Bitcoin’s down almost half of its high point mark achieved earlier this year, and naysayers are chuckling about the things they’ve always known about the currency. Like they always do whenever crypto hits the skids, which it does ever so often. It’s a common occurrence, and common enough that folks involved will keep quiet during these periods and be even quieter the next time it hits an all-time high.

Not if it does. When it does.

Here’s a sample bit of the received wisdom of crypto-afficionados.

Normal investing is like gambling. You can have safe bets or you can have risky bets, but you’re always betting, and you’re going to lose given a long enough timeline because the house always wins. With cryptocurrency, you are the house.

Sounds like someone’s drank the kool-aid, right? Possibly. But it’s a more common sentiment than you might think. Cryptocurrency, and bitcoin specifically, are side-products of the pessimism of the age. They’re built by people who want a hedge against the stupidity of people in large crowds, especially if we’ve elected them (the so-called ‘professionals’) into positions of power. The notion behind the average crypto investor is that as long as there’s human stupidity, there will be a reason for a trust-less technology to exist.

And they’re right, as it turns out, and dead wrong in other ways. The general intelligence of a crowd is only as high as it’s most charismatic member, and you can hedge away from it for a time. But it catches up and now we have core human hubris at the heart of cryptocurrency as well.

We see evidence of it in this weekend’s temperature range. At the time of writing, it’s a cool 30 degrees Celcius, but it’s looking to be another hot one like we’ve had over the weekend. Temperatures that wouldn’t be uncommon in Las Vegas or Riyadh. If you’re not local, keep in mind that we don’t get those kinds of temperatures here. It’s evidence of a warming climate and also evidence of human stupidity. And it’s the kind of human stupidity that Bitcoin miners are contributing too.

And it’s only going to get worse.

Your bitcoin bet is down because of China’s love-hate relationship with cryptocurrency. They’re creating their own so they don’t have to play with Bitcoin anymore, and the latest crackdown has sent miners either into hiding or scrambling to find greener pastures. That’s 60% of the blockchain’s hashrate in the wind and it won’t be coming back until it finds a new place to land. Ultimately, this is a good thing for Bitcoin, because it will introduce more geographical decentralization into the blockchain’s mechanics by spreading the mining around the world. We’ll see less crashes of this variety in the future because no-one country, especially an authoritarian juggernaut like China, will be able to exert so much influence over the processes involved.

Sadly, many are looking to Texas as a safe haven. Shenzhen-based BIT mining is investing $26 million into a 57-megawatt data centre set in the lone star state. They’re already joining Bitmain, themselves not exactly a miner but definitely adjacent, which is looking to set up a facility it launched in Texas in 2019.

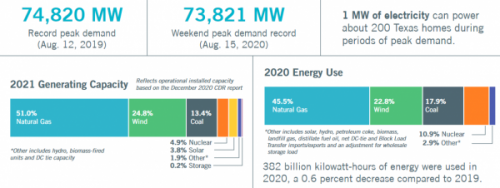

Texas likes to boast that its Electricity Reliability Council of Texas (ERCOT) grid gets a 30% of its electricity from renewable sources, as if somehow that’s an acceptable answer for our swiftly warming climate.

Greg Abbott, Governor of Texas, went on Twitter to set out the siren song to disaffected crypto-miners, informing them that Texas is open for business.

It’s happening!

Texas will be the crypto leader.

Cryptocurrency is now coming to Texas grocery stores.

H-E-B is putting cryptocurrency kiosks into some Texas grocery stores.#cryptocurrency @HEB https://t.co/e4CNsSbd0s via @chron

— Greg Abbott (@GregAbbott_TX) June 19, 2021

Earlier in his feed he posted a picture of himself surrounded by other legislative types and the topic was about reforming the ERCOT grid. So there’s something to watch for in the future. Until then, though, if Bitcoin is going to stave off government scrutiny, it’s going to need a solution for their environmental issues and that means a concerted green crypto movement.

Right now, we have the growing Crypto Climate Accord (CCA), which recently onboarded bitcoin miner Bit Digital (BTBT.Q) and already includes such miners are DMG Blockchain Solutions (DMGI.V), the UK-based Argo Blockchain (ARB.LON), as well as Gryphon Digital Mining, which is presently private, but merging with Sphere 3D (ANY.Q) in Q3 2021, and private wallet company, Zumo. Their list of supporters is considerably larger and includes such companies as Hut 8 Mining (HUT.T), the Ripple Corporation, which is behind the XRP blockchain and coin, and blockchain software company, ConsenSys.

The CCA is a private sector-led initiative to clean up the cryptocurrency and blockchain sector. The CCA is the combined effort of organizations devoted to informing, developing, testing and implementing solutions to help get the fossil fuel monkey off of crypto’s back and get it onto less environmentally damaging renewable energies. The accord gives an open space to meet challenges, gather information, develop and test hypothesis, showcase solutions, share learnings and create and promote best industry practices.

Accompanying their signatory status is a public commitment towards cleaning up their own back yard. Bit Digital has committed to have net-zero emissions from their electricity consumption for their crypto-operations by 2030, and report progress using best industry practices.

“To date, Bit Digital has taken major steps to ensure sustainability of our mining operations, and by signing the CCA we have emphasized our commitment to decarbonization. As of our most recent quarterly reporting, our fleet was running on a majority carbon-free power. We also participate in sustainability initiatives such as a previously announced demand-response energy curtailment program. Going forward, we intend to expand our use of clean power as we scale,” said Bryan Bullett, CEO of Bit Digital.

So far so good.

What other options are there?

The key problem regarding cryptocurrency and its relationship to environmental degradation is the Proof-of-Work (PoW) consensus mechanism. This started with Bitcoin’s white paper and it was Satoshi Nakamoto’s way of maintaining not only decentralization but transparency and information fidelity. It requires miners to expend considerable amounts of electricity to solve a mathematical equation, which increases in difficulty as more people join the network.

After which, the information on the blockchain is verified and Bitcoin is released as a reward for finishing the mathematical proof and doing the work. Hence, proof-of-work in that you’ve proven you’ve done the work, as well as proof-of-work in that you’ve solved the mathematical proof, and therefore get the block reward. There are two explanations here because no two cryptocurrency people can agree, and ultimately, it doesn’t matter. They’re both right.

In the beginning, you could do this from your home computer with a top-shelf graphics card. You leave it on overnight, get some sleep, and wake up the next morning with 100 bitcoin, each worth a fraction of a penny. You can still do this with some coins if you don’t mind taking a hit on your electrical bill, but the jury’s out on whether or not it’s a lucrative enterprise. General consensus is leaning towards that it isn’t.

Regardless, you can’t do this with Bitcoin anymore. Now large scale companies combine to use the energy equivalent of the country of Argentina to run the Bitcoin Skinner-box, pull the lever and get their block reward. Most coins use PoW. If it has Bitcoin in the name, like Bitcoin Cash (BCH), Bitcoin Satoshi Vision (BSV) or lesser lights like Bitcoin Gold, or even re-configurations of the Bitcoin core code like Charlie Lee’s Litecoin (LTC) or privacy coin, Dash, it’s a PoW coin. Although Dash seems to be moving towards staking, which we’ll get into in the next section.

There are other non-environmental issues associated with PoW mining, which are more or less beyond the scope of this article, but are worth mentioning in passing. These include the potential for a 51% attack, or a way for the entire blockchain to get hijacked by a bloc of bad actors looking to rewrite the blockchain (including block rewards) to suit their own interests. It’s happened a few times in Bitcoin’s history when it was much smaller, but the prospects of it happening now are slim. Other blockchains? They vary.

Alternatives to PoW

Chief among them is called the Proof-of-Stake consensus mechanism (PoS or staking), which is a less resource-intensive alternative to mining. It involves keeping your funds in a wallet to support the security and operations of a blockchain. It locks in cryptocurrencies and the reward is more crypto. Some exchanges offer staking to their users—for example, Binance and Poloniex will let you keep your holdings on the exchange in permanent-stake mode, and periodically, you’ll close the block based on your holdings, and get rewarded.

The problem with PoS is that the ability to close the block is heavily weighted towards stake-pools with the most crypto. So

basically, if Jim has 50 Cosmos and Jane has 25 Cosmos, then Jim is going to get to close the block two-times more than Jane. Eventually, as Jim collects more block rewards than Jane—then Jane will find herself phased out of the pool entirely and be unable to close the block. This is a bit of an oversimplication of how this complex mechanism works and also how it generates inequalities over the long term, but it works as a pedagogical tool.

It was originally built for Bitcoin back in 2014, and intended as a supplement for PoW making a hybrid PoS/PoW consensus mechanism. PoW would be used to mint the original set coins and PoS would take over. Nowadays, there’s no way that’s happening. Bitcoin mining is big business and the fluctuations of the hashrate and difficulty mean a steady flux and flow of miners, introducing new blood into the industry, rather than constantly rewarding the big boys for being big. High electrical output is causal for closing the PoW block, but there is room for smaller guys to get in there.

But for other cryptocurrencies—chief among them Cardano and Ethereum—PoS is the way of the future. Ethereum, for right now, is in the middle of a transition from PoW to PoS as part of its Ethereum 2.0 system upgrade, and Cardano has been full PoS for awhile now. The reason it works is because the consensus mechanism is not the sole revenue stream for users of the two blockchains (and others like it) but instead one of many.

This many constitutes the on-chain ecosystems offered by both ETH and ADA, and other coins like it, in which individual actors can engage in the economic activity that makes up the decentralized finance sector. Everything ranging from games, to the construction, sale and trade of non-fungible tokens to digital loans and bank accounts on decentralized exchanges like PancakeSwap or Uniswap.

Let’s not forget the auxiliary coins like Chainlink, Polkadot and Cosmos, which run support for DeFi, and use variations of PoS. If coins like ETH and ADA meet or exceed their promises in terms of scaling, then Bitcoin and its derivatives will likely fall behind in time. They’ll always have supporters among the non-DeFi, non-programmer crowd who want a hedge against the depredations of stupid people in large crowds, but they won’t be the top-dog in the yard anymore.

If that doesn’t happen, and there are still no guarantees that either Charles Hoskinson (for Cardano) or Vitalik Buterin (for Ethereum) are going to be able to make good on their promises, then we’ll continue to have Bitcoin and its PoW mechanism frontrunning the crypto-sphere.

And that brings us full circle to the need for more environmentally friendly sources of electricity and green crypto initiatives like the CCA. If you’re looking for a place in the crypto-sphere to put your money that’s equitable, functional and strives to reduce the environmental impact of the technology, you could do worse than Bit Digital, DMG Blockchain Solutions, or any of the supporters of the initiative.

—Joseph Morton

Leave a Reply