The TSX.V and the NASDAQ have a long history of hosting tech start-ups with high valuations and zero revenues.

Recently, Special Purpose Acquisition Companies (SPACS) dragged this dubious trend further into the mud.

SPACs raise cash for an IPO and then go looking for a company to buy.

So far in 2021, North American SPACs have raised more than $90 billion.

“The remarkable thing about some of these SPAC-backed companies is they’re going public before they’ve generated their first revenues,” states the Washington Post.

As every salesman knows, it’s easier to sell the sizzle than the steak.

If you’re old-school and feel more comfortable buying steak than sizzle, we present to you Plurilock Security (PLUR.V) – a $32 million cybersecurity company that “reduces or eliminates the need for passwords by measuring the pace, rhythm and cadence of a user’s keystrokes to confirm their identity.”

Plurilock has multiple revenue streams from prestigious fat-wallet clients.

On August 23, 2021 PLUR received a $1.08 million USD purchase order from the US Air Force as part of the National Aeronautics and Space Administration’s (NASA) Solution for Enterprise-Wide Procurement (SEWP) program.

On August 19, PLUR received a USD$794,000 purchase order from a California state healthcare agency under the NASPO ValuePoint program.

August 11, 2021 PLUR received an order from the National Aeronautics and Space Administration for $140,000 USD.

On July 15, 2021 PLUR received a US$1.7 million order with the U.S. Department of Defense.

In June 2021, PLUR received an order worth USD$180,000 on an existing contract with a California state agency, under the California Multiple Award Schedules (CMAS) agreement.

“The Cybersecurity and Infrastructure Security Agency (CISA) announced the addition of single-factor authentication to the list of bad practices,” reports CPO Magazine, “This authentication method relies on matching a simple attribute, like a username to a password.”

“To receive the full benefit of an MFA capability, organizations should be sure to implement it across all systems, applications, and resources,” CISA wrote. “Requiring multi-factor authentication to gain initial access to an organization’s network (usually the user’s workstation) is a good first step.”

“However, this provides only limited protection to other systems and data within the organization that are protected with only single-factor authentication,” added CISA.

August 27, 2021, PLUR released Q2, 2021 Financial Highlights

- Total revenue for the three and six months ended June 30, 2021, was $8,604,310 and $8,680,071 respectively ($79,512 and $182,851 over the same periods in the prior fiscal year). The increase in revenue is due to the acquisition of Aurora Systems Consulting Inc. (“Aurora”) in the Solutions Division.

- Hardware sales revenues accounted for 88.1% and 87.3% for the three and six months ended June 30, 2021, respectively (0% for both the periods in 2020) of total revenues. Hardware sales revenue was the new revenue stream added to the Company after the acquisition of Aurora.

- Hardware sales revenue was $7,581,208 for both the three and six months ended June 30, 2021, respectively. No revenue was recorded under this category in prior year.

- Electronic software license and maintenance sales revenue was $738,054 and $805,810 for the three and six months ended June 30, 2021, respectively, compared to $79,512 and $163,480 over the same periods in the prior year.

- Professional services sales revenue was $285,048 and $293,053 for the three and six months ended June 30, 2021, respectively, compared to nil and $19,371 over the same periods in the prior year.

- Adjusted EBITDA was $(985,142) and $(2,041,539) for the three and six months ended June 30, 2021, respectively, compared to $(482,375) and $(1,037,749) over the same periods in the prior year.

- Cash & cash equivalents on June 30, 2021, was $4,977,387 compared to $1,721,179 on December 31, 2020.

- Cash used in operating activities for the three and six months ended June 30, 2021 was $418,094 and $1,576,549, compared to $321,435 and $518,543 during the same periods in the prior fiscal year.

Q2, 2021 Operational Highlights

- On April 13, 2021, Wells Fargo Bank outstanding LOC totalling US$500,000 was repaid in full.

- On April 27, 2021, Aurora’s Paycheck Protection Program (“PPP”) loan obtained from the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) loan including US$199,830 in principal and US$2,053.81 in interest was forgiven.

- On April 27, 2021, Plurilock filed two additional U.S. provisional patent applications for new advancements in continuous authentication technology.

- On May 9, 2021, the Company filed a preliminary short form base shelf prospectus which when made final and effective, will enable Plurilock to offer, issue and sell up to $50 million of common shares, warrants, subscription receipts, debt securities and units.

- On June 28, 2021, the Company released a new Splunk® SIEM application for its DEFEND continuous authentication product.

- During Q2 2021 the Company announced US$3,319,000 of new orders and contracts which included a US$1.15 million order with the U.S. Department of the Navy under National Aeronautics and Space Administration’s (“NASA”) Solution for Enterprise-Wide Procurement (“SEWP”), United States Government-Wide Acquisition Contract Vehicle (“GWAC”) that was announced on May 7, 2021.

On March 29, 2021 PLUR announced that it has signed an agreement to acquire 100% of Aurora Systems Consulting – a provider of advanced cybersecurity technology and services based in California.

Key Aurora Highlights

- Revenue of US$28.1 million (CAD$35.8 million) in 2020

- Gross Margin of US$1.4M in 2020

- Diversified client base consisting of over 140 tier-1 organizations

- Numerous prominent master service agreements with state and federal agencies in the United States

Aurora’s margins are low (4.9% of revenue) but the kicker here for Plurilock is that Aurora has big customers – like the U.S. Department of Defense – and an existing high-performance sales team.

In this July 19, 2021 video interview, Plurilock’s Ian Paterson talks to Equity Guru’s Chris Parry about the post-password world.

“Our Technology Division is in the business of rethinking authentication from the ground up,” stated Paterson, “Traditionally, authentication is you proving yourself to the computer. Type a secret that only you and the computer in theory knows.”

“If we equate this to a house,” added Paterson, “We’re talking about the deadbolt on your front door. You can have strong steel. You can have a key with serrations on different plates. But even we check at the beginning of the day that you’re the right person, how do we know that you’re still the same person later in that day? Or at night? Or later in the week?”

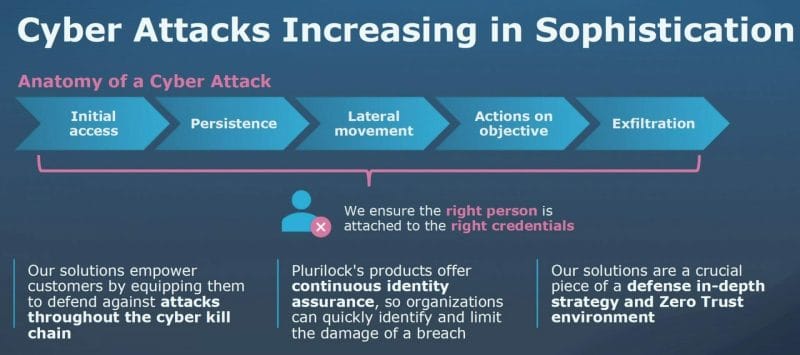

“Industry is looking for a new way of securing accounts,” stated Paterson, “If you recall, the Colonial Pipeline Attack, the attackers got in with stolen password. Once they have that initial access, then they were able to do their nefarious deeds. You can understand why Chief Information Security Officers are looking for a solution.

On June 29, 2021, Plurilock added retired U.S. Navy vice-admiral Jan E. Tighe to its advisory board, who currently serves as an independent director on the board of Goldman Sachs.

Plurilock is a small company with a clever solution to a growing problem.

Revenues are also growing.

Full Disclosure: Plurilock is an Equity Guru marketing client.

Leave a Reply