FansUnite (FANS.C) announced today that its subsidiaries, Askott Entertainment Inc. and E.G.G. Limited, have been granted licenses from the UK Gambling Commission.

“The approval of both the B2B and B2C licenses represents a significant milestone for us as we can now expand our operations to one of the largest online gambling markets in the world,” said Scott Burton, CEO of FansUnite.

Personally, I am not much of a gambling man myself, but that’s not to say I am above gambling. In my youthful ignorance, I would go so far as to bet parts of my body for the most menial things, like who would win in an arm wrestle or sink the first shot in a game of beer pong. Needless to say, my friends aren’t savages who would tear me limb from limb for a stupid bet or any bet for that matter…I hope. However, it wasn’t until a certain part of my body started hurting that I began to consider that maybe I was betting against fate as well. Since then, I have stopped betting and still have all my body parts.

Cautionary tale aside, online betting is a lot more practical and lucrative to boot. The UK is one of the world’s largest online betting markets, with the UK gambling industry, generating a gross gambling yield of £14.26 billion from 2019 to 2020. In total, this industry is comprised of 30.2 million registered adult bettors. Following FansUnite’s acquisition of two gambling licenses for its respective subsidiaries, the Company now has the capacity to serve as a Business-to-Business (B2B) technology provider and Business-to-Consumer (B2C) operator in the UK’s profitable online gambling market.

Having received a remote gambling software license and remote betting license, FansUnite is now able to supply its B2B wagering platforms to UK sportsbooks and casino operators. Additionally, these licenses will allow the Company to deliver its B2C betting solutions to the UK marketplace.

“The UK Gambling Commission’s approval of our application for these licenses opens the door for FansUnite to showcase the strength and robustness of our advanced technology in this market. As we enter our next phase of global growth, we will look to partner with betting operators in the United Kingdom and deploy our wagering solutions to capitalize on the UK’s large population of online bettors,” continued Scott Burton.

FansUnite’s latest news comes on the heels of the Company’s recent closing of a $24,792,390 public offering, further strengthening the Company’s financial position. According to FansUnite’s Q1 2021 Financial Results, the Company’s cash as of March 31, 2021 was CAD$15,877,628. To sweeten the pot, FansUnite’s total assets were CAD$35,925,646 compared to total liabilities of CAD$1,145,328 in the same period. With this in mind, FansUnite has done exceptionally well since it went public in May 2020. Today’s news only fortifies the foundation FansUnite has built itself upon.

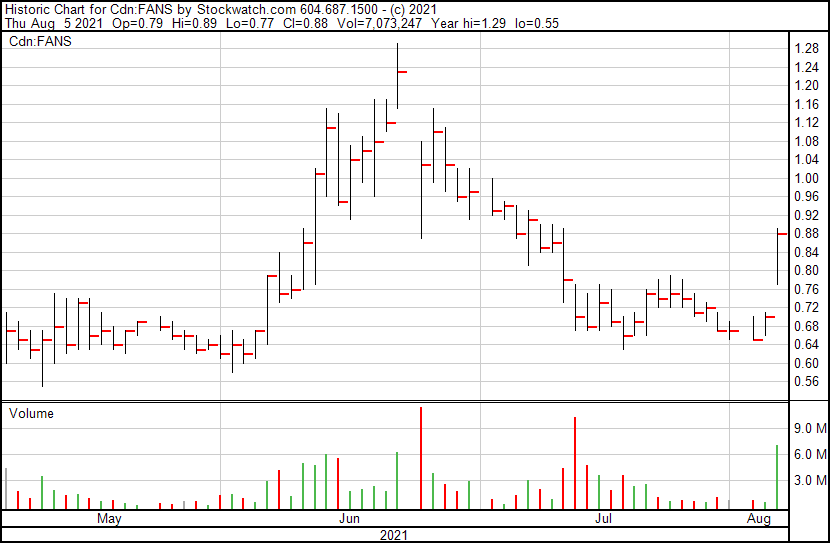

FansUnite’s share price opened at $0.79, up from a previous close of $0.70. The Company’s shares were up 25.71% before closing at a high of $0.88. This indicates that there was significant change following the news.

Full Disclosure: FansUnite is a marketing client of Equity Guru.

Leave a Reply