I don’t like to be the guy to say “I told you so”, but DAMN! I told you so! From a technical perspective, all the stars were aligned for Ethereum to rip higher! When you approach trading as a business of probabilities, the goal is to align as MANY positive confluences as possible!

If you want to hear me blabber about Ethereum and why you should buy some, read my Market Moment piece put out last week, aptly titled “Ethereum is My Favorite Cryptocurrency Chart. Here’s Why!”.

Regular Market Moment readers, and those who are part of Equity Guru’s Discord Trading/Investment Channel were given the heads up when the breakout was triggered.

We also have BIG news coming out in the form of the Ethereum Improvement Protocol, or EIP 1559. This is seen as a significant upgrade for Ethereum, and aims to change the way transaction fees, or gas light fees, are calculated. We can confirm this hard fork did happen today!

If you read my piece on why I love the Ethereum chart, the one issue I have had with Ethereum are the fees. You can read about my experience using Ethereum to stake a De-Fi project. I was not impressed, and for a coin being called the money of the internet, this issue had to be addressed. Ethereum 2.0 is supposed to fix all these issues, but we just don’t know when it will come out. Fingers crossed that it is out by the end of this year. EIP 1559 is a welcome upgrade until then. If this gas light fee issue gets fixed, it addresses my complaint, and I turn even more bullish on Ethereum for the long term.

The ecosystem of Ethereum is impressive. You use it for smart contract capabilities which power De-Fi, or decentralized finance apps, as well as NFTs. Having an Ethereum upgrade which is faster and cheaper for transactions increases the appeal for investors.

The big bearish case for Ethereum and other crypto’s in general remains the SEC and regulations. We have had a spew of Crypto news this week involving the SEC. SEC chairman, Gary Gensler, saying they need more power to fully regulate crypto’s, and this is required to protect investors from the ‘wild west’ that is crypto markets. Depending on how severe these are, it could hit crypto hard. This is why I still advise holding some De-Fi tokens. Bitcoin and other crypto’s were meant to be decentralized. An asset away from the prying hands of the government, big banks and institutions. Crypto purists don’t like this, and may move assets to De-Fi.

But it seems we may have some allies in government. A few senators have filed an amendment to the bipartisan infrastructure bill to exempt miners and providers of crypto services of proposed tax rules.

Technical Tactics

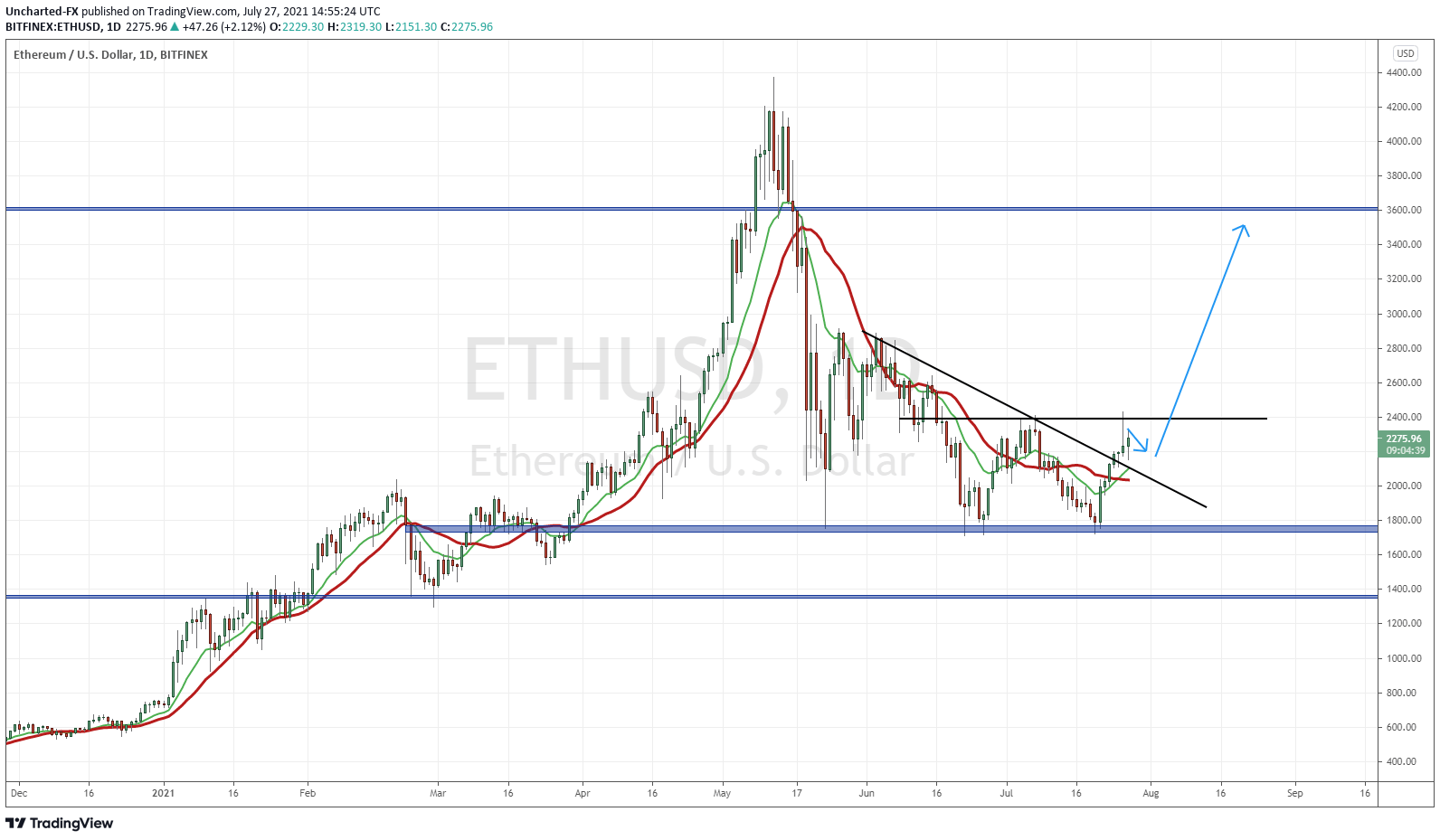

All those confluences (double bottom, engulfing candle at support, trendline break) have increased the probability of success for Ethereum. Technically, we had a lot going for us. The trigger though was the breakout and close above $2400. This happened, and we rallied. On Tuesday, we saw a big drop. It shook some weak hands out, but those knowledgeable about technical analysis and market structure had diamond hands.

Regardless of what asset you trade, charts have a tendency to break out and then pull back to RETEST the breakout zone. This is where we see buyers and bulls jump in. Check out my other Market Moment articles, or join us over on the Discord channel to see more examples of this. This is why patience is such an underrated skill in trading and investing. You need to beat the FOMO, and wait for the retest pullback in most cases.

Going forward, as long as price remains above $2400, Ethereum remains in an uptrend. I like to use my Moving Average, both in red and green lines) to determine if this uptrend continues with momentum. If we remain above them, we are all gucci.

Wednesday’s close was significant. Price closed above recent highs, which again, is a major technical positive. We call this a ‘higher low’ in technical analysis and market structure lingo. It increases the probability that price will continue higher rather than fakeout, sell off, and close below $2400.

Where does Ethereum go from here I hear you ask? $3000 is a nice whole number which could see some selling and traders taking profits. We will keep note of this price level. But in terms of actual resistance, or price ceiling, I would say it comes around the $3500 zone. This means we have a good risk to reward ratio for just a trade if you prefer.

My bullish case for crypto’s remains the same: it is a way out of fiat. Central Banks are talking about raising rates, but many analysts doubt it due to all the debt out there (and now…Delta Variant fears), it is likely that cheap money will continue. This currency war is being played out. Central banks will want to keep their currency low in order to keep assets propped up by inflation (it now takes more of a weaker currency to buy something), and export nations will want a weaker currency to boost exports in order to revive their economies. Holding crypto’s is a way to be out of fiat, and thus, a way to bet against this debt alongside precious metals and other commodities.

Leave a Reply