BetterLife is a biotechnology company that develops and commercializes psychedelic products for the treatment of mental disorders in Canada, the United States, Australia, and the European Union.

- BetterLife. has a research agreement with the University of California San Diego for preclinical behavioral pharmacology studies of TD-0148A, a lysergic acid diethylamide (“LSD”) derivative solution.

- BetterLife is a life sciences company creating and clinically validating an evolving intellectual property portfolio of novel molecules and drug delivery mechanisms for clinical trials and commercialization.

- The Firm’s managing team has decided to implement a business-minded and cost-conscious approach to product research and development and will use contract development and manufacturing organizations on a fee for service basis to perform any research, development, or production that is required

- They also own other platform technologies, which they do not have any current plans to develop and are assessing how best to proceed with these technologies. For example, In December 2020 the company sold on a share purchase agreement, Pivot Pharmaceuticals Manufacturing Corp. This was done so the firm could strategically exit the Canadian cannabis manufacturing market.

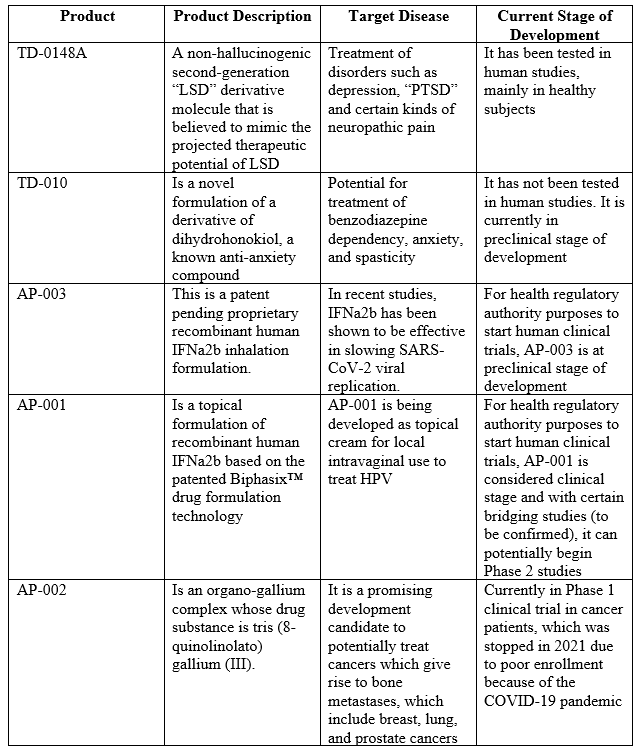

Products

Although the table below may seem complex is just a collection of the product names or titles and a description with the type of disease the product is targeting and where it is in the current stage of development.

Most of their products are still in either the development stage or entering a phase one or phase two meaning they have not yet commercialized. Most sharp-eyed readers would have gleaned over their financial statements and noticed that the company has not generated any sales yet and this is reflected in their product portfolio as well.

Do not be alarmed this is normal for a company in its industry that is trying to develop compounds that are very complex and time-consuming in the hopes that they get the needed regulations to commercialize their product.

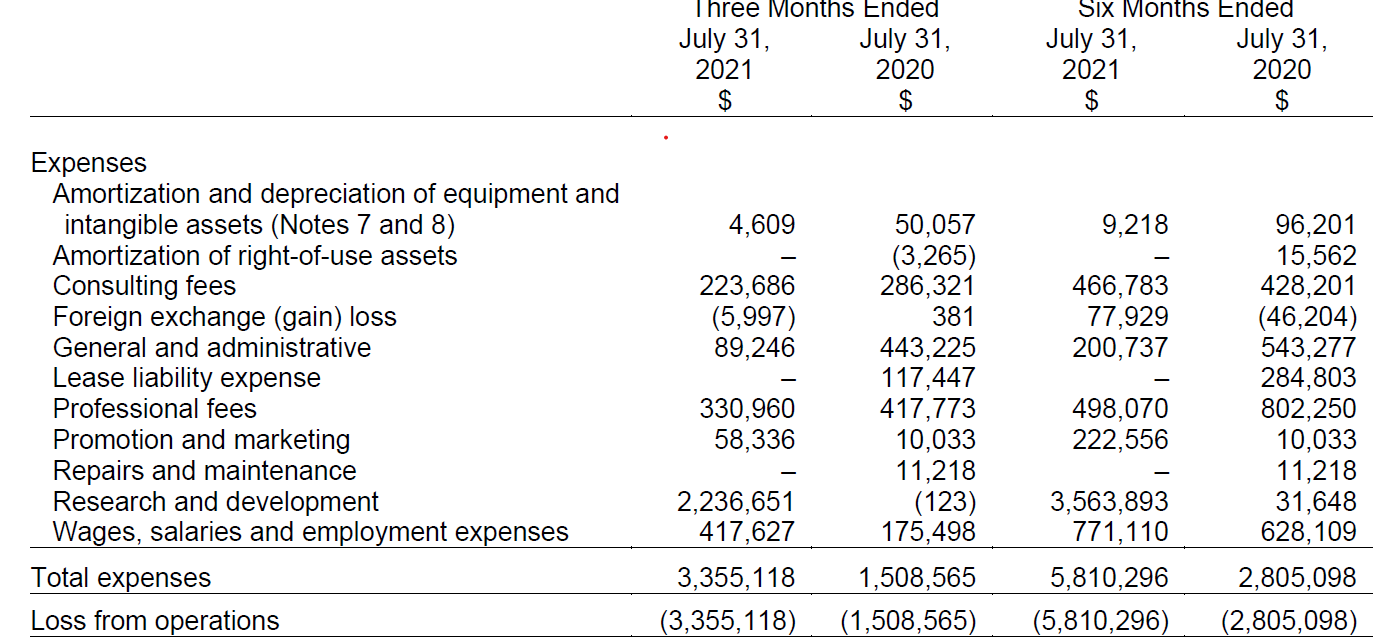

Because of this lack of sales, we’re going to focus on the operating expenses and the cost of producing their final product and break these down to understand more of what’s going on under the hood.

Pharmaceuticals companies are usually asset-light and have very little in tangible assets. In BetterLife’s case, they have a very light balance sheet when it comes to the tangible assets with only $40,000 in property plant and equipment. They also have $4.25 million in cash and $1.3 million in prepaid expenses. On the liability side, they have accounts payables of 3.57 million with short-term borrowings of around 250,000 not including long-term debt of 70,000. The company has total assets of $5.68 million and total liabilities of $4.41 million making it a company that has a net worth of $1.27 million.

Because of their lack of tangible assets, we’ll focus just on their operating expenses and break these down more. I will use their most recent Management’s Discussion and Analysis (“MD&A”) as of September 23, 2021, ending July 31st, 2021, for our analysis.

For the six months ended July 31st, 2021 the company had total expenses of 5.8 million and for the six months ended July 31st, 2020 the company had 2.8 million. The majority of this increase came from a sharp increase in the research and development expenses from $31,000 to $3.5 million. As the company starts up more research programs this figure will likely increase as their products move through the development phases.

In the same period, they also spent 400,000 on consulting fees and just shy of 500,000 on Professional fees.

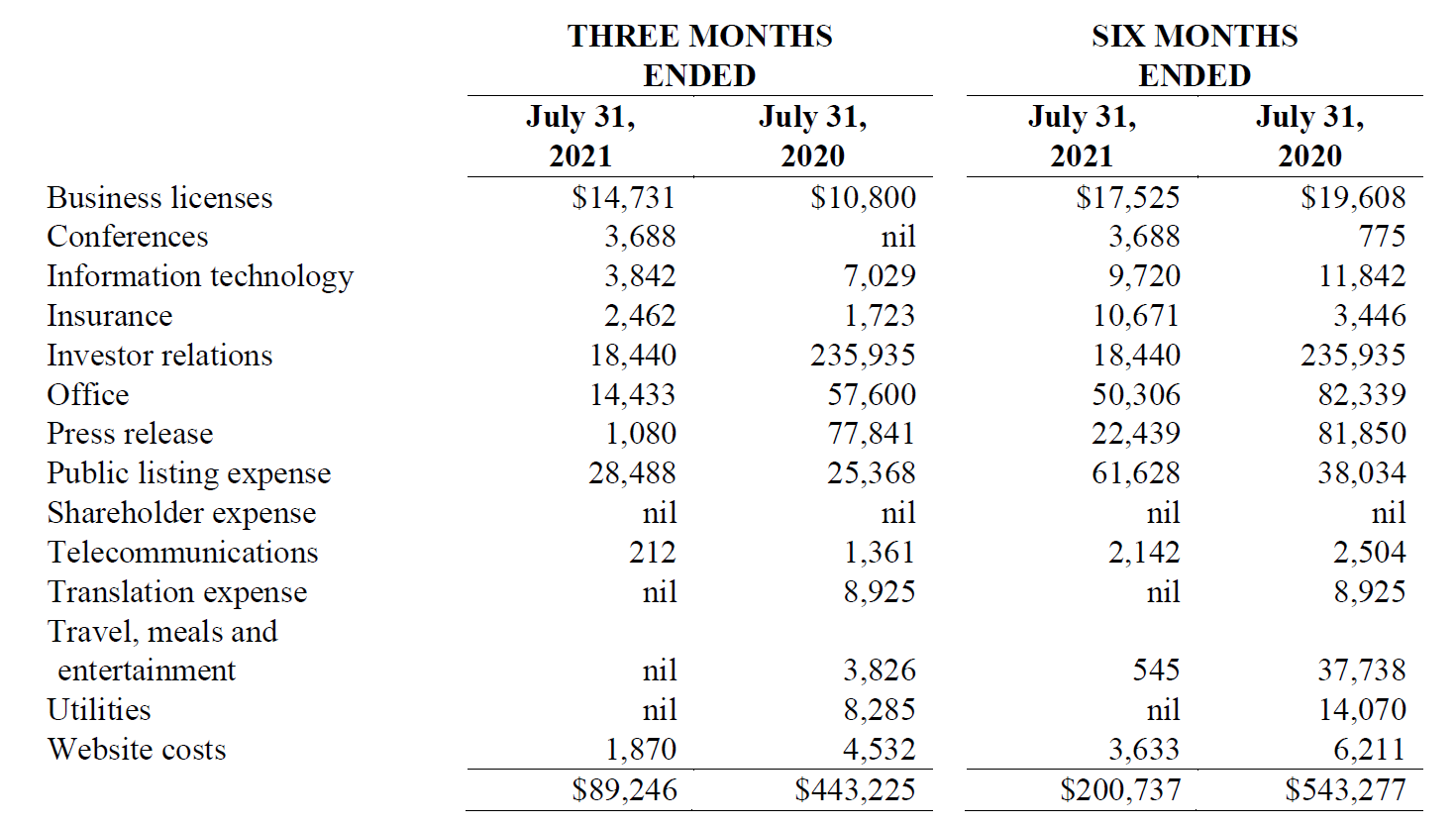

The general and https://equity.guru/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expenses which totalled 200,000 in 2021 and 500,000 in 2020.

The table above breaks down the majority of these https://equity.guru/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative costs. The sharp decrease in costs from July 31st, 2020, to July 31st, 2021, was due to a reduction in the investor relations expenses from 200,000 in 2020 to 18,000 in 2021. Further adding to the reduction in expenses was the reduction of travel, meals and entertainment from 37,000 to 545.

The company has also increased their insurance expenses from $3000 to $10,000 and reduced their office expenses from 82,000 to $50,000. It’s evident from this that over the last year ended July 31st, 2021, the company has changed its strategic positioning to focus more on its research and development and forgo discretionary costs in its general and https://equity.guru/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expenses.

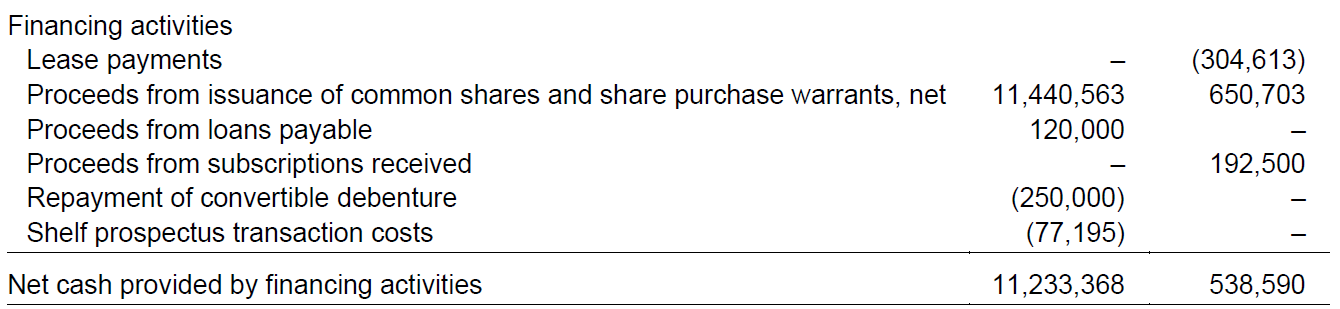

This snapshot from their financials only shows a short period of the business’s operational history. For a more concise overview of what the business has done a period of five years of financials should be looked over and the same analysis should be conducted seeing strategically if the business has shifted its resources. It’s important to see where these resources are going because a majority of the funding is coming from the issuance of common stock and not from the day-to-day operating cash flows as the business has not generated any sales.

The financing activities of the company show that they received proceeds from the issuance of common shares and share purchase warrants of $11 million and $650,000 as well as loans payable of $120,000 and subscriptions received of $195,000 net of payment of the convertible debt of $250,000 and shelf prospectus transactional costs of $77,000.

The company is currently utilizing shareholders’ funds to further expand its product portfolio in the hopes that its book of business will increase as they plan on achieving commercialization with their pipeline.

As a shareholder, this means we should expect this to continue to increase as the firm establishes its brand and product portfolio. The firm’s ability to be both business model-focused and cost-conscious will help them achieve profitability. On top of having a great strategy , it also has a great CEO in Ahmad Doroudian, Ph.D. who has 20 years of experience as a pharmaceutical CEO and finance including mergers and acquisitions and multiple IPO’s. He was also integral in the integration of pharmaceutical operations as the founder of Merus Labs that was sold for 300 million in 2017.

Not only do they have a great management team with an experienced CEO and capital allocator they have a diverse Advisory Board with the likes of Dr. Mark Swaim, MD, PhD, Dr. Thomas P. Laughren, MD, Dr. Eleanor Fish, Ph.D., Hattie Wells, and Ralph Anthony Pullen.

Biotech companies only need three things to succeed at the beginning according to Sharon Cunningham 3 tips for pharma startup success:

- Identify a clear focus

- Embrace agility

- Find the right partners

To this list, I would add a corporate management executive suite that is able to allocate capital and an ability to manage corporate-level costs. This is the magic formula that I think BetterLife wants to achieve.

Leave a Reply