X-Terra Resources (“XTT.V”) is a gold exploration company focused on James Bay Québec. Their concentration is in exploration where the operators believe the opportunity to offer the strongest rewards and growth opportunity for shareholders exists. The firm spent $536,284 in work on its mining properties for its first two quarters ending June 30, 2021.

The company holds 100% interests in the Troilus East property comprising of 182 mining claims that cover an area of 9200 hectares located in Québec, Canada; and the Ducran property consisting of 49 mining claims covering an area of 4160 hectares located in Québec, Canada.

It also holds an option to buy 70% interest in the Grog and Northwest property that contains 34 claims covering an area of 28,000 hectares located in northeastern New Brunswick, Canada.

The company stays increasing its management team and intends to continue to identify, purchase and advance mineral exploration assets that have large-scale potential.

The numbers

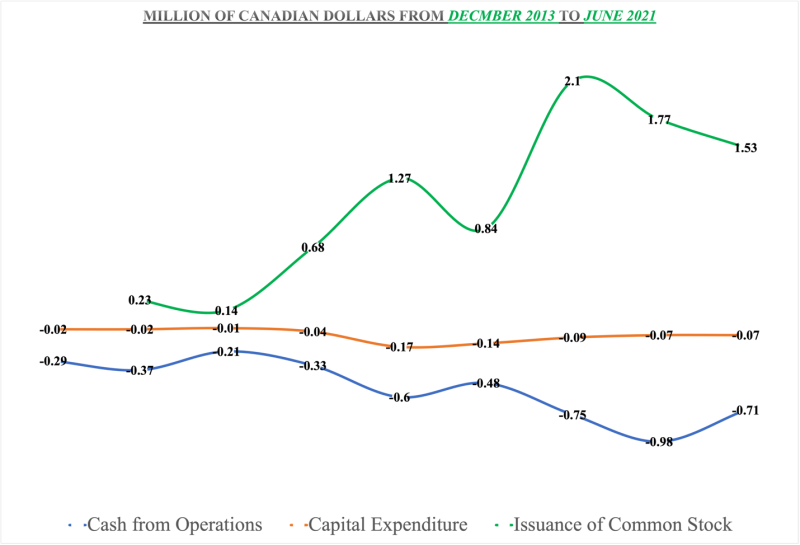

The Firm is an exploration company and, correspondingly, does not generate revenue on a regular basis and must repeatedly issue shares to further explore its mineral properties and its operations.

From the chart above we can see that their cash from operating expenses has been negative since December 2013. this is in line with their prediction that the exploration business depends heavily on the issuance of common stock to fund their capital expenditures. The capital expenditures since 2013 (the orange line) have been consistent and their issuance of common stock (the green line) has been rising. In 2014 they raised $200,000 and as of the last 12 months, they raise close to $1.53 million from issuing common stock.

They currently have $360,000 in cash on hand, $673 604 in Mining properties, and 2.7 million in Deferred exploration expenses. This brings the total assets to about $3.87 million. They also have total liabilities of $200,000 mainly in the form of Accounts payable and accrued liabilities. Meaning the business has a total net worth of about $3.5 million whilst its market cap is close to $5.08 million. In essence, the market has applied a premium above the net assets of the business of about $1.58 million.

This premium to the book value means investors are willing to pay now more for the business over his assets for the future earning potential of the business depending on its productivity with its projects. some of this premium is also accounted for by the general appreciation of the commodity space specifically the precious metals. But gold has had a rough time this year bringing in close to a negative 7% YTD return and XTT is down 53% YTD.

How has the business reacted to this rapid decrease in stock price? well, they did what manage has done best they went straight to the public markets and refinanced.

- On August 27, 2021, the Corporation closed a non-brokered private placement to which it issued 11,716,670 units at a price of $0.075 per unit, for gross proceeds of $878,750.

- Each of the 11,716,670 units was comprised of one common share and one common share purchase warrant.

- Each warrant entitles its holder to acquire one additional common share of X-Terra at a price of $0.11 until August 27, 2023.

- it has completed its phase 1,2021 drill exploration program on the Troilus East property and has exceeded X-Terra Resources’ expectations, as the principal southwest target has revealed an important alteration system developed about three kilometers east of the Troilus Mine infrastructure.

Leave a Reply