SKRR made its debut on the TSX Venture exchange in January of 2020. To say early shareholders experienced some wild swings over the past 20 months might be an understatement. The shares are currently trading at the lower end of that 20-month range.

SKRR is a Saskatchewan-based exploreco.

Before we pop the hood on this one, a word on Saskatchewan as a mining jurisdiction:

In this age of geopolitical uncertainty, it’s essential to understand the risks associated with your company’s zip code.

Twitchy governments, those without a fair and proper set of values where mining interests are concerned, can wreak all kinds of havoc as your prized (gold) discovery is pushed along the exploration, development, and permitting curve.

The article linked below recalls several sob stories experienced firsthand in this high-risk / high-reward arena…

The risks in straying outside the safe zones – the Fraser Institute unveils its Top Ten…

A Fraser Top Three

Early each spring, the Fraser Institute, a think-tank that analyses jurisdictional risk, serves up its Annual Survey of Mining Companies. This annual report ranks countries, states, and provinces based on gov’t policies that can encourage or discourage mining investment. It also serves as a report card to governments regarding the sense and soundness of their mining policies.

Saskatchewan is currently ranked Number Three on Fraser’s Top Ten list.

Saskatchewan is a mining-friendly jurisdiction.

Good to know.

Moving along…

SKRR, primarily gold-focused, is targeting Saskatchewan’s Trans-Hudson Corridor for its wide-open discovery potential. SKRR characterizes the Trans Hudson Corridor as “an under-explored and emerging gold-producing region that could become Canada’s next big gold district. Containing the La Ronge Gold Belt and part of the same geologic formation as the famed Homestake Gold Mine, the Trans Hudson Corridor has the potential to be the next great gold district, with two multi-million ounce discoveries to date (Seabee, MacLellan).”

This geological feature occupies an area roughly 2,500 kilometers in length by 300 kilometers in width.

Running down the middle of the continent, the Trans Hudson Corridor underpins the 40M-plus oz Homestake deposit in South Dakota, the prolific Flin Flon–Snow Lake (VMS) greenstone belt of Manitoba-Saskatchewan, and the multi-million-ounce SeaBee-Santoy mine, which lies in close proximity to the core of SKRR’s project base.

Further…

The geological setting of the Trans-Hudson Corridor is similar to the well-known Abitibi Gold Belt in Canada, but with 1/100th of the drilling activity.”

– Ross McElroy, P. Geol, Chief Geologist

Taking advantage of this vastly under-explored Canadian province, the Company has been aggressive on the acquisition front since having assembled a core portfolio of projects in early 2020.

I count six, the number of properties that make up the Company’s current project pipeline. Company Chairman, Ross McElroy, a highly regarded professional geo with over three decades of kicking rocks in the province, supplied several projects of his own to set the SKRR vehicle in motion (more on Mr. McElroy further down the page).

Looking for structure at depth

Exploration success in this part of the world requires some deep thinking. In following up on a surface showing, the real potential will often play out down plunge, at depth.

Geochemistry—soil sampling on a tight grid—can be a valuable tool in vectoring in on a potential orebody in this neck of the woods. If there’s gold in the immediate sub-surface stratum—in the bedrock—the region’s thin soil layers will often betray the source. Trenching is the next logical step, followed by a proper probe with the drill bit if results prove positive.

This short vid with Chuck Downie, Eagle Plain’s Chief Geo, describes this process in some detail (Eagle Plains served as a project vendor for two key properties in SKRR’s project portfolio—Cathro and Manson Bay South).

Olson

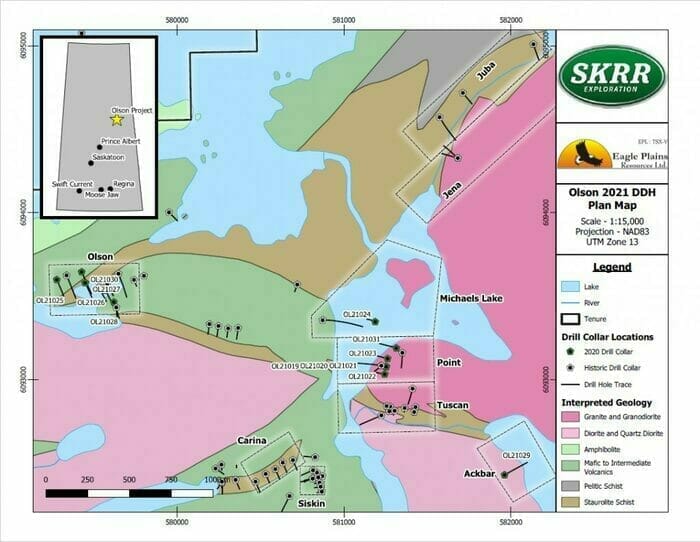

The Company’s 3,868-hectare Olson Project, located roughly 80 kilometers south of SSR Mining’s high-grade Seabee operation, is prospective for orogenic gold and VMS mineralization.

SKRR can earn up to 75% in the project from Eagle Plains Resources (EPL.V).

Gold mineralization was identified in several locations along the property via channel sampling and first-pass drilling.

Highlights from previous campaigns:

Olson showing (~250-meter strike length)

- 6.4 meters grading 1.73 g/t Au (channel sample highlight)

- 7.5 meters grading 2.07 g/t Au (drilling highlight)

Kaldo Showing (~475-meter strike length)

- 18.3 meters grading 1.11 g/t Au and 8.5 meters grading 2.82 g/t Au (drilling highlights)

According to the Company’s project page, geophysics played a key role in picking up this mineralization.

A maiden drill campaign launched late last fall tagged a new discovery at Olson—the Point Zone.

The February 4, 2021 discovery headline:

Point Zone highlights

Hole OL20004:

- 39.80 meters @ 1.09 g/t Au (3.05 to 42.85 meters) including:

- 7.62 meters @ 3.44 g/t Au (15.75 to 23.37 meters) including:

- 1.53 meters @ 13.80 g/t Au (21.84 to 23.37 meters).

Hole OL20005:

- 31.04 meters @ 0.51 g/t Au (2.88 to 33.92 meters).

Jena Zone highlights

Hole OL20002:

- 1.53 meters @ 13.5 g/t Au (125.13 to 126.66 meters);

- 1.24 meters @ 1.14 g/t Au (76.2 to 77.44 meters);

- 1.21 meters @ 2.54 g/t Au (116.84 to 118.05 meters).

The Point Zone discovery hole represents a broad interval of shallow mineralization—40 meters of one gram-plus rock is a solid hit. Note the high-grade ‘included’ intervals that offer the potential for high-grade zones within.

The Company reported the remaining 13 holes from this 2,981 meter Phase-1 campaign on March 25th…

Highlights

- 150 meter Step Out. Drill hole OL20017 tagged 9.64 g/t Au over 1.23 meters within a broader interval of 1.19 g/t Au over 19.94 meters in step out at the historic Olson showing area.

- New gold discovery. The first hole completed at Michael’s Lake, drill hole OL20018 encountered 2.85 g/t Au over 1.12 meters within 0.77 g/t Au over 6.46 meters.

- Near Surface Mineralization.

- 5 holes at the Siskin zone encountered near-surface mineralization including 0.42 g/t Au over 17.87 meters starting at a depth of 3.05 meters.

- Significant intercepts at the Tuscan zone included 0.52 g/t Au over 11.5 meters starting at a depth of 7.5 meters.

- Mineralized Core: 91 of the core samples assayed returned greater than 0.5 g/t Au, with 29 samples greater than 1 g/t Au.

A Phase-2 campaign designed to follow up on the positive results encountered late last Fall generated the following headline on May 6th:

Results from this last round of drilling continue to demonstrate the near-surface size potential of the Point Zone—significant widths and good continuity (with narrow higher-grade intervals included within).

Point Zone highlights

Hole OL21019:

- 50.24 meters @ 0.41 g/t Au (3.23 to 53.47 meters), including:

- 6.25 meters @ 1.15 g/t Au (35.75 to 42.00 meters).

Hole OL21020:

- 39.5 meters @ 0.37 g/t Au (2.66 to 42.16 meters), including:

- 12.61 meters @ 0.60 g/t Au (20.00 to 32.61 meters).

Hole OL21023:

- 7.04 meters @ 0.43g/t Au (36.46 to 43.50 meters), and

- 9.02 meters @ 1.16 g/t Au (67.53 to 76.55 meters), including:

- 4.55 meters @ 1.59 g/t Au (72.00 to 76.55 meters).

“Drill results at the Olson Zone continue to show encouragement and demonstrate well-developed thickness with higher-grade intervals.”

The Olson Zone is open in all directions.

Olson Zone highlights

Hole OL21025:

- 13.1 meters @ 0.89 g/t Au (32.22 to 45.32 meters), and:

- 8.41 meters @ 0.72 g/t Au (122.47 to 130.88 meters).

Hole OL21026:

- 11.04 meters @ 0.61 g/t Au (48.63 to 59.67 meters) and:

- 29.44 meters @ 1.30 g/t Au (105.04 to 134.48 meters), including:

- 10.21 meters @ 2.95 g/t Au (120.11 to 130.32 meters), including:

- 5.54 meters @ 4.12 g/t Au (121.69 to 127.23 meters), including:

- 0.78 meters @ 14.55 g/t Au (126.45 to 127.23 meters).

Commenting on both drilling phases at Olson, Sherman Dahl, CEO:

“Our Olson drilling was ambitiously designed to test the size potential of the Olson gold system. It was successful on all fronts. The presence of consistent high grade gold mineralization identified at the Olson project confirms the overall potential of growing into a significant resource. The Olson Project continues to yield exceptionally consistent gold results as we drill to define mineralization in the area.”

Manson Bay

Without the benefit of having spoken with management, and not to diminish the abundant geological potential further along the Company’s project pipeline, the Manson Bay Gold Project could be the standout worthy of flagship status.

Manson Bay consists of the 4,228-hectare Manson Bay South Property, acquired from Eagle Plains Resources, and the 64.537-hectare Manson Bay Property, acquired from Edge Geological Consulting—an acquisition that closed early this year.

Manson Bay is strategically positioned along the Trans Hudson Corridor in east-central Saskatchewan, roughly 40 kilometers northwest of the historic mining center of Flin Flon, on the Manitoba border.

The Manson Bay and Manson Bay South Property Highlights

- The 64.537 ha Manson Bay Property covers all of the known drill holes outlining the historic Manson Bay Gold Zone.

- Manson Bay Gold Zone: Preliminary drilling was conducted in 1985 by HudBay Minerals (3 holes) and was followed up in 1987-88 by Mingold Resources with a 44-hole, 4,607 meter program. Mingold estimated a historic resource of 660,000 tons grading 0.1 oz / ton (3.4 g/t) Au*** to a depth of 122 meters down-dip (66,000 ounces gold) with good potential for expansion of depth and strike extent. This historical estimate used a classification scheme other than those set out in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101“). SKRR is not treating the historical estimate as a current mineral resource estimate.

Highlights from historic drilling include:

- Hole MBO-15 intersected 15.39 g/t Au over 10.03 meters (85.98 to 96.01 meters) including

- 23.13 g/t Au over 6.40 meters (86.56 to 92.96 meters), including

- 219.02 g/t Au over 0.61 meters (87.29 to 87.90 meters)

- Hole MBO-37 intersected 2.91 g/t Au over 12.44 meters (from 84.16 to 96.59 meters) including 16.11 g/t Au over 0.24 meters.

- The 4,228 ha Manson Bay South Property surrounds and is contiguous with the Manson Bay Property and contains significant historic mineral showings including:

- Nest Group Gold-Silver-Copper-Zinc showing: Located ~3km south-east of the Manson Bay Gold Zone. Four zones of mineralization were encountered – The Showing, and A, B, and C Zones. Three trenches totaling 286.5 meters were completed on The Showing – Trench 1 included a 6.7-meter interval grading 0.93 g/t Au, 37.6 g/t Ag, 1.38% Cu, and 7.6% Zn.

- MAN Claim Copper-Gold showing: Located ~2km south-east of the Manson Bay Gold Zone where surface mineralization was encountered in a 30.5m x 4.6m gossan zone returning 1.0% Cu over 0.6 meters.

- Cunningham Lake: Located 2km south of the Manson Bay Gold Zone where Homestake Mineral Development obtained a grab sample (Sample ID #15854) on the west side of Cunningham Lake, which returned an assay value of 5,680 ppb Au.

On September 2nd, the Company dropped the following headline:

A summer/fall exploration program with a $1M budget is now in motion at Manson Bay. The program will include mapping, prospecting, soil sampling, an airborne VTEM “Versatile Time Domain Electromagnetic” survey, and a 1,700 meter (9-hole) drill campaign.

As noted above (and below), the highlight historic hit at this project was a weighty 15.39 g/t Au over 10.03 meters (including a higher-grade interval of 23.13 g/t Au over 6.40 meters).

The primary focus of the drilling will be to test the historic Manson Bay Gold Zone, where historic drilling by HudBay Minerals (1985) and MinGold Resources (1987-88) outlined the Manson Bay Gold Zone, with highlights such as drill hole MBO-15 intersected 15.39 g/t Au over 10.03m including a high-grade interval of 23.13 g/t Au over 6.40m. Drill targets are still being finalized, but it is expected that seven (7) holes will test within the known Manson Bay Gold Zone, with the aim to confirm and expand upon historic results, and two (2) step-out holes contingent on results from the summer mapping and soil geochemistry surveys.

The 2021 Manson Bay drilling targets are based on a comprehensive compilation and modeling of all available data including historic drilling, and from the recent fieldwork completed by SKRR.

According to this September 2nd press release, the Manson Bay Gold Zone showing consists of a silicified horizon within a northeast-trending shear zone. Mineralization has been traced over a strike length of 31.5 meters within this silicified shear.

“The mineralized horizon is a quartz-rich gneiss that contains hornblende-feldspar-biotite and locally chlorite and tourmaline crystals. Minerals present include trace to 15% pyrite, trace to 20% pyrrhotite, up to 10% graphite, trace to 12% chalcopyrite, trace to 10% sphalerite, trace galena and associated gold mineralization.”

Delineation drilling, at 30.5 to 61.0-meter centers, outlined an area roughly 91.4 meters by 152.4 meters where grades ran between 2.6 g/t Au to 19.24 g/t Au over an average width of 3.65 meters. Other zones of less significant Cu-Au mineralization were also encountered along strike.

ALL of the properties in the Company’s project portfolio, including Ithingo and Cathro, will likely see boots on the ground before 2021 is done.

The Crew

At the top of the page, we addressed the importance of a safe mining “jurisdiction”. Equally important is the pedigree of company management.

As I keep repeating, management is a pressing consideration when sizing up candidates for your ExploreCo Portfolio. You can have a great, company-maker of a project in the friendliest jurisdiction, but without the right team in place—a combination of gifted rock kickers and competent capital market types—things can fly apart at the seams.

Operational inefficiencies often create a processional effect that can lead to an erosion in shareholder value via reckless spending and an endless cycle of heavily dilutive raises.

The SKRR crew has the technical and capital markets side well covered.

Ross McElroy and Ronald Netolitzky are just two of the top-shelf names that stand out on this crew.

Slides 17 and 18 on the Company’s deck amplify the talent.

Mr. McElroy is a professional geologist with over 30 years of experience in the mining industry. He is the winner of the Prospectors & Developers Association of Canada 2014 Bill Dennis award for exploration success and the Northern Miner mining person of the year 2013. Ross McElroy has been instrumental in several major uranium discoveries in Saskatchewan including the Triple R deposit and Cameco’s McArthur River deposit. Mr. McElroy while at BHP, managed the vast Hope Bay Gold Project and was a key member of the team to discover 3 major high-grade gold deposits. He has comprehensive experience at both a technical and executive level for junior public companies and major mining companies managing many types of mineral projects from exploration to feasibility and production.

Mr. Netolitzky has been very successful in mining exploration with over 40 years of experience and having been directly associated with three major gold discoveries in Canada that have subsequently been put into production: Eskay Creek, Snip and Brewery Creek. He is a director of several publicly traded exploration companies. Mr. Netolitzky has been honored with the Prospector of the Year award from the PDAC, and Developer of the Year award from the BC & Yukon Chamber of Mines. In 2015, he was inducted into the Canadian Mining Hall of Fame.

In watching several Youtube interviews featuring company management, the passion is clear. This crew is determined to discover a world-class orebody in this vastly under-explored region of mining-friendly Saskatchewan.

Final thought

One solid discovery hole, that’s all it will likely take to push this sub-$7M market cap company substantially higher.

END

—Greg Nolan

Full disclosure: SKRR is an Equity Guru marketing client.

***SKRR considers these estimates to be historical in nature and cautions that a Qualified Person has not done sufficient work to classify the historical estimates as current mineral resources or mineral reserves in accordance with NI 43-101. SKRR is not treating the historical estimate as a current mineral resource estimate. The location of drill holes completed to produce these estimates have not been confirmed. These estimates do not comply with current definitions prescribed by NI 43-101 or the Canadian Institute of Mining (CIM), and are disclosed only as indications of the presence of mineralization and are considered to be a guide for additional work. The historical models and data sets used to prepare these historical estimates are not available to management, nor are any more recent resource estimates or drill information on the Manson Bay Property.

^^^The above results were summarized from the SMDI descriptions and assessment reports filed with the Saskatchewan government. SKRR cautions that historical results were collected and reported by past operators and have not been verified nor confirmed by a Qualified Person, but form a basis for ongoing work at the Manson Bay Project. Further work (including drilling) is required by SKRR in order to verify the historical work on the Manson Bay Project. Management cautions that past results or discoveries on proximate land are not necessarily indicative of the results that may be achieved on the subject properties.

Leave a Reply