The Company is primarily a junior exploration company with no revenues from mineral-producing operations. They focus on copper and gold projects. The company’s flagship project is the Knife Lake Project, which consists of 81 claims totaling 55,471 hectares (137,069 acres) deposits located in Saskatchewan, Canada. It also owns 100% interest in the Raney gold project, which consists of 11 mineral claims covering an area of 1,184 hectares located in the Raney Township, Porcupine Mining district.

To keep things short and simple with our analysis of Rockridge Resources we will focus on four pillars of operations that give an indication of how the business is doing.

- The first pillar being their total operating expenses

- Second would be their operating cash flows net of capital expenditures

- This will lead us to the balance sheet where we will focus on the operating assets and liabilities

- After that, we will end it by analyzing their sources of funds outside of their day-to-day cash-generating capabilities

Rockridge Resources, it’s all about managing corporate overhead

Operating expenses are significant because they can help assess a company’s cost and stock management productivity. It highlights the level of cost that a company needs to make to generate revenue, which is the main goal of any for-profit company.

Rockridge Resources, unlike other exploration companies, does not expense its exploration and development costs to the income statement but instead capitalizes them into the balance sheet through the cash flow statement.

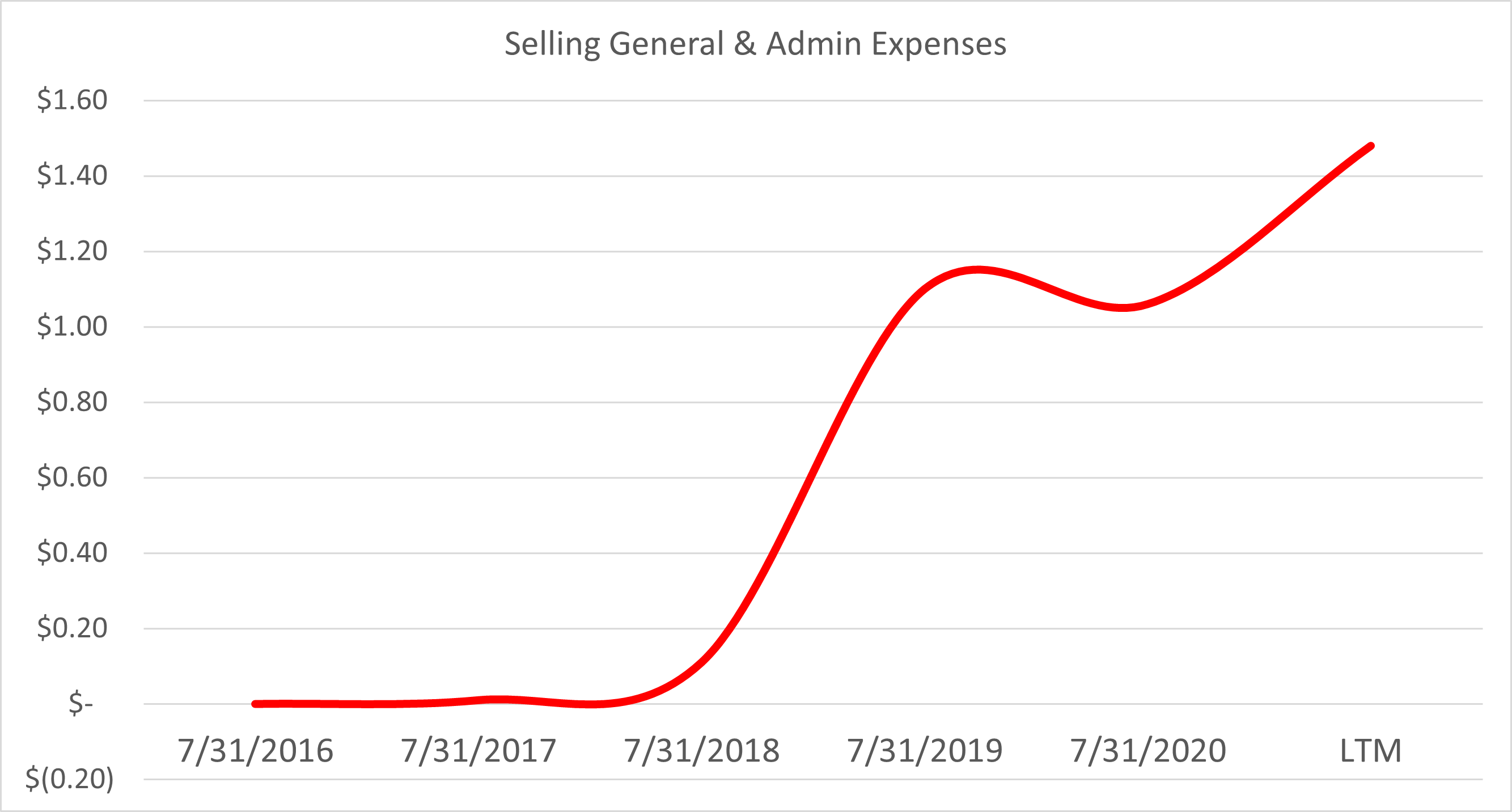

The majority of their expenses come in the form of selling and general https://equity.guru/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expenses. This consists of consulting fees, office and https://equity.guru/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration, professional fees, rent, shareholder investor relations communications, share-based payments and transfer agents, and filing fees including travel.

Since 2017 their total operating expenses have gone from $10,000 to $1.48 million as of the last 12 months. As of their latest unaudited interim financial statements ending April 30, 2021, year to date they had a total of 1.4 million in operating expenses. The majority of their expenses went to consulting fees with a total of $600,000 and shareholder communications with a total of $360,000. The next biggest expense was their share-based compensations which totaled 243 thousand dollars and a bill of $86,000 for office and https://equity.guru/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expenses.

The Company operates from the premises of a private company owned by a director that provides office and https://equity.guru/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative services to Rockridge and various other public companies on a short-term contract basis. The private company incurs costs that are reimbursed by the Rockridge. Rockridge has also entered into consulting agreements with two directors and an officer which contain a contingent obligation, exercisable at the option of the consultant, to pay a termination fee to everyone in the event of certain conditions involving concentrations of economic ownership of voting securities of the Company

As the company continues to explore its two flagship projects, we can assume that the operating expenses will increase in tandem with exploration increases. The hope is that the net present value of these projects will be positive (adjusted for the long-term spot price of Gold and Copper), meaning the cash inflows exceeds the total cash outlays over time as the business generates revenue from its mineral-producing operations.

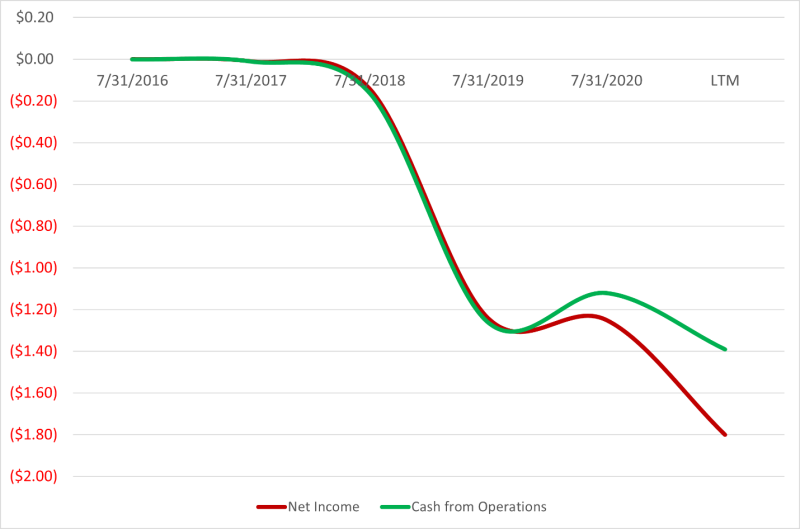

Net income is great but Operating cash flow is King

“Cash Flow is King” is a slang term reflecting the belief that money (cash) is more valuable than any other form of accounting income generated by a firm. Usually, this is because the income statement is more malleable two accounting malpractice. This can be something as simple as recording revenues faster than they economically should be increasing the bottom line of the business misrepresenting the actual cash-generating capabilities of the firm. Therefore, many investors focus on the cash flow statement because it is less malleable to manipulation, but this does not mean it is not possible to manipulate the cash flow statement it just means it is more difficult to do so.

As a junior minor it’s no surprise that their net income or their accounting income is negative as the business expands its operations in the hopes of attaining revenue through these exploration projects. The cash from operations is negative as well being that the business is using more cash than it is creating which is in line with our assumption that as they expand their operations, increasing their selling and general expenses and their working capital, the business will continue to expend cash. This means to understand the quality of the firm we must look at what they own instead of what they are generating (negative cash).

It is all about high-quality net worth

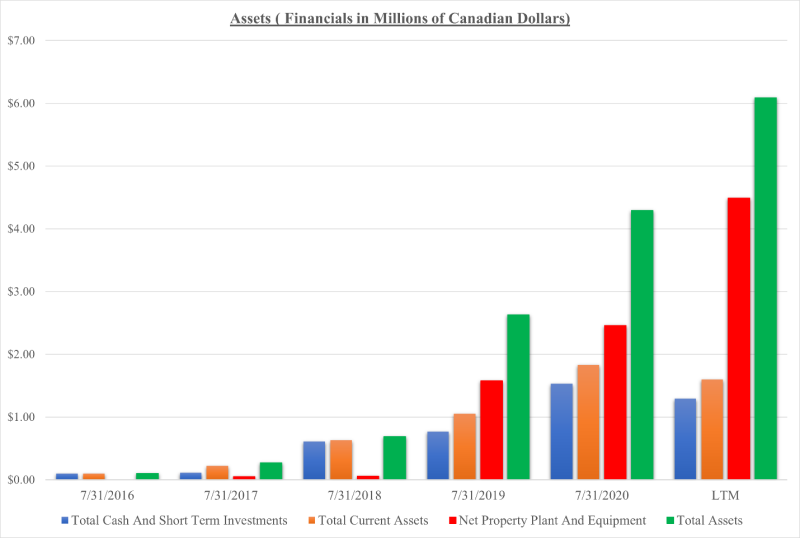

As an exploration company, it is important that the firm has high-quality assets. High-quality assets can be defined as assets that have a high potential to generate cash flow for the concern over a specified or nonspecific future period.

From the chart above it’s obvious that the total assets have grown over time mainly through their acquisition of net property plant and current equipment. Most of this equipment can be financed through capital expenditures, which we will talk about later.

In 2016 the company had a total of $100,000 in total assets, the majority of which were cash and short-term investments. Since then, their total asset position has gone up to $6.09 million consisting of $4.49 million in property plant and equipment and $1.29 million in cash and short-term investments. They also had total receivables of 100,000 and prepaid expenses of $200,000.

The total operating assets would be 4.49 million in property plant and equipment and $100,000 in receivables and $200,000 in prepaid expenses. These would be their operating assets that are utilized on a day to day to generate cash flow. We do not count the cash because it is a nonperforming asset, and this does not contribute to the organic operations of the business. But this cash is important for acquisitions or strategic investments for growth or maintenance over time. For a business like Rockridge, it is important to always have a cash cushion ready to deploy. Most companies can access funding through organic cash flow, equity, or debt financing.

Funding your Capital Expenditures

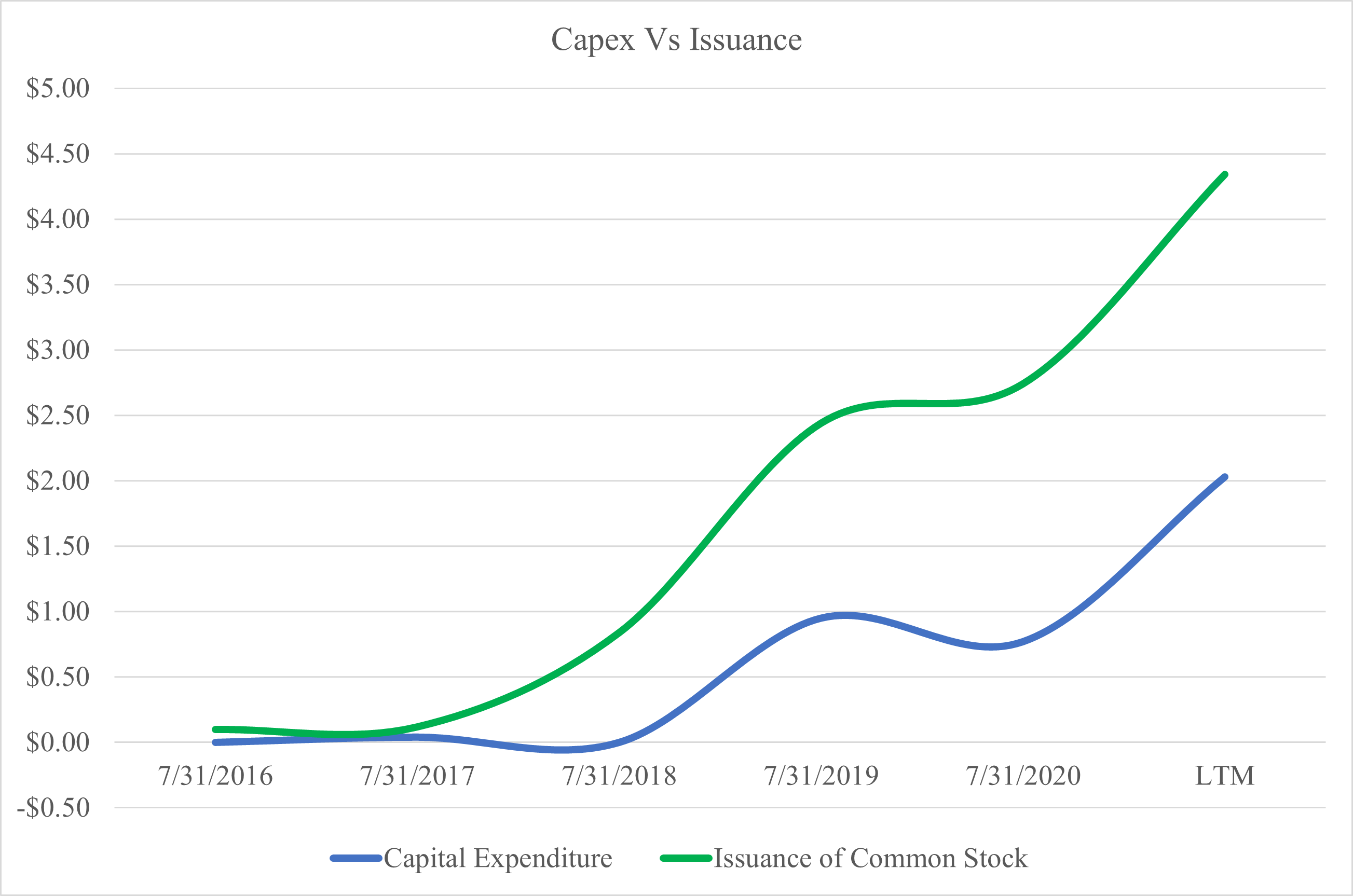

The company generates most of its cash from stock issuances. When we go to their financial statements, we notice that in 2016 they issued common stock with a total gross value of $100,000. As the business is expanded, they’ve issued between $2 million to $4 million from 2019 to the last 12 months.

If we compare their track record with issuing stock and their capital expenditures, we notice that there is also a similar correlation. Their first capital expenditure outlay was in 2017 where they spent close to $40,000. The next time they deployed capital was in 2019 where they spent $950,000, and then $700,000 in 2020 and as of the last 12 months, they’ve spent close to $2 million on CapEx.

As the company continues to push forward for profitability from sales of its copper and gold deposits, we can assume that the firm’s operating expenses would generally increase as the volume of business increases whilst issuing common stock and other financings during a period where their cash from operations is negative. The funds from the issuance of common stock will be applied to any maintenance and growth capital expenditures that will help provide future business for the firm.

The sharp-eyed readers will notice thus far, we have ignored the valuation aspect of investing. For those readers, I say congratulations on getting to the bottom where we will finally talk about to stock price quote. The closing price of the stock on September 27, 2021, was 0.095 Canadian dollars with a total market capitalization of $6.93 million.

- The company does not currently generate any sales and has an average expenditure of cash of $1,000,000 on total operating expenses.

- The company deploys between 1 to $2 million on capital expenditures

- they have total assets of $6 million and total liabilities of $330,000.

- Their CEO Jonathan Wiesblatt has over two decades of experience in the financial industry and most of his roles focused on the mining industry as an analyst and an institutional investor

- on top of having a great manager-operator, they also have over $1,000,000 in cash that is ready to be deployed

It’s hard to say if this is a bargain purchase at current prices but it sure as hell should be one of those companies you keep an eye on as they continue to expand.

Leave a Reply