In terms of revenue, Tencent (“TCEHY”) is the leading gaming company on the planet. In 2020, it grossed more than RMB156.1 billion (USD$25 billion) in online games sales which is 25% of the firms’ total sales. The Chinese enterprise owns stakes in several noteworthy game publishers, game developers, and live streaming platforms.

Tencent’s proprietorship in-game developers include:

- Riot Games (100%)

- Epic Games (48.4%)

- Bluehole (11.5%)

- Ubisoft (5%)

- Activision Blizzard (5%)

- Grinding Gear Games (80%)

- Supercell (84.3%)

- Frontier Developments (9%)

- Kakao (13.5%)

- Paradox Interactive (5%)

- Fatshark (36%)

- Funcom (29%)

- Sharkmob (100%)

Tencent additionally owns Huya, Douyu, bilibili, and Discord. We should recall that they generate sales from online advertising (17% of 2020 sales), and their FinTech and Business Services (27% of 2020 sales) so they are a well-diversified business.

But there are other “smaller” brands that are making record sales and disrupting the industry and are selling below CAD$5 per share. For reference, Tencent ADRs sells for $59.80 and has a market cap of over $600 billion USD. (the stock trades in Hong Kong at HKD$ 463.2 or about USD$ 59.50)

Today’s stock of the day is Enthusiast Gaming Holdings a Toronto-based firm that operates in the media, content, entertainment, and esports businesses in the United States, Canada, and internationally. The company manages an online network of approximately 100 gaming-related websites; owns and operates Enthusiast Gaming Live Expo, a video-gaming exhibition and provides management and support services to players involved in professional gaming.

This vertically integrated media platform also owns and manages esports teams, which cover games including Call of Duty, Madden, Fortnite, Overwatch, Apex, and Valorant. They additionally produce and program roughly 30 weekly shows across an advertising-based video on demand and over-the-top channels that represent approximately 500 gaming influencers across YouTube and Twitch.

It also operates Luminosity Gaming, an eSports franchise; and hosts other gaming events. Between its online digital media properties, its network of partner websites and video channels, its video gaming expo, and its esports organization the Company engages about 300 million gaming devotees worldwide monthly.

Their core brands are

Media

Enthusiast media and content revenue stream is comprised of over 100 websites that are wholly owned or exclusively monetized by the business and contain news, reviews, videos, live streams, blog posts, tips, chats, message boards, and other video-gaming related content.

Esports

The firm’s esports division, Luminosity Gaming, is a professional esports organization based in Toronto, Canada. It currently has fully owned teams competing in Fortnite, Super Smash Bros, Valorant, and Madden NFL. Luminosity teams compete internationally, and Luminosity has attempted to position itself as a significant contender at the highest level of competition in all games in which it fields teams. As an add-on to its competitive esports teams, Luminosity also has teams of content creators on YouTube, Twitch, and TikTok.

Subscription

The Sims Resource (“TSR”) is one of the world’s largest networks of female gamers and was ranked #7 on Quantcast’s Top 25 websites with the highest concentration of female audience in the United States (behind Oprah.com and Bravotv.com).

TSR operates on a subscription-based model and has a current subscriber base of approximately 150,700 monthly subscribers. TSR’s subscribers pay on average approximately USD$4 per month to access its VIP features.

The Company plans to continue to expand its subscription offerings across its networks of web and video properties. Enthusiast has a complementary organic and M&A growth strategy. M&A continues to be an important growth lever, having helped the Company grow and serve 300 million monthly active viewers.

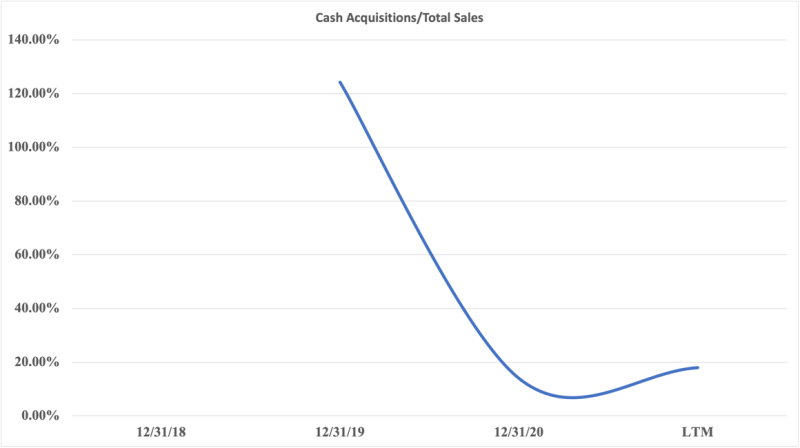

The chart above shows the relationship between cash acquisitions the business has made with the total sales. As the business has grown, they have spent more dollars on M&A. They spent $15 million, $10 million, and $22 million in 2019,2020, and the last twelve months ending in June 2021 respectively. During that period sales went from $11 million in 2019 to $72 million in 2020. In 2021 Q1 they made $30 million and $37 million in Q2.

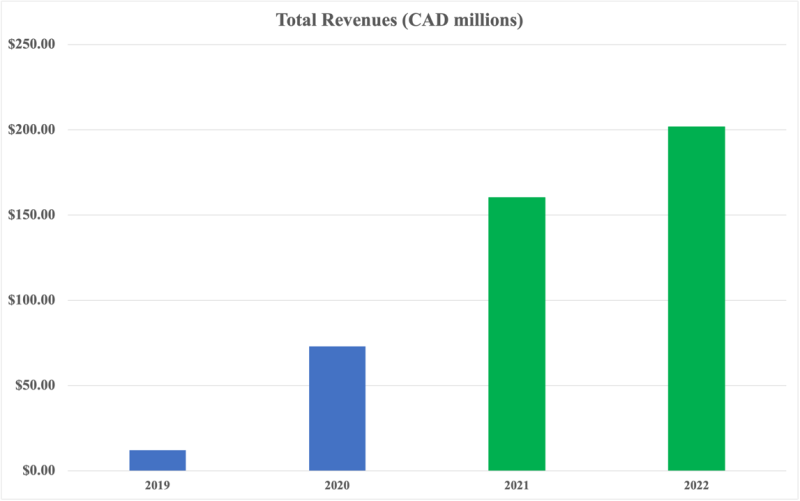

The cash outlays as a percentage of sales have dramatically reduced over time as the business grows its organic book of business and acquires assets that contribute to the top line. Analysts believe this trend will persist and have forecasted sales to be in the $130 million range in 2021, and $200 million range in 2022(as can be seen from the graph below).

With a potential CAGR of 107% in sales, 300 million monthly active viewers, and an Esports market that is growing rapidly what has the common done in its time as a publicly-traded company? Well, it went public on October 19, 2017, at $6.30 per share. From October till mid-August the stock was up over 130% peaking at $18 per share. It then plummeted by 87% from its peak of 18 to $2.21 per share in one month.

From the end of September 2019 till November 2020 that stock barely moved until it shot up by 480%. This time I peaked at just over 10 per share and has gradually lost 54% of its value since then and trades at $4.81 per share.

There are many things the stocks volatile performance can be attributed to. So, for sanity’s sake, we will not dwell too much on the stock’s past performance, but it should not be ignored. The business now generates $30 million dollars per quarter in sales, has a market capitalization of $600 million, $53 million in cash and short-term investments, and $12 million in total debt, and is trading 53% down from its peak of 10.48 in April of 2021.

Obviously, there is more to the story, and this should not be construed as a ‘buy the dip’ recommendation. The economics of the esports market is still relatively unstable and the larger firms like Tencent have diversified their business portfolios in anticipation of these diseconomies of scale in the sector. What would be great is to watch the cash flows of the business become less negative over time as it begins its process of creating shareholder value instead of destroying it.

Electronic Sports Group chairman Mike Sepso on brands’ hesitancy towards esports (Original Post)

“When marketing investments get to the level of the spend that is more thought of as traditional sports levels, and when brands have to activate those campaigns globally and through channels like esports that they’re not that familiar with, there’s a lot of hesitation,” he said. “One of the things that I’ve seen is the brands that are making big investments are getting pretty tremendous return on investment, as compared to other marketing channels—but there are huge brands out there that are in a wait-and-see mode. Through conversations that I’ve had, I feel like most of them are waiting on the sidelines mostly because they’re just not sure what to do. It’s different.”

Leave a Reply