Here’s an interesting stat to start this crypto roundup off:

“A study published in the journal Nature Climate in 2018 concluded that the growth of bitcoin could produce enough emissions by itself to raise global temperatures by 3.6 degrees Fahrenheit (2 degrees Celsius) as soon as 2033.”

The publication is three years old, which means the study is probably closer to four. Still, even with a bump of 1.5 Celsius, there’ll be widespread environment related issues. Most land regions will see more hot days, especially in the tropics. Around 14% of the Earth’s population will be exposed to heatwaves at least once every five years, and at 2 degrees that number jumps to 37%.

Remember that nasty 42 degree day we saw earlier this summer? The one that was actually 47 degrees in the north, and helped burn down Lytton, B.C? Expect more of it. The truth is that we’ve been thinking about this Bitcoin mining thing all wrong. We need to expand beyond looking at hashrate and how many terrahashes a company can commit to get the block reward to where they get their electricity from.

If it isn’t a renewable resource they’re tapping, then maybe consider giving them a pass.

Crypto miners

Case in point:

Riot Blockchain prioritizes profits over environment in Rockdale, Texas

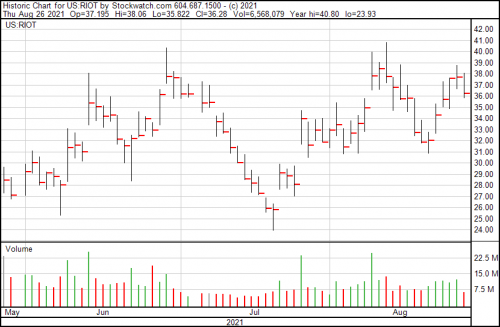

Riot Blockchain (RIOT.Q) dropped their financials this week. Let’s take a quick look at the highlights and then I’m going to point out what’s wrong with them.

- Increased mining revenue by 1,540% to a record $31.5 million for the three-month period ended June 30, 2021, as compared to $1.9 million for the same three-month period in 2020.

- Increased mining revenue margin to 70% for the three-month period ended June 30, 2021, as compared to 25% for the same three-month period in 2020.

- Produced record net income of $19.3 million, or $0.22 per share for the three-month period ended June 30, 2021, as compared to a $(10.6) million net loss, or $(0.31) per share, for the same three-month period in 2020.

- Total cash and Bitcoin of $195.4 million as of June 30, 2021.

It’s hard to deny that the numbers here aren’t solid. But Bitcoin mining has a large environmental problem that Riot isn’t doing anything to help resolve, and a company this size needs to get on board.

“The Company’s improved financial results are a direct result of Riot’s absolute focus on Bitcoin mining and growing its mining operations. With the successful acquisition of Whinstone US (“Whinstone”), the Company’s growth prospects have been significantly de-risked, and future financial opportunities are very exciting. As previously announced, Riot is aggressively expanding its capacity at Whinstone, which is expected to provide the critical infrastructure necessary to successfully execute on driving continued growth for the Company,” said Jason Les, Riot’s CEO.

The problem is Whinstone US, which is based in Rockdale, Texas, on 100-acre site, hosting Bitcoin mining customers in three buildings totaling 190,000 square feet. The problem is that if Texas is going to become the next hub in Bitcoin mining, they need to start offering cleaner sources of electricity. The Bitcoin network uses the functional equivalent of the country of Argentina in electricity every year, and if that’s going to continue, then we really need to start thinking about how to do it in a clean way. And Texas’ hodge podge electrical grid, mostly taken from fossil fuels, is not conducive to a clean way.

I mean damn folks. Isn’t it hot enough, already?

Cryptostar: the build continues

Cryptocurrency miner Cryptostar (CSTR.C) and a Hong Kong based company came to terms on the purchase and sale of even more GPU (graphics processing units) and ASIC (application-specific integrated circuit) miners, boosting their hashrate to a minimum total of 23,950 megahashes per second, and 5,510 terahashes per second.

If the above paragraph is gibberish to you—the GPU chips are used to mine altcoins, including Ethereum, and the ASICs can theoretically be used to mine whatever they’re used for, but they’re probably for Bitcoin.

You’ll notice the difference in hashrates as well. Megahash for the GPU chips and Terahash are for the ASICs. Megahash is considerably less than a Terahash, and therefore the reduced power is sufficient to mine altcoins, which don’t require an energy output analogous to whole countries to mine.

The asking price as 5,927,151 shares for a value of $1,422,516.24. And an addition 355,629 shares to Chen Peifeng in connection with the transaction.

By the way, they’re green crypto even if they haven’t joined up with the initiative. No fossil fuels here. All hydroelectricity.

Taal Distribution Information Technologies makes cash, doesn’t hurt environment

Taal Distributed Information Technologies (TAAL.C) mines, uses and promotes Bitcoin Satoshi Vision, or Bitcoin SV (BSV), which is one of Bitcoin’s bastards and itself a fork of Bitcoin Cash. It’s supposed to cleave closer to Satoshi Nakamoto’s vision as laid out in his white paper.

BSV is the 48th largest coin by market cap and presently trading at $159.71. Without getting too heavily into what BSV is supposed to be, it offers larger blocks, a little heftier transaction fees, and is meant to scale better. It hasn’t exactly been subject to widespread adoption, although that hasn’t stopped TAAL from mining it and picking up projects related to it.

- As of June 30, 2021, TAAL held approximately 100,900 BitcoinSV (“BSV”) in treasury

- Gross revenues of $6.7 million for the second quarter ended June 30, 2021, represented an increase of almost 7 times compared to Q1 2021

- Adjusted EBITDA* for the quarter was $629,000. Net loss for the period was $10.1 million, largely due to the loss on the revaluation of digital assets.

- TAAL purchased 3,000 Bitmain S19j Pro Blockchain computers due for delivery in Q1, 2022

- WhatsOnChain continues to deliver on its promise to be the world’s BSV block explorer and data provider, attracting 33.5 million web and API requests in June, and 40 million API requests in July.

The Bitmain S19j Pro ASIC rigs are normally used to mine Bitcoin with its considerable difficulty and electrical requirements, and now that they’re being used to mine the considerably smaller and less complex Bitcoin SV, TAAL should make a killing.

“The solid results that we report today for Q2 2021 reflect the success of our team through several strategic initiatives. The first half of 2021 saw growth of our processing power as we prepare for higher transaction volumes on BitcoinSV. Bigger blocks, more transactions, and more data on chain are all strong indications of BSV adoption. TAAL is well positioned to accelerate our strategy to grow BSV application development as well as enterprise demand,” said Stefan Matthews, TAAL’s executive chairman and CEO.

Technically, BSV is a proof-of-work coin and therefore should consider using alternative energy sources to mine, but BSV doesn’t produce the kind of environmental damage that Bitcoin does. There’s little information about what kind of information sources TAAL uses, but they have plants in Alberta (under a services deal with Hut 8 Mining (HUT.T), and therefore using hydroelectricity) and Kazakhstan, which is a big question mark in terms of power generation.

The best we can do is this from the international trade https://equity.guru/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration:

“Eighty-seven percent of Kazakhstan’s electricity is generated from fossil fuels, with hydropower accounting for 12 percent and less than one percent generation from solar and wind installations. Coal, produced in the northern regions, is used to power more than 70% of the country’s electricity generation.”

Neptune Digital gets on with it, finally

Neptune Digital (DNA.V), formerly Neptune Dash, 200 new Antminer S19 Pro next-generation bitcoin ASIC mining machines are now sitting in a warehouse in the United States waiting for NDA to pick them up and put them to work.

“We are quite pleased with our timing on this most recent purchase as rig prices have moved up a significant amount since we placed this order. This will add another 22,000 TH/s of capacity to our existing 12,000 TH/s, and we look forward to working with Luxor and our U.S. partners to get these new bitcoin mining machines operational as soon as possible. We continue to source the best machines at competitive pricing as we scale our bitcoin mining operations cautiously and strategically with market forces in mind. As we have mentioned before, the COVID-19 pandemic continues to impact logistics and the supply of miners, and we are working closely with our partners to maximize speed and decrease cost,” said Cale Moodie, Neptune chief executive officer.

Neptune’s commitment to the green crypto initiative is well documented through their joint venture with Link Global Technologies (LNK.C) called Pure Digital Power, which uses clean energy.

Beyond mining

Let’s scale it back from the environmental angle, because after all there’s more to crypto than just mining. Let’s see what else happened this week.

Coinbase gets hacked, but the baffling part is that people were surprised

When Coinbase (COIN.Q) went live for trading a few months back it did two main things: it pushed crypto kicking and screaming into the mainstream, and it painted a huge target on its back for hackers.

It was honestly only a matter of time before COIN got hacked. People logged on this week to find their accounts drained and the response from the folks at Coinbase (and the folks at the FBI) was a communal shrug. Even though it probably has the best security of any public exchange out there, it’s far from impenetrable to all the various nefarious types of hacks and techniques designed to part you from your crypto.

If anything, the fact that it has the best security out there acts as a challenge for most hackers. The problem with putting money on an exchange like Coinbase, with its high public profile, is that it can provide the illusion that it’s somehow safe. It’s not. There’s no FDIC backing for lost crypto—just like if you’d put it on Poloniex or Binance or any of the other unregulated exchanges—once you get hacked, there’s no getting your stake back.

So I’ll say it again for the folks in the cheap seats: Don’t keep your cryptocurrency on an exchange.

ThreeD Capital goes deep for Taiwan fintech

ThreeD Capital (IDK.C) pumped a $400,000 investment into Taiwan-based trade-tech company XREX earlier this week.

XREX is a crypto-fiat fintech operation working to drive financial inclusion using the blockchain. They closed a $17 million oversubscribed financing round, with the cash intended to expand their fiat currency portfolio, get the licenses they need, find more partnerships with financial institutions and digital wallets.

“We are very excited about our investment in XREX and its commitment to financial inclusion,” said Sheldon Inwentash, Chairman and CEO of ThreeD. “The cryptocurrency space can be intimidating and complicated, especially for those in emerging economies, where access to resources and financial markets is not easily accessible. XREX is accelerating international trade for emerging economies using blockchain technology in a secure, compliant, and easy-to-use manner. With the company’s technology, international focus, and expert management team, we believe XREX has strong growth potential and is solving a critical issue faced by cross-border merchants in today’s economy.”

Bigg Digital Assets Q2 revenues show a company in flux

Bigg Digital Assets (BIGG.C) is the parent company of a series of subsidiaries, each devoted to different aspects of the blockchain. The general notion is that they want to bring about a future in which crypto is safe, compliant and regulated, and they invest in products and companies that support said vision. That’s an ambitious and noble goal.

- Gross revenue of $4.55M, ~$4.16M for Netcoins and ~$385k for Blockchain Intelligence Group

- Netcoins revenue for Q2 represents ~24% Quarter over Quarter (QoQ) growth, and over ~2000% Year over Year (YoY) growth.

- Active Users reached ~19,000 during Q2, growing 40% QoQ, and 1880% YoY

- Registered users exceeded 80,000

- Gross trading margins in excess of 1.2%

- BIG revenues increased 26% QoQ, and gross margins sat at 87%

- Cash and cryptocurrency in treasury (excluding restricted cash and customer deposits) equaled ~$65 million

- Adjusted EBITDA, net of non-cash expenses, was positive for the quarter

- Further Highlights:

- At August 15, 2021, cash and crypto holdings equal ~$71 million

- BIGG currently owns 430.8 Bitcoin, valued at approximately $27.3 million.

There’s Netcoins, their proprietary exchange, where you can buy, sell and trade a limited bevy of crypto, and there’s Blockchain Intelligence Group, which handles their block-scanning technology, Qlue, sending it out to law enforcement and government agencies in an effort to chase down hackers, thieves, and put a serious crimp in money launderers lives.

“We are very pleased with our Q2 results – which reflect excellent growth across both Netcoins and BIG. Each company grew revenue by 24% QoQ or better, with margins remaining very strong. We also took advantage of the recent Bitcoin price degradation, adding to our holdings which now sit at 430.8 Bitcoin. We have made minority investments in two solid businesses – Wionder.fi and, of late, Zen Ledger – that boast strong leadership and offer significant growth potential. Netcoins has launched its iOS and Android apps to great reviews and happy customers, making it even easier and faster to trade crypto. We continue to execute on our core business plans. In the second half of 2021 we look forward to continued growth, customer acquisition and product enhancements, as well as partnership expansions,” said Mark Binns, BIGG’s CEO.

PayPal launches crypto services in the UK – is still terrible

PayPal (PYPL.Q) doubled down this week on its commitment to being a terrible place to keep your money.

Starting next week, PayPal is going to be offering their UK-based customers the ability to buy, sell and hold Bitcoin, Ethereum, Bitcoin Cash and Litecoin—which are exactly the same coins they offer their US-customers. That’s not the terrible bit.

Minimum spend is £1 ($1.3) using their bank account, PayPal balance or debt card through a crypto tab on the PayPal website and mobile app. The terrible bit is that there’s no transferring cryptocurrency to outside wallets, which should scare away anyone with any knowledge and experience.

Here’s Andreas Antonopoulous, Bitcoin guru, on why PayPal is ridiculous for cryptocurrency:

“If you buy your Bitcoin on PayPal you didn’t buy Bitcoin. What you bought is, exposure to the price of Bitcoin mediated by a custodian who you hope is doing good risk management practices. But, who you cannot audit for their actual existence of reserves.”

Right.

Vitalhub’s added revenue proves there’s more to crypto than just coins

Vitalhub (VHI.V) is a software provider for Health and Human Services providers intended to optimize outcomes. They provide their tech to hospitals, regional health authorities, mental health, long term care, etc. You get the idea.

The reason it’s on a list surrounded by crypto and blockchain companies is because it uses blockchain in some, if not most, of its services spanning the categories of Electronic Health Records, case management, card coordination, patient flow and operational visibility.

If anything, they’re an excellent example of the use-value of the core tech underlying the cryptocurrency craze, as the ledger they use keeps track of all of their important data.

It’s living proof that there’s more to this sector than just cryptocurrency and its apparatus.

“With the constraints of COVID-19 in the background, we are very happy with the progress of the Company over the last 4 quarters. With the acquisition of Alamac Limited, our Annual Recurring Revenue (“ARR”) now exceeds a run-rate of $21 million. Notably, over the last four quarters the Company has added over $3.4 million in ARR organically. This represents a 46% growth in organic annual recurring revenue over and above the $8.8 million annual recurring revenue purchased through acquisitions. The Company is approaching our target of 20% Adjusted EBITDA, with 18% Adjusted EBITDA reported in Q2 2021. We continue to work on integrating our acquired companies to generate increased synergies both from a revenue and cost perspective,” said Dan Matlow, CEO of Vitalhub.

Graph Blockchain puts an ultimate fighter to the NFT test

Technically, it’s Graph Blockchain’s (GBLC.C) latest acquisition, New World, which has put said UFC fighter, Ariane Lipsky, into their motion capture equipment so they can record her movements, strikes, etc, and translate them into a 3D animated character to be sold as a NFT.

And that’s an example of what New World’s been doing—creating NFT using their in-house tech. They can record an individual’s movements, and give creators and collaborators the ability to use their tracking data and map it into the NFT creation.

—Joseph Morton

Leave a Reply