The MDA is an agency within the U.S. Department of Defense that provides missile defense support for U.S. deployed forces and allies.1 The purchase order is part of a new contract between Plurilock and MDA within the SEWP V program and the latest in a series of new business for Plurilock’s Solutions Division. All contracts and orders announced by Plurilock since April 2021, including the latest order, represent a combined total of roughly US$10.7 million in sales.

Aligned with Plurilock’s stated goal to expand within the government vertical, this order marks one of several recent orders with prominent government and defense agencies including the Naval Surface Warfare Center, U.S. Air Force, the U.S. Department of Defense, U.S. Special Operations Command, the Department of Homeland Security, and the U.S. Department of the Navy.

Who are they?

Plurilock (PLUR.V) is a Victoria Canada based identity-centric cybersecurity company that provides multi-factor authentication (MFA) solutions using behavioral-biometric, environmental, and contextual technologies.

The company offers Plurilock DEFEND, an enterprise continuous authentication platform that confirms user identity or alerts security teams to detected intrusions in real-time. They also support their Plurilock ADAPT a standards-based login MFA platform that provides added login security without relying on fingerprint scans, SMS codes, authenticator apps, hardware tokens, or other intrusive legacy MFA requirements.

It serves financial services, healthcare, critical infrastructure, and government and military industries.

The firm is run by Ian Paterson who is the CEO and has 10-years of data analytics entrepreneurship and a proven track record of commercializing data science solutions and landing multi-million-dollar accounts. He is assisted by Jord Tanner the CTO who has 20-years of experience that was instrumental in scaling a previous venture-backed data analytics start-up from zero to 500k SaaS users before its sale to eBay.

Overseeing the board and keeping the shareholders’ interests aligned with the executive team the chairman Robert Kiesman is a corporate lawyer specializing in securities law and mergers & acquisitions, formerly with Stikeman Elliott LLP in Vancouver. He is also the Vice-Chair of the board of directors of the Provincial Health Services Authority, a public health authority with an annual budget of over $3.5 billion.

With this diverse management team in place, the operators utilize their experience to acquire additional business from other institutions outside of the government. The company’s revenue consists of mostly hardware sales, electronics software license and maintenance sales, and some professional services.

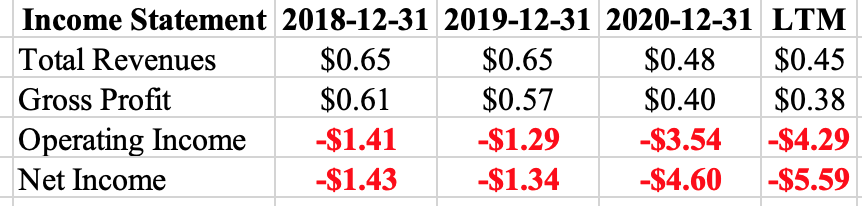

The table above is an extract from their income statement that shows the total revenue, the gross profit, the operating income, and the net income. From 2018 until the last 12 months the sales revenue has gone from 0.65 million to 0.45 million in the last 12 months. In the same period, the gross profit has reduced from 0.61 million to 0.38 million as the business continues to scale and acquire new books of business. In line with the gradual increase in the cost of goods and services, the operating losses have also increased from 1.41 million to 3.54 million at the end of December 2020. The same goes for their net losses.

Although their business performance on paper might seem out of touch with the reality of some of the news releases, this is merely a bi-product of them being in the development stage. The business at the start of its commercialization stage. This will force them to spend on marketing, sales, and R&D.

The recent announcement of a purchase order with the US missile defense agency is great news for the firm as they continue to build their reputation in the industry as a leader in identification-centric cybersecurity. This progress will take time and only the experience of the management team will allow the firm to leverage its current resources and assets and utilized its intangible assets to generate future cash flows for shareholders’ value.

As for now, it’s one of those stocks that you wait and see what the future holds, the rearview mirror is clearer than the windshield.

Leave a Reply