We trotted out an enticing new gold exploration and development play in recent weeks—a company with a strategic land position in a vastly under-explored region of the prolific Yilgarn Craton in Western Australia.

Altan Rio (AMO.V)

- 95,578,494 shares outstanding

- $12.42M market cap based on its recent $0.13 close

Earlier today, the Company announced having bulked up its land position in the region to the tune of 489%. Before we delve into the details of this news event, a bit of background.

The Yilgarn Craton is an upscale neighborhood. Characterizing it as “prolific” might be an understatement.

Murchison (>30M ounces), Laverton (41M ounces), Leonora (>44M ounces), Kalgoorlie (>160M ounces)… the following slide from the Company’s pitch deck highlights the extraordinary mineral endowment of this mining-friendly region.

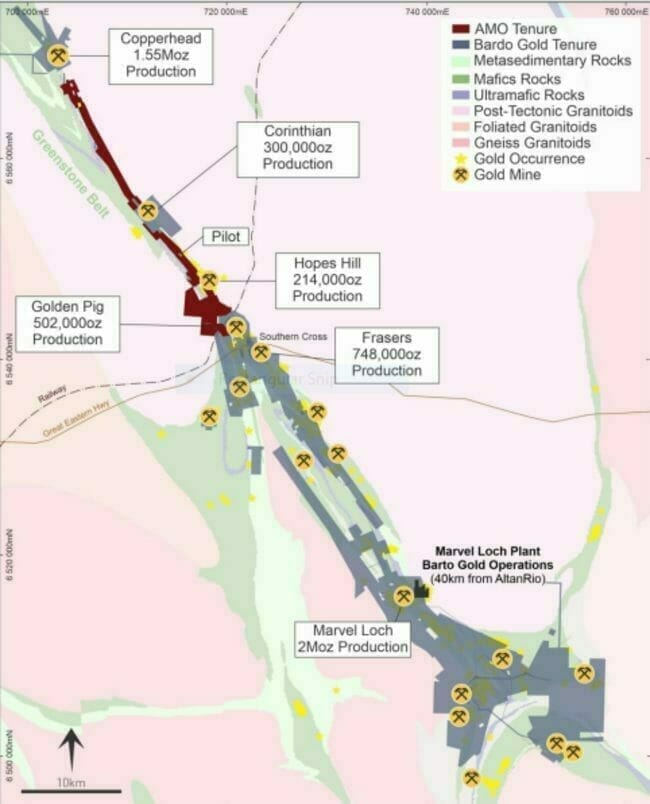

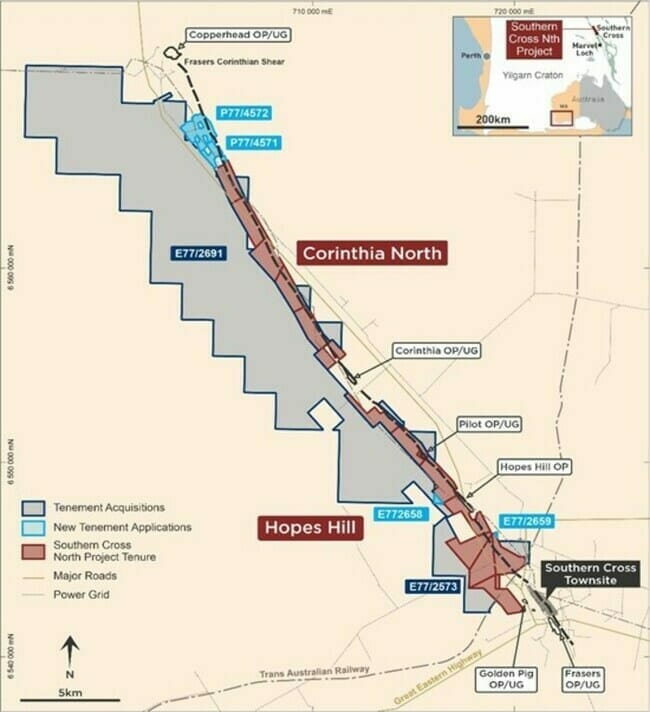

Within the YC domain, Altan Rio’s initial tenement in the area—aptly christened the Southern Cross Project—encompassed some 23.7 square kilometers of largely untapped geology along the northern portion of the Southern Cross Greenstone Belt.

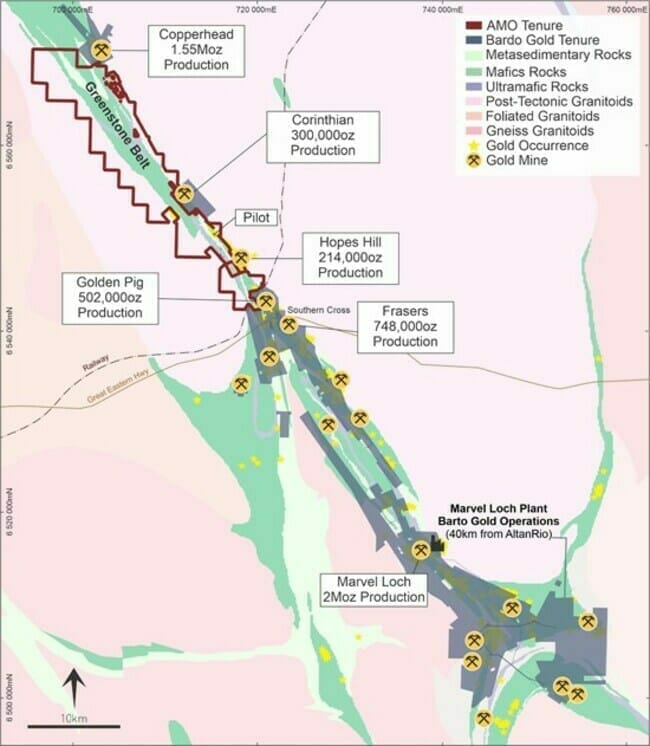

“The Southern Cross Greenstone Belt is a north-nor-west-trending highly deformed belt of sediments, mafic and ultramafic rocks wedged between two major granite domes.”

Still on the above map, Southern Cross’ mineral endowment—roughly 12 million ounces of gold production from 1900 to 2019—pales when compared to the likes of Murchison, Laverton, Leonora, and Kalgoorlie. Where Altan Rio’s mineral tenure is concerned, the basis for that underrepresentation is easily understood. Quoting a recent Guru offering on the subject:

Back in the day, prospectors chased gold mineralization along surface, exploiting the low-hanging fruit, rarely mining to depths greater than 50 meters. When these early miners ran out of near-surface ore, they pulled up stakes and moved further along trend, chipping away at the shallow easy pickings.

Much of Altan Rio’s land position along the FCSZ is especially compelling in that the surface material—the outcropping (mineralized) rock that would have spurred and guided early mining campaigns—disappeared under the cover of loamy farmland and saltwater lakes. Surface prospecting was simply not possible. The mineral wealth that lurked below this surficial cover… abandoned.

In more recent years, access to these unexplored areas along the FCSZ was restricted by farmers cultivating crops in the region. Altan Rio management has been successful in bridging the gaps between exploration efforts and these hard-working agrarian types. Now, for the first time, all of that prospective geology that lay buried, unprobed, unexploited, is seeing the business end of the drill bit.

“Game on” might be an appropriate response in light of this current development.

The Frasers-Corinthian Shear Zone (FCSZ) is the dominant geological structure along this belt. Significant mineralization—Frasers (1.2 Moz), Golden Pig (640Koz), Hopes Hill (214 Koz), Pilot (54 Koz), Corinthia (190 Koz), and Copperhead (1.5 Moz.)—can be found along its entire length.

With this next map, the Company’s tenements are shaded in dark red. Note the scale (bottom left) and note the number of mines and gold occurrences on a regional scale.

The gaps you see represent the wide-open exploration upside noted above—the thick overburden, lake cover, and the restricted access that derailed early prospecting campaigns. Geologically, there’s minimal difference between the southern half of this goldfield—where over a dozen mines have produced in excess of 10M ounces—and Altan Rio’s northern half, where production stands at a mere 2M ounces.

Thirty kilometers of vastly under-explored Southern Cross terra-firma is what we have here—prospective ground that may hold a similar mineral endowment (and then some).

Quoting my recent Guru article, again…

The opportunity not only lies in Southern Cross’ immediate subsurface stratum—the real upside may ultimately lie at depth (some of the deep deposits along the Abitibi Greenstone Belt of Ontario and Quebec may be an analog here). The same can be said for the entire Frasers-Corinthian Shear Zone as mining rarely exceeded depths greater than 50 meters (Marvel Loch to the south at 600 meters and Copperhead to the north at 670 meters are the two exceptions).

I’m not saying that we’re looking at another Hemlo, but the potential for deposits sharing similar geological characteristics—lode and vein-style deposits hosted in amphibolite metamorphic rocks—is certainly there.

Still on the Hemlo analogy, it may seem like a lofty likening, but one only needs to examine the mineral endowments on the map at the top of the page—the weight of multiple world-class Tier-1 deposits—to broaden one’s expectations. This is the allure of holding a position in a company probing virgin ground in a prolific geological setting.

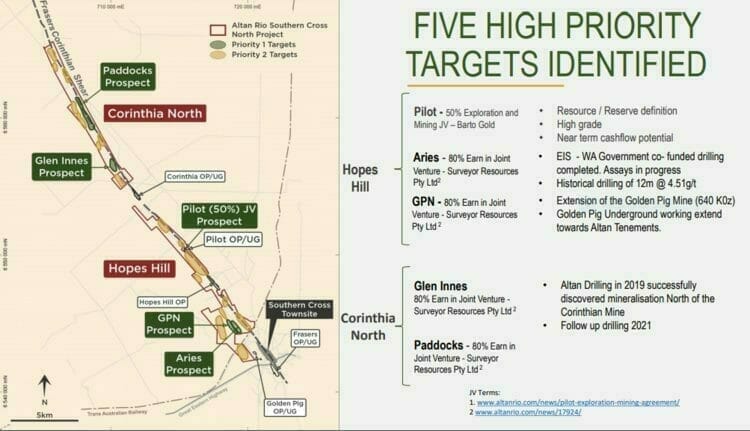

Altan Rio currently has five key targets in its crosshairs: Pilot, Aries, Golden Pig North (GPN), Glen Innes, and Paddocks. All hold similar geological potential (the truth machine will ultimately determine their rank as they collectively vie for flagship status).

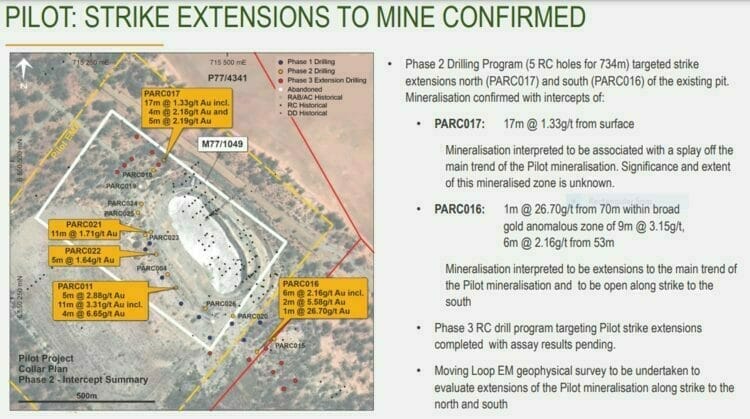

The Company has completed multiple drill programs at Southern Cross over the past year or so. Assays are currently pending for the Aries Gold Prospect and the Pilot Mine Prospect where a phase-3 drill campaign recently concluded.

The Pilot prospect, where drilling encountered near surface mineralization with good continuity, holds the potential for near-term production. Roughly 30k tonnes of stockpiled ore (grading ~1.5 g/t Au) lying adjacent to the historic pit will likely be the first load hauled off to the nearby Marvel Loch mill for processing.

Recent drill hole highlights near-surface:

- PARC017: 17 meters @ 1.33 g/t from surface;

- PARC016: 9 meters @ 3.15g/t (including 1 meter @ 26.70 g/t) from 53 metes.

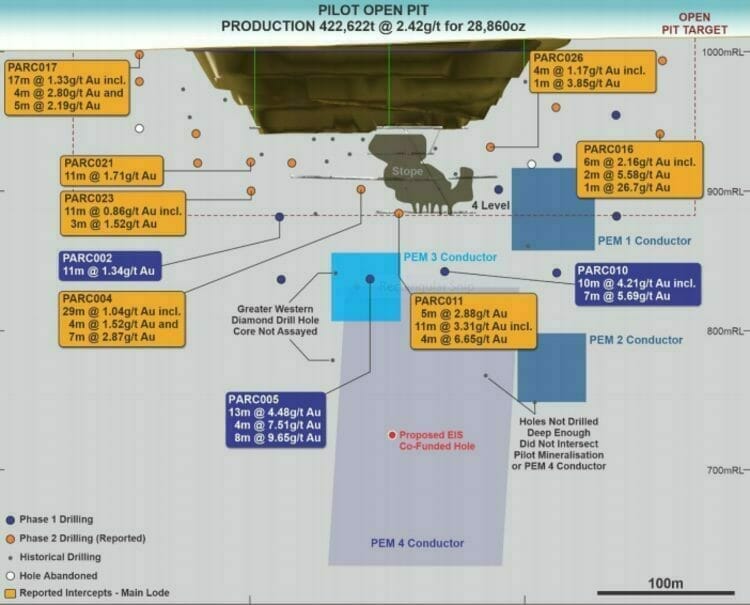

The depth potential below the historic pit is what has me most psyched, short-term.

Recent drill hole highlights below the historic pit (at depth):

- PARC010: 10 meters grading 4.21 g/t from 182 meters (including 7 meters @ 5.69 g/t);

- PARC005: 12 meters grading 4.41 g/t from 160 meters, 4 meters grading 7.51 g/t from 176 meters (including 1 meter @ 19.14 g/t), 8 meters grading 9.65 g/t from 199 meters (including 5 meters @ 13.93 g/t).

The geological sleuths at Altan Rio, embracing cutting edge exploration techniques—downhole EM to be specific—picked up a geophysical anomaly in what is now known as the PEM 4 Conductor (bottom center, image below).

This anomaly is thought to be associated with the sulphide-rich zone intersected in PARC005 (8 meters grading 9.65 g/t from 199 meters).

The quality of this geophysical anomaly was sufficient to qualify for EIS funding—two deep holes will probe PEM 4 with the WA gov’t footing half of the bill. The drill bit should begin turning here within the next four weeks, depending on rig availability.

It goes without saying that a significant hit here will be a game-changer for this sub-$13M ExploreCo—it could generate a geological model(s) that opens up the depth potential across the entire tenement.

PEM 4 is a weighty target.

The September 13th headline

Here, the Company announced having consolidated its foothold along this prolific greenstone belt entering into a binding tenement option (and sale agreement) to acquire a 90% interest in ~115.9 km2 of prospective ground to the west of its current land position.

Highlights of the acquisition:

- Altan Rio enters binding option agreement to acquire 90% of “E” tenement (E77/2691) covering a strategic ~115.9km2 land position in the Southern Cross Greenstone Belt;

- Acquisition will increase landholding to ~140km2, a 489% increase in tenure along the Frasers Corinthian Shear Zone (FCSZ).

Compare this map to the map further up the page—an additional 116 square kilometers of prospective ground (a 489% increase in tenure) adds considerable bulk to its land position in the region.

This September 13th press release reiterates the following key points:

- The FCSZ is a defined gold-rich bearing structure which is host to gold mineralisation along its entire length with multiple high-grade ore bodies including Copperhead (1.55 Moz), Frasers (748 Koz.), Golden Pig (502Koz), Hopes Hill (214 Koz), Corinthia (300 Koz) and Pilot (54 Koz) (map below).

- Altan Rio’s Southern Cross North Project lies in the centre of the Yilgarn Gold Field which encompasses the entire Southern Cross Greenstone Belt, the tectonic unit which covers the project (map at the top of this article). From 1900 to 2019, the Southern Cross Greenstone Belt recorded gold production of 12.3Moz (see Appendix 1 at the bottom of this press release).

- The Company’s tenements have strong near surface gold mineralisation and remain essentially untested below 50 metres vertical depth. Altan Rio is earning up to an 80% interest in the Southern Cross North Project from joint venture partner Surveyor Resources Pty Ltd.

The terms of this mammoth-sized land acquisition are as follows:

- Subject to the approval of the TSX Venture Exchange (the “TSXV”), initial consideration to be paid to McClaren following signing of the Agreement shall consist of a cash payment of A$100,000 and the issuance of A$50,000 of common shares of the Company (the “Shares”), such Shares to be issued at a deemed price of C$0.15 per Share.

- Altan Australia will hold the option (the “Option”) to purchase 90% of the tenement for a period of one year (the “Initial Option Period”). Altan Rio has the right to extend the Initial Option Period for an additional six months by providing written notice and an additional payment of A$50,000 to McClaren (the “Extended Option Period”).

- If Altan Australia exercises the Option during the Option Period (or the Extended Option Period, if applicable), subject to approval of the TSXV, consideration to be paid to McClaren will consist of a cash payment of A$250,000 and the issuance of A$250,000 of Shares, such Shares to be issued at a deemed price equal to the 30-day VWAP of the Shares prior to the date the Option is exercised by Altan Australia.

- Following the exercise of the Option, McClaren may convert its retained 10% interest in the Tenement (the “Interest”) into a 1.5% gross smelter royalty on all metals and minerals extracted from the Tenement (the “Royalty”). If McClaren wishes to sell the Interest or the Royalty (as applicable), Altan Australia will have a right of first refusal to purchase the applicable interest.

It looks like a solid deal to this humble observer.

Paul Stephen, Altan Rio’s CEO:

“Our mission has always been to consolidate our position in the Fraser-Corinthian Shear Zone (FCSZ) of the Southern Cross Greenstone Belt. This option agreement gives Altan Rio the potential to have exposure to a significantly larger land position in this region and if exercised will represent a five-fold increase on our current position. While our focus remains on the high priority targets in our Southern Cross North project, I will provide an update to investors in the near future on our exploration strategy over this new tenement.”

This “exploration strategy” will likely kick off with an aggressive (regional) mapping and prospecting campaign.

Final thoughts

Regarding the pedigree of Altan Rio management, slide six on the company’s pitch deck summarizes the depth of this crews geological and capital market prowess.

For a deeper delve into this compelling Western Australian exploration / development play, two recent Guru articles might offer an assist with your due diligence…

Mining for the layman: Altan Rio Minerals (AMO.V) is unknown, unseen, and potentially unreal

END

—Greg Nolan

Full disclosure: Altan Rio is an Equity Guru marketing client.

Leave a Reply