It is no surprise to readers that I am a big fan of agriculture. I don’t try to hide the fact that I have a bullish bias. In fact, one of my 2021 outlooks posted back near the end of December 2020 was all about agricultural commodities. Wheat, Soybeans, and Corn were displaying amazing weekly charts that met all my criteria for my Market Structure method for investing and trading. The second part of that agriculture outlook dealt with higher food prices. Something that will make future headlines if Oil prices continue to rise.

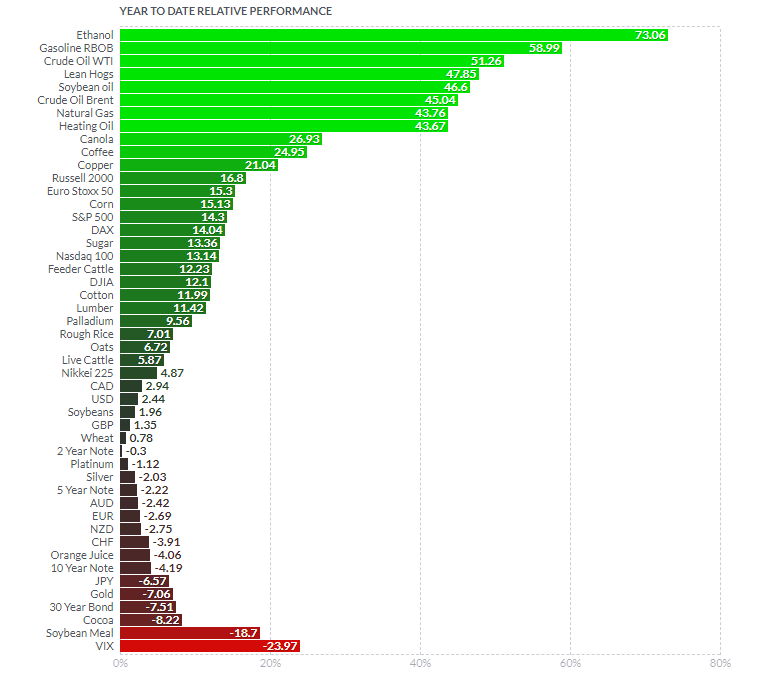

After only a few months into 2021, my weekly targets on the agricultural commodities were met. Since then, they have pulled back. On a year to date basis, Corn is up 15.13%, Soybeans are up 1.96%, and Wheat is up 0.78%. But take a look at the other agricultural commodities such as Lean Hogs, Canola, and Soybean Oil just to name a few.

And guess what? I remain bullish on agricultural commodities for the long term. There are many ways to play this space. You can trade futures or CFD contracts on agricultural commodities. I mainly look at the ones mentioned above, but you can trade sugar, cocoa, coffee, livestock, lean hogs, orange juice etc.

One can trade ETFs, and I will mention two popular ones later on in this article. Finally, one can trade food companies and other agricultural stocks. Loblaws, Saputo, Maple Leaf probably come first to mind. And I think these stocks deserve a defensive place in your portfolio due to their dividends and the obvious fact that people will continue to buy food even during the bad times.

While mainstream financial media is covering things such as AI, Electric Vehicles, Green Energy, Cryptocurrency, and Robotics as the next major investment opportunities, agriculture remains under the radar. By the end of this article, I hope to convince you that agriculture deserves your full attention, and there is a HUGE opportunity for investing.

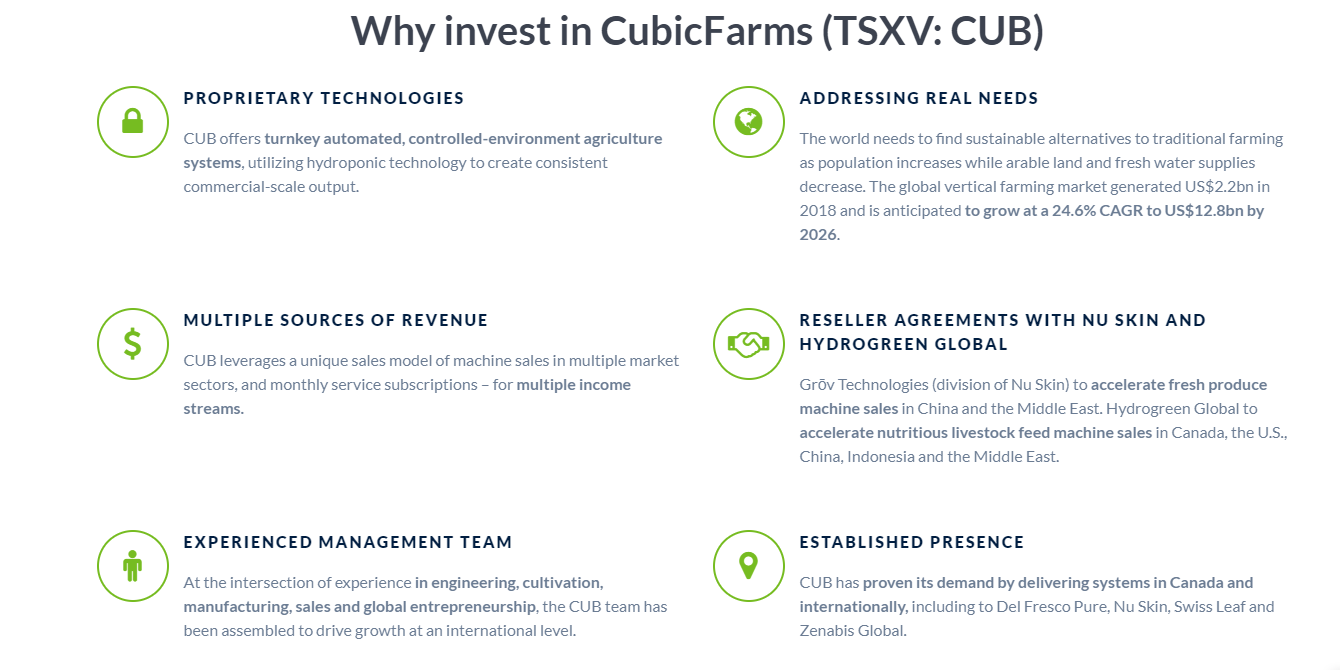

Not everyone on Wall Street and Bay Street is neglecting agriculture. Two of the most successful IPO’s this year were Farmer’s Edge (FDGE.TO) here in Canada, and Agrify (AGFY) in the US. Both are incorporating technology with farming, coining the new term “digital farming solutions”. Even though I am a fan of both companies, I have come across another company which has high potential. The company is CubicFarms Systems (TSXV: CUB), and I am a big fan of what they are doing.

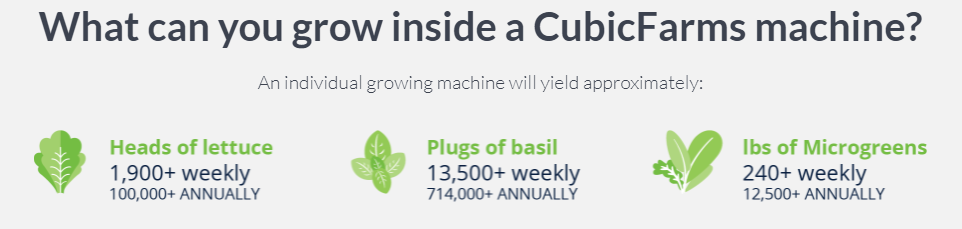

A few statements from their website:

But before we delve into CubicFarms further, I want to provide you with my Macro backdrop. These are the reasons I am bullish agriculture going forward.

- Jim Rogers

Yes, I am speaking about the legendary investor who dons his legendary bowties, and is the co-founder of the Quantum Fund alongside George Soros. Being a contrarian myself, I am a big fan of Rogers macro approach and view of the world. Highly recommend his books titled “Adventure Capitalist” and “Investment Biker”. They may be old, but provide great commentary and lessons about how things are done in other parts of the world.

When asked what’s his big secret for accumulating wealth in the stock market, he replies that he looks for things that are cheap. Simple. And things that are cheap, tend to be under the radar, or even better, hated. Recently Rogers has spoken about investing in places such as Russia, Zimbabwe, Iran, and even North Korea (if it ever opens up).

His approach can be brought down to the sector basis, and guess what? Agriculture is his favorite. Nobody is looking at agriculture as they ought to be according to Mr. Rogers. In plenty of interviews he is asked why he is so bullish agriculture? He always replies that no young people want to be farmers anymore. Young people nowadays want to be doctors, lawyers, accountants, computer engineers, and I’m going to throw in day traders. With the average age of farmers well above 60, this is going to be an issue going forward. So much so that governments may need to initiate or subsidize programs and businesses to get people back into farming.

Or step in CubicFarms with automated farming systems. More on this later.

Jim Rogers is so convinced at the opportunity in this sector, he even created his own Agriculture ETF: RJA.

Here is a list of some other Agriculture ETFs for you to consider. For Canadians, we have the aptly named COW agriculture ETF.

2. The Weather

Climate change is posing some challenges for farmers. I live in Vancouver (well actually Surrey) where we always complain about the weather, but this year, it has been warranted. There were some unusually cold and rainy days in late May to early June. This past weekend and in the first few days of this new week, we experienced a heat wave. Temperatures reaching 42 degrees Celsius with temperature overnight remaining above 20 degrees. Really unbearable stuff and humid stuff. Abbotsford, a city an hour away from me, saw temperatures hit 49 Celsius! Heck, I think it even snowed in Ontario a month ago.

With unpredictable weather, comes increased chances of crop failure and lower yielding harvests. Throw in some black swan events like the freak storm in Iowa back in 2020 where 50% of the state’s crops were lost, and you have the perfect storm for increasing agricultural commodity prices. To add more unpredictability, Iowa has seen a hailstorm this past week which could cut the portion of Iowa’s Corn yield by 10-15%.

With this recent heat wave on the west coast, President Joe Biden is set to meet with Governor’s to discuss drought amongst other things. The Western US is dealing with the worst drought in 20 years. California comes to mind with their agricultural land.

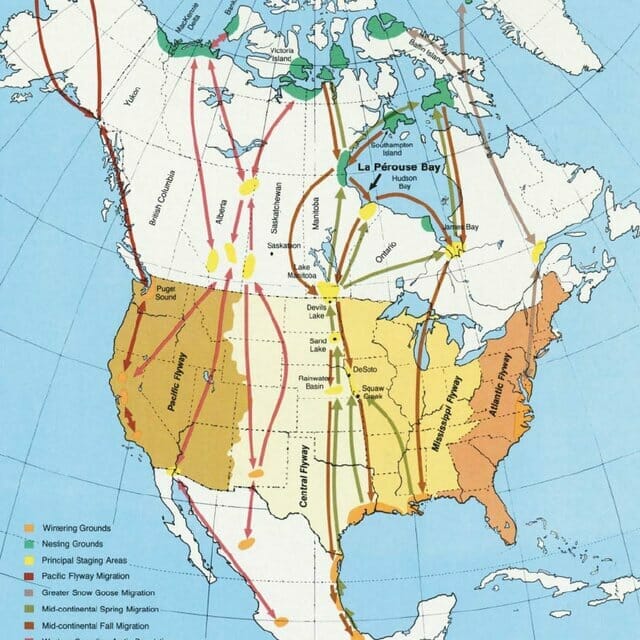

Another thing that I have learned about farming is how Farmer’s are connected to nature. Almost like this sixth sense. I have read about how Farmer’s await certain calls from migratory birds to let them know that Spring has arrived. The return of certain birds and hearing their chirping is their cue to begin planting crops. These bird calls are now being heard later than usual over on the East coast. Winter tends to linger longer into what was once early Spring. Pretty cool stuff, as I recently picked up the hobby of bird-watching, and like to consider myself an amateur bird watcher.

Some of this might sound a bit doom and gloom, but have no fear! Human ingenuity will be able to solve our food issues. Indoor/Greenhouse farming is a technology and farming adaption which will allow us to grow crops even with unpredictable weather. Humans will just create a space and control the weather and environment themselves.

CubicFarms ticks this box with their indoor farm modules, the control room.

3. Supply Chain Issues

This is relevant in today’s world. People have seen the threat of supply chain issues and disruptions with the pandemic. New car supply and semiconductor chips are just the two items making major headlines right now, but there are other instances of supply chain issues for niche products.

Personally, supply chain issues are the top reason I am bullish on agriculture. I foresee food issues sooner rather than later. The current media headlines regarding shortages have to do with economies re-opening. As people return to restaurants, supply chains will be pressured. Why? Many restaurants decided not to stock up on items as they usually do during the lockdowns and restrictions. They are now beginning to replenish and return to regular inventory frontrunning a return back to normalcy. But time will tell whether this is true, OR if there is a legit supply chain/agriculture supply issue.

Tons of headlines regarding shortages of meat products. Beef, Pork, and Chicken wings shortages are making recent headlines. I spoke with a fellow trader in New York, and he was ranting about the high costs of wings. I thought it was only New York, but he informed me it is around the US. Apparently the beef and pork shortages are being linked to a cyberattack on JBS, a major beef and pork producer in the US, shutting down plants in North America and Australia. Don’t think many would have expected to ever hear about cyberattacks and food, but in this world, it just adds another dimension in protecting supply chains. And for us investors, something to be aware about when looking for opportunities.

4. Green/Clean Energy

And finally, the most surprising reason I am bullish on agriculture is the move to green/clean energy. We know this is coming. Governments will be using green energy infrastructure for more spending and in an attempt to spur the economy. Think spending on infrastructure like after the Great Recession of the 20’s. The Biden https://equity.guru/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration has already unveiled their “Green New Deal”. Expect other nations to follow.

Why is this bullish agriculture? Because it will lead to new technology and adaptation in agriculture in many nations.

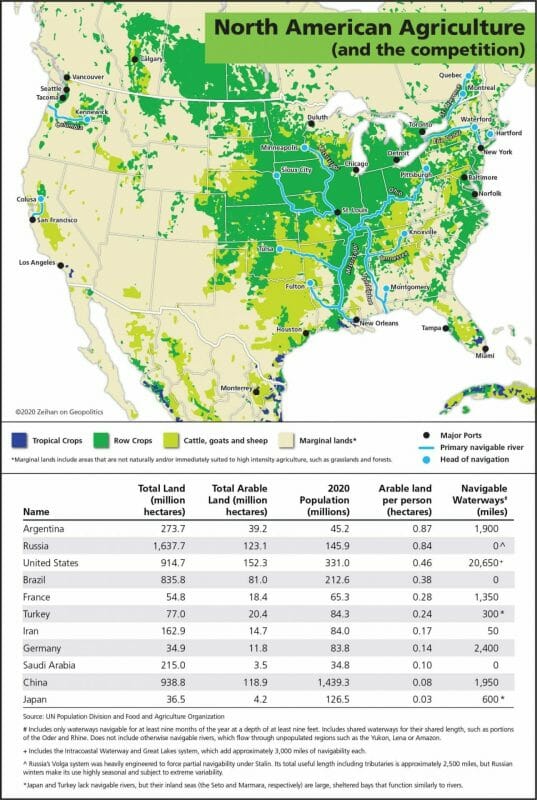

Peter Zeihan’s geopolitical book titled, “Disunited Nations: The Scramble for Power in an Ungoverned World”, is one I highly recommend reading. He delves into clean energy projects and why green projects will work well in some nations, and not so well in others.

To summarize his take: green energy projects (ie: solar panels and wind turbines) need to be placed in open areas that see a lot of sun and wind. These are areas that currently are where agriculture is produced. Mr. Zeihan details in the book that nations like the US will do well, but a nation like China, and other nations that are not well endowed with a lot of good farmland, would need to sacrifice farming for energy. By the way, even nations well endowed with farmland have an issue with soil. This is important as good farmland and soil yield better crops retaining their vitamins and minerals. Which means better food for us, and healthier human beings.

If you are competing with farmland, why not grow upwards rather than flat? This is where vertical integrated farming comes to mind. Sure, it can be indoors as well, but what this means is nations will not need to compromise between clean energy and agriculture. They can have both.

So those are some reasons why I am investing heavily into the agriculture sector. There might be some worrying aspects, with some supply shocks, but I believe human ingenuity will win in the end. Agricultural problems will be solved. As always, I encourage all my readers to research the topics I mentioned above and come to your own conclusion.

CubicFarms Systems

CubicFarms Systems gets me excited with their calls for an agriculture revolution. I am all in for a revolution in farming.

I want to highlight two things.

First, their indoor hydroponics modules. An automated, environment controlled system where trays of crops follow CubicFarms patented undulating “V-shape” path which ensures all sides of the plant are bathed in light to maximize growth. Here is what it looks like:

Here are also the benefits of growing in a CubicFarms system.

Looking back at the macro points I listed, you can see why I am very excited about this. This technology addresses the issues listed. The owners of Swiss Leaf Farms, who use CubicFarms indoor modules, nicely summarize my points by saying, “It is -42°C outside our CubicFarm in Westlock County, Alberta, and our vegetables are growing and thriving inside!”.

The second highlight is the HydroGreen automated feed technology. HydroGreen is a division of CubicFarms Systems. What this technology does is provide cost-effective animal nutrition in an innovative controlled environment setting that allows for quality nutrition 365 days a year.

Looking at customer reviews, the cows love the feed produced. They don’t even sniff at it, they just chow down. Well fed and healthy cows mean good beef. If you don’t know about the highly priced Japanese Wagyu luxury beef, everything is done to ensure the cows live a good lifestyle. From what they eat, to even daily massages.

The technology is amazing. All automated, and with a click of a button, you can have a yield in six days. Even young people, and those that are tech savvy, will love and appreciate this technology. Earlier, I spoke about young people not wanting to be farmer’s anymore. One aspect is the hard physical labor involved. Let’s face it, a lot of us are lazy nowadays. Well with this technology, young people and newer generations can get interested in farming and they don’t have to sweat it out in the field!

If I had a question for management it would be this: can this technology be scaled into smaller products/systems? I see an opportunity with consumers. My generation are buying apartments and condo’s rather than full homes. They don’t have gardens, but a small vertical system like this with perhaps 3 or 4 trays that you can either wheel out or just set up in one place to grow crops would be very popular.

The two most recent press releases from CubicFarms deals with equity financing, and Q1 earnings.

On the equity financing side, The Company issued a total of 18,740,742 Common Shares at a price of C$1.35 per Common Share for gross proceeds to the Company of C$25,300,001 which includes the exercise, in full, by the Underwriters of the over-allotment option granted by the Company to purchase an additional 2,444,445 Common Shares at a price of C$1.35 per Common Share.

It should be mentioned that this raising was all from the institutional side. Congratulations to the team. The company has the cash to initiate catalysts and develop, it is all about management delivering now.

On May 31st 2021, CubicFarms announced Q1 Earnings which saw record results. Highlights include:

- Revenue for the three months ended March 31, 2021 was $3,906,810, of which revenue from systems sales was $3,689,369 and revenue from other services and consumables was $217,441.

- Trailing 12 months (“T12M”) revenue was $8,594,606, up 662% over T12M revenue of $1,128,576 a year ago.

- Secured USD$6,120,400 in new contracts for a total of 42 modules of the CubicFarm System and HydroGreen Grow System technologies.

- Research and development (R&D) expenses of $1,140,419 were incurred, an increase of 180% compared to $407,097 during the same period.

- The Company nearly doubled its workforce from 49 to 94 full-time employees and contractors as of March 31, 2021, compared to the same period ending March 31, 2020.

- Selling expenses were $629,156, compared to $198,042 for the same period in the previous fiscal year, supporting the Company’s branding and expansion efforts.

- Net loss for the three months ended March 31, 2021 was $3,677,088, a 7% increase from the same period ending March 31, 2020.

- General https://equity.guru/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expenses increased 41% to $3,228,634 $ for the three months ended March 31, 2021 reflecting the continued expansion of the Company’s business and necessary staffing additions.

CEO Dave Dinesen had this to say about the results:

“This is our strongest quarter to date, with more than $3.9 million in revenue in the first quarter of the year, along with signing new customer orders for 42 modules of our indoor growing technologies,” said Tim Fernback, CFO, CubicFarms. “Our total sales and deposits have increased to 199 modules as a result of accelerating demand for our CubicFarm and HydroGreen divisions. This backlog represents a value of over $26 million under contract that are pending manufacturing and installation.”

Technical Tactics

To finish off this article, we will take a look at the technicals. But first, a quick glance at the balance sheet.

The major thing I look for is a positive working capital. Current Assets minus Current Liabilities, and I want to see that number be positive. In the case of CubicFarms, we do have a positive working capital. The balance sheet looks healthy and indicates a well run and managed company.

CubicFarms is indicating an intriguing technical pattern. A flag pattern indicates an upside breakout. The trigger would be a daily close above the trendline I have drawn. If this occurs, we can retest previous all time highs at $1.82 on the path towards new record all time highs. To the downside, we have a major flip zone (an area that has been both support and resistance) at $1.20. As long as price remains above this flip zone, the possibility for further upside remains buoyed just based on technicals.

The stock remains in an uptrend and is up 52.63% year to date. At time of writing, the stock is currently up 1.77% in today’s trading.

In summary, I believe CubicFarms has the right technology in a sector that presents a major opportunity for investors. Recent days with the heat wave just prove that climate range and disruption in agriculture and food supply is a real possibility. It is time for more investors to recognize the opportunity going forward.

Leave a Reply