I’ll waive the standard preamble and get right to it—rounding up a few of the companies on our client list that dropped weighty headlines in recent sessions.

Arizona Metals (AMC.V)

- 78.71 million shares

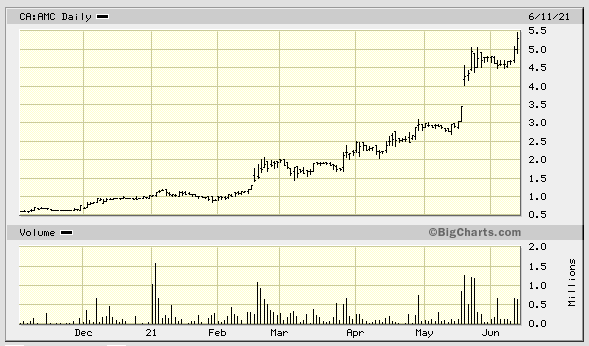

- $417.17M market cap based on its recent $5.30 close

We take great pride in having recognized the potential in Arizona Metals early in the going, engaging the Company and initiating coverage last fall when the shares were changing hands at $0.65.

Arizona Metals is a tight crew comprised of complementary skill sets—a union of technical proficiency and capital market savvy.

The Company also operates in a top-shelf mining jurisdiction—Arizona—ranked #2 on the Fraser Institute’s most recent Annual Survey of Mining Companies (Arizona is the leading copper producer in the U.S. and has produced roughly 10% of the world’s copper).

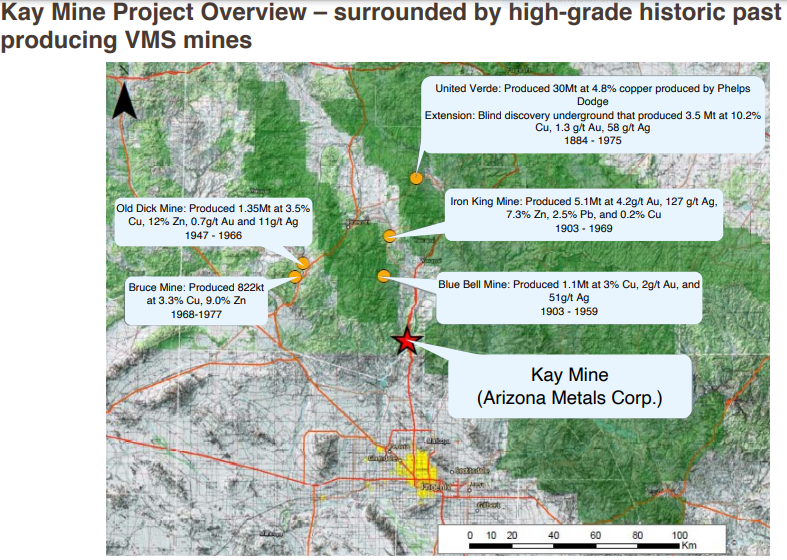

AMC’s flagship—the Kay Mine Project—is located in a region that is host to 60 past-producing underground Cu-Au-Zn VMS mines, all within a 150-kilometer radius of Kay. All told, the region has a production history of ~4 billion pounds of copper over its century-long run.

There is a historic resource at Kay. In the early 1980s, Exxon Minerals delineated 5.8 million tonnes grading 2.2% Cu, 3.03% Zn, 55 g/t Ag, and 2.8 g/t Au for a CuEq grade of 5.8% ***

Kay is in a Volcanic Massive Sulphide (VMS) setting. VMS deposits are submarine deposits—eruptions of sulphide mineralization bubbling up from hot springs on the seafloor.

Ranging in size from a few hundred thousand tonnes to over 100M tonnes, the discovery of one VMS deposit will almost always lead to multiple discoveries. They are rarely a one-off.

The Kay Mine is what’s known as an Isoclinal Folded Deposit. A good illustration of this folding sequence is offered by Quinton Hennigh, comparing Kay’s underlying geology to that of a taffy pull—the following vid beginning at 26:40…

Crescat Gets Activist on Gold & Silver #32 – Arizona Metals Corp ($AMC.V)

The Kay Mine belongs to a classic VMS setting where high grades are a dominant feature. “Birds of a feather”—if high grades are present in one deposit, that feature should repeat itself in other deposits throughout the district.

In the above vid, Hennigh opines that the high-grade gold component at Kay may be indicative of scale—”usually the big ones are the ones that have high-grade gold“.

The grades and intervals tagged deeper down in the system—as evidenced in a May 19th press release—suggest the Company has latched onto a monster deposit, one that may even challenge the granddaddy down the road—United Verde (30Mt at 4.8% copper produced by Phelps Dodge plus an extension that produced 3.5 Mt at 10.2% Cu, 1.3 g/t Au, 58 g/t Ag).

We covered this mid-May news event—an event that triggered the positive (gap-up) trajectory in the above price chart—via the following EG article…

What does it take to push a market cap north of $100M significantly higher?

A new gold-rich zone of open-ended mineralization with intervals and values like these…

- 79 meters of 7.0 g/t AuEq, including two separate higher-grade intervals of 9 meters grading 18.1 g/t AuEq and 11 meters grading 14.7 g/t AuEq (from a vertical depth of 638 meters).

- 91 meters of 4.7 g/t AuEq, including two separate higher-grade intervals of 20 meters grading 9.2 g/t AuEq and 16 meters grading 6.8 g/t AuEq (from a vertical depth of 470 meters). This hole also intersected a high-grade interval of 0.8 meters grading 33.4 g/t AuEq.

Regarding Kay’s metallurgy, the Company is beginning to prove very early on along the development curve that they can produce high-grade concentrates. And several smelters in the region would be interested in this concentrate.

From the get, Arizona Metals has been a classic “be right, sit tight” scenario.

Defense Metals (DEFN.V)

- 80.27 million shares outstanding

- $22.48M market cap based on its recent $0.28 close

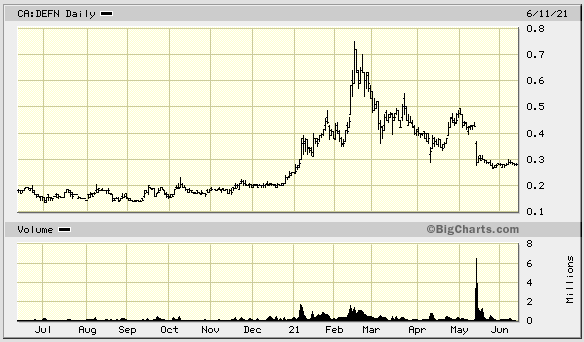

Defense Metals was a sector darling a few months back when the entire REE arena went on a rip-roaring tear. After topping out at $0.75, and then drifting sideways to down for the next two months, the stock was dealt what-for by a market that didn’t appreciate a $0.32 raise when the shares were changing hands in the forty-cent-plus range the session prior.

Fully cashed up, the Company continues to push its wholly-owned flagship Wicheeda Project further along the development curve.

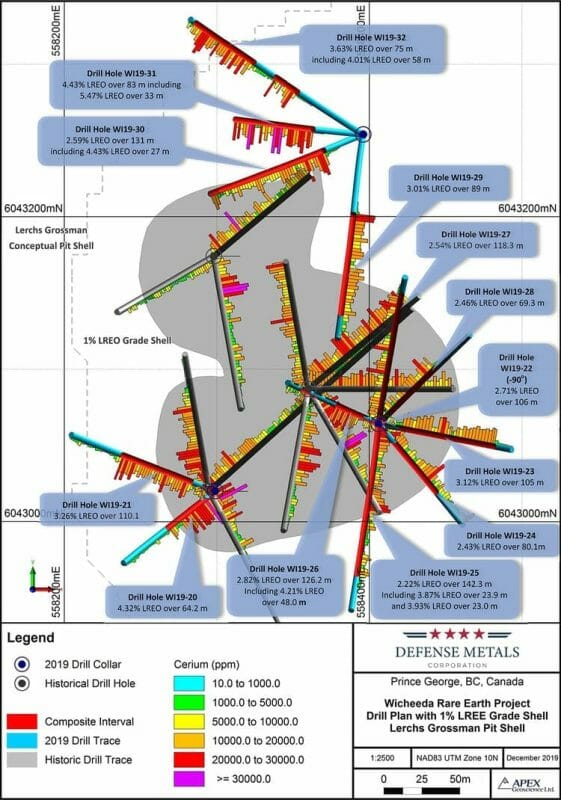

Wicheeda currently boasts a high-grade REE resource of 4,890,000 tonnes averaging 3.02% LREO (Light Rare Earth Oxide) in the Indicated category, and 12,100,000 tonnes averaging 2.90% LREO Inferred where “two specific rare earth minerals, Monazite and Synchysite/Parasite-Bastnaesite, are contained in approximately equal proportions.”

The values highlighted on the map below demonstrate the high-grade nature of this strategically located LREE deposit. Note the high-grade intervals tagged outside the main resource block (the grey rubber duckie image).

On May 26th, Defense tabled plans to test the extent of Wicheeda’s mineralized footprint via a diamond drill campaign that could see up to 5,000 meters drilled in 2021.

The current weakness in the stock may represent an opportunity for forward-thinking investors looking for exposure to REEs. The green energy revolution isn’t going away and REEs are a critical ingredient in the production of every electric vehicle that rolls off the assembly line floor.

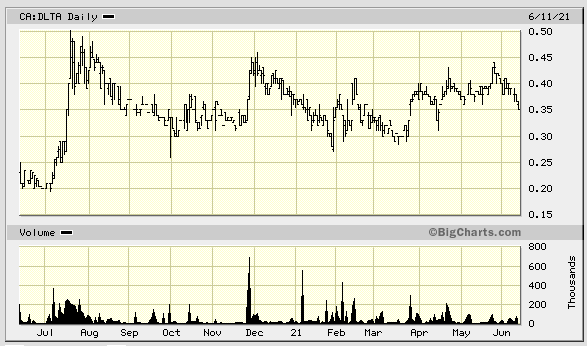

Delta Resources (DLTA.V)

- 36.8 million shares outstanding

- $12.88M market cap based on its recent $0.35 close

Delta’s price chart, range-bound for the better part of a year, has the looks of a stock that wants to go higher, but the market is waiting for the right catalyst.

Delta certainly doesn’t lack potential catalysts. The Company is active on two highly prospective fronts…

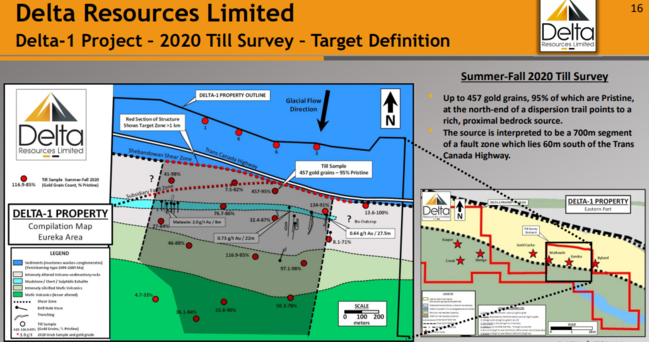

DELTA-1, forty-five square kilometers of prospective ground where a gold-in-till anomaly and kilometer-scale gold-bearing alteration halo point to an untested regional structure.

On June 2nd, the Company dropped the following headline concerning Delta-1…

Delta Resources buys back NSR royalty from the OEC at Delta-1 / Eureka in Thunder Bay, Ontario

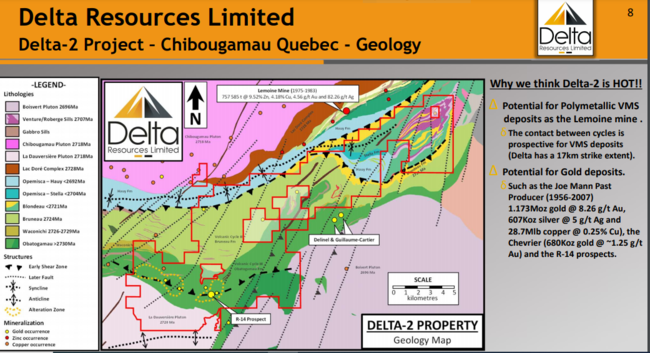

DELTA-2 GOLD and DELTA-2 VMS, one hundred and seventy square kilometers in the prolific Chibougamau District of Quebec, with a potential for hydrothermal-gold and gold-rich VMS deposits.

Having consolidated the VMS ground in and around Delta-2 via the recent acquisition of the 2,228-hectare Dollier property—host to the Delinel Gold-Pyrite VMS prospect where (best) results include 25.1 g/t gold over 1.0 meter, 13.3 g/t gold over 1.2 meters, and 11.9 g/t gold over 1.0 meter—the Company is setting up what promises to be a robust newsflow cycle over the coming weeks/months.

We’re currently waiting on drill results from both Delta-1 and Delta-2.

Two recent Guru pieces that’ll bring you up to speed on both projects…

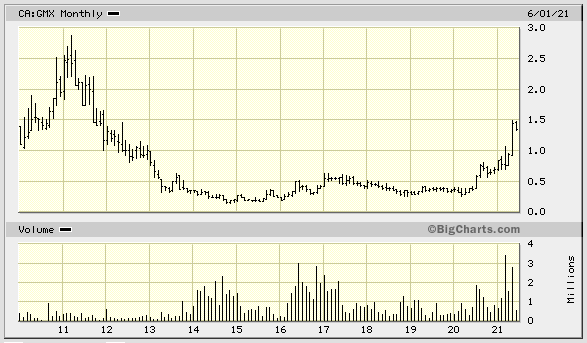

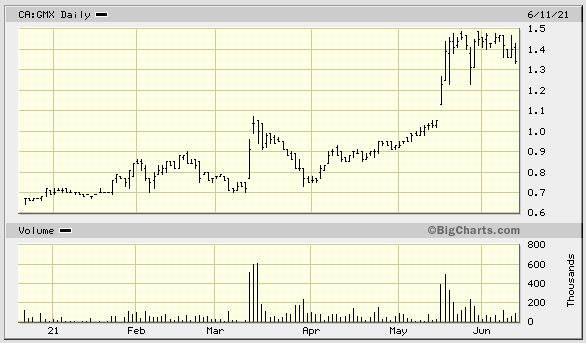

Globex Mining (GMX.T)

- 55.06 million shares outstanding

- $73.78M market cap based on its recent $1.34 close

The following is a monthly chart covering the past 11 years of trade.

The Company’s stock is pushing decade highs yet the market cap still strikes me as modest.

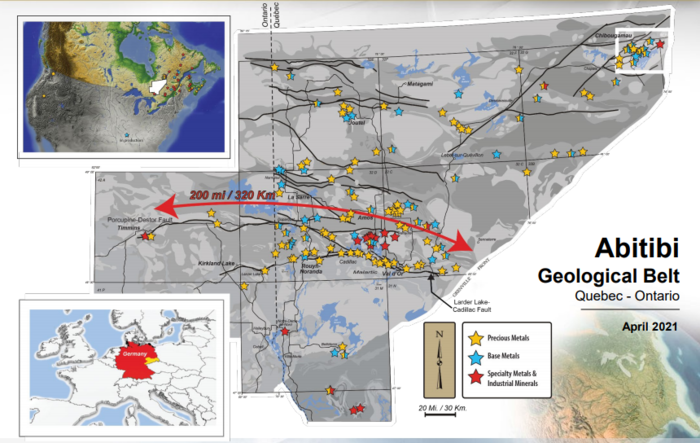

Globex is a mineral bank/project incubator with a total of 193 properties in its pipeline (this number is a moving target). Of the 193 projects, 96 are prospective for precious metals, 60 for base and polymetallic metals, 37 for specialty metal metals (lithium, manganese, scandium, etc).

Many of these projects are located along the Abitibi Greenstone belt of Ontario and Quebec. Only the goldfields of South Africa have outproduced this prolific greenstone belt where more than 200 million ounces of gold have been hauled to the surface since the first deposits were discovered in the early 1900s. The Abitibi has also surrendered some 654 million oz’s of silver, 16 billion lbs of copper, and 34 billion lbs of zinc.

The following is an excerpt from a September 2020 GMX piece—Globex Mining (GMX.T) – an undervalued Project Bank, Incubator, Explorer, and Royalty Company—that marked the beginning of our relationship with this expertly helmed project incubator…

It’s a tad overwhelming diving into a project base this extensive. I could spend days, if not weeks, attempting to get acquainted.

To get a better handle on all of these moving parts, I set up a call with Globex CEO Jack Stoch.

Interestingly, Jack—a registered Professional Geologist in the province of Quebec and major Globex shareholder—was once reported to be the largest private mineral rights holder in the Province of Quebec.

I asked Jack if he could narrow the field and shed some light on some of the projects he considers most prospective. His response, without skipping a beat: “You want me to tell you which of my children I love the most?”

Fair enough.

Getting back to the “rare” theme…

A lot of CEOs in this arena claim to have aligned their values alongside those of their shareholders. Talk is cheap in this Wild West of a sector. The proof is in the share structure.

Get this: there are currently 54.63 million Globex shares outstanding (57.5 fully diluted). Since Stoch took over the company in 1983, he has kept the dilutive financings to an absolute minimum and he has never engineered a share rollback.

If you’ve been following the junior exploration sector for as long as I have, you know how remarkable a feat this is. I know of companies that are rolling back their stock within their first year of operation.

Back in Dec of 2020, we suggested that Globex was poised for a re-rating.

Volatility aside, shareholders benefited from an acceleration in newsflow over the past few months, a standout being the monetization of the Mid-Tennessee royalty asset, the (revised) terms of which are as follows:

- Cash payment: Under the revised agreement, Globex will receive an additional $500,000 for a total of $13,750,000 of which $250,000 has already been paid.

- Share payment: Under the revised agreement, Globex will receive 9,000,000 Electric Royalty shares and 5,500,000 four-year warrants with an exercise price of $0.60 per share.

At the close of this transaction, Globex will own just under 20% of Electric Royalties (ELEC.V) and will have > $27,500,000 in cash and (listed) shares of other companies (plus the 5,500,000 Electric Royalties warrants highlighted above).

More recently, the Company reported progress at the high-grade Silver City Project in Saxony, Germany, where Excellon Resources (EXN.T) launched a 12,000-meter drill campaign covering four target zones.

After (significant) staged injections of cash and Excellon shares—CEO Stoch always seems to work upfront cash payments into his deals—Globex will be granted a fat 3.0% Gross Metal Royalty for precious metals, and 2.5% for all other metals. This Gross Metal Royalty may be reduced to 2% and 1.5%, respectively, upon payment of US$1,500,000.

Then, on June 9th, Globex dropped the following headline:

Globex Vends McNeely Lithium Property

More cash and stock in the Company coffers… and another fat Gross Metal Royalty.

The claims were sold for a single cash payment of $250,000 and 2,000,000 First Energy Metals (FE.C) shares (FE is currently trading in the $0.30 range). Globex will retain a 3% Gross Metal Royalty on all production from these claims.

Globex’s McNeely claims extend westward from the Quebec Lithium Mine property intermittently in several claim blocks over a strike length of approximately 18 kilometres, and includes several spodumene showings and historical mineralized drill holes. A large number of Globex’s claims surround and are in close proximity to the Augustus Lithium occurrence where First Energy Metals recently reported a drill hole grading 1.17% Li2O over a core length of 19 metres (see First Energy Metals press release dated June 1, 2021).

Globex, in my estimation, is one of the few stocks in the junior exploration arena that offers significant leverage to the positive sentiment sweeping across the sector, as well as an above-average measure of safety.

This just in…

Globex to Sell Francoeur/Arntfield/Lac Fortune Gold Property to Yamana Gold Inc. for +$15 Million

Boom, another significant monetization.

Here, Globex has entered into a definitive Purchase Agreement to sell the Francoeur/Arntfield/Lac Fortune gold property to Yamana Gold (YRI.T).

The property adjoins the Wasamac Gold Mine project that Yamana is pushing to production.

This property includes a number of past-producing gold mines and areas with excellent exploration upside—previous exploration work conducted by Globex has demonstrated this potential.

As part of the transaction, Yamana will acquire 30 claims in Beauchastel township to the east of the Wasamac Gold Mine property as well as three claims in Malartic township owned by Globex.

Under the Purchase Agreement, Globex will receive the following cash and share payments from Yamana:

- Upon closing of the transaction: $4,000,000, which will be satisfied by Yamana issuing 706,714 shares to Globex at a deemed price of $5.66 per share. Based on the closing price of Yamana’s shares on the Toronto Stock Exchange on Friday, June 11, 2021 of $6.22, the 706,714 Yamana shares have a current market value of $4,395,761.08;

- on the first anniversary of closing: $3,000,000 in cash;

- on the second anniversary of closing: $2,000,000 in cash;

- on the third anniversary of closing: $3,000,000 in cash;

- on the fourth anniversary of closing: $3,000,000 in cash

Based on Yamana’s current trading price, the total cash and share consideration is $15,395,761.08, of which Globex will receive $7,395,761.08 in cash and shares within the first year.

Globex may elect to receive one or more of the four anniversary payments in Yamana shares. If Globex so elects, the number of shares issued by Yamana will be based on the volume weighted average trading price of Yamana’s shares for the five trading days immediately preceding the date of payment.

In addition, Globex will retain a 2% Gross Metal Royalty on all mineral production from the Francoeur/Arntfield/Lac Fortune property and the 30 Beauchastel and three Malartic township claims, of which 0.5% may be purchased by Yamana for $1,500,000.

Yamana has agreed to assume payment of the three underlying royalties on the properties and will make a final environmental bond payment of $223,633.50 currently due by Globex on the Francoeur Mine in July 2021, after which Globex will transfer the bond to Yamana.

This transaction represents significant revenue for Globex over the next four years as well as a significant royalty stream should a mineral deposit on the property package enter into production.

Are we impressed yet?

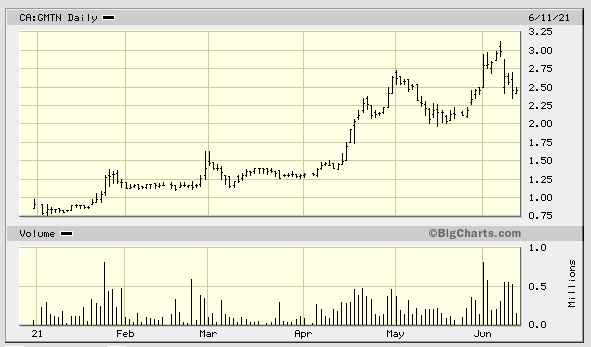

Gold Mountain (GMTN.V)

- 61.75 million shares outstanding

- $151.28M market cap based on its recent $2.45 close

During its short run as a publicly traded entity, the Company has tacked on heaps of market cap—a multi-bagger performance that rivals some of the better traders’ in the junior exploration arena.

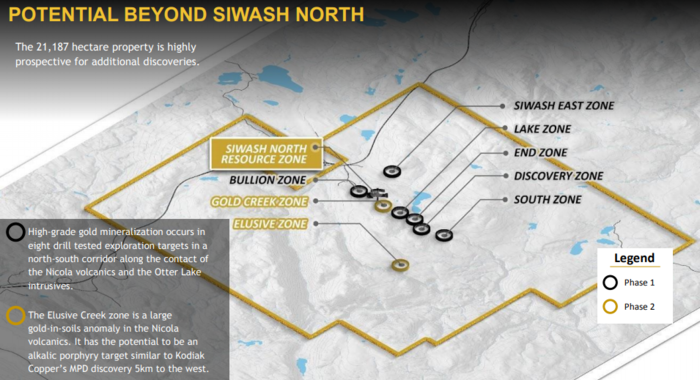

Setting an aggressive timeline to production, the Company defied the odds, silenced its naysayers, and picked off one key milestone after another at its flagship Elk Gold Project in the mining-friendly region of Merritt B.C.

This Gold Mountain crew can execute.

Most mine development scenarios, after the grueling permitting hurdle is overcome—never underestimate the risks associated in pushing a project along the permitting curve—require years of site construction before ore can be hauled off to the mill.

The Company can begin producing in only one month at Elk, after some straightforward haul-road upgrades.

After submitting its mine permit application in May 2020, the Company now has its (draft) permit in hand—Gold Mountain Receives Draft Mining Permit from the Ministry of Mines.

Now all that’s required is a bit of fine-tuning—roughly one week of refining the permit conditions—to gain full permit status. We should see this final document drop in a matter of days/weeks.

The area is now bustling with activity. On June 10th, the Company dropped the following headline:

Gold Mountain Provides Construction Update

Construction has officially begun at the Elk Gold Project and the mine plan is playing out seamlessly.

The Company is pushing development forward on multiple fronts:

Mining contracting partner, Nhwelmen-Lake, is currently completing site preparation activities—heavy equipment mobilization, drilling-blasting, overburden removal, and haul road rehab are in progress as I type this piece.

A little background on this top-shelf mining contractor and partner…

Determined to put every ounce in Elk’s subsurface stratum into play, the Company is continuing to drill in a Phase-2 campaign designed to increase the confidence in the current resource, and augment the ounce count which currently stands at 651,000 oz at 6.1 g/t Au Measured & Indicated Resources and 159,000 oz at 4.8 g/t Au Inferred.

This ounce count is destined to grow, perhaps significantly so.

The Company is also continuing to re-log historic drill core, looking for mineralized zones missed by previous operators.

Leaving no stone unturned, and in the spirit of fairness and cooperation, the Company put signatures to paper with the Indigenous communities in the area, establishing a process for ongoing engagement towards social and economic collaboration…

Gold Mountain Executes Three MOU’s with Indigenous Communities Surrounding the Elk Gold Project

The Path to Ore Delivery and Revenue

Once the final Mine Permit is issued, the Company anticipates beginning it’s large scale waste rock mining operations through July and August. This will allow the Company to mine the high-grade 1300 vein for ore delivery in October to its ore purchase partner, New Gold Inc.

Prior to delivery to New Gold’s New Afton Mine, the ore will be assayed by an independent third party and weighed on site to determine the ore’s value. Trucks then haul the ore approximately 133km to the New Afton Mine where title to the ore is passed to New Gold upon delivery. New Gold will pay Gold Mountain for the delivered ore within 17-days of each month end.

Ore delivery in October. Cash flow in November. Not too shabby for a Company that debuted in the $0.75 range (sub-$50M market cap) less than six months back.

Kevin Smith, Gold Mountain’s CEO:

“Aggressive timelines of getting into production are something we have committed to since coming to trade in December of 2020. We continue to deliver on key milestones and maintain our target of revenue generation in Q4. We’ve aligned ourselves with a first-class construction and mining contractor, Nhwelmen-Lake, to reduce our initial capex and leverage their expertise to develop BCs next high-grade gold and silver producer. With the Company receiving its early works permit and waste rock mining already underway through our gravel borrow, operations will be in full stride once we receive our mining permit amendment. All the while our drill team continues to hit mineralization and we anticipate receiving a steady stream of results from the lab in the coming weeks.”

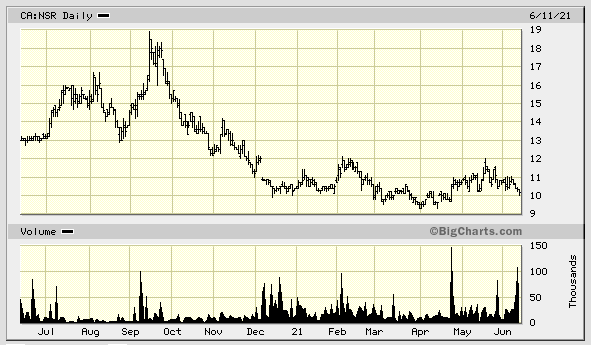

Nomad Royalty Co (GMTN.V)

- 56.64 million shares outstanding

- $574.88M market cap based on its recent (post-consolidation) $10.15 close

From the get, Nomad set out to ink high-quality deals, adding to an already robust project portfolio of producing and advanced-stage assets. Yet the market is still not rewarding management’s impressive track record.

Nomad’s portfolio now includes 15 royalty and streaming assets, eight of which are currently fixed to producing mines.

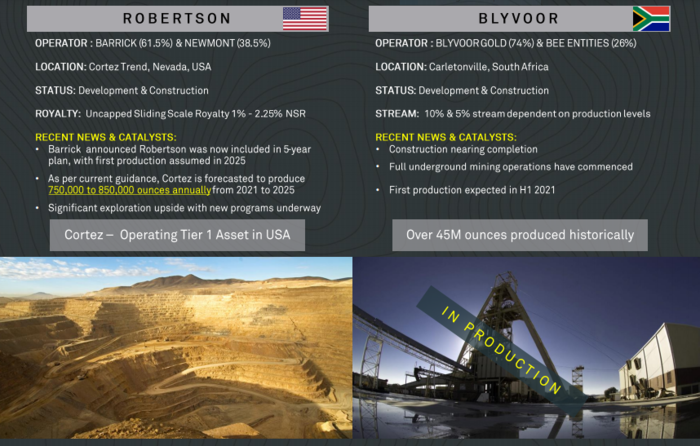

The two assets I find most compelling are Robertson and Blyvoor…

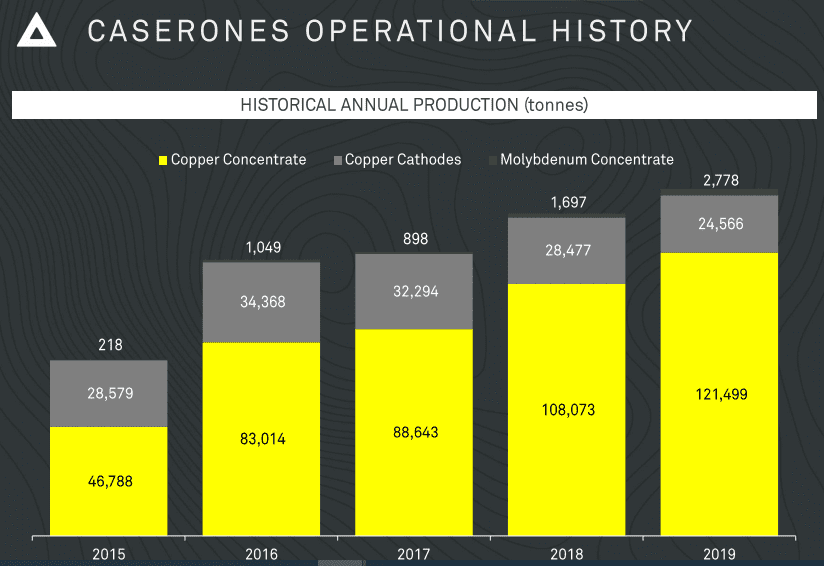

The Company’s most recent acquisition—Caserones—is a prime example of this crew’s financial capacity and deal-making prowess.

Though a 0.28% NSR may seem like small potatoes, Caserones is a robust producer—a long-life asset with considerable resource expansion and exploration upside.

In 2019, Caserones produced 146,000 tonnes of Cu and 2,778 tonnes of Mo.

Expected (life of mine average) annual payable production = ~148,000 tonnes of CuEq.

The setting here is rich in infrastructure—the project has seen a total investment of US$4.2B over the years.

Caserones’ production profile shows a very positive trajectory (production began in 2014)…

Located in the Atacama region of Chile, there are over 5 years of operational history and a current estimated mine life of 19 years—19 years, and that’s not factoring in the considerable exploration upside.

Vincent Metcalfe, company CEO:

“The acquisition of the Caserones Royalty provides Nomad with exposure to copper at a time when the demand for green and electrification linked commodities, in particular copper, is set to surge to record highs as the global economy transitions to zero emission technologies.”

On June 1st Nomad completed the acquisition of Caserones, and took the next step in attracting a wider audience.

Nomad Royalty Company Completes the Caserones Royalty Acquisition and Announces Share Consolidation

Nomad shareholders will receive one post-consolidation common share for every ten pre-consolidation shares held by them. No fractional shares will be issued as a result of the consolidation. Fractional interests will be rounded down to the nearest whole number of shares without any consideration payable therefore.

The consolidation affects all the Company’s common shares outstanding on May 31, 2021. As a result, the number of issued and outstanding shares will be reduced to 56,638,745 from 566,387,457, subject to treatment of fractional shares. Each shareholder’s percentage ownership in the Company and proportional voting power will remain unchanged, except for minor adjustments resulting from the treatment of fractional shares.

And as Equity Guru’s Lukas Kane stated quite correctly in his recent coverage, “The higher share price could allow Nomad to apply for a listing on the NYSE.”

According to Zacks, to qualify for NYSE listing a company must have at least 400 shareholders who own more than 100 shares of stock, have at least 1.1 million shares of publicly traded stock, and have a market value of public shares of at least $40 million. The stock price must be at least $4 a share.

Without a doubt, an NYSE listing would open the door to a wider audience.

If you believe we’re in the early stages of an epic bull run—a structural bull market that will prevail for years, if not decades—Nomad is a no-brainer IMO.

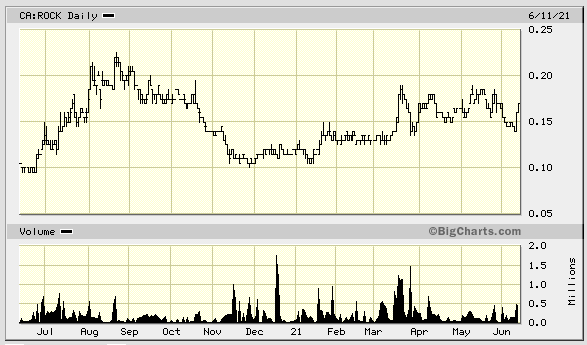

Rockridge Resources (ROCK.V)

- 73.01 million shares outstanding

- $12.41M market cap based on its recent $0.17 close

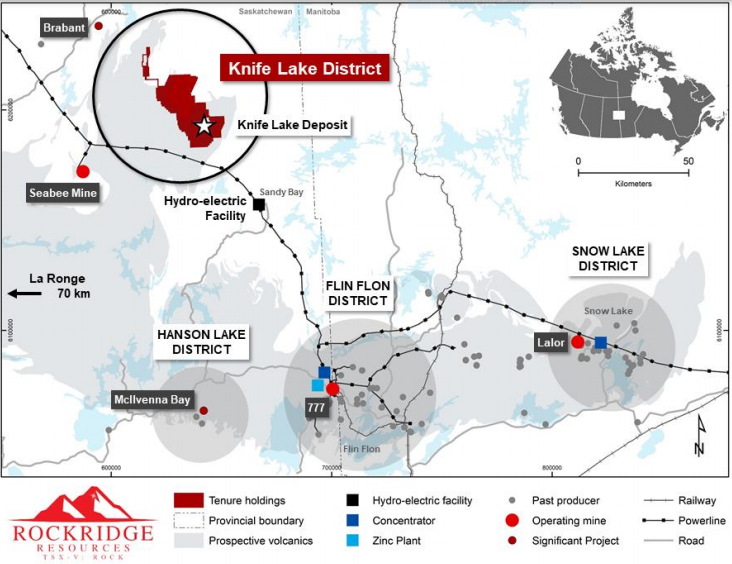

Rockridge’s flagship asset—the 55,471 hectare Knife Lake Project—is located in mining-friendly Saskatchewan, currently ranked #3 by the Fraser Institute.

We talked about the prolific nature of Volcanic Massive Sulphide (VMS) settings further up the page (see AMC.V). Knife Lake is in a VMS setting, in the (regional) vicinity of the famous Flin Flon and Snow Lake Mining Camps.

The Flin Flon camp has produced >170 million tons of sulphide ore from 31 VMS deposits worth in excess of $25 billion dollars.

Knife Lake is an advanced-stage VMS project. First discovered in 1968 by Straus Exploration, the project has undergone multiple phases of exploration over the years.

Knife Lake’s current resource—rooted in over 300 drill holes—stands at 3.8 MT @ 1.02% Cu Eq Indicated, and 7.9 MT @ 0.67% Cu Eq Inferred.

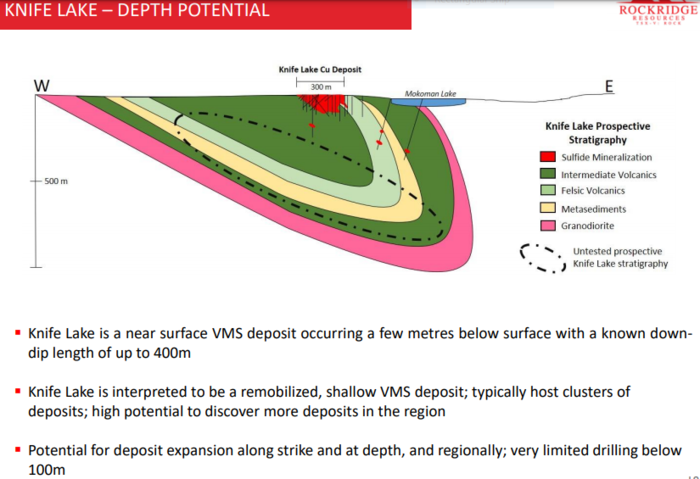

“The Knife Lake Project is interpreted to be a remobilized VMS deposit. The stratabound mineralized zone is approximately 15m thick and contains copper, silver, zinc, gold and cobalt mineralization which dips 30° to 50° eastward over a known strike-length within Rockridge’s claim area of 3,700 metres, and a known average down-dip extension of approximately 300 metres.”

A noteworthy excerpt worth from our maiden ROCK piece two weeks back—Rockridge Resources (ROCK.V) offers re-rating potential, district-scale (VMS) exploration upside – Knife Lake assays are pending…

It’s important to note that this deposit could evolve into an open-pit scenario as the mineralization lies near surface. This, and its predominant Cu nature, offers good leverage to buoyant metal prices.

There’s an element of intrigue surrounding the Knife Lake project as the current resource may represent only “a remobilized portion of a presumably much larger “primary” VMS deposit.” This, based on general observations regarding the deposit’s mineralogy, mineral textures, and metal ratios.

A much larger (and richer) deposit may lie in close proximity to the current resource, or it could lie at depth.

In this next slide, the black hatched oval feature (below the deposit) could represent be the real guts of the system.

There’s excellent discovery potential here for satellite deposits and what may ultimately lurk at depth (most of the historical work consisted of shallow drilling centered around the deposit area).

A limited 2019 Knife Lake drill program delivered 2.03% Cu, 9.88 g/t Ag, 0.19 g/t Au, 0.36% Zn, and 0.01% Co (2.42% CuEq) over 37.6 meters beginning at 11.2 meters in hole KF19003. Nice hit.

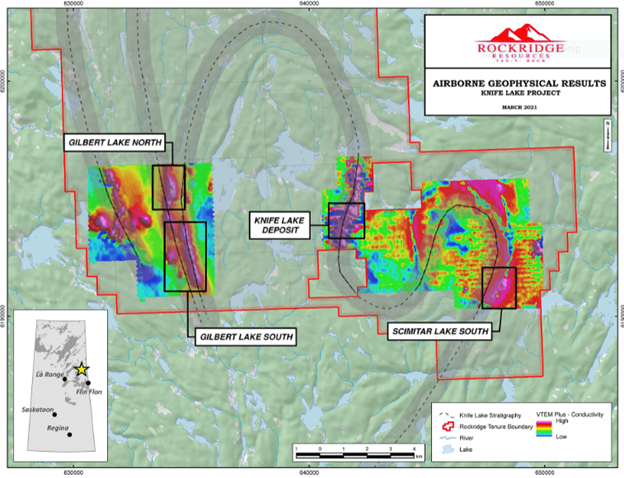

Regarding the regional potential at Knife Lake, the Company has a total of 11 high-priority targets in its crosshairs, the upshot of extensive groundwork and geophysics.

On March 18th, the Company mobilized a drill rig to the project to test several of these targets.

Rockridge Commences Drilling Program at Knife Lake Copper Project, Saskatchewan

On March 31st, the Company expanded the drill program from 1,600 meters to 2,100 meters…

Rockridge Expands Drilling Program at Knife Lake Copper Project, Saskatchewan

Then, on April 12th, the Company staked additional ground in the region, upping its hectarage by 70% (from 32,663 hectares to 55,471 hectares)—a clear indication of management’s growing optimism around the Gilbert Lake North and South targets, where very little exploration has been carried out historically.

Jonathan Wiesblatt, Rockridge CEO:

“The increased project area by 70% and expanded winter / spring drilling program is a clear indication of our overall confidence in the future success at Knife Lake. The most recent drill program is focused on new, highly prospective regional targets 5 – 6 km west of the Knife Lake deposit area. These new target areas, known as Gilbert Lake South and Gilbert Lake North, were previously undrilled and drilling in the current program has intersected visual indications of VMS-style mineralization. Through the staking of additional ground at Knife Lake we have added highly prospective stratigraphy to the project including the southern strike extension of both the Gilbert and Scimitar trends.”

Phase-1 Knife Lake drill results are on deck and could drop any day now. A Phase-2 drill campaign is scheduled for August or September.

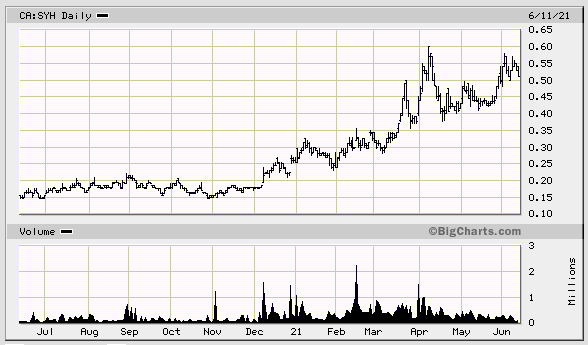

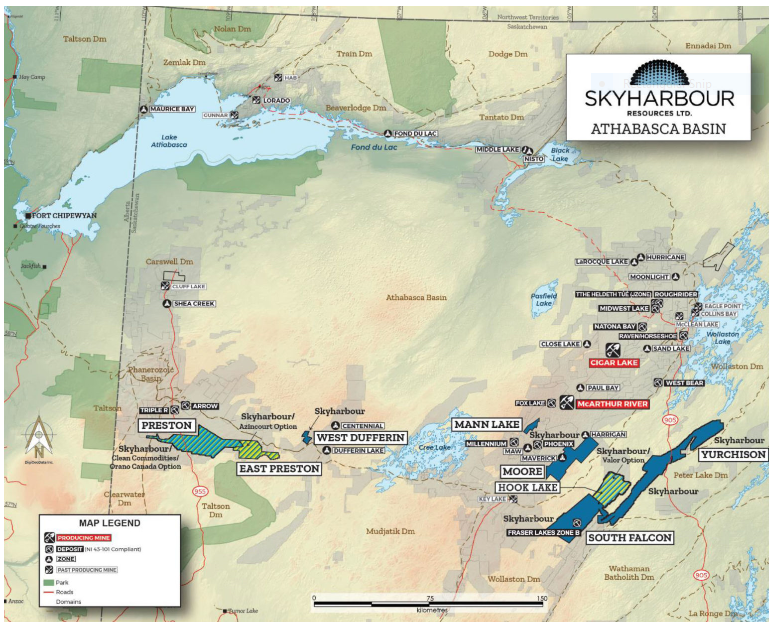

Skyharbour Resources (SYH.V)

- 116.08 million shares outstanding

- $59.2M market cap based on its recent $0.51 close

Riding the wave of positive sentiment sweeping across the uranium sector, Skyharbour is pushing its advanced stage Moore Lake Uranium Project aggressively along the curve.

Moore Lake is strategically located in the Basin—the Athabasca Basin.

As you may already know, the Basin is to uranium what the Carlin Trend is to gold.

The Basin, a 100,000 square kilometer setting straddling the Saskatchewan-Alberta border, is an ancient sedimentary basin hosting the world’s largest and highest-grade uranium mines and deposits.

As we stated in our maiden Skyharbour piece last week…

Skyharbour has a distinct advantage over the majority of junior exploration companies operating in the Basin.

Vectoring in on a potential uranium deposit is no easy task. Uranium deposits are often needles in a haystack, even in a prolific setting like the Basin.

It can take dozens, sometimes hundreds of holes to home-in on a new discovery. McArthur River, a Basin standout, ultimately required 210 pokes with the drill bit to tag.

Skyharbour’s advantage is that it’s testing ground that has already demonstrated significant (high-grade) resource and discovery potential—zones with known mineralization offering increased odds of success with the drill bit.

According to the Company’s website, Skyharbour is “well-positioned to benefit from improving uranium market fundamentals with six drill-ready projects.”

Moore Lake highlights:

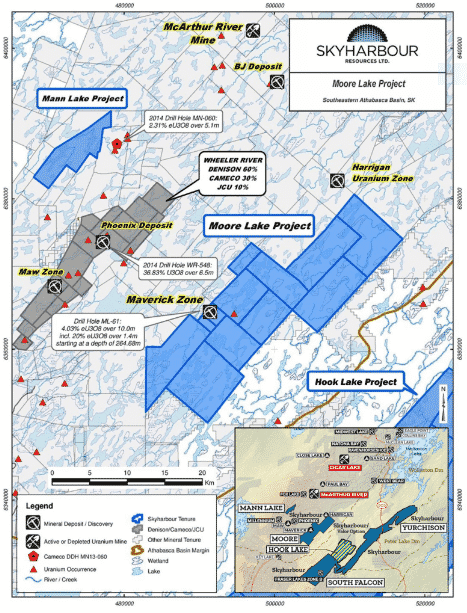

- Skyharbour has acquired a 100% interest in the 35,705 hectare (88,191 acres) Moore Uranium Project from Denison Mines, a mature uranium exploration property in the eastern Athabasca Basin near existing infrastructure with known high grade uranium mineralization and significant discovery potential;

- Denison Mines (TSX: DML) (NYSE MKT: DNN) is a large, strategic shareholder of Skyharbour and David Cates, President and CEO on Denison, is on Skyharbour’s Board of Directors;

- Moore hosts high grade uranium mineralization at the Main Maverick Zone, which was discovered by JNR Resources in the early 2000’s; historical drill results include 4.03% eU3O8 over 10m, including 20% eU3O8 over 1.4m at a depth of 265m in hole ML-61;

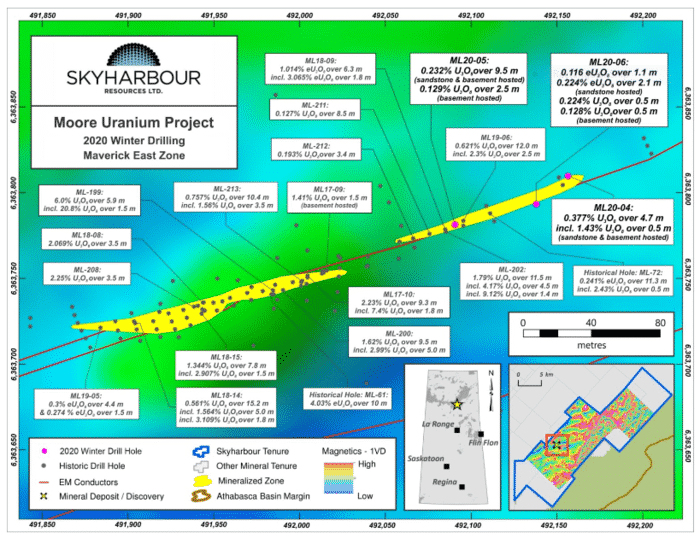

- Skyharbour has carried out diamond drill programs over the last few years with several drill holes intersecting high grade uranium mineralization along the 4.7 kilometre long Maverick structural corridor;

- Drill intercepts of high grade, shallow uranium include 20.8% U3O8 over 1.5m at 264m, 9.12% U3O8 over 1.4m at 278m and 5.29% over 2.5m U3O8 at 279m;

- Skyharbour’s drill hole ML-199 tested the Main Maverick Zone lens and intersected high grade uranium mineralization containing 6.0% U3O8 over 5.9m at 265 metres depth including 20.8% U3O8 over 1.5m;

- Hole ML-202 from the Maverick East Zone intersected high grade uranium of 1.79% U3O8 over 11.5m at 270m including 4.17% U3O8 over 4.5m and 9.12% U3O8 over 1.4m;

- This is a newly discovered high grade mineralized lens at Maverick East on the Maverick corridor 100 metres from the Main Maverick Zone, and illustrates the strong discovery potential of additional high grade lenses along strike.

More recently…

- Skyharbour has identified and refined new targets in the underlying basement rocks using modern exploration and methodologies;

- Drill hole ML19-06 intersected a broad zone of uranium mineralization from 273.0 metres to 285.0 metres downhole within the growing Maverick East Zone. The interval returned 0.62% U3O8 over 12.0 metres with a basal high grade basement-hosted intercept returning 2.5 metres of 2.31% U3O8;

- A drill program in the Fall of 2020 tested both unconformity and basement targets along the high grade Maverick structural corridor;

- Drill hole ML20-09 which returned 0.72% U3O8 over 17.5 metres from 271.5 metres to 289.0 metres, including 1.00% U3O8 over 10.0 metres hosted in the basement, represents the longest continuous drill intercept of uranium mineralization discovered to date at the project.

The Company believes they’ve barely scratched the surface at East Maverick and are currently testing that hypothesis via an aggressive (minimum) 3,500-meter diamond drill program.

This cash-rich exploreco—approx $6.5M in cash and $2.5 in stock—is on the verge of a robust newsflow cycle.

All told, the Company is looking to drill roughly 10,000 meters on its own dime in 2021—8,000 meters at Moore Lake and 2,000 meters at South Falcon Point (in the event they don’t option out South Falcon between now and November).

An expertly helmed, Basin-based land baron, we can expect to see multiple drill programs over the next seven to eight months as Skyharbour’s JV partners further advance additional properties in its expansive project portfolio.

That’s it for this roundup.

END

Greg Nolan

Full disclosure: all of the companies featured above are Equity Guru marketing clients, so… color me biased.

*** The Kay Mine historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to be a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

Leave a Reply