Nano One (NANO.T) is a $300 million clean technology company with patented processes for the low-cost, low-environmental footprint production of high-performance cathode materials used in lithium-ion batteries.

Six weeks ago, Nano One announced its financial results and operations overview for Q3, 2021, ended September 30, 2021

Q3 Highlights and Headlines

• Working capital of ~$54.0 million; cash of ~$54.6 million

• MOU with global automotive OEM to evaluate manganese rich cathode materials

• Joint development agreement with Euro Manganese for the development of high-purity manganese in lithium-ion battery cathode materials

• Completion of SDTC and BC-ICE Milestone 2 and receipt of Milestone 3 funds

• Engaged global engineering firm, Hatch, to lead an engineering study for expanded cathode evaluation project with a global automotive company

“Nano One continues to advance opportunities with our partners in the battery supply chain and in this past three months we have added a few more strategic relationships,” commented Mr. Dan Blondal, CEO.

“We have business dealings on many fronts around the globe, including opportunities to enable low cost integrated domestic supply chains in North America and Europe that with the use of our technologies could increase competitiveness, reduce environmental footprint and add value to critical mineral supplies.”

“Nano One is not going to pump out itty bitty bits of news designed to keep the share price bouncing like a Kardashian mattress,” wrote Chris Parry on March 9, 2016 when Nano One was trading at .37 (12% of its current share price).

“And it’s admittedly a way off from building a factory and churning out purchase orders. But that’s not the play here. The play is, the IP,” continued Parry.

“Those patents are not material specific. They are BROAD patents which means, if anyone, anywhere, decides they’re going to start farting about with materials to make nanotechnology a little cheaper, easier, whatever, they’re going to have Nano One’s lawyers peering over their shoulder, saying ‘where’s our licensing fee?’”

“And those patents aren’t built on patent troll hopes and dreams – the company, literally, as I was writing this, announced a $2m grant from Sustainable Development Technology Canada (SDTC), that is non-repayable (read: free money), to help gets it’s pilot plant up and running to properly demo the tech to industry”. – End of Parry.

From 2016-2020 NANO’s share price rose from .37 to $1 as the IP portfolio grew, and Chinese tech companies came calling.

During that time, we covered Nano One 55 times including locking down IP, partnering, CEO podcasts, collaborators, wealth creation, innovation, Chinese delegation, technology moats etc.

On June 15, 2018, we toured the Nano One Pilot Factory – firing questions at CEO Dan Blondal which he answered expertly.

In 2020 the share price spiked 600% to $6 – as the market anticipated the break though to commercialisation, then shed $300 million in market cap (falling to $3.16) as retail investors lost patience waiting for the commercial scale factory to be built.

Another head-wind for Nano One’s IR department: for competitive reasons, NANO’s biggest collaborators are often left unnamed as you see in the above reference to “a global automotive company.”

Recent Corporate updates:

On November 9, 2021, NANO announced a transition in its LFP cathode material focus towards emerging opportunities in domestic supply chains in North America and Europe, to create a secure, integrated and cost competitive solution that reduces environmental footprint.

On October 4, 2021, NANO announced the signing of a Joint Development Agreement with Euro Manganese Inc. (“Euro Manganese”), a battery raw materials company developing a significant manganese deposit in the Czech Republic.

The two companies will collaborate on developing economically viable and environmentally sustainable applications of high-purity manganese expected to be produced by Euro Manganese from its proposed Chvaletice Manganese Project.

On September 30, 2021, the Company announced the completion of a project with a global automotive OEM (Original Equipment Manufacturer), that was first announced on June 20, 2019 and the two parties have signed a Memorandum of Understanding (“MOU”) to evaluate manganese-rich cathode materials for potential use in automotive scale battery cells.

On September 9, 2021, the Company announced the achievement of Milestone 2 of the “Scaling Advanced Battery Materials” project jointly funded by SDTC and the British Columbia Innovative Clean Energy (BC-ICE) fund. Consequently, the advance funding for project Milestone 3, in the amount of $1,652,859 in aggregate has been received.

On December 2, 2021 Nano One CEO Dan Blondal joined Steve Darling from Proactive to share news the company has added a key person as a strategic advisor, Dr Yuan Gao.

“Dr. Gao is a foundational innovator in lithium cobalt oxide, the stuff that’s in our phones today and laptops,” explained Blondal, “He’s also a tremendous businessman as well and has gone on to lead a number of different initiatives in the in the battery space, including the surge of lithium iron phosphate in China.”

“The industry is changing rapidly,” added Blondal, “We’re feel that we’re right at the center of it right now. In a technological revolution, that will really help drive change in the supply chain. And leapfrog the way it’s done in Asia right now and other places in the world, and put North America in an advantageous position”.

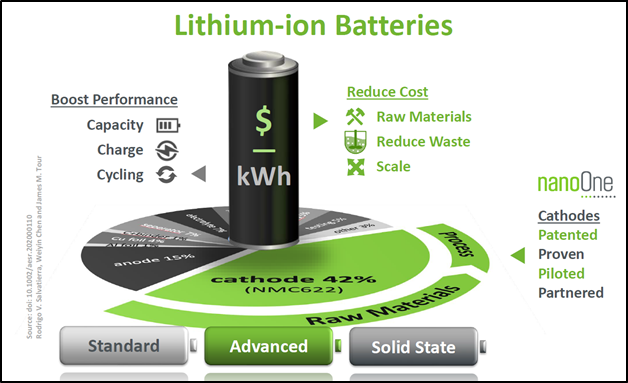

Nano One’s patented One-Pot and M2CAM (Metal direct to Cathode Active Materials) technologies reduce complexity, cost, and environmental footprint in the lithium-ion battery cathode supply chain. Applies to NMC, LNMO, LFP and more.

An overview of NANO’s core technology is given here:

On November 9, 2021 Dan Blondal, Nano One’s CEO, provided his view on COP26, taking place at the time in Glasgow, Scotland, and an update on NANO’s lithium iron phosphate (LFP) strategic direction as it relates to reducing the cost and environmental impact of the battery metal supply chains in North America and Europe.

• COP26 spotlights significant green energy start for the global market.

• Once-in-a-generation chance to create and differentiate North American supply chain.

• Nano One shifts LFP effort from China and Pulead to opportunities outside of China.

• One-Pot process reduces cost and environmental impact of battery metal supply chain.

• Nano One joins Accelerate, Canada’s zero-emission vehicle (ZEV) supply chain alliance.

The One-Pot process can leverage battery metal feedstocks that are available domestically without requiring the addition of costly refining infrastructure, and this removes barriers to adoption while eliminating complexity and environmentally wasteful steps common to offshore supply chains.”

“If we are to build a fully integrated and resilient battery supply chain here in North America,” stated Blondal, “it must include responsible mining of battery metals, onshore refining, environmentally favourable cathode material production, and recycling.”

“If we are to avoid the export of raw materials and technology to overseas markets, only to buy them back in value added batteries, then we must leapfrog and make redundant the wasteful, constrained and costly methods of making battery cathode materials that are entrenched in overseas supply chains,” added Blondal.

LFP production is free from the constraints of nickel and cobalt, and although its origins are deeply rooted in Canada, its growth over the last decade is almost entirely based in China.

The foundational IP that Parry spoke about in 2016, has got much stronger. The pilot factory has proved the concept. There are still no revenues or profits.

The predictable impatience of the retail investment community has gifted us an opportunity to buy NANO shares at a 50% discount to the December, 2020 high.

Full Disclosure: Nano One was previously an Equity Guru marketing client.

Leave a Reply