While waiting on drill results from its flagship Moore Uranium Project in the prolific Athabasca Basin of Saskatchewan, Skyharbour Resources (SYH.V) has been active on multiple fronts.

This cash-rich Basin-based land baron holds an extensive portfolio of projects beyond its flagship asset, all strategically located—all boasting significant discovery potential.

In order to push these projects further along the exploration and development curve, management wisely deploys the prospect generator business model with strategic partners who make staged cash/share payments to Skyharbour and commit to exploration expenditures for a majority stake in the project.

This prospect generation model is a win-win proposition that activates multiple exploration projects while preserving capital and minimizing dilution. In Skyharbour’s case, it’s a way of monetizing early-stage assets while retaining a substantial stake in the project (via a minority stake, JV partner equity, and in some cases, a weighty NSR).

The Partner Companies/Projects

Preston

The Preston Uranium Project is a joint venture (JV) with Dixie Gold (DG.V) and industry-leader Orano Resources Canada.

Orano has so far secured a 51% interest in the project, having spent CAD $2.8 million on exploration and making cash payments totaling $200,000 over the previous three years. The $200k was divided evenly between Skyharbour and Dixie.

Orano has spent a total of $4.8 million on the project to date.

Skyharbour maintains a 24.5% stake in the property.

Under the terms of the option agreement, Orano can earn up to 70% in the project by contributing cash and exploration expenditures totaling CAD $8,000,000 over six years.

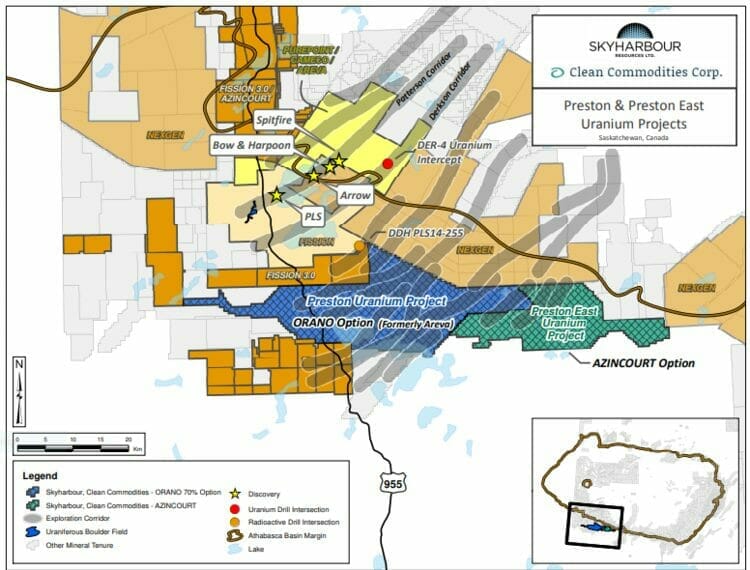

The 49,653-hectare Preston Uranium Project is located in the western Athabasca Basin.

The discovery potential of the project is elevated by recent discoveries in the area—NexGen Energy (Arrow), Fission Uranium (Triple R), and a JV involving Cameco Corporation, Orano, and Purepoint Uranium Group (Spitfire).

Over a dozen high-priority drill targets have been delineated across multiple prospective corridors via the application of good science—methodical, multiphased exploration campaigns consisting of geochem, geophysics, and exploratory drilling—initiatives that have culminated in an extensive, proprietary (geological) database.

East Preston

The East Preston Uranium Project is a JV with Azincourt Uranium (AAZ.V) and Dixie Gold.

Azincourt has earned a 70% interest in the project by spending CAD $2.5 million on exploration, making cash payments of $1 million, and forking over 9.5 million common shares—the cash and shares were divided evenly between Skyharbour and Dixie.

Skyharbour retains a 15% interest in the project.

East Preston is located on the west side of the Basin.

Three prospective conductive, low magnetic signature corridors have been discovered on the property. The three distinct corridors have a total strike length of over 25 km, each with multiple EM conductor trends identified. Ground prospecting and sampling work completed to date has identified outcrop, soil, biogeochemical and radon anomalies, which are key pathfinder elements for unconformity uranium deposit discovery.

The East Preston Project has multiple long linear conductors with flexural changes in orientation and offset breaks in the vicinity of interpreted fault lineaments – classic targets for basement-hosted unconformity uranium deposits. These are not just simple basement conductors; they are clearly upgraded/enhanced prospectivity targets because of the structural complexity.

The targets are basement-hosted unconformity related uranium deposits similar to NexGen’s Arrow deposit and Cameco’s Eagle Point mine. East Preston is near the southern edge of the western Athabasca Basin, where targets are in a near surface environment without Athabasca sandstone cover – therefore they are relatively shallow targets but can have great depth extent when discovered. The project ground is located along a parallel conductive trend between the PLS-Arrow trend and Cameco’s Centennial deposit (Virgin River-Dufferin Lake trend).

Azincourt had planned to drill 1,000 meters earlier this summer but instead opted to add those meters to an upcoming winter drill program—a campaign that should see roughly 7,000 meters in 30-35 drill holes.

Preparations for this winter program are set to begin next month. Drill targets are currently being prioritized via anomalies identified during a recently completed airborne survey.

A September 7th press release:

Azincourt Energy Completes Radiometric Survey – Updates Plans for the East Preston Uranium Project

7,000-meters is an aggressive campaign. Azincourt’s technical team is top-shelf, as is the discovery potential at East Preston.

Hook Lake

The Hook Lake Uranium Project (previously hailed as ‘North Falcon’) is a JV with Valor Resources.

ASX-listed Valor can earn an 80% interest in the project by contributing cash and exploration expenditures totaling $3,975,000 over three years ($475,000 in cash and $3,500,000 in exploration commitments) PLUS issuing 233,333,333 shares. The equity was delivered upfront.

The 25,846-hectare Hook Lake Project is located 60 kilometers east of the Key Lake Uranium Mine in northern Saskatchewan.

The property has an interesting history, one that amplifies the discovery potential of the project. There’s an element of intrigue here.

During a 2015 prospecting campaign, Skyharbour confirmed the presence of high-grade U3O8 mineralization identified by previous operators when it encountered extraordinary surface values along the northern edge of the property.

Skyharbour randomly selected three grab samples from the Hook Lake showing to verify historic results and these grab samples returned 68.0% U3O8, 35.7% U3O8, and 29.8% U3O8.

Intrigue enters the fray when you consider that previous operators failed to locate the source of this high-grade surface material.

The setting is somewhat reminiscent of Fission Uranium back in 2012 when high-grade boulders, traced up ice, led to a discovery—the Triple R discovery—that opened up the whole western side of the Basin.

A surface sampling campaign conducted by Vale earlier this summer yielded similar high-grade values along a zone called the Zone S Prospect:

- 59.2% U3O8, 499g/t Ag, 5.05% TREO (11,797ppm Nd2O3 + Pr6O11 and 1,825ppm Dy2O3), 14.4% Pb (Float sample);

- 57.4% U308, 507g/t Ag, 3.68% TREO (8,562ppm Nd2O3 + Pr6O11 and 1,676ppm Dy2O3), 14.5% Pb (Rock chip sample);

- 46.1% U3O8, 435g/t Ag, 2.88% TREO (7,054ppm Nd2O3 + Pr6O11 and 1,139ppm Dy2O3), 8.8% Pb (Rock chip sample);

- 6.92% U3O8, 0.81% TREO, 2% Pb (Rock chip sample);

- 6.42% U3O8, 1.17% TREO, 1.8% Pb (Rock chip sample).

“A total of 57 samples were taken from across the Hook Lake Project with assay results now having been received. The results are highlighted by the assays from the Hook Lake (or Zone S) prospect which confirmed the reported historical high-grade uranium mineralization. A total of seven rock chip samples were taken from a historical trench located at the Hook Lake prospect, with four of these samples returning high-grade uranium assays (>6% U3O8) as well as highly elevated rare earth (>0.5% TREO*), silver (>50ppm) and lead (> 1.8%) assays.”

Last month, Valor laid out its plans for a maiden Hook Lake drill campaign set to commence next month.

The October 6th headline:

We could see as many as 15 holes drilled during this first pass campaign—up to 4,500 meters.

Highlights from this October 6th press release:

- Planning of diamond drilling program at Hook Lake Project well advanced;

- All necessary permits in place for diamond drilling program to commence;

- Drilling to test at depth and along strike from historical trench at Hook Lake / Zone S Prospect where recent surface sampling returned assays of up to 59.2% U3O8, 5.05% TREO, 507g/t Ag, and 14.5% Pb;

- Diamond drilling to also test targets at West Way Prospect;

- Drilling set to commence in December 2021 with a program of at least 2,500 meters proposed;

- Project Geologist seconded from Dahrouge Geological Consulting.

- Aside from the outstanding U3O8 grades, note the elevated REE, Silver, and Lead values.

“Final drill hole locations are currently being determined with historical drilling data being digitised and compiled and integrated into a 3D geological model over the Zone S target area. The Hook Lake high-grade uranium (and rare earth) mineralisation is interpreted to be located at a dilational trap/jog which has formed at the intersection of a northeast-southwest trending shear zone and a possible north-south trending structure (potentially a re-activated Tabbernor fault structure). Besides the downdip and down-plunge potential of the immediate Hook Lake target, there is potential for further structural targets of this nature along strike to the northeast and southwest from the Hook Lake prospect.”

If this first pass campaign succeeds in tagging the source of all this high-grade surface material, it could light up Hook Lake in a big way.

Mann Lake

The Mann Lake Uranium Project is a JV with Basin Uranium (previously called Black Shield Metals). The stock symbol remains the same: BSX.V.

Basin Uranium’s price of admission: $850,000 in cash and $1,750,000 worth of BDX common shares (based on the 20-day VWAP at the time of issuance) PLUS a minimum of $4,000,000 in exploration expenditures spread out over three years.

This deal was inked very recently, on October 18th:

Mann Lake is located in the eastern Athabasca Basin, roughly 15 kilometers to the northeast of Cameco’s Millennium uranium deposit and 25 kilometers southwest of the McArthur River Mine.

An upscale neighborhood, this—McArthur River is currently ranked THE largest (high-grade) uranium deposit on the planet.

Mann Lake is also adjacent to the Mann Lake Joint Venture operated by Cameco (52.5%), along with partners Denison Mines (30%) and Orano (17.5%). Denison Mines acquired International Enexco for its 30% interest in this adjoining project after a 2014 winter drill campaign tagged high-grade, basement-hosted uranium mineralization.

In 2014, Skyharbour carried out a ground-based EM survey focused on a 2 kilometer long aeromagnetic low—an anomaly that coincided with basement conductors derived from earlier EM surveys. Confirmation of a broad, NE-SW trending corridor of conductive basement rocks (likely graphitic metapelites) was the upshot from this round of geophysics.

“The Mann Lake Uranium Project has seen over $3 million of previous exploration expenditures consisting of geophysical surveys and two diamond drill programs totaling 5,400 metres carried out by Triex in 2006 and 2008. The geophysical surveys identified graphitic basement conductors and structural corridors containing reactivated basement faults. These features trend onto the adjacent ground operated by Cameco. The 2006 diamond drill program intersected a 4.5 metre wide zone containing anomalous boron (with highlight values of up to 1,758 ppm B) in the sandstone immediately above the unconformity in drillhole MN06-005. Boron enrichment is common at the McArthur River uranium mine, and along with illite and chlorite alteration, is a key pathfinder element for uranium deposits in the Athabasca Basin. In the same drill hole, altered basement gneissic rocks with abundant clay, chlorite, hematite and calc-silicate minerals were intersected about 7.6 metres below the unconformity and contained anomalous uranium, including up to 73.6 ppm over a 1.5 metre interval. Background uranium values are commonly between 1 and 5 ppm.”

This is a good deal for both companies.

Skyharbour gets an immediate cash injection of $100k plus $250k worth of BDX common.

Basin Uranium is committed to spending $1M in the first year of this JV agreement. Of course, there’s nothing to stop them from accelerating the spend-cycle.

Yurchison – a new deal – Partner # 5

On November 2nd, Skyharbour inked yet another deal from its extensive pipeline of Athabasca Basin based projects available for option.

Skyharbour Signs Option Agreement with Medaro Mining Corp to Option the Yurchison Uranium Project

This is another accretive deal for Skyharbour.

Skyharbour has granted Medaro Mining (MEDA.C) an option to earn an initial 70% interest in the Yurchison Lake Project by (i) issuing CAD $3,000,000 worth of MEDA common shares, (ii) making aggregate cash payments of $800,000, and (iii) incurring $5,000,000 in exploration expenditures on the property over three years.

The 70% earn-in schedule:

This deal is slightly different. Once Medaro has earned its initial 70% stake in the project, it may go on to acquire the remaining 30% by (i) issuing $7,500,000 worth of MEDA common shares and (ii) making a cash payment of $7,500,000.

Once all is said and done—if Medaro is sufficiently impressed with the geology underpinning Yurchison’s subsurface stratum and satisfies all of the terms highlighted above—Skyharbour will retain a 2% NSR on 11 of the 12 claims with Medaro holding a buyback option where it can purchase 1% of the NSR for $1 million (a separate 2% NSR on the remaining claim is payable to a third party (payable pro-rata based on ownership interest in the property)).

The 55,934-hectare Yurchison Lake Project is located just outside of the Athabasca Basin, in the Wollaston Domain.

Historical prospecting near old trenches returned significant uranium (ranging from 0.09% to 0.30% U3O8) and molybdenum (ranging from 2,500 ppm to 6,400 ppm Mo) mineralization in both outcrop and float samples. Two historical holes drilled beneath the trenches returned highly anomalous molybdenum values, up to 3,750 ppm and anomalous uranium values up to 240 ppm. The Property boasts strong discovery potential for both basement hosted uranium mineralization as well as copper, zinc, and molybdenum mineralization. Regionally, Rio Tinto entered into a $30 million, seven-year, option agreement with Forum Energy Metals Corp. to acquire an 80% stake in their Janice Lake property which is located on-strike to the southwest of the Property.

Jordan Trimble, Skyharbour’s President and CEO:

“We look forward to working with the Medaro team at the Yurchison Project having just signed this Option Agreement. With another accretive property transaction announced, we continue to execute on our business model by adding value to our project base in the Athabasca Basin through strategic partnerships and prospect generation, as well as focused mineral exploration at our flagship Moore Uranium Project. News will be forthcoming on exploration plans at Yurchison and Medaro is well positioned to advance the Project with a strong management and technical team as well as a healthy treasury.”

It’s good to see the upfront cash payment of $150k—a common theme in these Trimble structured deals. It’s also good to see an aggressive exploration commitment—$5M over three years.

Skyharbour is also racking up quite an extensive portfolio of its JV partner’s common shares.

Final thoughts

Aside from an additional 12 or 13 holes due in the coming weeks from their 100% owned Moore Uranium Project, where we saw an impressive 2.54% U3O8 over 6.0 meters (including 6.80% U3O8 over 2.0 meters) released in mid-September, there’s plenty of news to flow from these JV projects.

Come January/February of 2022, we should see four active drill campaigns.

The market has an appetite for high-grade U3O8 plays, especially in top-shelf jurisdictions like the Athabasca Basin.

Moore Lake assays are on deck.

We stand to watch.

END

—Greg Nolan

Postscript: An article published back in mid-September—Skyharbour Resources (SYH.V) tags high grade uranium at Maverick East Zone – the stock takes out multi-year highs—digs into the Company’s flagship asset in some detail.

For a deeper delve, try my maiden piece published earlier in the summer – Skyharbour Resources (SYH.V) an Athabasca Basin Uranium gem in the midst of an aggressive drill campaign.

There’s also Lukas Kane’s recent coverage – Skyharbour Resources (SYH.V) to power the electrification of everything.

And Vishal Toora’s recent take of the technical picture – Chart Attack: Skyharbour Resources (SYH.V) Consolidates After 176% Move and Spot Uranium Rally

Full disclosure: Skyharbour is an Equity Guru marketing client. The author owns shares.

Leave a Reply