The Circular Economy is a model of production and consumption whereby materials that are already in circulation are re-purposed to create new products.

“The green transition will free us from our dependence on energy- and other resource imports,” stated Frans Timmermans, Executive V.P. for the European Green Deal, “More specifically it will allow us to reduce our demand for primary resources, and use a lot less energy for our production and consumption’.

“We are running headfirst into the limits of what our planet can provide,” added Timmermans.

“The circular economy provides a tangible framework for reducing our impacts, protecting ecosystems and living within the means of one planet,” states the 2020 Circularity Gap Report.

As landfills reach capacity, federal governments around the world are pushing diversion programs to the forefront.

The shift to the Circular Economy is gaining traction as an investing theme.

Here is a round-up of 5 innovative Circular Economy companies.

The RealReal (REAL.NASDAQ) is a $540 million company that operates the world’s biggest online marketplace for authenticated, resale luxury goods, boasting an astonishing 20 million members.

In the last 12- months the company shed half its market cap.

On February 23, 2022, REAL released sobering year-end financial results.

“One potentially ominous sign in the company’s numbers came from what it didn’t talk about,” reported the Motley Fool’s Sophie Ding, “In previous years, The RealReal has called its non-GAAP “contribution profit” — gross profit per order, minus variable expenses — “an important metric to assess our marginal profitability and measure our progress driving operating efficiencies.”

“But the RealReal has been doing well in other metrics,” wrote Ding, “Since 2015, the amount of money it spends on acquiring new buyers has fallen 41%, from $178 to $104”.

Full Year 2021 Financial Highlights

- GMV was $1.482 billion, an increase of 50% compared to full year 2020

- Total Revenue was $468 million, an increase of 56% compared to full year 2020

- Net Loss was $236 million compared to $176 million in 2020

- Adjusted EBITDA was $(126.9) million or (27.1)% of total revenue compared to (42.7)% of total revenue for full year 2020

- GAAP basic and diluted net loss per share was $(2.58) compared to $(2.01) in the prior year

- Non-GAAP basic and diluted net loss per share was $(1.88) compared to $(1.71) in the prior year

- At the end of 2021, cash and cash equivalents totaled $418 million

On October 04, 2021 The RealReal founded National Consignment Day to raise awareness of the importance of resale in creating a more sustainable future for fashion and to drive shoppers to take action by recirculating items they no longer wear.

“Fashion is one of the top polluting industries, contributing 10% of the world’s total carbon footprint,” stated REAL, “Clothing production has approximately doubled in the last 15 years to 80 billion garments per year. A garbage truck’s worth of textiles is landfilled or burned every second, even though 95% of trashed clothes could be re-worn, recycled or reused.

If the industry continues on its current trajectory, its share of the world’s carbon footprint could jump to 26% by 2050 and it will miss the 1.5-degree pathway laid out by the Paris Climate Accord.

Northstar Clean Technologies (TSXV: ROOF) is a $26 million clean technology company focused on the recovery and repurposing of single-use asphalt shingles to produce liquid asphalt, fibre and sands while diverting shingle waste from landfills.

On February 17, 2022, Northstar announced that it has initiated steady state production at its reprocessing facility (Empower Pilot Facility) in Delta.

“A steady state implies that the System State is independent of its initial start-up conditions,” reports the International Journal of Development Research, “providing top management with a clear picture of how to make their production line more effective.”

“This announcement proves to the market that our technology works and validates our business model,” states Northstar CEO Aidan Mills, “as we set out to scale up this technology to a facility size that we can expand with across the North American market.”

ROOF’s business model anticipates four revenue streams: 1. tipping fees (paid by waste haulers and roofing contractors), 2. Sale of Asphalt, 3. Sale of Fiber and 4. Sale of Aggregate. The sale of carbon credits would add a 5th revenue stream.

“One of the critical metrics for any energy transition, ESG-based, clean technology company is demonstrating that its transformational technology actually works,” stated Mills, “For Northstar to do that, we need to produce the end products from our facility at the specification we expected, in a repeatable manner.”

“The Empower Pilot Facility is not only producing exactly the end products we planned, but we have also initiated the production plan to do that repeatably,” added Mills.

The Circular Economy is a hot investing theme partly because it inverts the typical regulatory headwinds into powerful tail winds.

“An increasing number of investors are incorporating their values into their long-term investing strategies through the lens of environmental, social and governance concerns, or ESG investing,” reports US News.

Steady state production is expected to deliver throughput of asphalt shingles in the range of 10-20 tonnes-per-day up to 4-5 days per week. The objective is to demonstrate repeatable production in terms of safety, quality, and duration.

The two primary output products (liquid asphalt and aggregate) are being produced exactly as designed, meeting ROOF’s end product specifications.

Northstar is delivering samples of its “green asphalt” and aggregate to multiple major road construction companies, shingle manufacturers, and other industry stakeholders.

ROOF has a clear roadmap for commercial production levels targeted at 50-75 tonnes-per-day.

Northstar believes that each future facility could divert ~40,000 tonnes of shingles per annum each year.

Since its IPO 7 months ago, ROOF has raised $12.3 million, began small batch production, engaged Wellington Dupont to liaise with governments, began modular design, proved carbon reduction, hired a Sustainability Officer and has initiated steady state production.

Kontrol Technologies (KNR.NEO) is an $73 million company that has developed propriety solutions to make buildings safer and more energy efficient.

The “smart city/smart building” market is experiencing parabolic growth.

“The global smart cities market size was valued at USD 98.15 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 29.3% from 2021 to 2028,” reports Grandview Research.

On March 9, 2022, KNR was awarded a $9.7 Million HVAC and Automation project, through its wholly owned subsidiary Global HVAC and Automation for a new high rise building in the Greater Toronto Area.

Following the award of the project to Global a binding Letter of Intent has been signed and a contract is in process of being drafted, with completion of that contract expected to take place in Q2, 2022.

The project is slated to begin in Q3, 2022, with estimated completion in Q4, 2023.

“We are pleased that we are able to win these larger opportunities with our Global team,” says Paul Ghezzi, CEO of Kontrol Technologies. “Global provides us with a larger project footprint and capability that we seek to expand while we also focus on adding recurring revenues through an integrated building technology and service platform.”

Following the acquisition of Global in August of 2021, the Company has been focused on vertically integrating in-house capabilities around the inclusion of more energy efficient solutions such as heat pumps and VRV technology.

“We seek to lead the building efficiency market by offering our customers advanced solutions as part of our overall building integration and service platform,” continues Ghezzi. “Now more than ever, energy savings in buildings and the corresponding reduction in GHG emissions is critical to lower operating costs and improved sustainability.”

The customer for the project described above is a leading Canadian developer in the multi-family high rise sector with a significant number of projects in various stages of development. For industry competitive purposes the customer will not be named.

On January 14, 2022, Kontrol announced that it is expanding its BioCloud technology global footprint with a Japan-based trading company.

Kontrol BioCloud – an operating subsidiary of Kontrol Technologies – is a real-time analyzer designed to detect airborne viruses and pathogens. It is “safe space technology” that samples air quality continuously.

“With a proprietary detection chamber that can be replaced as needed, viruses are detected, and a silent notification system is created,” stated KNR.

“BioCloud continues to garner international interest given the growing, ubiquitous need for creating safer spaces and monitoring of heating, cooling and ventilation systems (HVAC) in real-time,” stated Paul Ghezzi, CEO of Kontrol Technologies.

Q3 and Year-to-Date 2021 Highlights:

- Record revenues of $21.5 million in the third quarter of 2021, up 614% year-over-year

- Record net income of $2.1 million in the third quarter of 2021, representing second consecutive quarter of positive net income

- Record adjusted EBITDA* of $2.8 million in the third quarter of 2021, up 224% year-over-year

- Cash flows from operating activities of $4.8 million in 2021 year-to-date

- Strengthened balance sheet by eliminating $4.0 million in debt in 2021 year-to-date

- Completed acquisition of Global HVAC & Automation, the largest acquisition in Kontrol’s history

- Raising Fiscal Year 2021 Outlook

- Revenues of $43 million to $46 million, up from previous $38 million estimate

- Adjusted EBITDA of $6 million to $7 million, up from previous $3.7 million estimate

“In a paper published in the journal Science, 39 experts in various fields called for a “paradigm shift” in the design of buildings and their ventilation systems, a safety upgrade on par with the 19th century introduction of clean water supplies and centralized sewage systems,” reported the L.A Times on May 13, 2021.

“The scientists envision futuristic buildings with systems that could detect a crowd gathering in a room and immediately adjust the ventilation to increase air turnover. Monitors would display air quality measurements in real time”, said The L.A. Times.

The paper cited estimates suggesting that the systems would increase the construction cost of a typical building by less than 1%.

Loop Industries (LOOP.NASDAQ) is a $395 million company with a mission to “accelerate the world’s shift toward sustainable PET plastic and polyester fiber and away from our dependence on fossil fuels.”

Loop Industries owns patented and proprietary technology that depolymerizes no and low-value waste PET plastic and polyester fiber, including plastic bottles and packaging, carpets and textiles of any color, transparency or condition and even ocean plastics that have been degraded by the sun and salt, to its base building blocks (monomers).

Loop Industries is participating in the global movement towards a circular economy by reducing plastic waste and recovering waste plastic for a sustainable future.

On January 11, 2022 Loop Industries provided a business update and reported its consolidated financial results for Q3, 2022.

Site work has begun for Loop’s flagship Canadian facility project in Bécancour, Québec, including building access roads, gravel pads, drainage and landscaping. This initial work has been completed and readies the site for subsequent construction phases.

The Company believes the Infinite Loop™ Québec project is aligned with the Government of Canada’s “2030 zero plastic waste action plan”, which includes goals and initiatives such as:

- requiring all plastic packaging in Canada contain at least 50 % recycled content by 2030;

- working with provinces to implement and enforce an ambitious recycling target of 90% for plastic beverage containers;

- introducing labelling rules that prohibit the use of the chasing-arrows symbol unless 80 % of Canada’s recycling facilities accept and have reliable end markets for these products.

Infinite Loop™ Engineering Update

The engineering design of Infinite Loop™ manufacturing facilities is progressing on schedule with partners at Chemtex Global and Worley. LOOP has entered into the feasibility study phase of the engineering design. It has adopted a “design one, build many” engineering philosophy, which includes a modular facility construction design to allow the Company to replicate the Infinite Loop™ model across all projected facilities in North America, Europe and Asia.

Infinite Loop™ Europe

On September 10, 2020, we announced a strategic partnership with SUEZ GROUP (“Suez”), with the objective to build the first Infinite Loop™ manufacturing facility in Europe.

Infinite Loop™ Asia

Asia remains the largest market opportunity for Loop Industries, as it is home to 60% of the world’s population, represents nearly 70% of the world’s PET consumption and is the center of global polyester fiber manufacturing. Loop and its strategic partner, SK geo centric, signed a memorandum of understanding (“MOU”) for exclusivity to commercialize Loop’s technology across Asia through a Joint Venture.

“From our joint venture partnership with SK geo centric to the announcement of evian bottles made from 100% recycled Loop™ PET and the beginning of site preparation work in Bécancour, Québec, we have remained steadfast in the pursuit of our commercialization objectives,” stated Daniel Solomita, Founder and CEO of Loop Industries.

“We expect 2022 to be an equally transformational year, focused on accelerating the commercial development of our technology, cementing partnerships with CPG brand clients through commercial product launches across different markets throughout the year and securing multi year offtake commitments for Infinite Loop™ production facilities,” added Solomita.

The net loss for the nine-month period ended November 30, 2021 increased $7.50 million to $30.65 million, as compared to the net loss for the nine-month period ended November 30, 2020 which was $23.15 million.

The increase is primarily due to increased research and development expenses of $10.25 million and increased general and administrative expenses of $2.64 million, offset by lower write-down and impairment of property, plant and equipment (“PP&E”) expenses of $5.04 million, lower depreciation and amortization expenses of $0.25 million and a decrease in foreign exchange loss of $0.23 million.

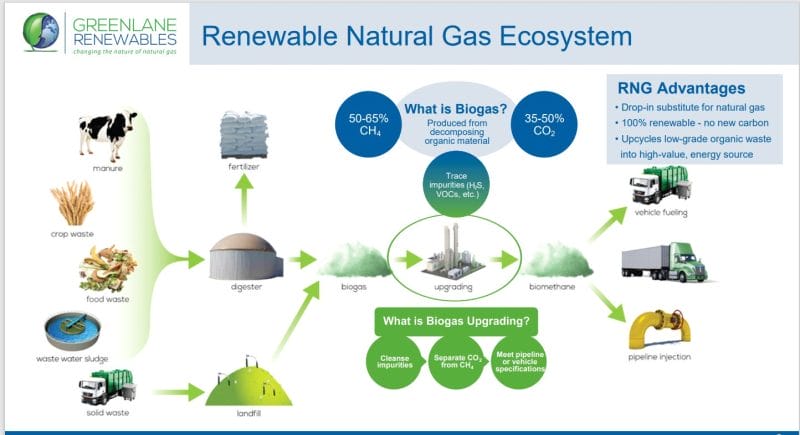

Greenlane Renewables (GRN.T) is a $243 million company providing biogas upgrading systems that are helping decarbonize natural gas.

GRN’s systems produce clean, low-carbon and carbon-negative renewable natural gas from organic waste sources including landfills, wastewater treatment plants, dairy farms, and food waste, suitable for either injection into the natural gas grid or for direct use as vehicle fuel.

On March 10, 2022, GRN announced financial results for the fourth quarter and fiscal year ended December 31, 2021. All amounts are in Canadian dollars unless otherwise stated.

- Record revenue of $17.1 million, an increase of 94% over the $8.8 million reported in the fourth quarter of 2020.

- Gross profit of $3.9 million, gross margin (gross profit excluding amortization) of $4.3 million (25% of revenue).

- Net loss of $1.2 million.

- Adjusted EBITDA of $0.3 million1.

- Record sales order backlog2 of $50.1 million as at December 31, 2021.

- Sales pipeline3 valued at over $850 million as at December 31, 2021.

- Cash and cash equivalents of $31.5 million and no debt, other than payables and bonding resulting from normal course operations, as at December 31, 2021.

- The Company finalized system sales contract wins totalling $19.2 million for renewable natural gas (“RNG”) projects in Canada, the United States and Brazil.

- The Company announced the acquisition of Italian company Airdep S.R.L., to bring in-house an effective and proven technology to remove hydrogen sulfide (H2S) from biogas for integration with the Company’s portfolio of biogas upgrading systems and also to add an attractive line of products for sales into existing and new biogas projects globally. The business acquisition was completed on February 1, 2022.

Fiscal Year 2021 Highlights Include:

- Record revenue of $55.4 million, an increase of 146% over $22.5 million reported in 2020.

- Gross profit of $12.9 million, gross margin (gross profit excluding amortization) of $14.1 million (26% of revenue).

- Net loss of $2.4 million.

- Adjusted EBITDA of $1.1 million1.

- Finalized over $57 million in system sales contracts utilizing all three of the core upgrading technologies Greenlane offers. This represents several new RNG projects in Canada, the United States, Brazil, Spain, and the first commercial scale biogas upgrading system deployed in Colombia, marking the 19th country where the Company has sold biogas upgrading systems.

- In February 2021, the Company’s common shares commenced trading on the TSX after graduation to the senior board from the TSX Venture Exchange.

- In February 2021, the Company became debt free4 as it repaid early and in full, the $6.0 million balance (including principal and interest) of its promissory note due June 2021.

“2021 was another outstanding year for Greenlane as we advanced our business strategy focused on helping to clean up two of the largest and most difficult-to-decarbonize sectors of the global energy system: the natural gas grid and the commercial transportation sector,” said Brad Douville, President and CEO of Greenlane.

“Looking ahead, we remain in a very strong position and are encouraged with the outlook for the RNG industry both in North America and abroad, as we continue to see expansion in both the transportation and natural gas utility.”

“The concept of circular economy is a foundational blueprint and if we could get more and more of the money owners to agree that this is a good way to invest, not just for social reasons, not just for environmental reasons, but for investment reasons, performance reasons,” it would be a good thing, stated Larry Fink, CEO & Chairman of BlackRock, an asset management company with $6.5 trillion under management.

The RealReal (REAL.NASDAQ), Northstar Technologies (ROOF.V), Kontrol Technologies (KNR.NEO), Loop Industries (LOOP.NASDAQ) and Greenlane Renewables (GRN.T) are smart young companies designed to succeed in this new business paradigm.

Leave a Reply