Because we’re all about value let’s start this out with some fake news.

Walmart (WMT.NYSE) decidedly did not partner with Litecoin, despite news published earlier this week that did the rounds with multiple sources. Charlie Lee, the brain behind Litecoin and leader of its peoples, said the news was fake. Walmart quickly quashed it on CNBC, saying they were “the subject of a fake news release issued on Monday, Sept. 13, that falsely stated Walmart announced a partnership with Litecoin (LTC).”

The news saw a bump in LTC’s price from $175 to $231 before the correction. The price has since dropped back to approximately $186.69.

I might be the only person who found it funny. That’s a whole new level of trolling right there.

Grayscale Investments meets a milestone, aims for the sky

Grayscale Investments, a digital currency asset manager and sponsor for a number of different cryptocurrency-related trusts (the biggest of which is likely Grayscale Bitcoin Trust or GBTC.Q) announced that their Registration Statements on Form 10 filed with the SEC on behalf of each trust have become effective. The trusts now form the existing lineup of investment products all with the same designation—Grayscale Bitcoin Trust, Grayscale Ethereum Trust (ETHE.Q), and Grayscale Digital Large Cap Fund (GDLC.Q) (and a few others) meaning that Grayscale now has six SEC reporting companies.

“This milestone reflects Grayscale’s continued commitment to offering transparent investment vehicles that voluntarily exceed standard reporting requirements, meet a heightened level of disclosure, and are subject to additional regulatory oversight. As we await regulatory approval for a Bitcoin ETF, we remain focused on providing investors with opportunities to access the digital currency ecosystem through Grayscale’s secure, trusted family of products,” said Craig Salm, vice president of legal at Grayscale Investments.

This is an interesting development because it jives with Grayscale’s stated intention of moving each of its digital currency investment options onward to full conversion into digital currency ETFs.

Hello Pal mulls over an uplist to the NASDAQ

The news from Hello Pal International (HP.C) is that they’re thinking about uplisting to the Nasdaq and contracted out to Maxim Group for general advisory and investment bank services in connection. The uplisting would mean more exposure and access to a larger retail and institutional investor base in both the United States and internationally.

Maxim is an investment banking, securities and wealth management firm headquartered in New York. The firm plenty of services include: investment banking; private wealth management; and global institutional equity, fixed-income and derivatives sales and trading, equity research, and prime brokerage services, to a diverse range of corporate clients, institutional investors and high-net-worth individuals.

“We are very pleased in taking this next step forward with our new strategic adviser, Maxim. Their expertise in the U.S. capital markets and experience in the Nasdaq listing process is accretive for Hello Pal and its shareholders. We look forward to working together as we continue to grow,” said K.L. Wong, CEO of Hello Pal.

The jury is still out on Alternet’s african electrical vehicle taxi service

Alternet Systems (ALYI.OTC Pink) is a curious case of a company that jump-started its asset-train by issuing an initial coin offering, pulling in a good chunk of cash, and then using that to build out their electrical vehicle product.

First off, they really want you to know the good news about the global motorcycle taxi market. It was worth $16 billion in 2018 and is expected to get jacked to over $29 billion by 2026, according to Verified Market Research. And isn’t that exciting news? That’s not really what’s noteworthy here, though.

I wrote some not-nice things about this company back when it looked like it was another fraudulent outfit bilking investors on the back of a questionable unregulated fundraising scheme, and I had reason to believe that. All signs definitely pointed in that direction. Now a little over a year later, they haven’t exactly moved any of those electric bikes but they’re sure to report that it’s going to happen any day now, but they sure made a lot of money off of their ICO.

“The company expects to begin delivery on an order of 2,000 electric motorcycles slated for service in the motorcycle taxi (boda boda) market in Africa,“ according to a news release.

Also, there’s nothing on the Electronic Data Gathering, Analysis, and Retrieval system (EDGAR), where the SEC normally stores filings for publicly traded companies, since 2017.

If you’re still in—how many red flags do you need?

Currencyworks auctions live-action NFTs and makes bank

Make hay while the sun shines, as my grandmother has been wont to say. Currencyworks (CWRK.C) has been all about doing that with their NFT collection while NFTs remain hot. They’ve provided a second series of NFT for auction as part of their partnership with Barrett-Jackson Collector Car Auctions.

They unloaded four exclusive NFTs for auction at the Barrett-Jackson 2021 Las Vegas auction, and riased over $65,000 in combined sales, while they marked the launch of the Motoclub.io platform.

These were movie themed NFTs, which will be auctioned live at the event under the 20-21 Film Fan Series. These include a replica of the Ecto 1 vehicle from the original Ghostbusters alongside an actual customer 1994 Toryota Supra used in 2001’s The Fast and the Furious movie, which both sold at the auction and those sales were then commemorated within Motoclub’s latest NFTs.

“We were delighted with the success of the first Motoclub NFT auction held back in June. Having a partner like Barrett-Jackson allows us to create and sell a wide range of high-quality and highly desirable NFT content. I’m really looking forward to seeing these two movie legends go under the hammer in Houston,” sad Cameron Chell, executive chairman of Currencyworks, ahead of the auction.

TruTrace Technologies and the future of cannabis supply chain management

Trutrace Technologies (TTT.C) launched their StrainSecure 2.0 platform today. The original blockchain based platform followed the lifecycle of the cannabis plant from seed to sale, guaranteeing validity at each step of the way. The general idea is to provide transparency to anyone who may be interested from shareholders to producers, distributors and end users who might want to know that their weed is what the box says it is.

Blockchain’s good for that. The latest upgrade includes features to enhance collaboration, engagement, marketing and mobile integration, and the company believes it’ll drive long-term value for business for both hemp and cannabis industries in the future.

“Over the first two years of our business, and after extensive work with leading organizations such as Shoppers Drug Mart (Loblaws), University Health Network and Deloitte, we’ve gained a deep understanding of the new challenges facing this industry. The second version of StrainSecure will allow us to provide our clients with turnkey tools specifically designed to support the quality of their products and increasing engagement with their customers,” said Robert Galarza, Trutrace’s CEO.

Mining

Mining is generally always going to be about buildout. Company X picked up Y amount of antminers/other ASIC rigs and they expect their hashrate to go up by Z amount. Whether or not this makes them competitive is determined by who can get the most miners operational at one time, after which it’s a matter of probability. There are 144 chances for any given company to close the block (and get the crypto reward) in a day, and that extrapolates out naturally to 52560 a year. The big dogs like Marathon Digital Holdings (MARA.Q) and Genesis Mining are going to eat first and more often, but there are definitely times when the smaller companies can get in there.

Given that bitcoin is presently at …., it doesn’t take many hits to make a good year for a lot of companies.

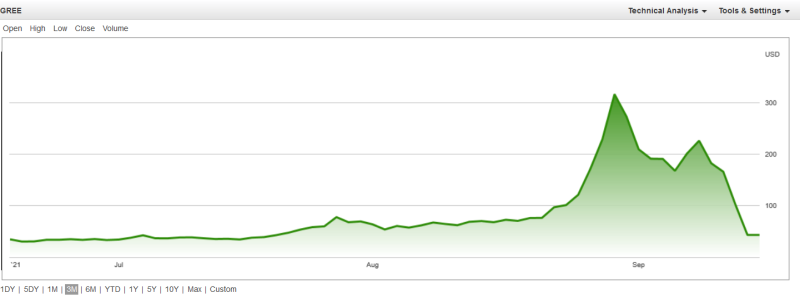

Let’s look at Greenidge Generation Holdings (GREE.Q) first.

Greenidge is a upstate New York based bitcoin miner and power generation company taking advantage of hydroelectric clean energy for the output required. They’ve placed an order for 10,000 S19j Pro bitcoin miners from Bitmain, and intends to deploy all of them ni Spartansburg, South Carolina.

They’re carbon neutral, which is a plus.

“The addition of 10,000 new miners is an important step in our commitment to expand our fully carbon-neutral capacity,” said Greenidge Chief Executive Officer Jeff Kirt. “We expect that these miners will anchor our anticipated facility in Spartanburg, expanding our national footprint by growing our environmentally sustainable mining operations.”

Cryptostar expands self-mining hashrate in Alberta, leaves behind some stats

Earlier this week, Cryptostar (CSTR.C) signed off on equipment hosting agreements and boosted their mining capacity by another 27 megawatts, with 12 megawatts going to their data centres in Utah, and another 15 going to Alberta in Q4 2021. Honestly, CSTR might be onto something. It’s awfully expensive to gear up to compete with the big boys in the space nowadays, but pivoting to offer both subsequent mining for yourself and offering up some spare electricity AND real estate to other miners (and anyone else in need of said services) could be rather lucrative.

Now here’s how they’re doing with mining:

- The company currently has an aggregate self-mining hash rate of 86,160 megahashes per second from GPU (graphics processing unit) miners and 40,796 terahashes per second from ASIC (application-specific integrated circuit) miners running at its data centres.

- The deployment of 86,160 megahashes per second and 40,796 terahashes per second of existing self-mining hash rate currently contributes $607,843.02 (U.S.) per month in self-mining revenue for Cryptostar (source: What to Mine website; mining metrics are calculated based on an ethereum/U.S.-dollar exchange rate of one ethereum to $3,405.31 (U.S.) and a bitcoin/U.S.-dollar exchange rate of one bitcoin to $47,379.50 (U.S.); updated at 11:38 UTC on Sept. 15, 2021).

- An additional 10,000 terahashes per second of hash rate from ASIC miners has been delivered and will be deployed in the company’s data centres by Nov. 30, 2021.

Not bad.

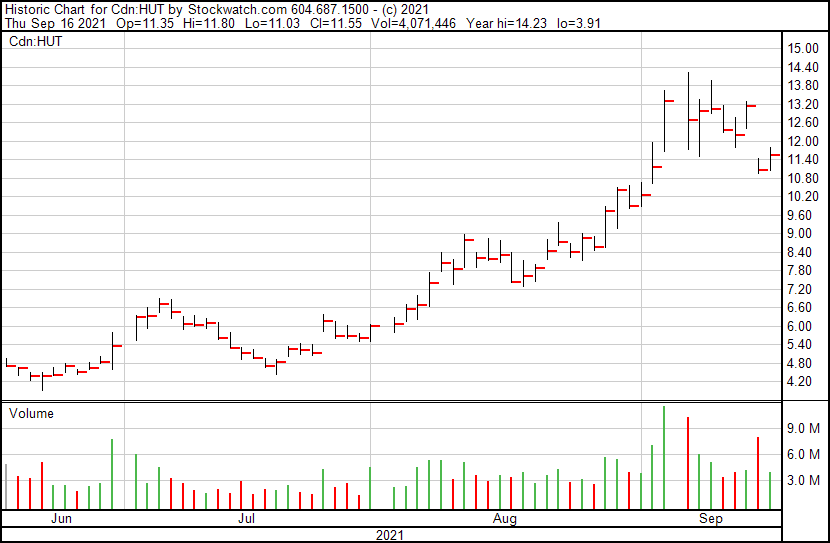

Hut 8 Mining to raise money and get certified for MicroBT

Contrary to some of the laughably fake and ridiculous news rolling out of the cryptosphere in the past weeks, we have some legit players doing legit things. Hut 8 Mining (HUT.T) announced this week that they’re engaging in a public offering in the United States and Canada trying to unload 17.55 million shares for $8.55 a piece and trying to pull in USD$150,052,500.

The other half of this week’s news involves collecting another revenue stream. Getting certified to fix the MicroBT machines for their Medicine Hat, Alberta, facility, which themselves are Bitcoin miners if you’re not familiar, means that not only can they bring in other clients and for routine maintenance.

Benefits to Hut 8 of this partnership with MicroBT include:

- Access to replacement machine parts at cost;

- The ability to repair on-site reduces the downtime associated with the repair of miners for Hut 8 as well as our hosting clients;

- Generating revenue with respect to both in- and out-of-warranty repair services for MicroBT clients in North America and Northern Europe.

Link Global Technologies shoots proper regulatory channels for growth

Link Global Technologies (LNK.C) got the ball rolling on regulatory approvals for their electrical buildout on their three 10-metawatt sites in western Alberta to be added with the latest learnings and requirements to facilitate the connection between Link and the Alberta Utilities Commission (AUC). They’ll be boosting their initial commitment, in which they agreed to a ten megawatt boost, to now add a twenty megawatt boost, bringing their total procurement to 30 megawatts.

Some of the operational improvements include:

- The company has accepted the AUC joint submission outcomes and completed a thorough review of both existing sites and new sites to ensure smooth construction commissioning and compliance with AUC and other regulatory bodies.

- The company has taken steps to ensure that sites under contract and new sites have all the requirements of AUC implemented to avoid future regulatory operational interruptions.

- The company is relocating its Campbell battery operations to a site farther north.

- AEP (Alberta Environment and Parks) paperwork has been filed for the Kirkwall site, and this operation is expected to resume once approval is received.

- The company had reviewed existing assets and determined that the short-term growth model will be financed through partnerships and cost sharing that will not require a capital investment and avoid shareholder dilution.

Both sites will also offer Link and its partners the ability to operate over 9,000 machines, which Link states will deliver a consistent revenue stream.

“Being flexible and mobile allows us to relocate operations when deemed necessary, whether for technical, social, environmental or financial reasons. This is the case at present where three operations are expanding to five. With market conditions where they are, there is an opportunity to modify our infrastructure inventory so that we can take advantage of demand to improve cash flow and improve our financial model moving forward,” said Stephen Jenkins, Link Global chief executive officer.

Powerbridge Technologies combines blockchain with AI and big data to monitor the supply chain

Powerbridge Technologies (PBTS.Q) finished the design and development of the technology infrastructure of its blockchain supply chain traceability platform, which is now at the consumer nidustry applications development stage.

The platform combnies blockchain wtih big data and artificial intelligence to collect data na dtrack the entire supply chani using a ‘one product – one code’ system, thereby achieving supply chain transparency and traceablity from production through distribution to sale. What it does is provide verifiability, cut down on counterfeits and inferior products, and protects brands and consumers rights.

“By increasing the efficiency of the supply chain with full traceability of consumer products, our platform can prevent consumer-deceiving product information, and in the process can help merchants build and maintain consumer trust and confidence,” said Stewart Lor, President of Powerbridge Technologies.

Sounds like a decent use of blockchain tech to me.

Filecoin is a thing and Code Chain New Continent is going to mine it

Of all the various types of cryptocurrency out there, Filecoin is one of the strangest. Not the strangest mind you—Augur still has that one locked down—but strange enough. Here. Here’s a quote from David (Weidong) Feng, CEO of Code Chain New Continent (CCNC.Q) that explains both what his company is doing and what Filecoin is.

“The LOI marks an important step for Code Chain’s Filecoin success. We are excited to continue our efforts in expanding our Filecoin footprint after acquiring China’s Filecoin miner. Filecoin is the native token of the Filecoin Network, a decentralized data-sharing platform that offers a thriving ecosystem of independent storage providers while eliminating barriers. I am confident that this will become the major trend for the industry, and Code Chain is placing itself ahead of the competition.”

The news is that CCNC inked a letter of intent with Shenzhen Jindeniu Electronics to buy Filecoin’s servers, computing power and digital currency for USD$15.9 million in cash. Code Chain New Continent is involved in research, design and development of electronic tokens. They’re based on and stored using the Code Chain system and can be used to monitor and document consumer behaviours involving code scanning.

The more I follow this sector, the stranger it gets. That’s not really news.

—Joseph Morton

Leave a Reply