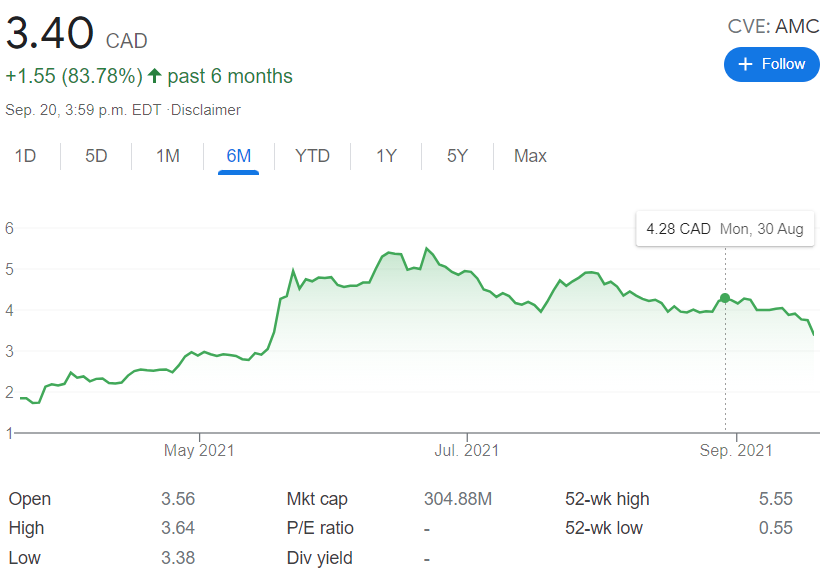

The popular adage that defines a mining project as someone standing in a hole swearing you’re going to be rich, rings true for many juniors operating in the mineral extraction space, but there are exceptions to this modern proverb and Arizona Metals (AMC.V) has proven itself to be one of them.

In one of the top ten mining friendly districts on the planet, AMC’s Kay Mine and Sugarloaf Mountain outline a potential that foretells even greater value than its current 83% climb. We called it, our mining expert, Greg Nolan, tucked into Arizona from the start, praising its management and discovery potential. He summed up AMC’s story back in October 2020 like this:

The company’s recent success with the drill bit is geological sleuthing at its very best.

The two geophysical anomalies at the Kay Mine project, should the company hit during the upcoming drilling campaign, could really move the needle for this play.

The goal at the Kay Mine project is achieving scale.

If the company can delineate, say, 20-plus million tonnes of Au-Cu rich material… this could turn into a serious home run for the company, and its shareholders.

Since that point, the company has followed through on its exploration objectives producing some impressive results from Kay which already had an unverified historic resource estimate of 5.8 million tonnes grading 2.2% Cu, 3.03% Zn, 55 g/t Ag and 2.8 g/t Au resulting in a CuEq grade of 5.8%. In a world where copper mines are pulling in on average below 0.6% copper, Kay stands out like a champ and to the company’s credit, the project isn’t subject to any royalties.

The Kay Mine project, located in Yavapai County, Arizona, sits in a region of copper-rich VMS mines and shares similar geology to its successful neighbours. As Chris Parry stated in his piece celebrating AMC’s ramping value:

Closeology is no guarantee of success, but it sure as hell doesn’t hurt to be digging near others who have achieved success in their digging.

That said, AMC’s drill programs have gone on to prove that Kay is more than a flash in the pan. Back in May, the junior explorer announced drill results that included intersections of:

- 79 metres of 7.0 g/t AuEq, including two separate higher-grade intervals of nine metres grading 18.1 g/t AuEq and 11 metres of 14.7 g/t AuEq and in another hole,

- 91 metres of 4.7 g/t AuEq with two separate higher-grade intervals of 20 metres at 9.2 g/t AuEq and 16 metres of 6.8 g/t AuEq. This hole also produced an intersection of 0.8 metres grading 33.4 g/t AuEq.

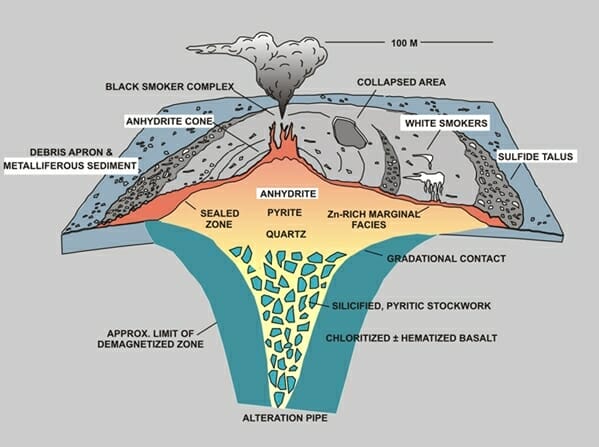

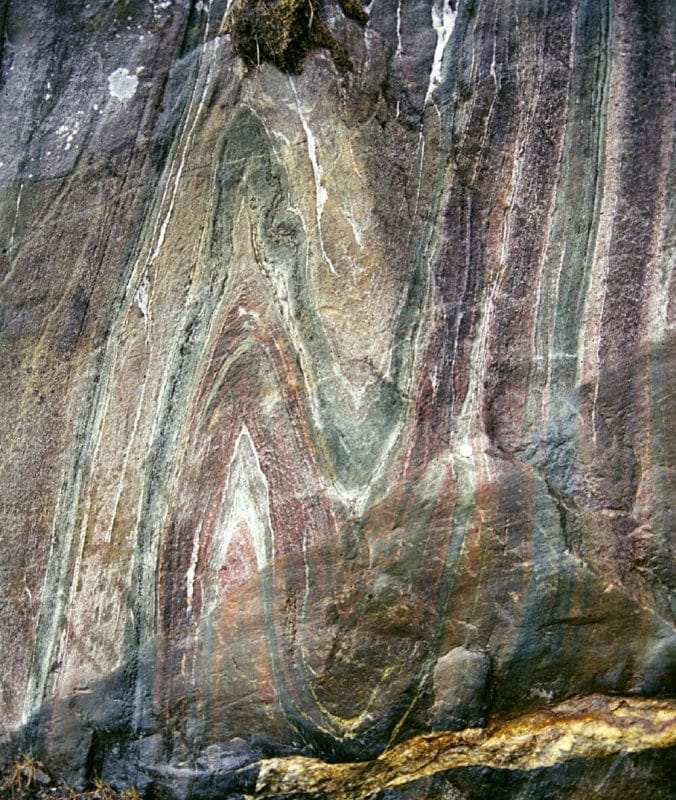

Kay is what is known as an isoclinal folded deposit meaning that where a normal VMS deposit is shaped like a pimple covering a core of high-grade minerals as illustrated below:

Kay’s deposit looks somewhat like stretched taffy pulled this way and that by shifting tectonic forces. The same eons-long force that crumples flat land into mountain ranges. Kay’s particular folds are parallel to each other and are roughly at the same angle. This distortion gives AMC the opportunity for new discoveries beyond the typical VMS envelope with a relative minimum of guesswork.

Kay is also strategically located north of Phoenix just off I-17 with easy access to water and utilities, and as stated before, near to copper-rich projects like United Verde which produced 30Mt at 4.8% copper and Blue Bell Mine which produced 1.1 Mt at 3% Cu.

Having been defined from a depth of 150 metres to at least 900 metres, Kay Mine’s steeply dipping deposit is open for expansion on strike and at depth. With strong community support in hand, the upcoming completion of its Phase 2 drill program and $27 million in the till as of June 30, 2021, the story can only get better.

Sugarloaf Peak Project is AMC’s secondary project and a heap-leach, open pit contender. While the focus is on Kay, Sugarloaf is nothing to sneeze at.

Also located in the mining-friendly Arizona, Sugarloaf sits in La Paz County and has a historic estimate of 100 million tons containing 1.5 million ounces of gold at a grade of 0.5 g/t. The numbers don’t initially dazzle but the deposit’s location does. Sugarloaf’s historic riches lay in shallow earth up to a depth of 70 metres.

In June 2021, AMC announced that the bottle roll metallurgical testing on drill holes completed in the company’s Phase 1 drill program demonstrated gold recoveries averaging 76%, from surface to 111 metres. AMC is currently column testing and hopes to have results by the end of the year.

At the end of June, AMC filed a new NI 43-101 technical report for Sugarloaf, which proposed a Phase 2 drill program at the project, but the company stated it would wait for the remainder of the 2020 Phase 1 drill results to confirm whether it would proceed with plans for Phase 2. The company expects to complete metallurgical testing on Phase 1 results at Sugarloaf by the end of 2021.

At present, AMC intends to keep Sugarloaf under care and maintenance until it has decided to move ahead with a further drill program.

Sugarloaf Peak is like the tasty side dish in an already luscious dinner, it may or may not be consumed, but has the potential of a spin-out which could further build value for current investors as AMC moves on Kay Mine.

Location and grade are important factors for identifying decent investment plays in the mining space, but without good management all could be for naught. AMC sports an executive team with notable pedigrees and complementary skills to what’s needed to develop Kay into a going concern.

At the helm of the company, sits Marc Pais, president, CEO and director. In 2011, Pais, who has a B.Sc. Geological Engineering from Queen’s University, co-founded Telegraph Gold and strategically acquired the Castle Mountain Mine which is now operated by Ross Beatty’s Equinox Gold (EQX.T) and poured its first bar in October 2020.

Paul Reid, who sits as chairman of AMC and has 15 years experience in financing mineral exploration, development, and production, was with Pais in those heady days at Telegraph where he acted as co-founder and chairman to the fledgling explorer.

It was when Reid and Pais teamed up again in 2014 that Arizona Metals was formed. From there, the duo sought out highly prospective but distressed assets for development and in the process, picked up Kay Mine and Sugarloaf on the cheap in a bear market.

Their combined foresight was joined by Colin Sutherland and Rock Vernon, both directors. While Sutherland served recently as president of McEwen Mining (MUX.T) and has 20 years of operational and financial experience under his belt as a CPA, Vernon is a 30-year mining professional who was previously Managing Director, Head of Investment Banking at PI Financial, a leading independent investment bank for small to mid-cap companies.

AMCs expansive technical prowess is powered by Technical Advisor, Dr. Mark Hannington, a 35-year veteran research geologist with specializations in volcanogenic massive sulfide (VMS) deposits, and the metallogeny of modern and ancient volcanic belts. Dr. Hannington’s significant contributions to AMC were made clear when he helped delineate two more mineral-laden drill targets at Kay.

In the end, Arizona Metals is firing on all pistons and the market is beginning to catch on:

Don’t take my word for it, however, dig into Greg Nolan’s work on AMC for a meaty in-depth technical breakdown of the company’s portfolio and its obvious potential. Here’s a sample to get you started:

Arizona Metals (AMC.V) homes in on gold-copper-rich VMS targets in mining-friendly Arizona

Arizona Metals (AMC.V) demonstrates excellent recovery rates at Sugarloaf Peak project in mining-friendly Arizona

Arizona Metals (AMC.V) tags more high-grade at recently discovered gold-rich zone at Kay Mine project – accelerates exploration with a third rig

Arizona Metals (AMC.V) tags thick intervals of high-grade mineralization at its Kay Mine Project in mining-friendly Arizona

Also check out our latest Roundtable on AMC as well as Vishal Toora’s technical thoughts and Taku Ndechena’s fundamental analysis on the rising junior explorer. That said, do your due diligence and as always, good luck to all!

–Gaalen Engen

Leave a Reply