Ginger Beef (GB.V) is a company traded on the Canadian markets that operates as a franchiser of Chinese food restaurants located primarily in Calgary, Alberta Canada. The company franchises takeout and delivery units, full-service restaurants, and food court concepts under the Ginger Beef Bistro House, Ginger Beef Peking House, and Ginger Beef Express names. It also manufactures fresh and frozen Chinese food items for wholesalers primarily in Canada.

In terms of retailers and distributors, it really is an impressive list:

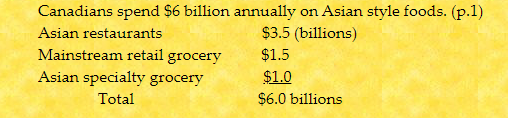

There is a trend of Asian style foods here in Canada. I must say, it is my favorite cuisine. Ginger Beef states that Canadians spend $6 Billion annually on Asian Style foods. This number will likely grow in the future. One of my favorite long term holds has been Loblaws. I got extremely bullish when they bought T&T Supermarket, because I know the Asian style food trend is only going to get stronger.

My regular readers know I am bullish agriculture and foods. It seems like supply chain issues and inflation are already here. Just an example: went to Costco this weekend to buy groceries. Prices were significantly higher. I pick up a big container of Vegetable Oil for cooking. For years it has always been $21. This time the price was $41. Canadians will be feeling the pinch in their wallets. Not only are food prices rising but so is gas for driving and natural gas for heating homes as we head into Fall and Winter. Agriculture and food stocks such as Ginger Beef will be the way to play this trend.

I highly recommend investors to read TK’s financial piece on Ginger Beef. He likes the numbers. It is a well run company. I must admit, the first time I was told about this company, I thought of the New Jersey Deli that went public and has a market cap of over $100 million. The stock (HomeTown International, Ticker:HWIN) is still trading at $13.75 per share. But Ginger Beef has been publicly traded for years, whereas HomeTown took advantage of the current market environment. All power to them.

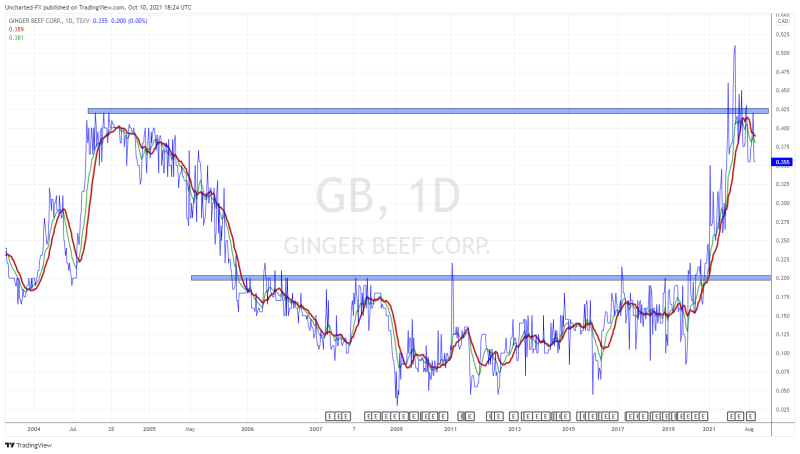

Now let’s get down to the chart:

For Ginger Beef, it would be better showing the line chart rather than the candlestick chart for one simple reason: liquidity. Not many shares are traded. In fact, no shares have been traded or exchanged hands from September 30th 2021 to today.

The line chart also better shows us the major technical breakout. Ginger Beef has been ranging from 2006-2020. Price always remained below $0.20. Near the end of 2020 (in December), price broke out, and then in subsequent weeks, pulled back to confirm the retest. And what a confirmation! January 20th 2021 saw a huge 70.73% rally day! The stock slowly drifted upwards hitting all time record highs of $0.55 in May of 2021. Where we stand now, the stock is currently up 44.90% year to date.

What next? Well, using a technical approach, the stock remains bullish above $0.20. A decade long range break is huge. Bulls will want to keep prices elevated above it. I have drawn a resistance zone above at previous record highs. This is at $0.425, which has seen recent touches. Price needs to close back above for another momentum move higher. Where we are right now, the $0.355 zone, provides interim support.

So do I think Ginger Beef heads higher? We have a technical breakout. Food prices are going to move higher, and supply chain issues will have money looking at agriculture and food plays. Finally, the company itself, according to TK’s financial analysis, is being run very well. All bullish indicators. The only problem is that the stock is thinly traded.

Leave a Reply