It’s getting a little hard to keep track of who does and who doesn’t like Bitcoin. This week, George Soros offered an endorsement whereas three years ago he panned it, calling it a “typical” bubble.

The head of Soros Fund Management argued thi sweek that it has even more long term potential.

“I’m not sure bitcoin is viewed only as an inflation hedge here. It’s crossed the chasm to mainstream,” said Dawn Fitzpatrick, CEO and chief investment officer of Soros Fund Management.

For the rest of us, especially those of us who have been watching this develop for the better part of a decade, there’s no end to the amusement of these so-called big names getting their waffle on and parroting what we’ve been saying all this time.

But wait for next week. Bitcoin will be down twenty, thirty, forty percent, and everyone will start flapping their pieholes, issuing fast retractions and generally continuing to be hilarious. Here’s what everyone’s responding too, if you’re new here.

And here’s what’s happened in the world of crypto.

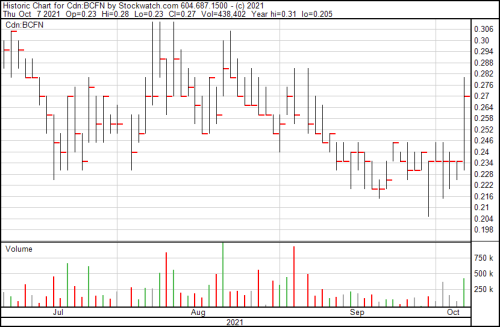

Blockchain Foundry and House of Kibaa get on the NFT train.

Blockchain Foundry (BCFN.C) and House of Kibaa (HoK) have put their collective heads together to create and deliver a generative art non-fungible token drop, which they’re calling GenZeroes and the Rise of the X. They’ll be minted as digital collectibles with exclusive memberships carrying unique benefits.

“House of Kibaa is taking augmented reality to another level and has been gaining a lot of attention in the world of NFTs and VR [virtual reality]. It is a pleasure to continue working with the talented HoK team, and this experience has brought us to the forefront of generative art NFTs. We’re looking forward to our continued partnership with HoK and to releasing more exciting news about our upcoming ecosystem partners,” said Dan Wasyluk, chief executive officer of Blockchain Foundry.

This is the first time we’ve heard from BCFN for awhile now, and it’s unsurprising that they’ve found a way into the non-fungible token space, and taken HoK with them. The partnership on this particular deal seems more like they’re made for each other.

Bigg’s Netcoins exchange goes legit

Last year, if I had to place a bet on which blockchain or crypto company was going to get the Canadian government’s nod to go legit first, I would have bet all my money on Bigg Digital Assets (BIGG.C). It’s their tech and the deals they’ve brought in—specifically, Qlue, and it’s ability to scan various blockchains and watch coin movements from address to address—and it’s brought in big contracts from undisclosed government organizations looking to well… find a way to get a bit more control of transactions on the blockchain.

Honestly, Netcoins, being one of their subsidiaries, seems like the first solid bet for the first exchange to get the nod. They’ve followed all the rules and dictates as set out on the emerging crypto regulatory regime, and now they’re looking towards adding more coins, more options and potential United States expansion.

“This is a great day for crypto in Canada. After a lengthy process, we are thrilled that Netcoins has been registered as a restricted dealer in Canada. This marks a first for a public company in Canada and sets Netcoins up for a bright future. This registration will enable Netcoins to expand advertising to channels not available to unlicensed competitors, expand coin offerings, open up new partnerships, and will attract retail and institutional customers seeking a licensed and regulated trading platform. We also believe regulation will shrink the competitive playing field in Canada as non-compliant companies are forced out of the market. We look forward to updating shareholders with more news in the coming weeks,” said Mark Binns, Bigg’s CEO.

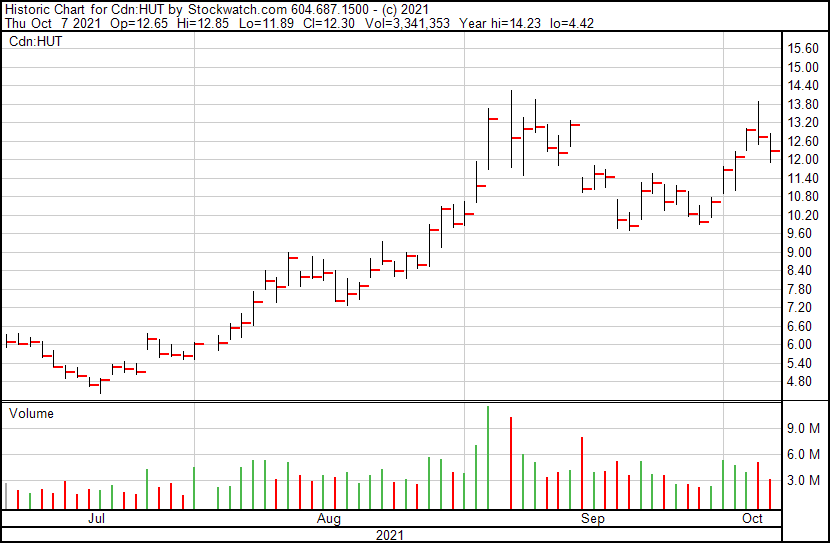

Hut 8 Mines 264 bitcoin in September

It’s update day for Bitcoin miner, Hut 8 Mining (HUT.T). They mined 264 bitcoin over the month, averaging out to 9.11 bitcoin per day. They deposited all of their bitcoin for September into custody, keeping with their hodl strategy. Now their total bitcoin reserve is 4,724.

Mining equipment deployment update for September, 2021:

- Received and installed 600 servers consisting of 2,400 Nvidia cryptocurrency mining processors (CMPs) graphics processing unit (GPUs), resulting in a daily earning of 7.10 ethereum, equivalent to 0.5 bitcoin per day totalling $25,000 in income per day;

- Deployment of Nvidia CMP GPUs has progressed over the past 30 days, and approximately 25 per cent of the company’s total server fleet is deployed and earning;

- To date, Hut 8 has earned $265,000 from the CMP deployment.

“Our current capacity of deployed CMP GPU miners will continue to earn $25,000 per day, ramping up to the full capacity earnings over this period, which is expected to be at $110,000 per day, based upon current mining economics. Hut 8’s full CMP deployment has been hampered by the supply chain constraints and manufacturing shortages many industries are experiencing globally. We continue to work with our technology partners and we anticipate this issue to be resolved early in Q4,” said Jason Zaluski, CTO of Hut 8.

When you consider that Bitcoin is up over $54K, the only reasonable response to this news is… unrelenting jealousy.

This whole Bitcoin mining thing seems to be working for for Marathon

But if Hut 8’s Bitcoin haul brought out the jealousy, you’re going to need to hold Marathon Digital Holdings’ (MARA.Q) beer. They minted 1,252.4 new bitcoins during Q3 2021, boosting their production by 91% quarter over quarter. In September alone, they brought in 340.6 new bitcoins, and their total bitcoin holdings are now 7,035. Market value? $336.3 million.

You could theoretically have gotten that many bitcoin in a month or two if you were mining back in 2010, when it was under a buck. There are lots of folks out there pontificating on where Bitcoin’s going to be this time next year. Some say zero and others say orbiting Saturn. I’m somewhere in the middle.

“In the third quarter, we increased our bitcoin production by 91% quarter-over-quarter to 1,252 BTC, which increased our total bitcoin holdings to approximately 7,035 BTC. Our September production figures were impacted by a material increase in the total network’s hash rate, the ‘luck’ factor inherent in bitcoin mining, and two days of scheduled downtime at the Hardin power plant. While some amount of downtime and ‘luck’ will always be present in bitcoin mining, affecting results in the near-term, we believe our production will become more stable over time as we continue to bring new miners online and achieve greater scale,” said Fred Thiel Marathon’s CEO.

Riot Blockchain’s mining operation isn’t looking too bad either

I’ve been down on Riot Blockchain (RIOT.Q) over the past few months because of their general lack of social responsibility. Honestly, setting up a Bitcoin mining operation in Texas, taking advantage of what is essentially an ancient energy source running on fossil fuels isn’t good for anyone. You, me, or bitcoin. But that doesn’t mean it’s not lucrative.

In September, they brought in 406 BTC, which is an increase of 346% over its numbers from this time last year, which were 91 BTC. Their year to date has then at 2,457 BTC, which is a 236% increase over the same time last year—which was 731 BTC. Surely, you’re noticing a pattern here. The grand total BTC that Riot’s presnetly holding as of Sept 30, is 3,534 BTC, produced by in-house self-mining. And they have 25,646 miners an da hashrate of 2.6 exahash per second.

They’re a big deal in the space. That’s why they need to get in line on the green crypto initiative.

Bit Digital closes private placement

Bit Digital (BTBT.Q) closed a private placement with institutional investors for 13,490,728 ordinary shares. The company also offered unregistered warrants for an extra 10,118,046 shares. The purchase price for a share and a warrant for three fours of an share is $5.93. The warrants will be met at an exercise price of $7.91 per share. They’ll carry a three and a half year timeframe following the resale registration statement.

They made roughly $80 million off the deal.

Nobody ever said Bitcoin mining was cheap and if you want to stay competitive in the game, you’re going to need to dole out the dough.

Hello Pal has some curious moves

Hello Pal (HP.C) pulled in $2,707,496 in revenue for September from its mix of livestreaming services nad cryptocurrency mining ops. The gross margins for the period tell the tale—the numbers look like 68% for mining and 15% livestreaming. The livestreaming operations were up 30% in revenue from their non-China territories—specifically in the Middle East and Southeast Asia.

Meanwhile, they endured a significant amount of volatility in the cryptocurrency pricing, which resulted in lower revenues than they’d expected. Factor in the whole ‘we need to leave China’ thing and they’re hoping to reach full capacity sometime in the next two to three months.

They’re not there yet. Interesting enough, though, they’re not mining Bitcoin or Ethereum, but Dogecoin and Litecoin and they still brought in almost three million. Not bad.

“We’ve been very fortunate in having Shanghai Yitang helping us navigate the current fast-changing cryptocurrency environment in China. Although there may be some delay compared to our initial expectations, we do not foresee any major hurdles in implementing our original plans regarding cryptomining and its incorporation into our international social platform,” said K.L. Wong, founder and chairman of Hello Pal.

The company has also sold 4,500 of their existing Antminer L3+mining rigs for 2.1 million tether (or roughly $2.67 million). They bought these as part of a 12,500 mining rig package for $3.5 million in June of this year, and have since sold off a chunk, giving them a profit on the sale. Not bad.

They’re using the proceeds to buy 100 units of Antminer L7’s, which are the latest Litecoin/Dogecoin mining rigs to be released by Bitcoin. They carry a hashrate of 9,500 megahashes per second, which are 19 times faster than the existing L3’s.

BTCS Digital Asset Analytics Platform In Beta Release

BTCS (BTCS.Q) just launched their own digital asset data analytics platform. If you’re into crypto, and specifically cryptocurrency arbitrage, then this is the one you’ve been waiting for. It gives you the ability to connect multiple exchanges to aggregate portfolio holdings into one platform so you can see how various coins are performing at various exchanges at the same time. The company intends to integrate its platform with its staking-as-a-service platform, so you can watch your crypto grow (or shrink – let’s be fair) over multiple exchanges and platforms.

Mostly, when you’re doing arbitrage, the only ones who make bank are the exchanges themselves through onboarding and offboarding charges, but in this case it might be possible to take your BTC to USD pairing that isn’t working out on exchange A – and move it over to exchange B which offers a coin that’s doing much better.

“The digital asset market now records over $48 billion of transactions each day, up +30% compared to over a year ago. Despite rapid maturation of the market, the need for a sophisticated, comprehensive solution to track digital asset holdings and performance remains in its infancy. We are building our platform to serve this unmet need,” said Charles Allen, CEO of BTCS.

The platform presently supports Coinbase, Gemini, Bitstamp, Kraken, Binance.US, Bittrex adn FTX-US. The company intends on expanding on its bevy of performance-tracking tools, as well as adding additional centralized and decentralized exchanges, wallets, and staking options.

Mobilum Technologies adds another crypto-to-fiat option for would-be crypto-consumers

Mobilum Technologies (MBLM.C) launched their new crypto-to-fiat off-ramp product. You can offload to a gift card, or via debit or credit cards. The off-ramp is the natural logical extension onto their fiat-to-crypto onramp. The gift cards are from major retailers across 80 different countries with over 2,000 retail brands and no fees.

“This new product feature opens up a significant revenue stream for the company, and we are excited to see the continued customer and market demand for these services/ Off-ramp services are an evolving and core part of our product strategy. Our goal is to ensure our partners and customers have a secure, compliant and efficient payments ecosystem to entrust and move in and out of,” said Wojciech Kaszycki, Mobilum’s CEO.

There’s more.

Mobilum’s subsidiary, Xport Digital, signed into a memorandum of understanding with online back office solution PhyloPay.

PhyloPay offers accounting, vendor management, payroll and procurement. The agreement has Xport integrating its simple fiat-to-crypto and crypto as a payment acceptance widget into their back office solution.

—Joseph Morton

Leave a Reply