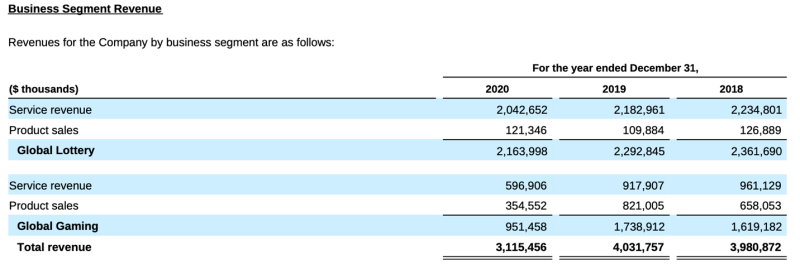

Today’s stock pick for the Gaming Sector Roundup is UK based International Game Technology PLC (“IGT”). IGT operates and provides gaming technology products and services worldwide. It operates in two segments, Global Lottery and Global Gaming. This $6 billion ($29 per share) company made $3.1 billion in sales at the end of 2020. Of that $3.1 billion they kept $1.1 billion in gross profits, meaning they had a gross profit margin of 37.3%, and they had an operating loss of $900 million.

The company operates an integrated portfolio of innovative gaming technology products and services including lottery management services, instant lottery systems, gaming systems, instant ticket printing and electric gaming machines. On top of this they also have sports betting and digital gaming to their plethora of platforms.

Products and Services

Lottery

The firm is a principal source of completely amalgamated lottery product roadmaps and advanced solutions to fast-track retail and digital convergence.

As an operator, they have an inside view on the trends that impact players and the industry. They partner with lotteries around the globe, applying their understandings and a substantial investment in research to deliver entertaining and vibrant player experiences with smooth communication across all devices, locations, and touchpoints. Most of the Company’s revenue in the Lottery business comes from operating contracts and FMCs.

Machine Gaming

The Company designs and develops cabinets, games, systems, and software for customers in regulated gaming markets throughout the world under fixed fee, participation, and product sales contracts. The Company holds more than 450 global gaming licenses and does business with commercial casino operators, tribal casino operators, and governmental organizations. The Company’s primary global competitors in Machine Gaming are American Gaming Systems, Aristocrat, Everi, Euro Games Technology, Konami, Novomatic, and Scientific Games

Sports Betting

IGT PlaySports marks IGT’s position as the U.S. market leader for B2B sports betting platform technology. The firm supports commercial gaming operators, tribal casinos, and lotteries alike. For more than a decade, IGT has been delivering sports betting solutions in Europe, Latin America, and Asia, including. Furthermore, IGT platforms have https://equity.guru/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistered more than 1.9 billion bets to date.

Digital

Digital gaming enables game play via the internet for real money or for fun. IGT offers a complete portfolio of digital gaming products, platforms, and services. Their flexible solutions are scalable and backed by a market-leading technology investment program to ensure participants always catch the next wave.

The Company’s iGaming systems and digital platforms offer customers an integrated system that provides player account management, advanced marketing and analytical capabilities, and a highly reliable and secure payment system.

Commercial Services

The Company develops technology that enables lotteries to offer commercial services over their current lottery infrastructure or over individual networks separate from the lottery. The Company offers high-volume processing of commercial transactions including prepaid cellular telephone recharges, bill payments, e-vouchers, and retail-based programs. In general, IGT’s business is not materially affected by seasonal variation although the lottery business may decrease over the summer months due to the trend of buyers being on vacation during that time.

Recently the company has realigned its corporate organizational structure to better align with long term shareholder value creation. On July 1, 2020, they adopted a new organizational structure focused on two business segments: Global Lottery (65% of service sales and 4% of product sales in 2020) and Global Gaming (19% of service sales and 12% of product sales in 2020)., along with a streamlined corporate support function. They state that the key benefits of the new structure include:

• Enabling greater responsiveness to customers and players.

• Increasing effectiveness and competitiveness in each segment.

• Harmonizing best practices in each product category.

• Increasing organizational efficiency by leveraging economies of scale.

• Improving market understanding of segment performance; and

• Reducing complexity to support IGT PLC’s intrinsic value

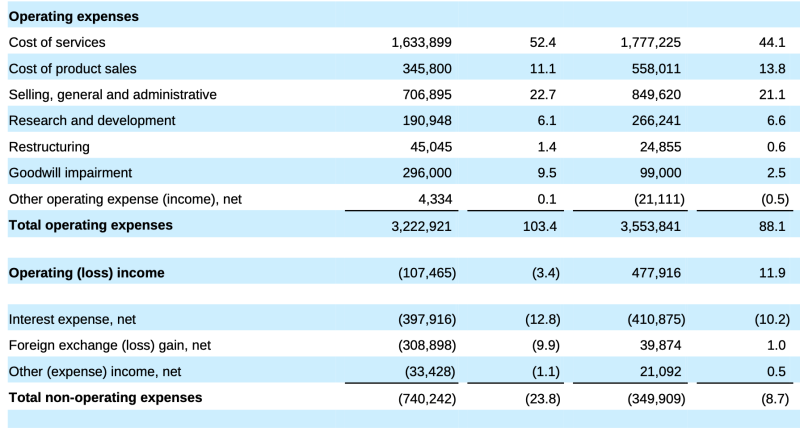

Corporate Overhead

Lastly, we talk about the total operating expenses of the business from 2019 to 2020. In 2020 the cost of services was a total of $1.6 billion or 52.4% of the total sales. It also cost them $345 million to produce the product sales. This means in total the cost of services and products was about 60% of the total sales. Compared to 2019s $1.7 billion in cost of services and 550 million and cost of product sales. The bulk of the company’s expenditures are in selling and general https://equity.guru/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expenses which constituted 20% of these sales figures. Majority of the expenses in this section would be the sales and marketing and other expenses related to the day-to-day operations of the business but not directly related to the production costs. In 2020 they spent $700 million on SG&A and $840 million in 2019.

They also spent close to 6% of their sales on research and development which came to a grand total of 190 million in 2020, and 260 million in 2019. In 2020 they took a big hit of $296 million on goodwill impairment. The company stated that this was due the expected impact of COVID-19 to the Company’s future operations. The impact indicated that it was more likely than not that an impairment loss had been incurred within certain reporting units. As a result of changes to the discount rates and changes to management’s forecasted results for the former International and North America Gaming and Interactive reporting units, the Company recorded non-cash goodwill impairments of $193.0 million and $103.0 million, respectively.

Restructuring for 2020 increased $20.2 million, or 81.2%, to $45.0 million from $24.9 million for the prior equivalent period. This increase was primarily due to management initiating restructuring plans in 2020 to achieve long-term structural cost savings by simplifying the organizational structure.

Since the total sales decreased from 4 billion in 2019 to 3.1 billion in 2020 the total operating expenses as a percentage of sales increase from 88.1% in 2019 to 103 percent in 2020 although the dollar value decreased from 3.5 billion to 3.2 billion.

During that reporting period the stock was up 12% and from its pandemic low of $4 per share it is now up 525%. Sales in the last twelve months are 3.7 billion dollars!

Although it might seem like we’ve missed the perfect buying opportunity with this one there is always room for the company to grow as the market expands. Shareholders should expect corporate overhead just still hangover the company as it repositions itself in the lottery and gaming sectors. As the company makes strategic investments there will be more write-downs and restructuring costs that would put a noncash burden on the income statement. although the business is not perfect and it does have its faults this is one to put on the watch list.

Leave a Reply