Yesterday, the gold price fell $40 to $1,778 after Federal Reserve Chair Jerome Powell told the U.S. Senate that the U.S. central bank may soon stop printing money.

It perked up to $1,789 by 6 a.m. Vancouver time this morning (December 1, 2021).

“At our next meeting, it is appropriate for us to discuss whether to wrap up our asset purchases a few months earlier,” Powell testified.

Powell claims to be alarmed about inflation. Understandable. The U.S. consumer price index – gasoline, health care, groceries and rents – rose 6.2% from a year ago. That’s the highest annual inflation rate since 1990.

Rampant money printing is inflationary but there are more sinister underlying causes.

“There’s a deeper structural reason for inflation, one that appears to be growing worse,” states The Guardian, “The economic concentration of the American economy in the hands of a relative few corporate giants with the power to raise prices”.

“If markets were competitive, companies would keep their prices down in order to prevent competitors from grabbing away customers. But they’re raising prices even as they rake in record profits”.

Inflation devalues cash, and creates an argument to own gold. If gold prices do rise, the share price of junior explorers typically go up dramatically

On December 1, 2021 Gold Mountain Mining (GMTN.V) announced it hit one of the widest intercepts ever recorded at the Elk Gold project during its Phase II, Siwash North drill program.

Gold Mountain is a gold and silver exploration and development company focused on resource expansion at the Elk Gold Project, a past-producing mine located 57 kilometers from Merritt in South Central British Columbia.

Highlights:

- 2.4m grading 20.2 g/t Au including 0.4m of 127.0 g/t Au

- 1.3m grading 6.87 g/t Au including 0.3m of 28.6 g/t Au

- 1.3m grading 4.48 g/t Au including 0.3m of 19.4 g/t Au

- 1.3m grading 4.25 g/t Au including 0.3m of 18.4 g/t Au

Phase II drill program is complete and GMTN is waiting for the results from its final drill holes from the Lake, South and Elusive Zones.

“When we acquired this project from Equinox in 2019, many believed that all of the Elk’s exploration upside had been realized and that drill programs would struggle to add value,” stated Gold Mountain’s CEO and Director, Kevin Smith.

“Our drills continue connecting with high grade mineralization and this latest bonanza grade intercept should show the market Elk’s significant upside potential,” added Smith. “With almost all the assays from Phase II Siwash North drilling back from the lab, we now await the updated geological model.”

“Based on the quality of these intercepts we continue to see, management is very keen to see how these grades play into our upcoming resource estimate.”

The Intercept

One of the widest intercepts ever recorded at the Elk, located 150m north of its open pits. This mineralization was the result of a 75m step out along the 2600 vein, which remains open to the east and will be further explored during the Company’s Phase III drill program.

With 127,000m of historical drilling on the property, management is confident the Elk is still home to significant, untapped mineralization that will allow the Company to continue to scale its resources.

Phase II

Gold Mountain has concluded all drilling activity for its Phase II program and now awaits its final assay results. In total the program drilled 13,900m with 10,500m occurring in the Siwash North zone and the remaining 3,400m drilled in the Lake, South and Elusive Zones. The results of the Phase ll drill program will inform an updated resource estimate which the Company anticipates publishing in the coming weeks.

Satellite Zones

The Elk Gold Project has eight additional exploration zones that were drill tested by previous operators. To date, 9,000m of drilling have been performed in the Elk’s Satellite Zones which do not currently contribute to the project’s resource estimate.

For the first time, Gold Mountain has explored these satellite zones and will look to develop maiden resources in multiple areas on the Elk claims. By coupling historical drill data with strong visual mineralization in new core samples, the Company is confident that these satellite zones will showcase similar grade and structure as the Siwash North zone.

Elusive Zone

The Elusive Zone is located 10km away from Siwash North and is the most prospective region on the property. When the Elk Gold Project was discovered in the 1980’s, the second largest gold-in-soil anomaly was identified in the Elusive Zone; however, given the focus on developing the Siwash North deposit, the Elusive Zone has never been drill tested.

Phase III

With the conclusion of Phase II drilling, Gold Mountain and HEG have immediately transitioned into the Elk’s Phase lll exploration program, with the first holes of the campaign already being completed in Siwash North. Currently, the program is forecasted to include 2 drill rigs performing 10,000 total meters and will also feature 5,000 meters of historical core relogging.

Drill Results

In this December 1, 2021 video CEO Kevin Smith and COO Grant Carlson give their take on today’s news.

“The last batch of assays have come in from our Siwash North drill holes, and we’ve hit one of the widest intercepts ever recorded on the property,” confirmed Smith.

“By continuing to chase our project’s high grade mineralization, we were able to intercept 20 grams per ton over two and a half meters, including 127 grams per ton over half meter,” stated COO Grant Carlson in the video, “We hit this mineralization approximately 180 meters below my feet on the 2600 vein, which is completely open to the east”.

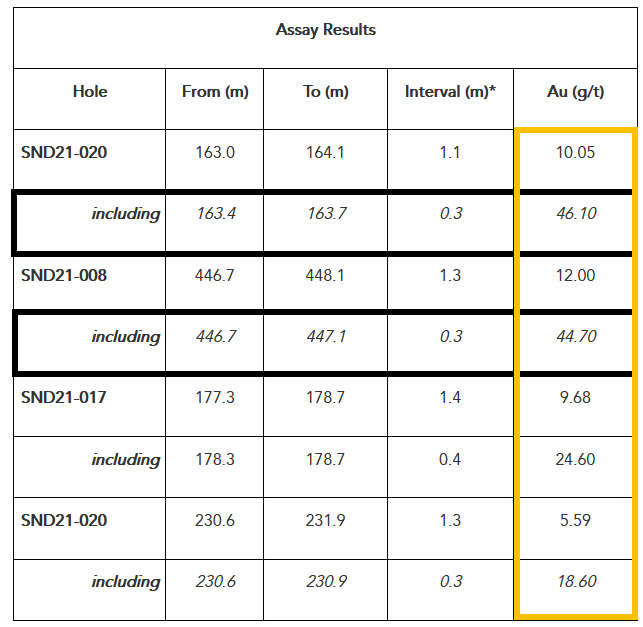

The December 1, 2021 assays were not an anomaly. Last weeks assays were also very strong.

Drilling Highlights Included:

- 1.10m grading 10.05 g/t Au including 0.30m of 46.1 g/t Au

- 1.30m grading 12.00 g/t Au including 0.30m of 44.7 g/t Au

- 1.40m grading 9.68 g/t Au including 0.40m of 24.60 g/t Au

- 1.30m grading 5.59 g/t Au including 0.30m of 18.60 g/t Au

“Amongst a flurry of news events in H2 of 2021—while the Company was picking off one key milestone after another—management dropped a revised mine plan for the Elk project, one that sidelined any notion of building a mill on-site for production years 4 thru 11.,” reported Equity Guru’s Greg Nolan on November 8, 2021.

“The new mine plan involves broadening an ore purchase agreement that was already in place with New Gold, by scaling the volume of ore delivered to the New Afton mill from 70k to 350k tonnes per annum.

Aside from (dramatically) slashing the project CapEx, putting the kibosh on plans to build a mill on-site will drive down Elk’s all-in sustaining costs (AISC) from $735/ounce to $554/ounce,” added Nolan.

“The threat of persistently higher inflation has grown,” stated U.S. Fed Chairman Powell this week, “We will use our tools to make sure higher inflation will not become entrenched.”

Powell’s “tools” encompass the decision to stop money-printing.

Meanwhile, mega-corporations will continue fleecing street-level consumers, creating inflation which devalues paper currency and makes gold more attractive.

“When we acquired the Elk Project from Equinox in 2019, it only had a 375,000-ounce resource,” stated Smith, “Fast forward today we’ve more than doubled the resource and have a goal of pushing it over a million ounces before 2021 is complete”.

The December 1, 2021 high-grade assays bring that goal closer to a reality.

Full disclosure: Gold Mountain is an Equity Guru marketing client.

Leave a Reply