Given that the United States is once again going to the cookie jar to raise the debt ceiling and foist this generation’s financial issues onto the next generation (or the next after that… or after that) you’d think this week in crypto would be all about people bailing out of their positions, and piling their hard earned cash into positions in Bitcoin or other decentralized coins.

But nope.

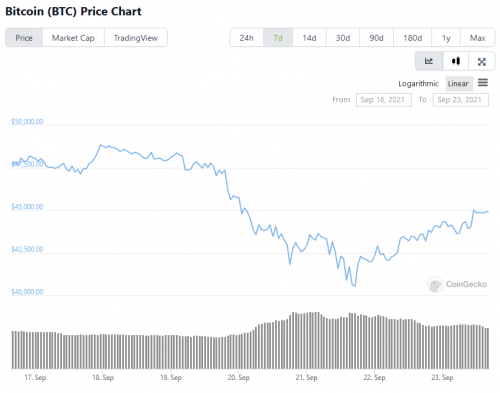

Here’s Bitcoin’s chart this week.

It’s enough to make someone wonder whether or not Bitcoin and the alts have lost their original ideological focus—as an alternative to traditional stores of wealth.

Regardless, here’s how the crypto and blockchain sector fared this week.

Cascadia Blockchain subsidiary sets up in Kazakhstan

Cascadia Blockchain Group (CK.C) subsidiary Eurasia Blockchain Fintech Group signed into a share subscription agreement for USD$600,000 with an investment company working on high-growth companies in the blockchain sector.

Normally this kind of thing would be something to gloss over, but for this quote:

“Our team is preparing for the opening ceremony for the launch of EBX. Media and officials from the government of Kazakhstan will be invited to the ceremony to celebrate and witness the success of the completion of our first milestone. We will announce the exact date once we confirm the venue and availability of guests, but the plan is to launch EBX by the end of October 2021. In the near future, we also plan to get a license to support fiat-crypto and crypto-fiat services. Investors will be able to easily carry out transactions through EBX, as its services are convenient and secure”, said Nurbolat Akysh, CEO of EBFG.

The money will give EBFG the capital infusion to continue their development and operation of the Eurasia Blockchain eXchange within the next 12 months. But ultimately, it’s inclusion of the country Kazakhstan that’s the most interesting part of this weekly news, because the country has successfully branded itself into a haven for blockchain companies in need of safe harbour.

LUXXFOLIO gets an early Christmas present as their miners come in ahead of schedule

Luxxfolio Holdings (LUXX.C) received their early delivery a 600 Bitcoin S19J Pro miners courtesy of a swap agreement with a strategic partner. They were supposed to arrive in the latter part of Q3 and Q4 of this year, but half of the 600 miners have arrived and they’re installed and operating. The other half are enroute to the facility.

“This transaction accelerates our revenues by an estimated 45 to 75 days during a time when hash rate difficulty is very attractive for the bitcoin mining industry. With the miner supply chain tightening again, stepping up install timelines is highly accretive and enhances near term cashflow and return on assets,” said Ken MacLean, president of LUXX Mining.

MacLean isn’t wrong here. The diaspora is slowly coming to a close and we’re going to start seeing a rise in mining activity as the formerly Chinese mining crew gets their act collectively in gear, and starts spitting out bitcoin again. Then small fry companies like LUXX are going to start feeling the crunch as the difficulty and hashrate start to climb.

BTCS gets onboard with smart contract platform Avalanche

BTCS (BTCS.Q) added Avalanche (AVAX) to their blockchain infrastructure operations this week. Now AVAX has a 16 billion market capitalization, and ranks eleventh by market cap. Their claim to fame is that they’re one of the fastest smart contract platforms offering high transaction throughput.

“Founded by Emin Gun Sirer, an associate professor of computer science at Cornell University, AVAX has garnered significant financial backing since inception, including its recent $230 million raise,” said Charles Allen, chief executive officer of BTCS.

The interesting point is that several factions in the decentralized finance, non-fungible token and other projects have taken up with Avalanche, including The Graph, SushiSwap, TrustSwap and Copper among others. AVAX is presently developing a bridge to the Ethereum blockchain so its users can transfer digital assets between the two chains.

The company’s implemented and funded a validator node as of August 20, 2021, and is expected to start generated revenue soon.

Cosmos Group Holdings could be on borrowed time

In a roundup a few weeks ago, I called the frothy NFT market a game of ‘greater fool hot potato‘ and Cosmos Group Holdings (COSG.OTC) the company I was incidentally talking about didn’t like it much. Their attempt to explain it away the subsequent news release failed to note that this particular batch of techno-tulips will have zero resale value when the bubble for NFTs bursts.

Granted, that didn’t stop Cosmos Group from gobbling up the hot potato factory, Massive Treasure Limited, which is the parent company of Coinllectibles Group this week, completing an acquisition which they originally announced three months ago.

“I am very happy that the acquisition was completed within 3 months. Since the acquisition was announced in Jun 2021, the team had been hard at work to seal this transaction. Now that this is done, the team will be able to continue growing the company, increasing shareholders value and making Coinllectibles™ Fusion NFTs™ the gold standard of the NFT industry,” said Dr Herbert Lee, founder and advisory board chairman of Coinllectibles.

In their defense, this digital tulip-mania could run for years. But just as easy, it could be over tomorrow. Pick your poison.

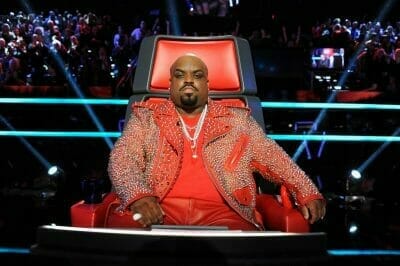

CeeLo Green to contribute to NFT streaming movie soundtrack

Does anyone remember CeeLo Green? He was popular in the oughts as one-half of Gnarls Barkley, which did rather well for maybe two songs and then basically disappeared. I think he was also a judge on either The Voice or American Idol or maybe one of the overseas derivatives, but I know he definitely won a Grammy. Either way, we have an answer for what washed-up musicians from previous decades do, when presumably they’re not either attending AA meetings (on one end) or doing anything they can to stay relevant and make money (on the other).

CeeLo Green seems to be in the second camp. Okay. He might be in the first as well. We have no evidence to support either way, and that’s mostly between him and his god, whoever that may be. What he is doing is getting involved with Vinco Ventures and ZASH Global (BBIG.Q) latest set of entertainment acquisitions, and that means NFTs.

Yeah. No surprise here.

Specifically, they’re getting involved with a NFT platform called EVNT, which Emmersive Entertainment will use to launch their first NFT streaming movie soundtrack. There are some other names attached like Anderson .Paak, Kota the Friend, and it’s being produced by Grammy winners Om’Max Keith and Adrian Miller of A Tiny Universe (ATU).

Sure.

The movie is called Karen and it’s about a young black couple who move to a white neighbourhood and have to tend with a racist and sinister white woman, presumably named Karen, who wants to kick them out of the community.

Right. How much do you think Green pawned his Grammy for?

Polygon and Nukkleus aim to help Hyderabad, India with their sewage problem

Nukkleus (NUKK.OTC), a crypto-payments specialist, is teaming up with the folks behind the Polygon blockchain and anti-poverty non-profit Grassroots Economics to deliver a blockchain community grant to Bollant Industries in Hyderabad, India. The grant will fund and support the development of a blockchain solution to improve the waste management supply chain.

Unlike most of the things on this list, this has the potential to be the most useful entry in terms of proper use of blockchain tech if only they actually added what the grant is going to improve into the news release.

“Polygon will be providing a grant to Bollant Industries. This generous act is a refreshing reminder of the blockchain philosophy of financial inclusion. We look forward to many more industry leaders following in their footsteps as we develop a global network of democratized payment solutions for communities that are ready to adopt crypto,” said Erin Grover, head of emerging markets at Nukkleus subsidiary, Digital RFQ.

Regardless, Nukkleus is a digital asset business that drives sustainable environmental, social and corporate governance (ESG) issues that also make money. Sure. Polygon is an India-based cryptocurrency with a $14 billion market cap that wants to build a world where communities can thrive unconstrained by national borders and regulations. Presumably by making crypto payments affordable and accessible.

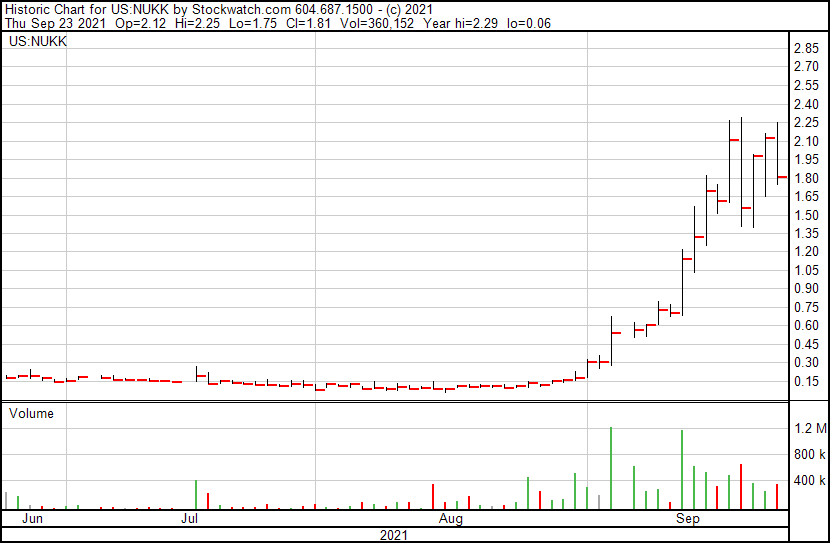

The chart itself gives me a case of FOMO, but I’ll get over it.

Galaxy Digital Holdings and Invesco team up to get more digital assets ETFs out to investors

The history of cryptocurrency ETFs in the United States is long and fraught with peril. It goes back to at least 2013 when Bitcoin wasn’t really a thing people talked about with any variety of seriousness. And there have been a handful of attempts in the eight years since then, with the SEC shooting each one down as they’ve come along.

Now it’s Galaxy Digital Holdings (GLXY.T) and Invesco’s turn to take a kick at the can in developing a suite of US-listed, physically-backed, digital asset ETF.

“Invesco has a long history of using ETFs to democratize investor access to disruptive, innovative asset classes. Now, through our partnership with market leader Galaxy Digital, we are able to incorporate their expertise of blockchain technology, digital assets and cryptocurrency into our product capabilities,” said John Hoffman, Head of Americas, ETFs & Indexed Strategies at Invesco. “This combination of complementary strengths will help clients safely and prudently navigate this exciting new asset class to help meet their desired investment outcomes.”

The case for a bitcoin EFT (let alone one for crypto in general) would give investors greater access to the world of cryptocurrency, and generally simplify the process of acquisition, storage and security. Namely—no more private keys to lose. Let’s consider for a second, at least according to data from Chainalysis, that about 18% of bitcoin is either lost or otherwise stuck in wallets that can’t be accessed due to lost keys.

That’s a ridiculous amount of wealth that’s just… gone.

Graph Blockchain augers down on DeFi and NFTs with three company spinout

Graph Blockchain (GBLC.C) is planning on spinning out three of its businesses into two independent, publicly traded companies through a share dividend to their shareholders. Specifically, they’re doing this so they can focus exclusively on their non-fungible token (NFT) operator, New World.

“The company considers DeFi to be such a diverse sector that we believe our shareholders are best served by owning three pure play companies. We believe that the best possible path to unlock equity value is to create three independent companies that are each well equipped to capitalize on growth trends in their sectors,” said Paul Haber, chief executive officer.

These guys were a client of ours for a hot minute when they spun off from Datametrex AI (DM.V) and they spent a few years spinning their wheels trying to figure out somewhere to go. Then they had it—back to basics with crypto, mining, launchpads into DeFi, all good things. But then NFTs came along with their frothy promise of short term gains and it seems they’re going all-in on those. So they’re going to join the long list of people and companies left holding the bag when the market gets tired of digital-tulips and goes onto digital knapsacks, or whatever’s next.

Well hopefully Graph has a nice, long run with NFTs.

The spinoff will establish separate companies that include:

- Optimum Coin Analyser Inc. will be spun out as a stand-alone company focused on software for crypto traders. Optimum is a cloud-based discovery search engine subscription model that will create a recurring revenue stream on its platform.

- Babbage Mining Corp. and Beyond the Moon Inc. (BTM) will be combined and spun out as stand-alone altcoin and IDO-focused (initial DEX (decentralized exchange) offering) company.

Globalblock flings open their doors to over 80 digital assets.

If you’re a regular user of Globalblock Digital Asset Trading’s (BLOK.V) subsidiary GlobalBlock, you already know what I’m going to say. You’ve likely already had a once over the newest additions of 80 more digital assets through their GlobalBlock U.K platform. The assets can be bought, sold, and held across the company’s combined offerings of telephone, online trading and mobile app.

“Being able to offer the widest possible range of high quality digital assets for our clients is important and we aim to soon expand further the number of digital assets available for trading across our telephone broking service, mobile app and online platform. We see ourselves as not only providing a market leading personalised digital asset trading service, but a low cost one,” said Tim Bullman, head of sales and trading at GlobalBlock U.K.

The top five most popular crypto traded on the platform by volume so far this month are bitcoin, ethereum, quant and polkadot.

CurrencyWorks offers Golden Tickets to their NFT movie offering featuring Anthony Hopkins

We originally wrote about Currencyworks (CRWK.Q) bid for digital movie magic in July when they originally announced they were making a movie with recent Oscar winner Anthony Hopkins called Zero Contact. Normally, that’s not really news. What CRWK is doing, though, in that they’re converting it into a non-fungible token to be displayed on the Vuele platform, is the angle.

I haven’t exactly been totally 100% down with all the froth that non-fungible tokens have generated in the crypto markets, and admittedly, the prospects behind this don’t exactly fill me with glee either. But ahead of the film’s debut on Vuele, the platform launched a Golden Ticket sweepstakes (think: Willy Wonka) including a batch of digital assets from Currencyworks. The ticket is the access pass to the first four wide release film NFTs that will be available on the platform.

So… not exactly full chocolate factory. But it’s still a decently neat little promo that could make the day of the first 100 golden ticket winners, which have already been picked ahead of the first two NFT drops. Regardless, the bidding will take place for OpenSea will take place on Sept 24.

- The one-of-one Zero Contact platinum edition NFT bundle (available for 72 hours);

- The 10 Zero Contact elite edition NFT bundles (available for 48 hours).

Naturally, they’re touting this as the future of way we’re going to watch movies as if Netflix is going to go out of business tomorrow. But seriously, NFT and Chill doesn’t sound half as appealing. You know?

ASIC-chip maker Canaan graduates up to indexes

Canaan (CAN.Q) is a high-performance computing solutions provider that builds the ASIC chips used by crypto miners. ASIC stands for application specific integrated circuit and these chips are one of the major reasons why Bitcoin is worth what it is. Arguably. Either way, they were added to the FTSE Global Equity Index Series China Regional Index, effective after business closed last Friday, which should bring them wider attention from a much more broad pool of investors.

“With our strong earnings performance and growth momentum, we are also pleased to gain greater recognition in the capital market. The inclusion in the Index benefits our Company and shareholders by further elevating our visibility within the global investment community and potentially diversifying the Company’s overall investor base,” said Nangeng Zhang, chairman and chief executive officer of Canaan.

—Joseph Morton

Leave a Reply