Bionano Genomics (BNGO.Q) has been keeping busy lately, and the Company’s Q2 2021 Financial Results are a testament to their efforts.

Bionano has been on my radar for quite some time, although I couldn’t really tell you why. After all, I don’t know the first thing about genomics, let alone science. In fact, I almost failed science in high school, so why on earth would a guy like me take interest in a company like Bionano? Well, I think its possible to be passionate about something even if you absolutely suck at it. Take Logan Paul for example. I mean, he was so passionate about boxing that he decided to step in the ring with Floyd Mayweather. Sure, he may have lost, but more than 1 million people still tuned in to watch him “fight”.

As much as I would like for that many people to read this article, I’m not as big of an optimist as Logan. Regardless, let me explain to you why Bionano is worth its salt, even if you don’t know anything about genomics. For starters, the Company is led by its President and Chief Executive Officer, Erik Holmlin, a man with two decades of experience developing innovative solutions and companies in the life sciences and health care industries. He’s also got some fancy diplomas under his belt, including a PhD in chemistry from Caltech and MBAs from UC Berkeley and Columbia University.

That’s cool, but what has he done? Erik has served as CEO of GenVault and CCO of Exiqon, a leading provider of innovative gene expression analysis products for real-time PCR. More notably, in 2001 he led the formation and financing efforts of GeneOhm Sciences Inc. and orchestrated the company’s acquisition by Becton Dickinson (BD) in 2006. As of 2005, GeneOhm had revenues of approximately $5 million before being acquired by BD for a whopping $230 million plus up to $25 million in additional incentives. Since then, BD’s share price has grown substantially and is trading at $243.08 compared to a close of $61.06 on June 12, 2006. Adding to Erik’s long list of credentials, he also served as an entrepreneur in residence (EIR) at Doman Associates, a leading life-science venture capital firm. Don’t worry about the details, just know that the title of EIR is given to the entrepreneurial cream of the crop with the expectation that they will lead an emerging company’s growth and expansion.

Erik sounds like a pretty neat guy, but lets take a moment to talk about the Company itself, Bionano Genomics. As you probably could have guessed, Bionano is a genomics company, credited for its Saphyr System. Bionano went public on August 21, 2018, with an Initial Public Offering (IPO) of 3.36 million units at $6.125 each. Following its IPO, Bionano was able to generate total gross proceeds of $20.58 million.

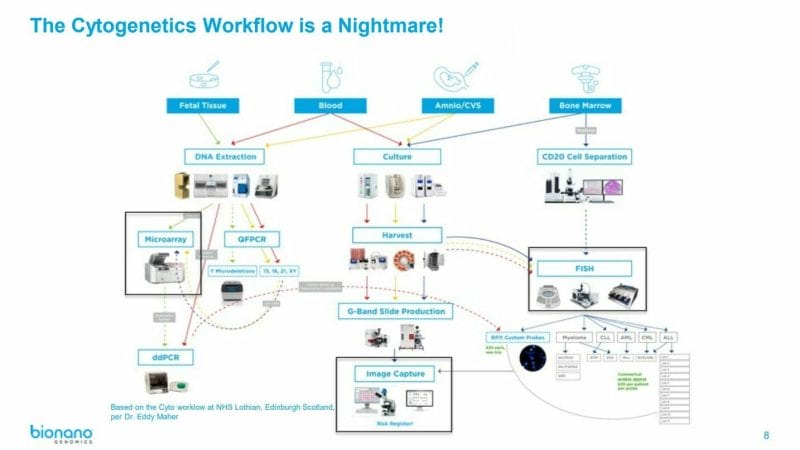

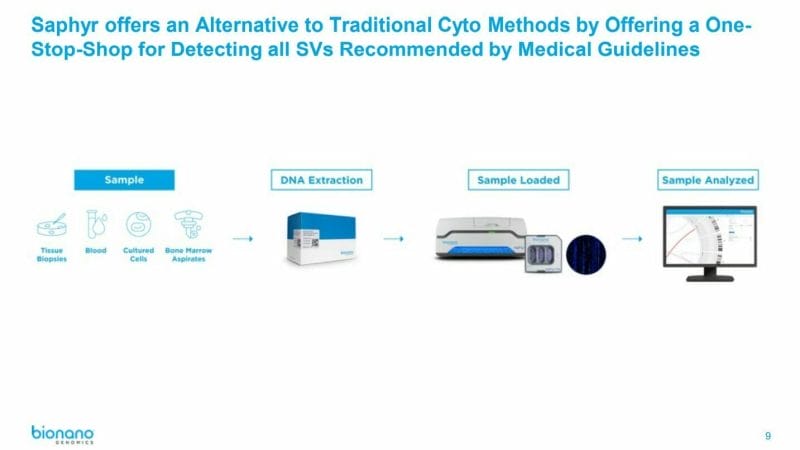

Before we move on, let me give you a quick rundown on Optical Genome Mapping (OGM) that wont make your head explode. Put simply, OGM is used to analyze entire DNA sequences of an organism’s genome. This enables scientists to isolate the DNA of an individual and identify different codes as well as structural variations (SVs). Why is this important? Well, my astute reader, some structural variations are responsible for genetic diseases such as autism. With this in mind, Bionano’s OGM platform, Saphyr System, is intended to identify these SVs in one streamlined workflow, compared to the overcomplicated process of traditional genome analysis methods like Cytogenetics.

Saphyr System for Dummies

If I had to summarize Bionano’s Saphyr System, I would tell you to imagine we are playing a game of “Where’s Wally”. I have the attention span of a goldfish so I wouldn’t be much help, but Bionano would be able to find that beautiful bastard without breaking a sweat. In the case of genomics, structural variations (SVs) are like Wally and Bionano’s Saphyr System is the tool used to find them. Through the identification of SVs, diseases can be diagnosed and treated, however, traditional genome analysis tools are unable to identify some SVs, which are hidden among the repetitive sequences found in the human genome. With this in mind, Bionano’s Saphyr System is intended to be a “one-stop-shop” for detecting SVs as well as an alternative for traditional genome analysis tools.

In addition to creating a streamlined workflow, Bionano’s Saphyr System has also demonstrated 100% concordance with current standard of care methods. For example, a team led by Dr. Alex Hoischen reported the results of a successful validation study comparing the performance of the Saphyr System to traditional cytogenetic methods for the clinical analysis of 48 leukemia genomes. The study concluded that Bionano’s Saphyr System was able to detect all abnormalities and was also able to provide better resolution and a more complete picture of the aberrations themselves.

Looking Forward

Earlier this week on August 4, 2021, Bionano released its Q2 2021 Financial Results highlighting several major achievements for the Company. Some of these achievements include the shipment of 13 Saphyr Systems as of June 30, 2021, compared to 6 systems year-over-year. In total, by the end of Q2 2021, Bionano had installed 121 Saphyr Systems at numerous cytogenetic labs and hospitals around the world. With this in mind, Bionano credits its subsidiary, Lineagen, for improving service revenue and accelerating clinical adoption of its Saphyr System.

Furthermore, an increasing demand for Bionano’s Saphyr System led the Company to achieve total revenues of $3.9 million as of June 30, 2021, up 226% from $1.2 million in the same period in 2020. Bionano’s operating expenses increased from $12.2 million in Q1 2021 to $17.9 million in Q2 2021, however, the Company had cash and cash equivalents of $333 million by the end of Q2 2021. That’s pretty outstanding considering the Company’s cash position was sitting at $38.4 million as of December 31, 2020.

Looking forward, Bionano plans to introduce an initial prototype of a next-gen high throughput Saphyr System in Q4 2021. Additionally, the Company hopes to reach an installed base of 150 Saphyr System, marking a 50% increase over year end 2020. Keep in mind, Bionano’s Q2 2021 results have already surpassed Zack’s Consensus Estimate by 16.85%, representing the fourth time the Company has surpassed estimates in the last four quarters. Personally, I think Bionano is in a great position to hit its Q4 2021 targets and I look forward to seeing where Erik Holmlin takes the Company.

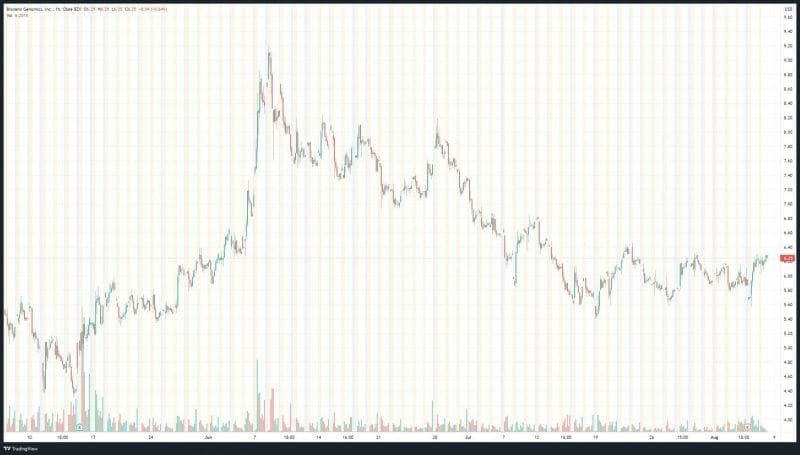

Bionano’s share price opened at $6.22, down from a previous close of $6.24. The Company’s shares are up 0.24% and are currently trading at $0.26 as of 2:26PM ET.

Leave a Reply