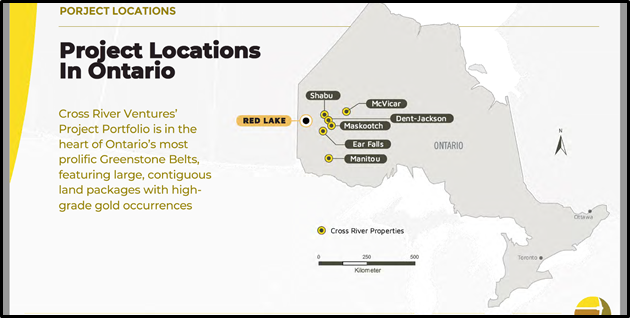

Cross River Ventures (CRVC.C) is a $3.7 million gold explorer focused on the development of top tier exploration properties located in emerging Greenstone Districts of Northwest Ontario, Canada.

CRVC controls a 28,000-hectare multiple-project portfolio in gold-bearing greenstone belts.

While grade is more critical than foot-print, it doesn’t hurt for a gold explorer to have a sprawling mineralised land package.

Cross River’s combined Ontario projects are 82 x larger than New York City’s Central Park.

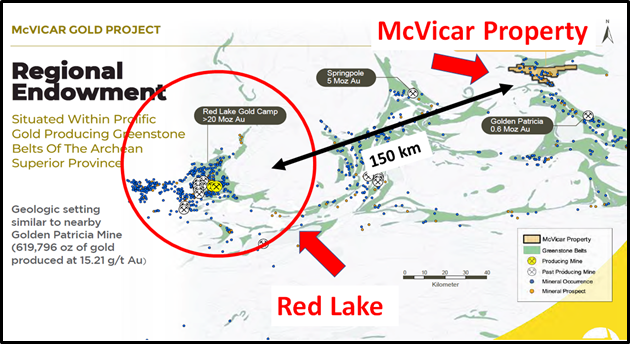

“Northwestern Ontario is favorable to exploration and there’s a lot of working mines,” Cross River CEO Alex Klenman told Gerardo Del Real of Resource Stock Digest on August 27, 2021.

“It took the Great Bear discovery south of Red Lake to bring the attention back to Red Lake,” continued Klenman, “It took Newfound Gold, a generational discovery in Newfoundland, to get people excited about Newfoundland, but prior to those discoveries, the gold was there.”

“And if you look at Northwestern Ontario, and that endowment and how many mines and things are in that sub-province in the Archean belt, and you realize there’s massive opportunity”.

“Those Greenstone belts are prolific, their endowment is 300 million ounces and we’re right there. We have big packages, obviously our McVicar project is our flagship,” added Klenman.

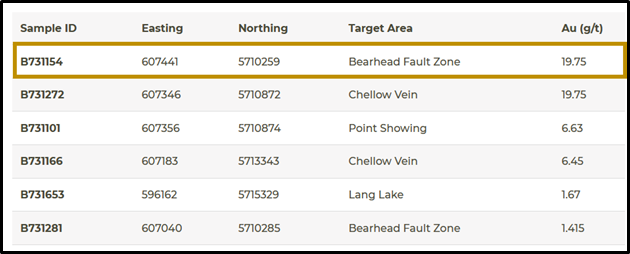

Two months ago, Cross River defined a new surface trend at the McVicar Project; assays select grab samples up to 19.75 g/t gold

“Sample assay results at the 12,000-ha McVicar Gold Project have now outlined a new, approximately 700 meter long, mineralized trend south of the Chellow Vein,” stated Cross River.

This trend, which is open in all directions, will now be called the “Bear Head Trend”.

A total of 354 grab samples were collected during the program with six grab samples returning values of greater than 1 gram-per-tonne gold as summarized in the following table:

Of these samples, two confirmatory samples taken from the Chellow Vein returned 19.75 g/t Au and 6.63 g/t Au from stripped outcrops.

These samples demonstrate the high grade of the Chellow Vein, and they are consistent with sampling completed by previous operators.

Two samples taken from approximately 600m south of the Chellow Vein, which returned values of 19.75 g/t Au and 1.415 g/t Au respectively, represent new surface discoveries of Au mineralization at McVicar.

Follow up exploration programs will focus on the Bearhead Fault Zone to better define the extent, width, and grade of Au mineralization.

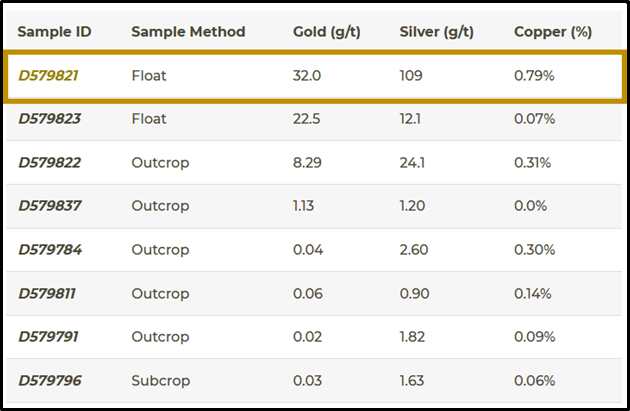

On November 4, 2021, Cross River confirmed High Grade Gold at The Maskootch Project; Assays Select Grab Samples Up to 32 g/t gold.

The assay results follow exploration work at its 1,480-ha Maskootch project, situated along the southeastern margin of Archean Uchi Greenstone Belt, NW Ontario, Canada.

“The team collected three grab samples from semi-massive pyrite-chalcopyrite mineralization at the historic Wenesaga Road showing,” stated CRVC, “Two locally derived angular boulders, returned values of 32.0 grams-per-tonne gold with 0.79% Copper and 22.5g/t gold respectively”.

Cross River warned that “Grab samples are selective by nature and may not be representative of the average grade or style of mineralization but will be used to help guide additional exploration on the properties.”

The Table below summarizes the selected results:

In December, 2021 – every precious-metal CEO on the planet thinks their company is undervalued “compared to our peers.”

Given the size of the Ontario land package and the recent gold assay results, at a $3.7 million market cap Cross River appears to undervalued – compared to everything-in-the-universe – including aluminum tricycles, post-it notes and Calendars of Defecating Cats.

CRVC has the same valuation as this 70-year-old, 2,500 square foot, 3 bedroom home at 1750 w. 66th Ave in Vancouver, BC. (note to sellers: would it kill ya to scrape the moss off the roof?)

“McVicar was held by multiple companies and multiple prospectors in separate land packages and we consolidated all of them,” Klenman told Resource Stock Digest.

“No one had ever taken a cumulative look at all of that data and superimposed it onto the claim package. And then you suddenly see things from a bird’s eye view that you couldn’t necessarily see when it was piecemeal and broken up.”

“We have a different look, a different way to visualize where we’re working and then you combine the modern techniques and things begin to take shape”.

“A good portfolio has a percentage allocated to explorers, because your return on a successful exploration and impactful discovery is clear,” added Klenman, “And so you need to find the best ones, and I think if you like Northwestern Ontario, you’re going to like Cross River”.

Full Disclosure: Equity Guru is currently proving marketing services for another Klenman-helmed company, Azincourt Energy.

Leave a Reply