In recent weeks we’ve seen M&A activity in the gold sector begin to pick up. In September Agnico Eagle and Kirkland Lake announced their intention to combine in a deal valued at $13.4 billion.

More recently, Newcrest waded back into the Golden Triangle, taking out Pretium. In mid-2019, Newcrest paid $804 million for a majority stake in the Red Chris Mine. Earlier this year, they announced their intention to invest another C$135M into this Gldn-Tri project.

This Nov 9th deal with Pretium is valued at $3.5 billion. These are bold moves into a jurisdiction deemed by many as tough on mining interests. Newcrest obviously sees the province in a different light (as does Gold Mountain).

If the pace of M&A is indeed beginning to accelerate, others on our list may have a target on their back.

In a recent Guru offering, I zeroed in on an October 12th headline out of the Arizona Metals camp:

I addressed the assay values in the headline, and the wordage in the intro—a lead-in delivered by one of the better, resume-rich management teams in the junior exploration arena:

‘Gold-rich zone‘ – ‘Open-ended mineralization‘ – ‘Areas previously untested by historic drilling‘… when a junior explorer trots out this kind of wordage in the intro of a communique, pay attention to the details that follow.

When the crew behind such phrasing is top shelf—a crew not prone to hyperbole or puffery—pay close attention to the details that follow.

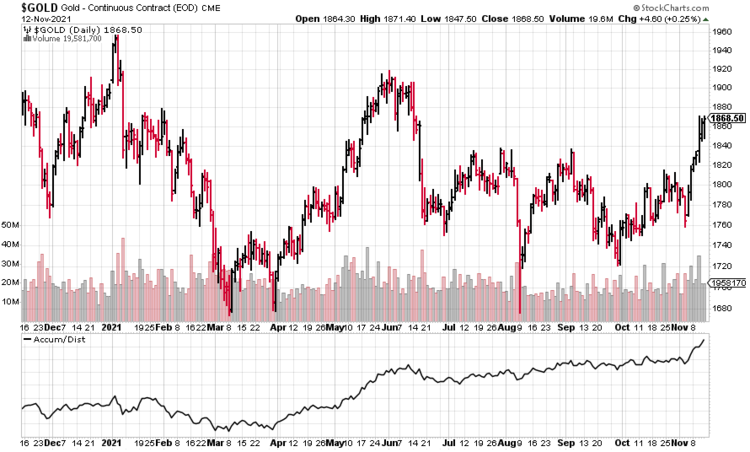

Gold’s recent price trajectory offers some context regarding the heft in this recent batch of assays.

(I added the Accumulation/Distribution Line to the above price chart as it suggests ‘smart money’ is behind this ascending flight path)

The Flagship

Arizona Metals’ flagship asset—the Kay Mine Project—is located in a world-class (mining-friendly) jurisdiction currently ranked #2 by the Fraser Institute (Arizona leads the U.S. in copper production).

Fraser’s Investment Attractiveness Survey

The extraordinary mineral endowment of this district gave rise to no less than 60 underground Cu-Au-Zn mines during its century-long run (roughly 4 billion pounds of copper was produced, all within a 150-kilometer radius of the Company’s flagship).

An excerpt from my October 19th piece Arizona Metals (AMC.V) expands VMS mineralized zone at Kay Mine Project in mining-friendly Arizona:

These deposits were formed via a series of volcanic hydrothermal events along seafloor beds when tidal H2O enveloped the region. These are what’s known as Volcanic Massive Sulphide (VMS) deposits.

Everything You Need to Know about VMS

High-quality VMS deposits are on the radar of every resource-hungry producer looking to bulk up its project pipeline (pipelines made lean by the brutal bear market of the past decade).

Why are these deposits so highly prized? Though they can vary dramatically in scale—from < one million tons all the way to up to 100 million—these polymetallic orebodies often hold huge concentrations of metals due to their rich nature.

The right VMS orebody can be a company-maker.

And as you may already know, especially if you’ve been following this rapidly evolving exploration/development play for any length of time, VMS deposits rarely occur in isolation. They almost always occur in clusters—where there’s one deposit (or lens), there are often others.

The grandsire of this prolific VMS district was United Verde—30 million tons (Mt) at 5% copper PLUS an extension deposit that produced 3.5Mt at 10.2% Cu, 1.3 g/t Au, and 58 g/t Ag (fabulously rich rock y’all).

Exxon Minerals tabled a historical proven and probable (P&P) mineral reserve back in the early 1980s showing some 6.4 million short tons grading 2.2% copper, 2.8 g/t gold, 3.03% zinc, and 55 g/t silver.***

The Company is pushing Kay along the exploration and development curve with an aggressive 75,000-meter Phase-2 drill program—a campaign that was accelerated back in June with the addition of a third drill rig.

Recent drill hole assays

The largely untested gold-rich zone of open-ended mineralization highlighted in this October 12th press release generated the following highlight intervals (true width is estimated to be 50% to 97% of the reported core width, 80% being the average):

Drill hole KM-21-40

- Hole KM-21-40 intersected 24 meters at a grade of 5.0% Cu, 0.6 g/t Au, 1.0% Zn, and 23 g/t Ag, including a higher-grade interval of 8.1 meters grading 7.6% Cu, 0.4 g/t Au, 0.4% Zn, and 27 g/t Ag;

- 30 meters further downhole Hole 40 also intersected 53 meters at a grade of 2.9 g/t Au, 3.4% Zn, 0.5% Cu, and 36 g/t Ag, including two separate higher grade intervals of 7.2 meters grading 7.7 g/t Au, 8.3% Zn, 1.1% Cu and 89 g/t Ag, as well as 3.8 meters grading 10.9 g/t Au, 9.5% Zn, 1.5% Cu, and 25 g/t Ag;

- Nice hit;

- This hole extends the high-grade mineralization encountered in Hole 28 (54 meters grading 1.9% Cu, 2.9 g/t Au, 5.0% Zn, and 29 g/t Ag) approximately 65 meters to the south at a similar depth;

Drill hole KM-21-41

- Hole KM-21-41 intersected 97 meters at a grade of 1.0% Cu, 1.5 g/t Au, 2.7% Zn, and 41 g/t Ag, including higher grade intervals of 11 meters grading 5.3 g/t Au, 1.0% Cu, 8.2% Zn, and 106 g/t Ag, as well as 11.4 meters grading 5.9% Cu, 5.8 g/t Au, 3.2% Zn, and 185 g/t Ag;

- Another solid hit;

- This hole extends the high-grade mineralization encountered in Hole 24 (90.8 meters grading 0.45% Cu, 1.33 g/t Au, 3.42% Zn, and 43 g/t Ag) and Hole 26 (76 meters grading 1.6 g/t Au, 4.2% Zn, 0.8% Cu, and 33 g/t Ag) by approximately 60 meters up-plunge and 20 meters to the north demonstrating excellent lateral and vertical continuity;

Drill hole KM-21-43

- Hole KM-21-43 intersected 17.1 meters at a grade of 1.8% Cu, 0.2 g/t Au, 0.1% Zn, and 8 g/t Ag, including a higher grade interval of 1.8 meters grading 6.3% Cu, 0.6 g/t Au, and 25 g/t Ag;

- This hole extends the new mineralized zone approximately 50 meters to the north of the high-grade mineralization encountered in Holes 24 and 26 (90.8 meters grading 0.45% Cu, 1.33 g/t Au, 3.42% Zn, and 43 g/t Ag, and 76 meters grading 1.6 g/t Au, 4.2% Zn, 0.8% Cu, and 33 g/t Ag respectively);

These next two holes—KM-21-32 and KM-21-44—demonstrate good vertical continuity at shallower depths. The mineralization remains open toward surface—assays are pending for Hole 46 in the same area.

Drill hole KM-21-32

- Hole KM-21-32 intersected 9.4 meters at a grade of 1.5 g/t Au, 0.6% Cu, 2.0% Zn, and 46 g/t Ag;

- This hole extends the new mineralized zone approximately 30 meters up-plunge of Hole 18A (32.5 meters grading 1.09% Cu, 0.62 g/t Au, 1.25% Zn, and 17.6 g/t Ag);

Drill hole KM-21-44

- Hole KM-21-44 intersected 23.9 meters at a grade of 1.0 g/t Au, 0.3% Cu, 2.5% Zn and 18 g/t Ag, including a higher grade interval of 2.6 meters grading 2.1 g/t Au, 8.0% Zn, 0.2% Cu, and 39 g/t Ag;

- This zone extends the new mineralized zone approximately 40 meters up-plunge of Hole 18A (32.5 meters grading 1.09% Cu, 0.62 g/t Au, 1.25% Zn, and 17.6 g/t Ag);

Drill hole KM-21-38

- Hole KM-21-38 intersected 8.7 meters at a grade of 1.7 g/t Au, 3.9% Zn, 0.1% Cu, and 61 g/t Ag, including a higher grade interval of 5.2 meters grading 2.4 g/t Au, 5.7 % Zn, 0.1% Cu, and 88 g/t Ag;

- This hole extends the mineralization by approximately 30 meters to the north of the high grade encountered in Hole 21A (63 meters grading 1.3 g/t Au, 3.1% Zn, 0.5% Cu, and 59 g/t Ag);

Drill hole KM-21-35

- Hole KM-21-35 intersected 5.5 meters at a grade of 1.3 g/t Au, 0.9% Cu, 1.7% Zn, and 58 g/t Ag;

- This hole extended the mineralization encountered in Hole 25B (4.3 meters grading 0.9 g/t Au, 0.9% Zn, 0.9% Cu, and 25 g/t Ag) by approximately 80 meters to the south, also in an untested area;

Drill hole KM-21-34

- Hole KM-21-34 intersected 4.6 meters at a grade of 1.7 g/t Au, 0.3% Cu, 0.9% Zn, and 46 g/t Ag;

- Collared in the North Zone, Hole 34 extended mineralization approximately 50 meters below Hole 6 (13.5 meters grading 1.0% Cu, 0.6 g/t Au, 1.23% Zn, 46 g/t Ag);

Good continuity

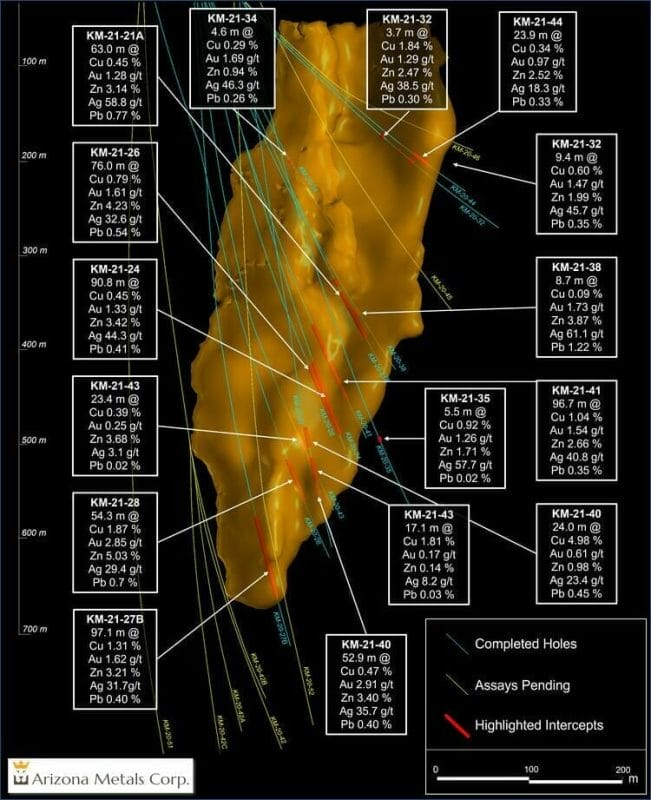

This last batch of results—wide, high-grade intervals—hold the potential to add significant tonnage outside of the historic resource block where Exxon Minerals defined two discrete mineralized zones—North and South—separated by 100 meters on strike.

Connecting the dots—demonstrating good (vertical) continuity—is the key to establishing positive economics in any underground mining scenario.

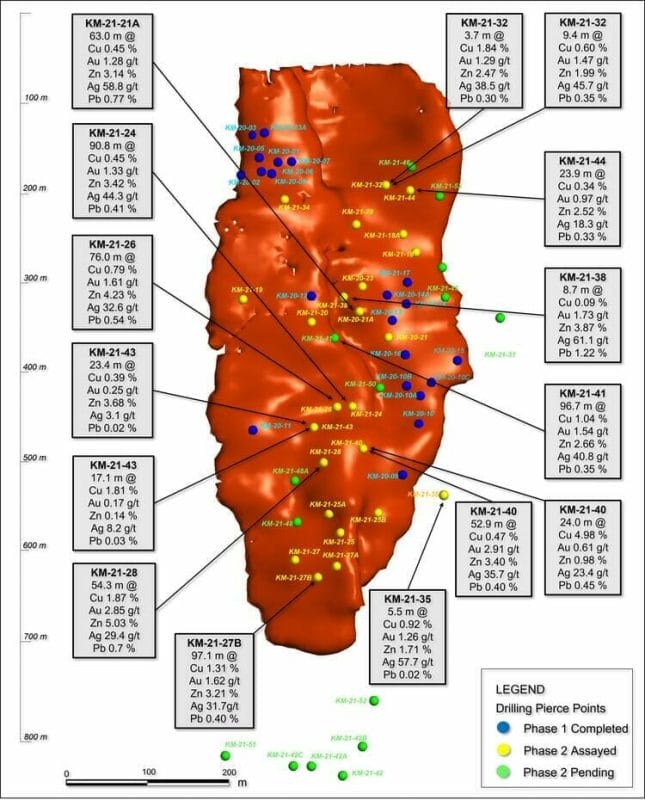

If you examine this next map closely, you’ll get a good sense of the well-defined extent of Kay’s mineralization.

The vertical continuity the Company is establishing with this current drill campaign is one of the reasons its market cap is now well north of the $500M mark.

It was originally thought that the North and South zones were separate, distinct. Phase-2 drill results now indicate that these two zones are linked.

This new geological model amplifies Kay’s tonnage potential.

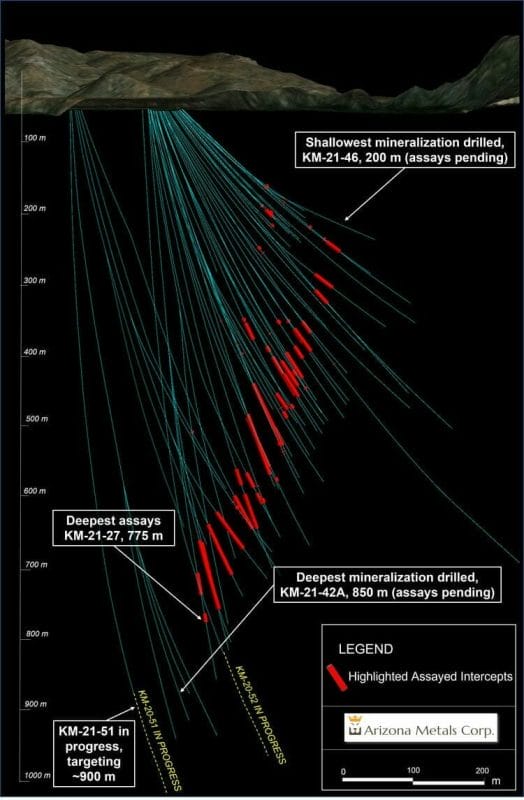

Still on the above map, note where the assays are pending—KM-21-46 (200 meters depth) and KM-21-42A (850 meters depth). Also note where the last deep hole was collared—KM-21-51 (down 900 meters).

Surface mapping

The Company recently initiated a detailed surface mapping campaign to update and supplement the structural mapping completed in 2019.

Surface mapping is a valuable tool in teeing up drill targets in these types of geological settings. As an Isoclinal Folded Deposit, the folded hinges in the deposit represent the thickest sections of mineralization, hence the most compelling drill targets—targets that often demonstrate superior grades and widths.

The above image demonstrates this folding characteristic along the surface at Kay. Note the ‘folding’ sequence along the upper section of the outcropping rock.

The results from this mapping campaign will be combined with core logging data to refine drill targets at pads 4, 5, and 6 (map below). These pads will test for mineralized extensions roughly 500 meters to the north and 300 meters south of the main mineralized body.

Other high-priority drill targets on the property—the Central and Western targets (C1 and C2 – W1 and W2 on the map below)—are located roughly 0.5 kilometers and 1.3 kilometers to the west of the Kay deposit. Surface mapping will further refine these targets for a proper probe with the drill bit early in the New Year.

In a recent chat with CEO Marc Pais, I learned that the Central targets can be drilled from pad 3 (permits to drill these highly prospective targets should be in hand by now).

These regional targets represent a compelling speculative dynamic—an element of intrigue if you will—to this rapidly evolving VMS play. Both will see their subsurface layers tested during this Phase-2 campaign.

To fully appreciate the regional potential at this flagship project, note the scale on the map below.

From this October 12th press release, Marc Pais, CEO:

“The ten drill holes released today continue to demonstrate the richness and size potential of the Kay Mine system. Virtually all holes drilled to date at Kay have intersected semi-massive to massive sulphide mineralization, with assays pending on ten more holes, and three holes currently underway.

In Phase 2 the deposit has been drilled to 775 m below surface (in Hole 27) along a strike length of 300 m and drilling continues to expand Kay mineralization in all directions with assays pending on a number of holes up to 850 m below surface. Holes 40 and 41 were drilled to test above and below the high-grade intervals encountered in Holes 24, 26, and 28. Both Holes 40 and 41 demonstrate exceptional vertical continuity of thickness and grade in this portion of the deposit. Drilling is currently underway with three drill rigs to test for further extensions of high-grade mineralization, both laterally and targeting depths below 900 m.

Our geological model, especially the modeled orientation of mineralized zones, is evolving rapidly as we drill, and is confirming a deposit considerably larger than reported historically. Our drill program is evolving to reflect these changes, and we are currently drill testing a number of new targets both at depth and near surface.”

A Bought Deal Raise

On October 22nd, Arizona Metals announced a significant raise:

Arizona Metals Corp. Announces Bought Deal Financing

Here, the Company entered into an agreement with a syndicate of underwriters—co-led by Stifel GMP and Clarus Securities—for the purchase of 7,350,000 common shares from treasury, and 1,500,000 common shares from certain existing shareholders. The offering was priced at C$4.25 for gross proceeds of C$28,591,875.

The very same day, only hours later, the Company announced a significant upsizing, from C$28,591,875 to C$36,656,250.

Arizona Metals Corp. Announces Upsize to Previously-Announced Bought Deal Financing

It might be an understatement to state that there’s an appetite for AMC common. Note that there was no discount in the pricing of this Bought Deal, and NO dilutive bells and whistles. No Warrants.

You can now color Arizona Metals cash-rich.

Final thoughts

The last time I checked in with management, they were operating with three rigs—three drill crews, 20 drillers, two onsite geos—drilling twenty-four hours a day, seven days a week.

The Company is probably halfway through its 75,000-meter campaign by now.

Three holes are being shipped off to the lab every month. Lab turnaround is nine to ten weeks.

The fundamentals underpinning the Arizona Metals story are stacked high and evolving rapidly. Reflecting back on the M&A idea posed at the top of the page… being right and sitting tight might be the best strategy for this one.

Quoting a recent Guru offering on the subject:

The narrative now becomes, how big can this thing get? Or, more precisely… could this turn into another United Verde? If the Company continues to encounter broad intervals of high-grade mineralization outside the historic resource block, the answer is an emphatic “YES”.

Just a hunch, but there may be resource-hungry predators about. They may be circling already.

We stand to watch.

END

—Greg Nolan

Full disclosure: Arizona Metals is an Equity Guru marketing client.

*** The historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a “qualified person” (as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects) before the historic estimate can be verified and upgraded to be a current mineral resource. A qualified person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

Leave a Reply