One of the biggest unforeseeable events of the past twenty years has been the disintermediation effect of new tech. Netflix killed blockbuster, Amazon has slain Sears and other big box chains of the past, and services like Uber and Lyft are disrupting the traditional taxi services. Technology has been busy slaughtering the sacred cows of the 20th century but there’s one such idol that’s far older and in need of ritual slaughter, and that’s finance.

Now blockchain and its adherents have stepped up with grand promises of a much vaunted new way of operating. That’s decentralized finance or DeFi.

The presumption is that DeFi will provide a faster, cheaper, safer, and accessible alternative to the antiquated routes of traditional finance.

Is it?

Not really. At least not yet.

DeFi has a number of gaps in its infrastructure and the learning curve is astronomical. If this thing is going to take off, it needs to be made more accessible to the average person, and the tech needs to improve.

But it’s early. Like Netflix sending DVD’s through the mail early. This is Amazon in the late nineties early.

That’s what kind of potential decentralized finance has to bear.

If you don’t have the time or are otherwise not interested in scaling the steep learning curve, but still don’t want to miss out on the lucrative development and growth that DeFi offers, there are alternatives.

There are companies in the blockchain and cryptocurrency space that provide intermediary doorways that reduce your risk exposure while maximizing return potential, both today and later on down the line when everything’s coming up DeFi.

Let’s talk about Wellfield Technologies (WFLD.V), which offers two DeFi adjacent products, each taking advantage of the decentralized finance ecosystem but without any of the hidden costs in time, energy or money, required to get your toes wet.

Products

Wellfield’s two product options are Seamless and MoneyClip.

Seamless allows for financial services solutions with multiple verticals:

Liquidity shift between blockchains

Specifically they intend to create a specialized Ethereum token called an ERC-20 that will be compatible with Bitcoin’s blockchain, and therefore be able to transfer funds and liquidity between each.

Increase in use of liquidity through financial instruments.

Seamless enables financial instruments tasked with increasing liquidity and taking advantage of volatility among crypto assets. This is generally done through risk-reducing products like loans, investments, options, hedging, trade and other derivatives.

- MoneyClip is a peer-to-peer and social payments application offering a variety of features including:

- send and receive digital cash

- split bills

- buy and sell online or in-person

- withdraw balance at any time to a bank account

- zero account fees

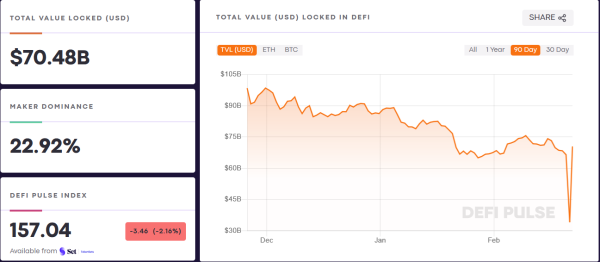

These products are only as valuable as the core ecosystem they support, and right now, courtesy of the recent sleeping bears in the crypto-sphere, that’s down considerably from where it was at the beginning of the year. But it’s still up from this time last year, which isn’t surprising.

The chart shows that DeFi still has $70.48 billion dollars locked in investments, which even though it’s down from triple digits, is still a fairly heft number. And that number’s only going to go up. Eventually. Crypto is correlated with Bitcoin, and Bitcoin investors tend to bail out (or buy in) based on relative periods of peace, stability or its opposite.

Right now, with much geopolitical uncertainty accompanied by increasing global scrutiny on Bitcoin, we’re seeing generalized downtrends in pricing leading to what’s beginning to look like the first flakes of a crypto-winter.

This is neither unexpected nor unprecedented.

Actually, it’s right on time.

Bitcoin’s next halving is two years away. The previous halving was two years ago. So far this mirrors the arrival of the first crypto-winter in 2018, which means the crypto-spring forecast should happen sometime at the end of this year and consistent low-prices for crypto between now and then.

Buy the dip? Definitely.

You can’t talk about a company like this without mentioning who’s at the helm. So much can go wrong when negotiating an unexplored space like decentralized finance, that you need not only strong C-level leadership, but the tech and theory guys behind them providing them with their expertise.

Wellfield’s been busy getting both.

People

First, they have Marc Lustig, the former CEO of Origin House who presided over the merger which it to connected Cresco Labs (CL.C), and now sits on the board of many companies, and sitting on the board of his own investment firm, L5 Capital. He wouldn’t be here if it weren’t a good deal.

Next is Levy Cohen, their CEO, who as a technologist focusing on research and development in the fields of computer science and blockchain, bridges the gap between C-level and the tech and theory section.

After which, we have the recent technological support to their advisory board:

- William Keliehor – who brings 25 years of payments and fintech experience in 30 different markets, including the Europe, Middle East and Africa.

- Dr. Tamir Agmon – professor, researcher and global financial consultant and also a co-founder of Seamless.

- Amir Shpilka – professor and researcher, who’s been involved in some capacity with Seamless and Wellfield since its inception.

- Marshall Ball – assistant professor of computer science at NYU Courant, focusing on theoretical computer science, where it pertains to the foundations of cryptography and computational complexity.

One of the problems with DeFi and one that can’t go possibly unmentioned if we’re going to be responsible adults is the risks associated. For every Netflix or Amazon there are likely a dozen unnamed and unknowable failures.

The Road Ahead

But what’s this mean for companies like Wellfield?

It means they need a good roadmap, which is precisely what they’ve done.

Here’s their roadmap for 2022:

- Making Bitcoin more compatible with DeFi, rather than a simple store of wealth

- Blockchain interoperability, so you can use the resources of different blockchains in one transaction.

- Decentralized prime brokers

- A user-friendly DeFi application for Moneyclip

- Distributed Identity solutions

- Develop deeper integration with DeFi communities

That’s a hell of a start.

They have also recently joined Paytechs, which is a not-for-profit association that speaks for Canadian fintech companies. Their goal for 2022 is full integration with DeFi communities and the overall ecosystem, and they’re launching solutions under both Seamless and MoneyClip to accomplish this end.

Regulation

One of the biggest unresolved questions presently affecting decision making in the space is the big question mark surrounding regulation. Most of crypto is unregulated. Everyone from government to individual companies to most retail investors recognizes that regulation is necessary, suitable and on its way, but there isn’t enough information out there yet to find the right questions let alone the answers to those questions.

So what we’re seeing is a lot of self-regulation and a lot of companies trying to get out ahead of the conversation, which is probably an excellent strategy as the Biden administration comes closer to making a decision on the future of the space.

“As the regulatory landscape locally and globally continues to evolve, MoneyClip is looking for opportunities to be an active stakeholder in regulatory discussions and also to strengthen community relationships and leverage collaborative opportunities with talented contributors in the space. Paytechs of Canada has created a strong and growing ecosystem in Canada built on a mission and goals that strongly resonate with our own values. MoneyClip aims to provide consumers the best possible experience and we are grateful to be a member with Paytechs as we both seek to offer greater choice, improve critical infrastructure and broaden access to Canadians,” said Chanan Steinhart, founder of MoneyClip and chief strategy officer for Wellfield.

This is normally where the chart would go, but if you’re looking for technical analysis then I’ll direct you over to Vishal Toora. Finally, if you want to see what the rest of the gurus are Equity Guru think about Wellfield, then check out our roundtable discussion.

Parting Thoughts on Decentralized Finance

If success is about having the right people with the right products in position at the right time, then Wellfield has two thirds of that equation down. All they’re lacking is the timing. But as DeFi is still in a neonatal stage and there are questions looming surrounding regulatory factors, this is likely an excellent time to get involved with a company offering connection to the DeFi ecosystem but at a distance.

That way if decentralized finance goes to the moon next time Bitcoin goes on a run, Wellfield should go with it. But if DeFi withers under Joe Biden’s regulatory scrutiny, you don’t risk your funds being locked in impenetrable technological vaults.

The risks are there but so are the rewards.

Go big or go home.

—Joseph Morton

Full disclosure: Wellfield Technologies is an Equity.Guru marketing client.

Leave a Reply