The gold price has recently taken a hit. No problemo. The sell off occurred at a major resistance zone, and there is a chance the US Dollar might cause more pullback.

The real move has been in the bond market. Interest Rates are spiking. The 10 year yield is above 2.40%. What has kept gold bulls excited is the fact that the metal held up in a rising interest rate environment. Gold yields nothing. When money runs to risk off assets due to fear it will go to bonds. Ray Dalio and others have recently said it makes no sense because bonds yield nothing. Gold is the better option.

Historically, when interest rates rise, gold falls. Because gold yields nothing, and bonds are starting to yield a higher amount, money runs into the debt market for safety and yield. Gold held strong as rates were spiking.

Two ways to look at this: either the markets are pricing in a less hawkish Fed down the road, or the market is pricing in more inflation.

The first situation is a contrarian viewpoint betting on the Fed not being able to raise rates substantially due to the amount of debt in the system. I actually wrote about a flat and inverted yield curve last week. The debt markets are indicating economic uncertainty, and very soon, could be indicating an economic slowdown/recession. If so, we contrarians believe the Fed may need to reverse policy before they can get their 6-7 interest rate hikes this year. Keep watching that 2 and 10 year yield. At time of writing, we are now less than 5 basis points until the inversion. No joke, we might be inverted by the time this article comes out. Watch for stock markets to keep on ripping as they price in more cheap money. Stocks also will move up because they remain the best place to go for real yield to beat inflation.

The second situation gets a bit nerdy. We know the bond yields are returning 2% and higher. However, in real terms, one is still losing money. Basically if inflation is still coming in over 7%, then you are losing money in real terms holding a bond giving you 2%. Same logic applies to savers with money in savings accounts yielding less than 1.2%. If this is the case, then money would still be better off in gold, especially if it is all about rising inflation that the Fed will not be able to control.

On the other side, we gold contrarians might be completely wrong and the Fed continues to raise interest rates. I would be looking at the US Dollar.

The Dollar (DXY) has just been ranging after a major breakout. If the Fed is going to be hawkish, we should expect to see the Dollar breakout here.BUT…

It isn’t as simple as that. The Dollar could rise AND gold could rise at the same time. Not something you would expect from gold being the anti-dollar. However, during periods of a confidence crisis, money runs into both cash and gold. The US Dollar gets the bid because it is the reserve currency/safe haven.

I have to bring this up because of the situation going on in Ukraine. If things escalate, or we see some major event occur, then gold will rise if fear and uncertainty persists. Anything hinting at the war expanding would be bullish gold. I still believe we will be seeing geopolitical tensions rise causing more uncertainty. Watching China to get involved here.

Rising inflation which the Fed will not be able to control (unless we get a deflationary event ie: lockdowns or worse), and geopolitical tensions to exacerbate. Sounds fun. Both will be positive for gold in the long term. And Silver. In fact, I remain bullish on most commodities.

Before jumping into how I invest in gold, let’s take a look at the gold chart.

A pullback but nothing unexpected. Gold has been ranging between $1960 and $1880. The latter is still holding as major support. My bullish case for gold remains as long as we remain above $1840. The interesting thing is both gold and the Dollar fell together, when many consider them the inverse of each other. As I said, both can rise in a confidence crisis. We sort of have one with people fearing World War III. With rumors of a peace talk, the safe haven assets such as gold and the Dollar are pulling back.

So how to play gold for the long term?

There are plenty of ways to play gold. From physical bullion, trading gold futures and cfds, buying GLD and other gold ETFs, buying GDX and GDXJ ETFs, buying junior mining and explorer stocks, buying mining stocks, buying gold and royalties.

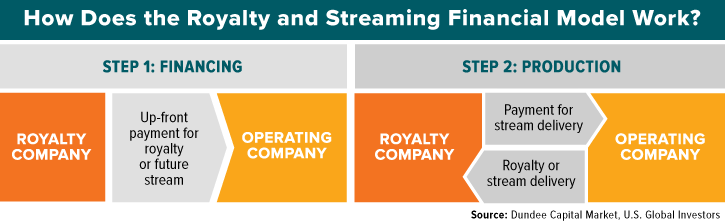

Back in Spring of 2021, I wrote a piece about my preferred way to play gold and silver. Investing in gold royalty and streamers, which is probably the best business model ever created.

The reason why I like royalties and streamers compared to GLD and miners can be summarized on this table:

What happens when gold and silver prices fall? Because Royalty and Streamers are leveraged to the price, they tend to fall as well. But here is the kicker. A mining operator will continue to mine even if margins begin to drop, and quite frankly, they start losing money. Hence why their balance sheets generally show a lot of debt, and look brutal.

A Royalty and Streamer will still be making money, will likely be paying out dividends, and can still hammer out catalysts for the stock price. If the management is astute, they will use bear markets in precious metals to create and acquire new royalty deals which will pay off handsomely in the future.

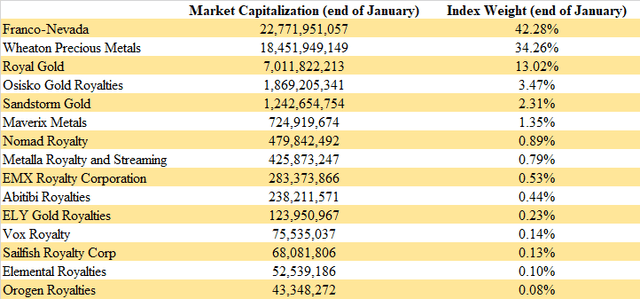

Here are some royalty and streamers for your consideration:

Even though I prefer royalty and streamers, I do believe even the juniors and miners will obviously rise with gold. I am bullish on the whole space.

With the juniors, the returns will be crazy since you are trading basically penny stocks. When it comes to juniors I am picky. I look for companies operating in good jurisdictions, that have cash, and have an experienced management team with past success.

With this in mind, let me present you with companies that fit my criteria both technically and fundamentally. Something for everyone as I will look at a junior, a producer, and a royalty and streamer.

Sokoman Minerals (SIC.V)

Market Cap ~ $74 million

Sokoman Minerals Corp., an exploration-stage company, explores for mineral properties located in Canada. The company’s primary focus is its portfolio of gold projects that include 100%-owned the Moosehead project, and the Crippleback Lake and East Alder projects located in the Central Newfoundland Gold Belt, as well as the Fleur de Lys project situated in northwestern Newfoundland.

Recent news has seen first assay results come in from the Golden Hope project, which is the initial testing of Sokoman’s Lithium discovery, and the closing of a non-brokered private placement.

Having the funds to drill is important for the growth of the company, and provides catalysts for the share price. The cash position is very important when it comes to junior plays. Sokoman announced the closing of a non-brokered private placement with Eric Sprott as the lead investor. Mr. Sprott owns ~25% of the shares outstanding. A substantial holder, and it is always a good thing to place your bets with the experts.

Junior mining can be a gamble because you never know what is under the ground, but big money definitely has geology teams. In this recent $5,000,000 financing, Eric Sprott is making up $4,000,000 of the gross proceeds. The man has done his due diligence.

Good jurisdiction, money in the bank, and a big backer. Expect drilling catalysts this year. Sokoman President and CEO Timothy Froude has this to say about the year ahead:

“Drilling continues to confirm high-grade gold at Moosehead and provide insights into the complex geological controls of the high-grade mineralization. Our methodical approach is paying off as we continue to intersect and extend the interpreted high-grade shoots that lie within the larger envelope of gold mineralization. With high-grade gold existing in all known zones within an area at least 700 m in strike, up to 200 m in width and at least 250 m vertical, the potential to link these zones as well as expand the footprint of the Moosehead system is high.”

“We are also pleased to announce that the current Phase 6 drilling program has been increased from 50,000 m to 100,000 m with drilling to continue with occasional breaks through 2022. We see growth potential in all areas of the known mineralized corridors as well as discovery potential on our numerous regional targets”

“We are extremely pleased with the early results from the North Pond, barge-based drilling. The barge program consisted of 20 holes, testing both the Upper Eastern Trend and the Footwall Splay zones. Gold mineralized veins have been encountered in the majority of the holes drilled to date.”

“At Golden Hope, drilling the Lithium Pegmatite Swarm commenced in early January and is ongoing with Joint Venture Partner Benton Resources to help determine how best to monetize this asset for our shareholders.”

“With drilling ongoing at Moosehead and planned for multiple gold projects in 2022 as well as the initial testing of our Lithium discovery, we expect 2022 to be a very exciting year for Sokoman.”

On the technicals, we have a nice looking set up. Sokoman stock has been in a range since Fall of 2021. We have been bouncing between $0.40 to the upside and $0.30 to the downside.

My readers know I like this type of market structure set up, A range after a clear downtrend. Usually hints at a reversal. The trigger though will be a daily break and close above $0.40. This would trigger a new run higher up into and above $0.50. With all the things I have said about Sokoman above, I can say we are likely to get a catalyst which will give us this trigger.

Gold Mountain (GMTN.TO)

Market Cap ~ $ 99 Million

Gold Mountain is an upcoming producer. Gold Mountain Mining (GMTN.V) is a BC based exploration and development company focused on the 100% owned Elk Gold project. This project was once owned by Equinox, and Gold Mountain acquired it back in 2019 when Gold prices were down. The asset was a past producer with 97 g/t average.

We here at Equity Guru are quite excited because the mine is not too far away from us, AND the company was issued a mining permit here in BC.

The company recently delivered the first shipment of ore to New Gold inc. This first load of ore delivered to New Gold’s New Afton mill marks the official commencement of production and the beginning of cash flow and revenue generation for the Company and its shareholders. The most recent news which came out on March 22nd 2022 announced Gold Mountain receiving payment for its first month of ore delivery to New Gold’s New Afton Mine. In total, the Company delivered 2,500 tonnes of ore to New Gold, averaging a gold grade of 3.9 g/t and a sale price of $1857 USD/oz. This translated to Gold Mountain shipping 303 ounces and generating $548,862 (CAD) in revenue for its pilot run.

- Following the extended provincial review and approval of New Gold’s custom milling permit, the Company is now positioned to deliver high-grade ore to accommodate its Year 1 production profile.

- The material was mined from the 1300 vein near historic Pit 2, which was last mined from 2012 to 2014 at an average grade of 16.7 g/t.

- This initial delivery marks the Company’s transition into cash-flow and revenue generation.

- Under the terms of the Ore Purchase Agreement with New Gold, the Company will be paid on a monthly basis for all ore delivered.

- Ownership of ore transfers to New Gold upon delivery, eliminating all risks of recovery for Gold Mountain.

Our mining expert, Greg Nolan, discussed the economics of the Elk project in his latest article:

Elk’s economics are compelling. The LOM all-in sustaining cost (AISC) is $554 per oz. This puts Gold Mountain at the lower end of the cost curve for a gold producer.

These are (potentially) high-margin ounces. Again, it’s simple math:

- Gold currently trades at roughly $1,800.00 per oz

- $1,800 – $554 (AISC) = $1,246 per oz

- $1,246 per oz x 19k ounces (projected rate of production per annum) = $23,674,000

An annual production rate of 19k ounces is projected for years one thru three. Beginning in year four, as per an enhanced OPA with New Gold, the Company plans to scale the operation via increased delivery commitments to the New Afton mill—from 70,000 to 350,000 tonnes. This 400% bump is expected to produce 65,000 ounces per annum. Once the Company fires on all cylinders, we could see yearly production top 100,000 ounces via multiple open pits and an underground operation.

Check out Greg’s article for the ounce count and the exploration upside. In a nutshell, Gold Mountain is beginning to produce and make some cash now, then use that money to explore and expand the project and the resource.

No major change on GMTN since the last time I looked at the technicals. Still holding above our support zone, and retests see buyers jumping in. $1.30 is the key zone. One interesting point is that we broke above a trendline. We want to see a close above $1.60 to trigger a breakout and confirm a higher low in the new uptrend. I remain bullish as long as the price remains above $1.30.

Nomad Royalty (NSR.TO)

Market Cap ~ $ 570 Million

Nomad Royalty (NSR.TO) is a gold and silver royalty company that purchases rights to a percentage of the metals produced from a mine, for the life of the mine. Nomad owns a portfolio of 16 royalty and stream assets, of which 8 are currently producing mines. The company will grow by acquiring more producing and near term producing gold and silver streams and royalties.

Here are Nomad’s 8 producing mines as of now:

Nomad is on the hunt for additional producing and near-term producing gold & silver streams and royalties. The company reported 2021 and Q4 preliminary results showcasing a transformative first full year of operations and declared Q1 2022 dividend!

The recent highlights include:

- New value accretive transactions for a total over $220 million on near-term cash flowing royalties and streams, including the Platreef Gold Stream, the Greenstone Gold Stream and the Caserones Copper Royalty

- Implementing innovative ESG-linked long-term financial commitment on the Greenstone Gold Stream, pioneer in the precious metals royalty sector

- Listing on the New York Stock Exchange

- Increasing credit facility by $75 million to $125 million

- Maintaining sector leading dividend yield at 2.1%, one of the highest in the precious metals royalty sector

- Completing offering for gross proceeds of C$42.5 million in the beginning of January 2022

- Maintaining low general and administrative expenses compared to peers

- Establishing various tools to enhance financial flexibility including the at-the-market equity program for up to $50 million, normal course issuer bid program and dividend reinvestment plan

With a recent raise of $42 million, Nomad has the war chest to get things done. Great catalyst for the stock price especially as gold, silver and copper prices run up either on inflation or geopolitics.

For those looking for an in depth look at Nomad and their news, check out Lukas Kane’s article here.

I must say, I like the stock chart of Nomad for a long term acquisition. $10.00 remains the large resistance zone. If we can breakout above it, we initiate a new major uptrend. I like the recent breakout back above $9.00. Buyers are stepping in as evident from yesterday’s daily wick candle.

So there you have it. It is going to be a very interesting (and I believe bullish) few months for gold. The yield curve is pretty much ready to invert, which means the market will begin to price in less rate hikes. The inflation will continue unless we get a deflationary event. Let’s not forget the geopolitical side of things. The confidence crisis in governments and central banks is increasing pace. All of this provides a good environment for rising gold prices.

Leave a Reply