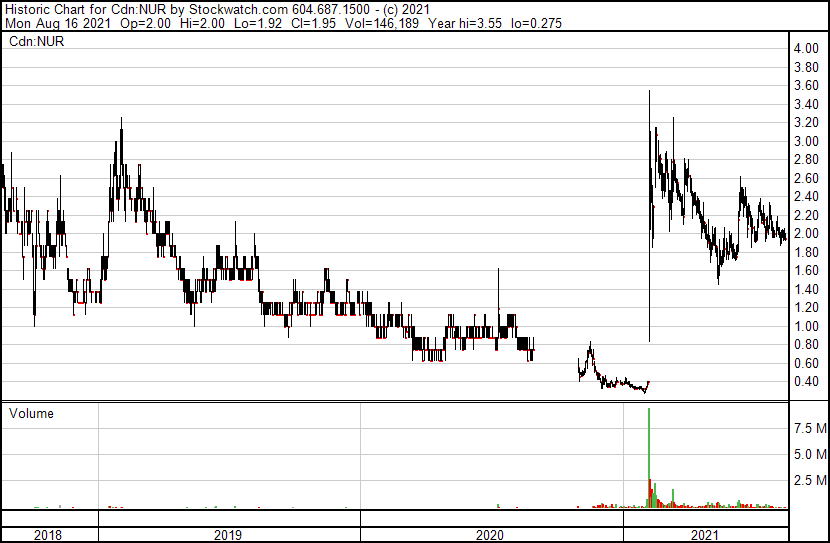

Stock Performance

It’s common to see a stock chart like the one below when some very big news has hit the market and investors are pricing in this new material information. Sometimes this could be the firm signaling to the market developments or basically setting in stones strategic goals and testing to see if the public interest will vote in confidence for management’s ability to deploy capital and shareholder resources.

In the case of Nuran wireless, the stock has done virtually nothing for a long period of time until an announcement of two large new scale strategic deals allowed investors an opportunity to profit from their patience.

From the 4th of January till the 5th of February 2021 the stock had ranged between $0.39 to $0.38, basically flat until it pumped up to a peak of just above $3 in a 10-day period.

The big news causing this +610% jump in price was that the firm had implemented a contract that would net them revenues of just over $400 million in a 10-year on-the-run period.

“The Company is also implementing the NaaS contract with Orange DRC SA, to build 2,000 sites throughout the Democratic Republic of the Congo over the next 40 months. This contract is being managed through a newly established entity, NuRAN Wireless DRC. The procurement process is well advanced identifying a number of key vendors with an initial batch of 180 sites planned. Once all sites are fully operational, annual gross revenues are expected to exceed $40 million.”

Before this, they had also announced another deal, although underwhelming to the market, would generate annual sales of $4 million for the firm over the next 10 years as well.

“The extension in March 2021 of the 10-year NaaS contract with Orange Cameroon SA to increase the number of sites from 122 to 242. In aggregate, once fully operational the contract is expected to generate revenue of over $4 million annually. The additional 120 sites are expected to be deployed in 2021-22 of the contracts with similar economics to the previous 122 sites.”

For a firm that was previously trading at a market cap of $4 million the announcement of two contracts that would net them $44 million in annual sales is significant. But how significant is it? Well, the market thinks it’s about $50 million in the market value of significance based on their current market cap after the deals.

But what are the numbers telling us about the valuation being presented by the market?

Base, BlueSky, Worst Case

Base Case.

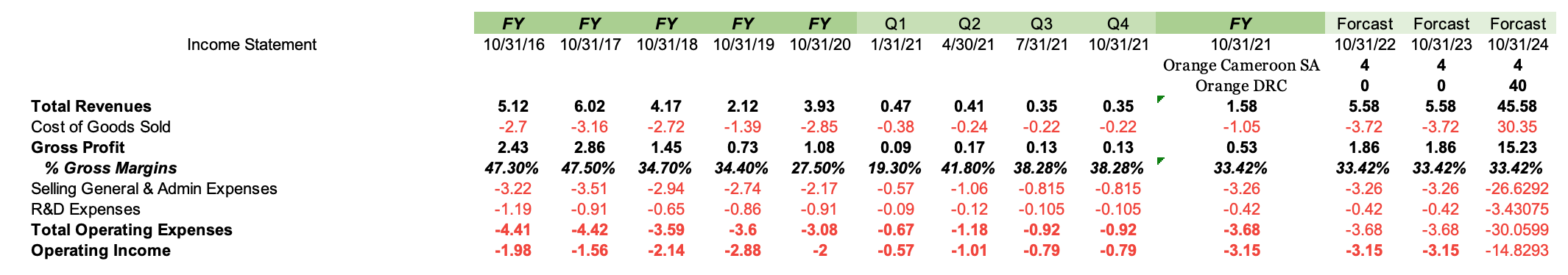

The chart above is our first step in trying to appreciate this new $50 million in market valuation from the perspective of how these two deals will affect the profitability of the business. The table above is an extract from the income statement going back to 2016 until 2020, then we break down the 2021 figures into individual quarters since we have not yet received the full data set for 2021.

To be conservative we assumed that they would make an average of $0.35 million in sales in Q3 2021 and Q4 2021, netting them gross profits of $0.13 million in both quarters. Totaling this past business and their initial contracts before the new deals would give us a full year 2021 total of $1.58 million in sales and a gross profit margin of 33.42%. This total compared to the trailing 12 months total of 1.33 million is a good estimate of the business operations before the initiation of the new contracts.

Once we have the new contracts in play starting in 2022 their Orange Cameroon SA contract would net them $4 million in sales and their Orange DRC deal would not generate anything assuming they need more time to deploy capital and raise money for the new project. We assume in 2023 the same would be true. The most significant change comes in 2024 where we assume that they’ve been able to deploy some of their new financings from the respective sources of capital into productive assets.

If they are able to deploy these assets at a reasonable rate of return in 2024, we can assume sales of 40 million from the initial contract.

Leaving out the details about how I came with the figures of the selling and general https://equity.guru/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expenses and the R&D expenses we can see that the operating income has gone from negative 3.15 million to negative 14.82 million in our base case. We came to these numbers by assuming that the business did not change any corporate efficiencies and was able to maintain a particular gross margin and percentage of expenses to sales. if we were to assume in a blue sky or better than the average case that they can increase efficiencies this could be different.

But remember we can also assume that things don’t go as planned maybe they need more resources is and more financing or unable to get the initial financing to run all the projects. this could put a stall on win this sales figure would be recognized but the hopes are that the business has enough financial backing to do so. This last situation can be thought of as the worst-case scenario where gross margins might be compressed although sales are increasing it’s costing them more to produce the final good.

So, was the market, right?

To be completely honest with you it’s difficult at this moment to know if the business can keep up with the production capacity needed for the new sites. It seems to take a lot of money to get each individual site up and running and profitable but once they do that, they experience economies of scale because they don’t have to erect new infrastructures to add people to their network allowing them to lower their cost and increase their sales volume per unit.

Since the market has already priced in its worst-case best-case scenario, our job is now to figure out how we can protect our downside, because I feel the upside has been fully priced in. To get that we’ll need to look more at (1) the specifics of each contract and (2) the certain requirements and covenants that are needed (3) how are they going to be recognizing the revenue over time since it is a contract is it based of the percentage of cost or the percentage of production for the final service.

All this leads me to the conclusion that as of now the market has priced in the potential for the firm and it would be best to keep an eye on the operational costs and new information as the company initiates the first few sites of its Orange Cameroon contract.

Leave a Reply