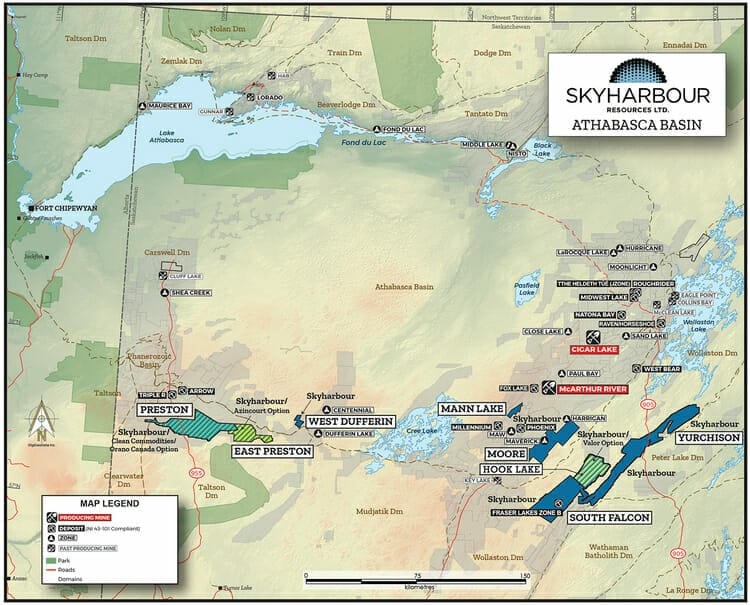

Skyharbour Resources (SYH.V) holds an extensive portfolio of uranium and thorium exploration projects in Canada’s Athabasca Basin.

The company has six drill-ready projects consisting of over 240,000 hectares.

“After years of stagnant prices, a 37% rally in prices for nuclear fuel uranium has helped attract investors back to the sector,” reports the Financial Times on October 11, 2021, “The price of raw uranium, known as yellowcake, rose to its highest level since 2012 at $50 a pound last month.”

For the last 24-months, Skyharbour’s stock has been on fire.

Let’s review the fundamentals.

Uranium is required to power nuclear reactors.

Nuclear reactors are required to stop the planet choking in smog.

For the survival of our species, there is no other way forward.

Yet, nuclear reactors have a reputation for being unsafe.

True, when something goes wrong – it tends to be dramatic and deadly – like a plane crash (20 million North Americans suffer from chronic fear of flying).

But fear of flying and fear of nuclear reactors is irrational, according to government data.

US Census data puts the odds of dying as a plane passenger at 1/205,552.

Following the March, 2011 Tōhoku earthquake and tsunami, the Fukushima I Nuclear Power Plant disaster was a highly publicised “nuclear plane crash.”

Although there were no deaths caused by acute radiation syndrome, about 2,500 Japanese people died from “disaster related deaths” – mostly caused by a clumsy evacuation of residents out of the radio-active area.

“Perhaps best characterized as a cash-rich Athabasca Basin land baron, Skyharbour holds an extensive portfolio of projects beyond its flagship property,” wrote Equity Guru’s Greg Nolan on October 21, 2021, “all strategically located—all boasting significant discovery potential”.

“In order to push these projects further along the exploration/development curve, management deploys the Prospect Generator Model (PGM), where strategic partners fund exploration and make cash/share payments for a majority stake in the project.

Multiple irons in the fire via these partner-funded programs = multiple shots at a new discovery.” – End of Nolan.

For a geologically savvy over-view of Skyharbour’s uranium assets, we highly recommend you read the entire October 21, 2021 article..

Nuclear energy now supplies 10% of the world’s electricity and is responsible for one-third of global carbon-free electricity. In the United States, nuclear provides 20% of the country’s electricity and over 50% of its carbon-free energy.

There is also a footprint issue.

Due to the encroachment of suburbs, arable (farmable) land is being lost at the rate of over 38,000 square miles per year.

A wind farm requires about 360 times more land than a nuclear plant.

“China has pledged to increase nuclear power generation to 70 Gigawatts by 2025, from 50GW currently, as part of President Xi Jinping’s plans to move away from coal,” reports the Financial Times.

“At the same time,” added the Times, “President Joe Biden’s U.S. administration has said that nuclear will be included in its ‘clean energy standard’ that would mandate utilities to produce power that is carbon-free by 2035.”

In this informative September 22, 2021 video interview, Skyharbour Resources CEO Jordan Trimble talks to INN about the company’s six high grade #uranium projects scattered throughout the #AthabascaBasin in northern #Saskatchewan.

“The flagship project Moore Lake where we just announced our first batch of drill results from the 2021 drill program has returned some notable high grade mineralized zones over the last few years of drilling,” stated Trimble.

“More recently, we’ve been drill testing targets in the underlying basement rocks. This is the geological setting that most of the recent discoveries in the Athabasca basin have been made in so we are looking for higher grade mineralization at depth,” added Trimble.

“These were targets that had been untested or poorly tested by previous operators. So, we feel that there is a lot more mineralization to be discovered at the project. And that’s what we’re going to be testing with the ongoing drilling”.

Trimble then talked about the prospect generator model.

“In addition to our flagship project, we have a host of other properties scattered throughout the Athabasca basin,” stated Trimble, “We’ve been opportunistic over the last eight years acquiring these projects for pennies on the dollar.”

Trimble noted that one of the benefits with the prospect generator business is that it creates additional news flow on top of the drilling they are executing at the flagship Moore Lake project.

“The work is predominantly funded by partner companies,” stated Trimble, “Though we do typically retain a fairly large equity holding in these partner companies. As the market moves higher, those positions increase in value, offering investors multiple shots at new discoveries in the Athabasca Basin”.

It’s generally a good sign when a small resource company has big names amongst its stakeholders – and boy does Skyharbour have that.

- Insiders/management

- Denison Mines Corp. (TSX: DML)

- Marin Katusa and KCR Fund

- OTP Fund Management Ltd.

- Sachem Cover Partners

- Extract Capital

- Paul Matysek

- Jeff Phillips (Global Market Development)

- Doug Casey

If these names are unfamiliar, Google “Marin Katusa” “Paul Matysek” and “Doug Casey.”

Check out Equity Guru’s investor round-table here:

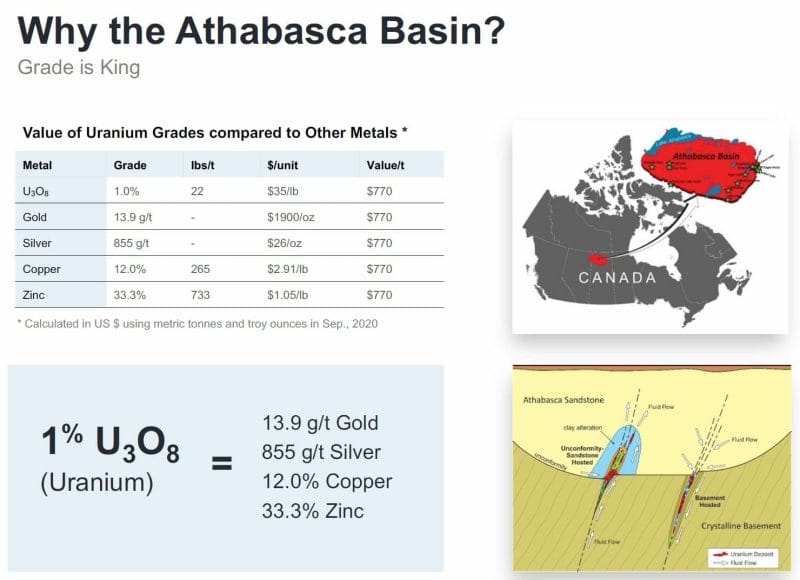

“On September 14th, 2021 the Company released one of the highest grade intercepts discovered to date at the Maverick East Zone,” wrote Greg Nolan, “Hole ML21-03 tagged an impressive 2.54% U3O8 over 6.0 meters from 276.0 to 282.0 meters (including 6.80% U3O8 over 2.0 meters from 278.5 to 280.5 meters).

Compared with nuclear power, coal is responsible for 5 X more worker deaths from accidents, 470 X as many deaths due to air pollution among members of the public, and more than 1,000 X as many cases of serious illness.

Uranium is having a moment.

But to some degree, the stock price of innovative uranium companies like Skyharbour is still suppressed by the unpleasant memory of the 2011 Japanese reactor meltdown.

As the hard data blows away some of the fog, attitudes are changing and so is investor enthusiasm for uranium.

Full disclosure: Skyharbour is an Equity Guru marketing client.

Leave a Reply