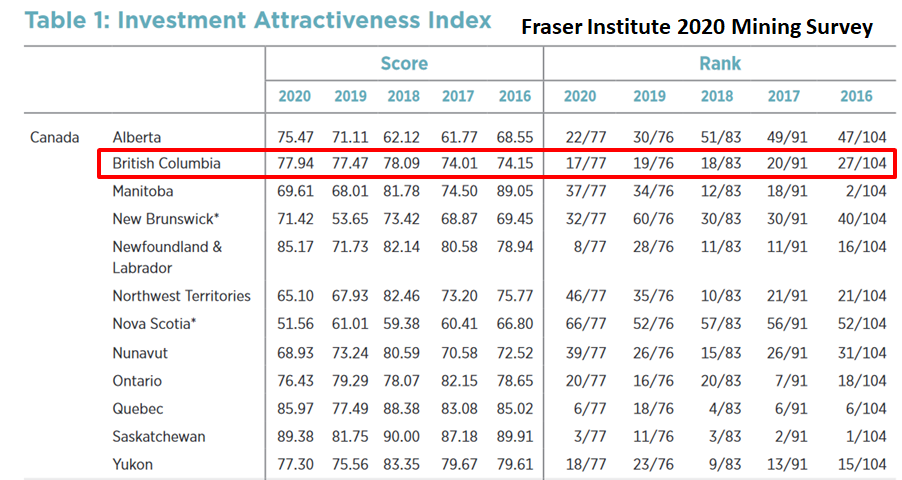

“Sixty-nine percent of respondents for British Columbia were deterred by the uncertainty concerning environmental regulations,” reports the Fraser Institute’s 2020 Mining Survey, “Investor concerns related to disputed land claims and protected areas likely reflect the ongoing tensions in the province over land title issues”.

Despite this, in the last 4 years, BC has risen from 27th to 17th on the Fraser Institute’s overall “Investment Attractiveness Index.”

Nhwelmen-Lake LP is currently mobilizing equipment to begin mine construction at the Elk Gold project.

This project is expected to provide up to 30 on site job opportunities and will help strengthen the region’s economy for the next 10 years.

Stay tuned to GMTN’s CEO Kevin Smith for further updates.

– Lukas Kane

Full Disclosure: Gold Mountain is an Equity Guru marketing client.

Leave a Reply