Ripple is the key product of San-Francisco based Ripple Labs. It acts simultaneously as a currency exchange, remittance network and settlement system, and was introduced to the market in 2012 on a distributed, open source protocol that supported fiat currency, cryptocurrency, commodities and other value stores, including mobile minutes and frequent flyer miles.

Its cryptocurrency is called XRP.

Here are the specifications on XRP at the time of writing:

- Market Cap $40,875,911,451

- 24 Hour Trading Vol $3,034,842,879

- Circulating Supply 47,535,964,473

- Total Supply 100,000,000,000

- Max Supply 100,000,000,000

- At present it’s number 8 by market cap size, and presently trading at $0.859204.

The company wants to construct an inexpensive, secure and instantaneous global financial remittance market for transactions at scale with no clawbacks. It’s a decent market to be in as well as the global remittances market, according to researchandmarkets.com, is slated to be worth USD $42.46 billion by 2028, growing at a compound annual growth rate of 13.3%.

History

Ripple originated with programmer, entrepreneur and philanthropist, Jed McCaleb, and was built by Arthur Britto and David Schwartz. They approached Ryan Fugger, who had had some success developing a system called OpenCoin, which would later transform into XRP. The company created its own digital currency intending to give financial institutions the option to transfer money with favourable fees and low wait times..

Fast forward five years and the company had gathered 100 banks under their umbrella, but most were only using Ripple’s Xcurrency messaging technology and avoiding XRP, scared off by its volatility.

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) objected that issues regarding Ripple’s ability to scale kept them to bilateral and intra-bank applications.

Consensus

Like other blockchain-based cryptocurrencies, Ripple relies on a common shared ledger, or a distributed database that stores information from all Ripple’s accounts. The system involves a network of independent servers devoted to comparing transaction records.

Ripple’s network validates accounts and balances instantly and fires back payment notification in seconds, but because of the type of transaction, payments are irreversible and there zero chargebacks. Just like every other crypto.

The consensus mechanism is applied every few seconds by all the network nodes to verify the network. When the nodes come to consensus, the current ledger is considered ‘closed’ and becomes the last-closed ledger. If the algorithm is successful and there are no forks in the network, the last closed ledger maintained by all the nodes in the network will be identical.

Criticisms:

Most of the criticism levied towards Ripple surrounds their cryptocurrency, XRP. Banks and businesses don’t like it thanks to its volatility, and it can’t really justify its market cap. This suggests that the force propping it up in the lofty eighth position by market cap is retail investors, and frankly, given the opportunity cost of owning this crypto over potentially owning something that actually moves and has a future like say, Solana or even lower ranked ATOM, it’s difficult to tell why.

The reason:

Trans-border transactions occur normally between disconnected systems and Ripple’s transactions don’t. Instead it uses interledger protocol which connects payments through a series of ledgers to make the necessary connections. The ledgers can either be part of the financial institution’s network or they can be used as trusted nodes in a network spanning multiple geographical locations. The technology is designed to increase transaction processing across geographical jurisdictions.

The remaining problem is how no tech, including Ripple’s, have a solution for the problem of pre-funding fiat currencies into accounts for foreign exchange transfers. These are called nostro and vostro accounts, and they’re normally kept by banks and other financial institutions at all ends of a transaction to ensure liquidity for foreign exchange transactions.

Ripple Labs and the Elephant in the Room

We can’t really talk about Ripple or XRP without discussing the ongoing legal contest including Ripple Labs and the United States Securities and Exchange Commission.

Ripple Labs and two members of its executive team were sued by the SEC for selling XRP as an unregistered security as early as December 2020. The complaint charged the company’s co-founder, executive chairman and former CEO, Christian Larsen, along with Bradley Garlinghouse, the company’s present CEO, with raising capital to finance the company’s business through XRP in the biggest ongoing initial coin offering (ICO) to date.

They contend that Ripple distributed billions of XRP for labour and other services, and also to line their own pockets with $600 million, all without registering their offers adn sales and attempting to meet any registration exemptions. If XRP is what the SEC contends it is, that’s a violation of federal securities laws.

The Consequences

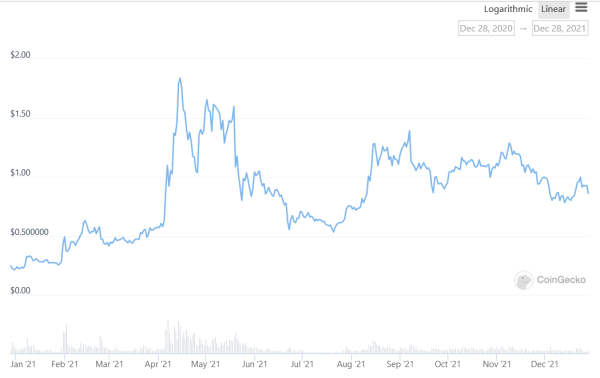

Whether or not XRP is a security, I’ll probably speculate about in a future article (probably next week) but for right now suffice it to say the effects didn’t sit well. Before all of this started, XRP was a top five contender by market cap and it’s since dropped to 8th with a $39 billion market cap.

The coin is getting even more scarce. The lawsuit has caused many United States and Canadian exchanges to delist XRP. Coinbase dropped it in response to an investor, who filed a class action suit alleging that the exchange had been selling XRP tokens with full knowledge that they were unregistered securities. That got the ball rolling on XRP’s delisting trend.

Others, including Binance.US, eToro, Bitstamp and more, including Canadian exchanges Bitbuy, Newton and more, have followed out of an abundance of caution. That being said, despite various setbacks including being basically shut out of the world’s largest economy, Ripple went on to have what Garlinghouse called ‘their best year ever.’

Proud to say it was @Ripple’s strongest year ever (XRP-based On-Demand Liquidity payments account for 25% of $ volume across RippleNet, and ODL txns are up 25x from Q3 2020, and 130% QoQ). 4/10 https://t.co/2V2ORfzTqm

— Brad Garlinghouse (@bgarlinghouse) December 22, 2021

Who knows what’s to come in 2022?

—Joseph Morton

Leave a Reply