Falcon Gold (FG.V) and its JV partner Marvel Discovery (MARV.V) could very well benefit from the shifting inflationary forces, slowing economic growth and supply chain interruptions currently plaguing our global financial health.

Commodities are strong with silver outperforming both bitcoin and gold. With the functional and fungible metal testing a major support at $21, we could see a breakout soon.

Falcon Gold (FG.V) has used the recent metals supercycle downturn to acquire precious metal exploration properties across Canada and in South America. Company CEO, Karim Rayani, penned a note to shareholders at the beginning of January assuring them he was still committed to creating shareholder value growth throughout 2022. The last twelve months have been a pain in the ass for everybody as the pandemic split up into variants, creating an environment of unease as well as supply chain disruptions and labour shortages. Added to the heart-breaking aspect of covid, governments, corporations as well as junior explorers struggled to perform.

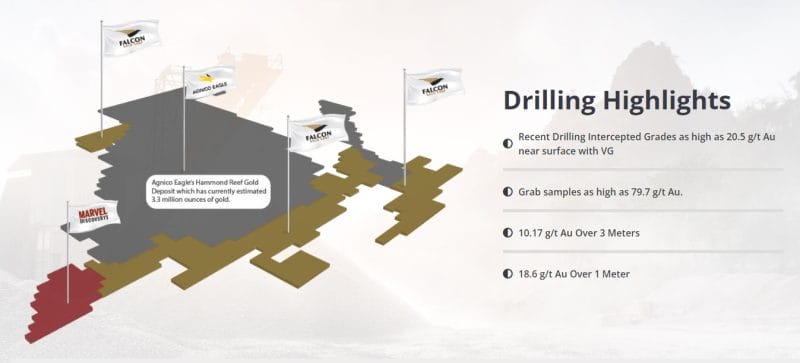

Rayani highlighted some milestones reached by Falcon Gold in 2021 which included two successful rounds of drilling at the company’s flagship Central Canada project, located just 20 kilometres south of Agnico Eagles Hammond Reef Deposit thought to host a measured resource of 3.32 million ounces of gold.

The campaigns at Central Canada Mine trend extended the strike length over 140 metres with sampling and mapping producing new discoveries on the Sugar Shear, Monte, Honey and Hoist zones. Sugar Shear stood out with grab samples reaching up to 23 g/t gold tracing over 360 metres on surface. This created a previously undocumented target for future exploration.

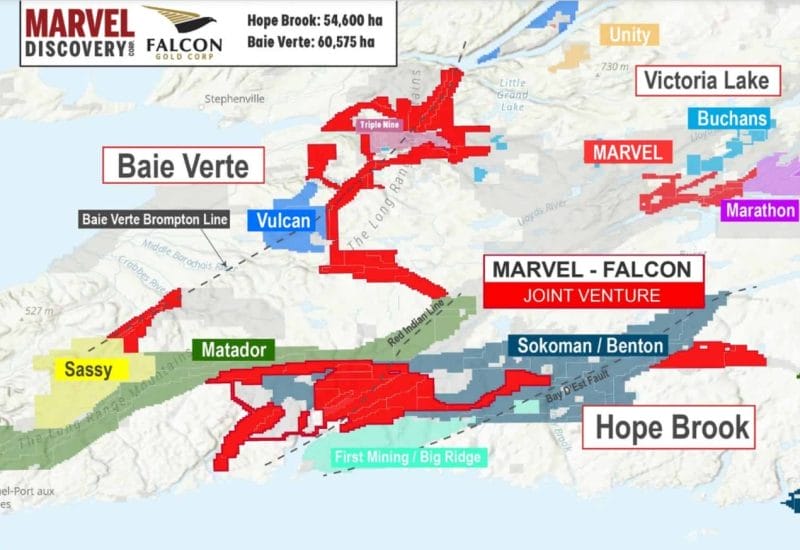

It is in Newfoundland where Falcon and Marvel weave into one force at the Golden Brook gold project. Marvel Discovery, also led by Karim Rayani, has a diverse portfolio of precious, base, fungible, and functional metals. The two explorers joined efforts in the Hope Brook Camp of the central Newfoundland gold belt.

The duo’s 50-50 JV brings totals landholdings to 115,000 hectares and allows the companies to defray costs as well as take advantage of shared capital. The JV controls a package strategically located 13 kilometres south of Glover Island trend. Glover Island hosts 17 base metal, polymetallic mineral prospects and numerous gold showings and anomalies.

Falcon’s assets have always been about location, location, location as the company snaps up prospects near large deposits in prolific districts. Rayani is very optimistic about the company’s NL holdings including the Baie Verte project located in the Baie Verte peninsula which currently hosts all the province’s gold production.

FG also holds properties in BC, Northern Chile, and Argentina. While the company holds 100% interest in BC’s Gaspard Claims and commenced a Phase 2 drilling program at BC’s Sunny Boy-Spitfire gold project near Merrit in 2021, it has a definitive option to-purchase agreement for its Viernes Project in Northern Chile and through its wholly owned subsidiary, Latamark Resources, intends to spin out its Argentine gold asset located in the world-renowned Sierra de Las Minas district.

Falcon seems to be a junior focused on a JV-buyout exit strategy, providing a real growth opportunity for investors without the pain and costs of late-stage development. This of course presents the obligatory risks of early-stage exploration as the company works to delineate viable resource deposits.

As a junior explorer, Falcon is heavily dependent on continued financing to advance their exploration efforts. At the end of June 2021, the company reported that it had $975,000 CAD in cash and cash equivalents. Since that point, it has raised an aggregate $715,210 through private placements. Considering the company recorded $1.09 million in expenses in 2021, it looks to have approximately a little over a year runway before it must raise capital or sell off assets.

The company has a lot to do with its early-stage properties so this capital may disappear quicker than estimated.

Marvel presents a slightly different story with its Canadian focus. On top of its holdings in NL, one of which the JV with Falcon, it has projects, it has projects in Quebec, Ontario, and BC.

Marvel’s hand is varied with gold projects in Newfoundland, a nickel-copper-cobalt/Fe-Ti project in Quebec, precious metals, and rare earth metals projects in Ontario as well as a rare earth metals project in the storied Wicheeda Carbonatite Complex near Wicheeda lake in beautiful British Columbia.

The company’s Wicheeda North project is contiguous to Defense Metals Wicheeda REE property located 80 kilometres north of Prince George, BC. Defense Metals boasts an indicated resource of 4.89 million tonnes at 3.02% light rare earth oxide, 2.1 million tonnes at 2.90% light rare earth oxide, using a cut-off grade of 1.5% total metal.

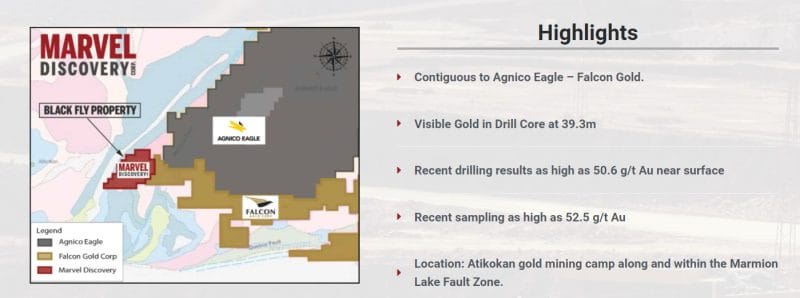

Marvel sits beside Falcon in Ontario with its Black Fly Gold Property located in the Atikokan gold mining camp. Black Fly also runs contiguous to Agnico Gold. Nine of the 16 holes have been completed in the company’s 2021 Phase 1 drill program at Black Fly intersecting multiple gold domains, including 50.6 g/t gold over 0.5 metres near surface as well as 1.06 g/t gold over 9.3 metres and 1.42 g/t gold over 4.0 metres.

The junior’s East Bull REE project hosts a possible extension of the Folson Intrusive Block. The Pecors Anomaly located to the west of Marvel’s holdings was drilled by International Montoro in 2015 and intersects were reported of 0.224 gpt Pt+Pd+Au over 22.45 metres beneath the overlying sediments.

Marvel reported it had $254,787 in cash and cash equivalents as of August 31, 2021, with expenses totaling $946,801. Since then, the junior announced closing a private placement for total proceeds of $1.01 million on December 16, 2021. It intends to use the funds to advance exploration particularly at both Black Fly and its JV holding Golden Brook.

Marvel also announced on Monday that it created a SpinCo called Power-One Resources and transferred over its Serpent River Pecors Project in Eliott Lake, Ontario, and its Wicheeda Project in BC. Marvel currently owns a 26% equity stake in Power-One.

The new entity announced a non-brokered private placement for gross proceeds of up to $800,000 which it plans to close on or before February 1, 2022.

Spinning off its REE assets will free up capital and resources for its precious and base metals plays, allowing Marvel to narrow its focus in 2022.

Considering this, 2022 will be a year of reckoning for Falcon Gold, Marvel Discovery and Power-One Resources. Acquiring prospective land is one thing, turning it into a tasty de-risked acquisition target is another. Rayani has managed to accumulate some strategically located properties and both Falcon and Marvel are trading at low multiples to their current asset values.

However, penny-stocks always present significant challenges in continuing business, investors will have to determine their risk profile, adequately spread out their holdings. Buy the commodities themselves or investigate royalty and streamers as well as blue-chip majors before dipping their toes into this highly prospective water.

That said, with the current and possibly long-terms trends for metals, the potential for growth could be stratospheric and it wouldn’t be prudent for the smart investor to dismiss these opportunities out of hand. Of course, as always do your due diligence and speak with an investment professional before making any portfolio decisions. Good luck to all!

For a detailed technical breakdown, check out Vishal Toora’s expert analysis here.

If you prefer Vishal’s video version check out our Falcon Gold Chart Attack video.

If you’re interested in another investor viewpoint from our Investor Roundtable Video series, it’s here as well.

–Gaalen Engen

Leave a Reply