Gold is currently trading at a two-month high of USD $1,830 – despite the fact that Central Bank bullion purchases are down from 2019 highs, and many gold ETFs have experienced outflows.

What’s pushing gold prices higher?

Demand from jewellers and small investors.

If gold prices continue to rise, the gold juniors (GDXJ.NYSE) will typically out-perform bullion and big-cap miners.

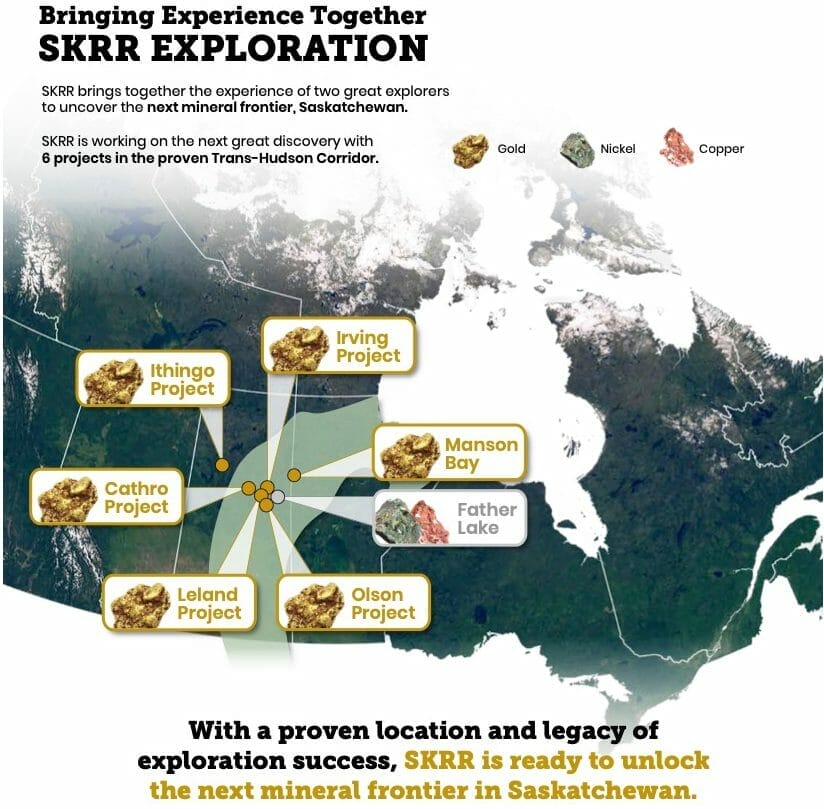

SKRR Exploration (SKRR.V) is an explorer focusing on the Trans-Hudson Corridor in Saskatchewan in search of world class precious metal deposits.

“Saskatchewan is ranked #3 in the world for Mining Investment Attractiveness,” reported Equity Guru’s Chris Parry on October 6, 2021, “Saskatchewan loves a mine, can’t get enough of them, would marry them in a heartbeat if they were asked”.

“SKRR’s projects are hosted ‘in close proximity and in the same regional geology as the Santoy Mine and Seabee Mill, operated by SSR Mining Inc,” continued Parry, “both high grade/high margin gold mining operations.’ When an existing mine or two are pounding ore out, that means you’ve got power, roads, people, and transport nearby”.

On October 20, 2021, SKRR Exploration announced the completion of a 12-hole drill program on its 100% owned Manson Bay gold project, which consists of 13 mineral claims compromising a total of approximately 4,293 hectares.

“The primary focus of the drilling was to test the historic Manson Bay Gold Zone, where historic drilling by Hudbay Minerals (1985) and MinGold Resources (1987 to 1988) outlined a gold-rich zone,” stated SKRR, “With highlights such as historic drill hole MBO-15 that intersected 15.39 grams per tonne gold over 10.03 m including a high-grade interval of 23.13 g/t Au over 6.40 m.

“I count six, the number of properties that make up the Company’s current project pipeline,” wrote Equity Guru’s Greg Nolan on September 20, 2021, “Company Chairman, Ross McElroy, a highly regarded professional geo with over three decades of kicking rocks in the province, supplied several projects of his own to set the SKRR vehicle in motion.”

Since the above infographic was created, SKRR entered into a non-arm’s length acquisition to acquire a 100% interest in Edge Geological Consulting’s Watts Lake zinc property, consisting of 24 mineral claims compromising a total of 13,700 hectares.

“Zinc has a range of applications across many industries, including agriculture, construction, pharmaceuticals, and transportation,” explains Sherman Dahl, CEO of SKRR, “Approximately half of the world’s supply is used in corrosion-proof galvanized steel, which is widely used in infrastructure projects.”

“Electric vehicle demand is fueling demand for all metals including Zinc and Nickel. Watts Lake fits in with our Father Lake Nickel project and our well-advanced gold properties in the Trans Hudson Corridor – the home of giants SSR mining and Hudbay Minerals,” added Dahl.

Watts Lake Property Highlights

- World-Class Jurisdiction: Saskatchewan is consistently ranked globally as a top mining investment jurisdiction

- Large Land Package in a Favorable Geological Setting: Watts Lake is a large contiguous land package consisting of 13,708 ha in the established, deposit endowed La Ronge Domain, of Saskatchewan. The project is strategically located near important infrastructure, including within 20km of major provincial highway network.

- Historic Borys Lake Lead-Zinc Zones: The Borys Lake Corridor is anchored by the shallow depth historic Borys Lake lead-zinc deposit, including all four known drill hole delineated zones; Mac, Main, Will A/Will B and Sam zones. The main zone was interpreted to have an approximate strike length of 975 m and widths varying from 5.3 to 19.5 m with the zinc to lead ratio being approximately 10:1). Mineralization is open along strike and at depth.

- Strong Blue-Sky Potential: Watts Lake Project area covers multiple, parallel basement conductive corridors, identified by a 2008 airborne versatile time-domain electromagnetic (VTEM) geophysical survey, including the entire approximately 14km-long Borys Lake conductive corridor, as well as significant portions of parallel corridors. The conductive corridors have numerous drill intersected and surface identified mineralized occurrences of zinc, copper, and silver as well as anomalous gold, nickel and cobalt.

Ross McElroy is a director of SKRR and is also a director of Edge, therefore the Watts Lake deal is a “related party transaction”.

In the video below, Jody Vance talks to SKRR Exploration Chairman & Director, Ross McElroy.

McElroy is a professional geologist with over 30 years of experience in the mining industry.

McElroy has been instrumental in several major uranium discoveries in Saskatchewan and three major high-grade gold deposits.

Call him the Sidney Crosby of resource extraction, McElroy is a gifted player who elevates the game of his teammates. Like Crosby – he has a cabinet full of trophies.

“There is an inclination now to look to bitcoin as a portfolio diversifier, with inflation being one of the catalysts,” said Mohamed El-Erian, president of Queens’ College, Cambridge and chief economic adviser to Allianz. “Bitcoin has attracted money away from gold.”

Historically (100% of the time) when an army of neophyte investors pile speculatively into an asset class, the bubble will pop and the price will plummet dramatically. Bitcoin could be the first counter-example to that rule – but we wouldn’t bet on it.

For investors seeking hard assets, at $1,830 USD/ounce – gold is a viable option.

“I’ve spent the better part of my career in Saskatchewan,” concluded McElroy, “We have excellent opportunities in our own backyard. The ground is easily accessible and we’re comfortable operating in this area”.

In this September 20, 2021 McElroy gives an overview of SKRR and the gold market.

“Gold is an important commodity that comes to the forefront every time that there’s uncertainty in the economy,” stated McElroy, “Gold has had a great history for thousands of years and it’s just as important in today’s economy as it as it ever was”.

“The price of most commodities is strong now. We’re looking at over $1,800 US an ounce for gold. It’s held up relatively well. If you look at a chart path over the last year or two, it’s up substantially. Investors are probably wise to be taking a look at gold as part of their portfolio”.

Many investors have strong concern for the environment and for community governance.

“That’s where Canada ranks very highly,” confirmed McElroy, “The province of Saskatchewan is right up there in the upper two or three places in which to conduct mining. So, it’s an investment friendly environment.”

Full Disclosure: SKRR Exploration is an Equity Guru marketing client.

Leave a Reply