Who are they?

Organic Garage is an expanding specialty grocery chain of Organic & Natural groceries operating in Ontario, Canada. They focus affordable everyday pricing on high-quality products in a fun and inviting retail environment.

Their core business philosophy seems to be a focus on:

- Rationalized offers in terms of the stock-keeping unit SKU’s they carry that allow them to focus on the top-selling brands and drive volume and lower pricing to ensure they have what they like to call “aggressive everyday pricing”.

- A business model of selling only natural and organic groceries that meet strict quality and ingredient guidelines dictated by their comprehensive approved ingredient list called the “Dump It List.” This list is available in stores and on their website.

- With an average square footage of about 10k, their smaller-store format enables them to cut unnecessary overhead costs and pass those saving down to the prices they charge on the shelf.

Organic Garage was started with an outdoor organic fruit market under a tent inside High Park located in Toronto, Ontario in 2005.

The picture above is the original picture and is posted in every store to remind the family (customers, employees, and management) of the core roots of the business.

Under the picture is a message from the president of Organic Garage and it goes…

… “Things change, but what we say and do BEGINS AND ENDS WITH FAMILY!

The picture above of my grandfather and his brothers in front of our family store in downtown Toronto reminds me that with hard work, persistence and love you can do anything. It also reminds me of the importance of family. Not just the family that shares the same last name, but our staff and our customers…to us they’re family too.

Four generations later, Organic Garage remains the same. Committed to offering our FAMILY of customers great products at fair prices.

No matter how things change, who we are and what we believe will always remain the same.”

Matt Lurie

President Organic Garage

James Sinegal, the Pioneer of shared economies of scale (SES)

Jonny Cornish wrote a wonderful article on the topic (Scale Economies Shared) and it is a must-read for anyone interested in a deeper understanding of the mechanics of this competitive advantage. In it, he wrote,

The strategy of SES is where a company benefitting from economies of scale chooses to lower its prices and/or improve its offerings to customers in order to win market share over the long-term, rather than pricing its products & reducing its investments to maximize per-unit profit in the short-term.

SES businesses have a flywheel because their competitive advantages increase as the business grows larger, making it harder and harder for competitors to offer as much value to customers.

SES businesses embrace delayed gratification (in the form of long-term shareholder value) while giving their customers instant gratification (in the form of immediate increased value proposition of the company’s goods/services). SES businesses reinvest their scale benefits into improving the customer value proposition, even if the financial return on the investment isn’t immediate (or even guaranteed).

James Sinegal, founder of Costco, believed in this flywheel effect, although he didn’t call it ‘shared economies of scale.’ His belief was that Costco would do well in the long term if it:

- Focused excessively on customers and lower prices (Costco 15% to 20% markup compared to 30%) and their customer experience

- Reduce the shrink in inventory

- Utilize store footprint effectively

- Lower costs at the corporate level and pay higher than the market rate of wages for employees, including perks (they wear badges of honor on their chests)

- Shared Economies of Scale – Lower prices, more sales, more earnings, retain earnings to get even lower prices and improve customer experience and use economies of scale to improve the conditions for the customers not the shareholders in the short term.

Although Organic Garage is not a Costco it does share some of these economies. But don’t be fooled, not all businesses can use this competitive advantage. There are many businesses that masquerade as SES businesses but purely just have lower prices, and once they reach a certain amount of volume or get pushed by investors enough, they will start taking savings away from their customers and utilizing that cash to benefit their investors in the short run. This ends up destroying long-term shareholder value.

Organic Garage has focused on (1) Utilize store footprint effectively, (2) focusing excessively on customers and lower prices.

(1) The Stores

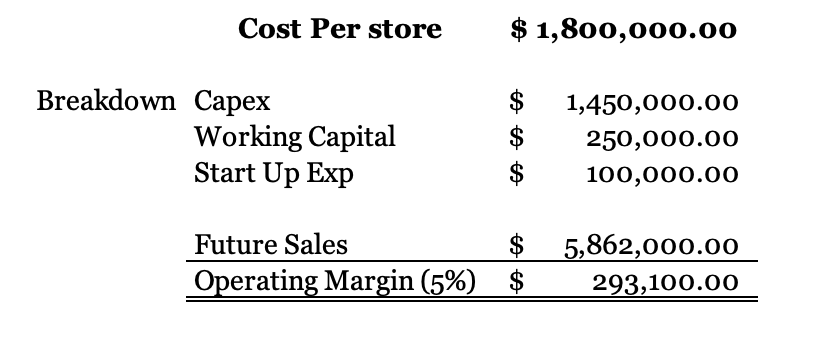

With their stores, they’ve chosen to focus on the format, site selection, and store management to improve both the cost efficiencies and the ability for the turnover period of each store to be optimized. The typical Organic Garage requires an upfront capital investment of approximately $1.8million, consisting of $1.45million of capital expenditures, $0.25million of initial inventory, and pre-opening expenses of $0.10million.

Format: Their stores range from 12,000 sqft to 15,000 sqft with the ideal size being between 10,000 sqft and 12,000 sqft

Site Selection: They focus on densely populated areas with proximity to other grocery retailers given how easy it is to recruit new shoppers based on how competitive their pricing is.

Store Management & Staffing: The store structure consists of 3 department managers (cash, produce, grocery) and 3 assistant managers (cash, produce, grocery). Each department manager is responsible for the weekly labor budget for their department, along with the purchases and margin. Each store contains 20-30 team members in total including managers but can vary depending on location and store volumes.

(2) “The Dump It List”

Their intention is to apply the basic principles of a retail discounter to the way they operate. That means a smaller format store, a curated and selective SKU offering, and a simplified labor model and taking those savings and passing them down to the customer through aggressive everyday on-shelf pricing.

Walmart is a company that has gained significant success due to its everyday low pricing strategy. The major retailer offers low prices to consumers throughout the year, instead of offering low prices during sales events.

The company adopted the strategy following its founding, building its reputation on being the store that offers consumers the lowest prices every day. It can be said that Walmart embodies the pricing strategy of EDLP. Although the strategy results in slim margins, the retailer is able to generate significant profits from high sales volume.

As I mentioned previously Organic Garage is in this weird place where it handles high-quality products but also must promise everyday low pricing for those same items. This sort of niche concentration forces him to specialize their product list hence their dump it list, allowing them to curate exactly what they need and control inventory at the same time reducing shrink lowering their operating costs.

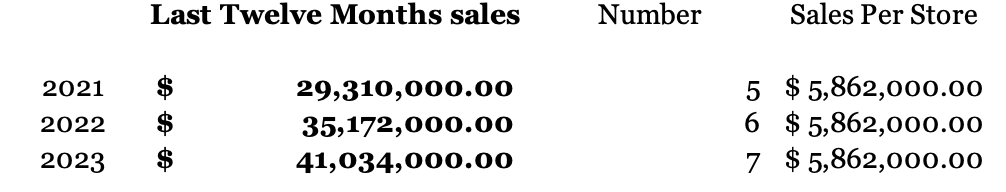

They plan to expand their store base from today’s five to about 7 allowing them to increase the volumes per store. This would hopefully allow them to experience the same economies of scale that come hand in hand with their pricing strategy.

Final thoughts and some maths (sorry)

Let’s assume the company makes $29 million, $35 million, and $41 million in the next three years adding a store each year. We can generate $5.8 million in sales from an individual store in a year. The firm has estimated that it costs $1.8 million to open a 10,000 square foot store similar in scale and size to their current stores.

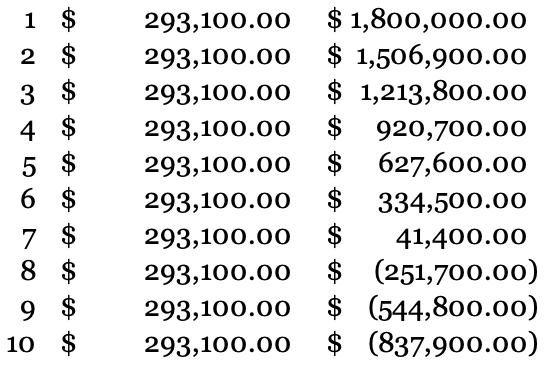

Once we have opened the store and paid for all the lights to stay on, we can keep before tax operating earnings of about 5% using the industry average. Using this 5% margin on the total future sales of 5.8 million we get a profit of $293,000.

Assuming they make the same profits from the one store for the next 10 years it would take them 7 years to break even (known as a 7-year payback period).

This is neither bad nor good, but it definitely shows that if the team at Organic Garage is able to match the corporate efficiency and economies of scale of its peers its business model has the potential to grow at a smaller scale than the Walmarts and Costco.

Leave a Reply